About Prisma Finance

Prisma Finance is a cutting-edge, decentralized finance (DeFi) platform built on the Ethereum blockchain. The project is specifically designed to maximize the utility of liquid staking tokens (LSTs), which represent staked assets that continue to earn rewards while being freely traded or utilized within DeFi. The primary mission of Prisma Finance is to unlock the full potential of these LSTs by enabling users to mint a stablecoin, mkUSD, that is fully collateralized by these assets. This not only enhances the capital efficiency of the staking process but also provides users with additional liquidity and DeFi opportunities.

The importance of Prisma Finance lies in its ability to offer a sustainable and decentralized alternative to traditional financial systems, empowering users with more control over their assets. By integrating with various DeFi platforms, Prisma Finance allows users to maximize their staking rewards, leverage their assets for additional yield, and participate in the broader DeFi ecosystem. The project is governed by a decentralized autonomous organization (DAO), ensuring that the platform evolves according to the needs and desires of its community.

Through its innovative use of liquid staking tokens and its focus on decentralization, Prisma Finance positions itself as a key player in the rapidly evolving DeFi landscape. The project’s emphasis on sustainability, transparency, and user empowerment sets it apart from other DeFi protocols, making it a significant contributor to the ongoing transformation of the global financial system.

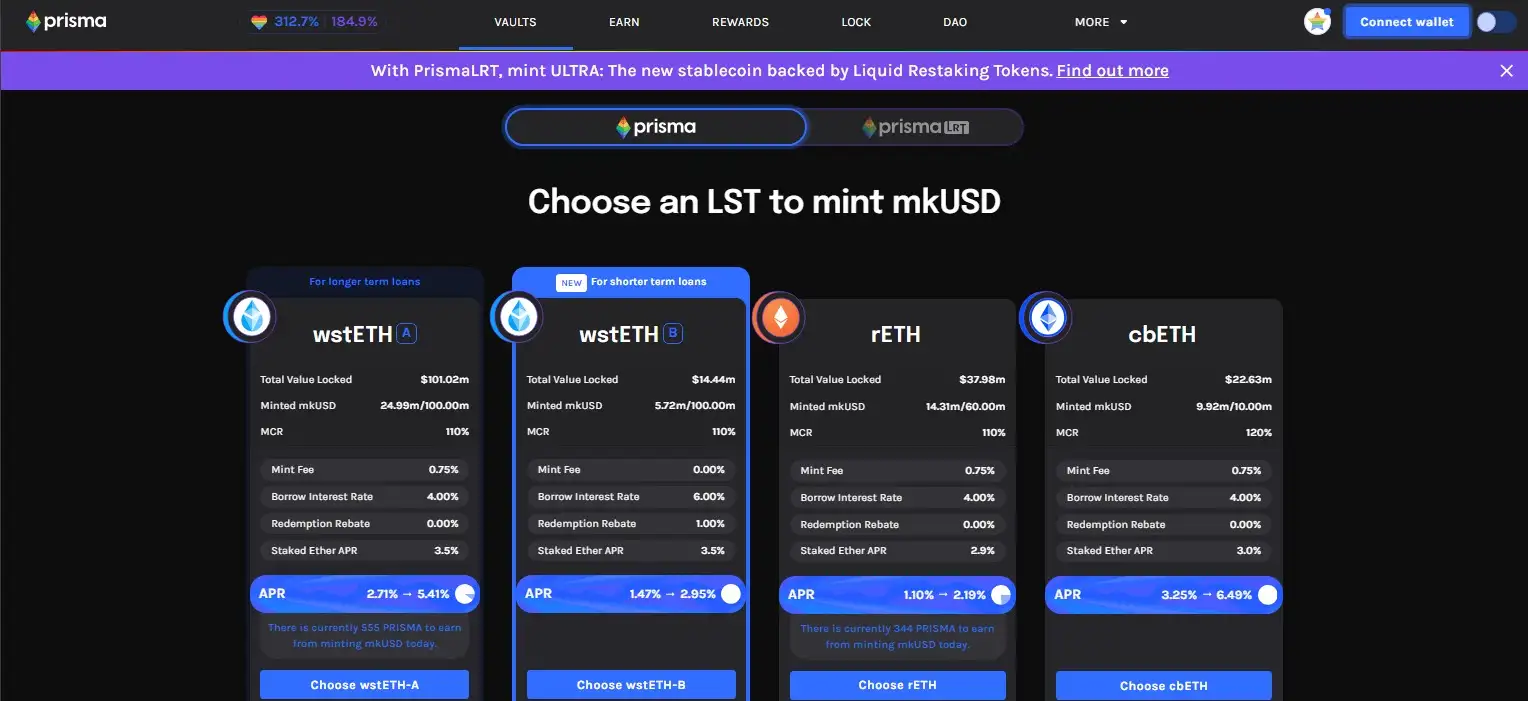

Prisma Finance was conceived to address a critical gap in the Ethereum DeFi ecosystem: the limited utility of liquid staking tokens (LSTs). As staking on Ethereum gained popularity, more assets were locked in staking protocols, earning rewards but remaining largely illiquid. This created a need for a solution that could unlock the potential of these assets without compromising on the rewards they generate. Prisma Finance meets this need by allowing users to mint mkUSD, a stablecoin fully backed by LSTs like wstETH and sfrxETH, effectively enhancing the liquidity and utility of staked assets.

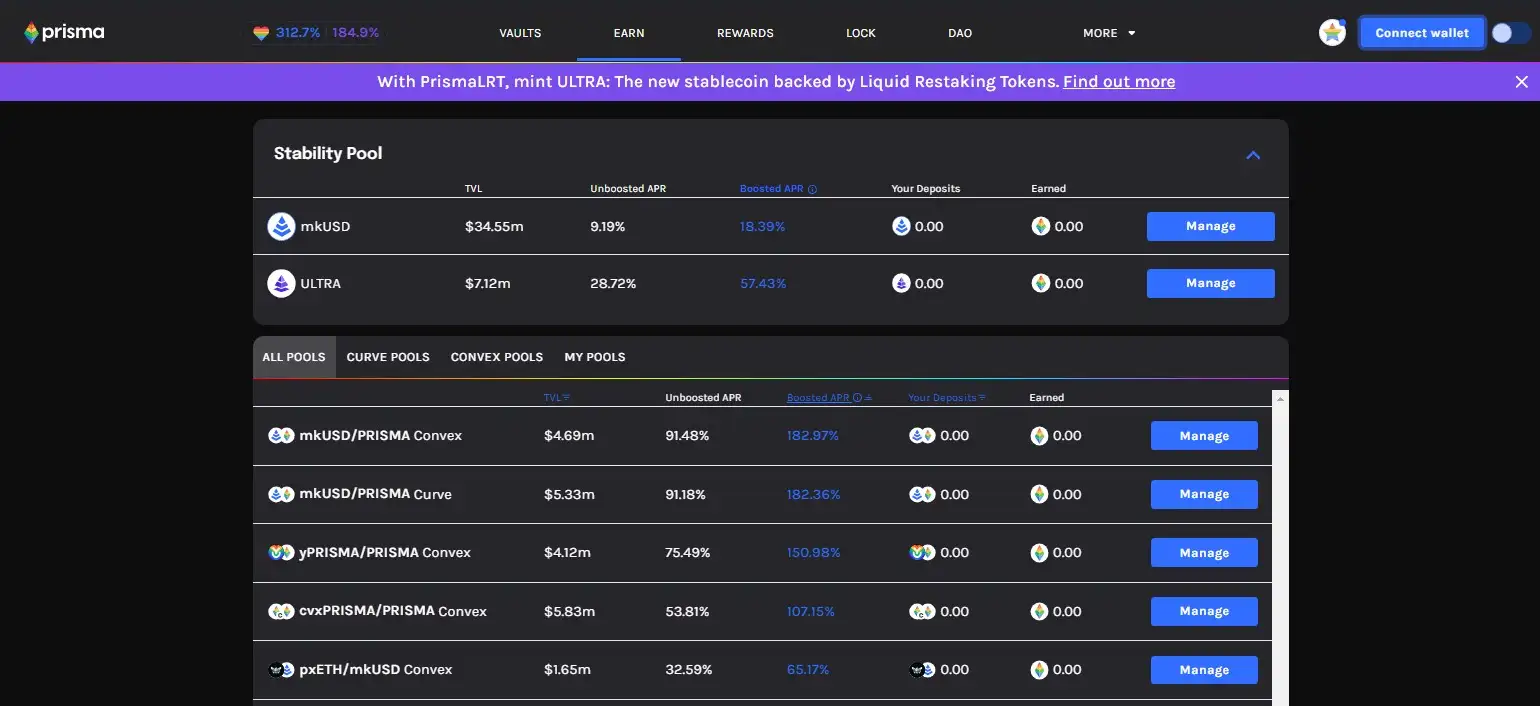

The project is built on the robust and secure Liquity framework, which ensures the immutability and security of the protocol. This foundation is critical as it guarantees that once the protocol is deployed, it cannot be altered or tampered with, providing users with a high level of confidence in the safety of their assets. Since its launch, Prisma Finance has focused on expanding its ecosystem through strategic integrations with leading DeFi platforms, including Curve and Convex Finance. These integrations allow users to utilize their mkUSD across various liquidity pools, earning rewards and enhancing their returns on staked assets.

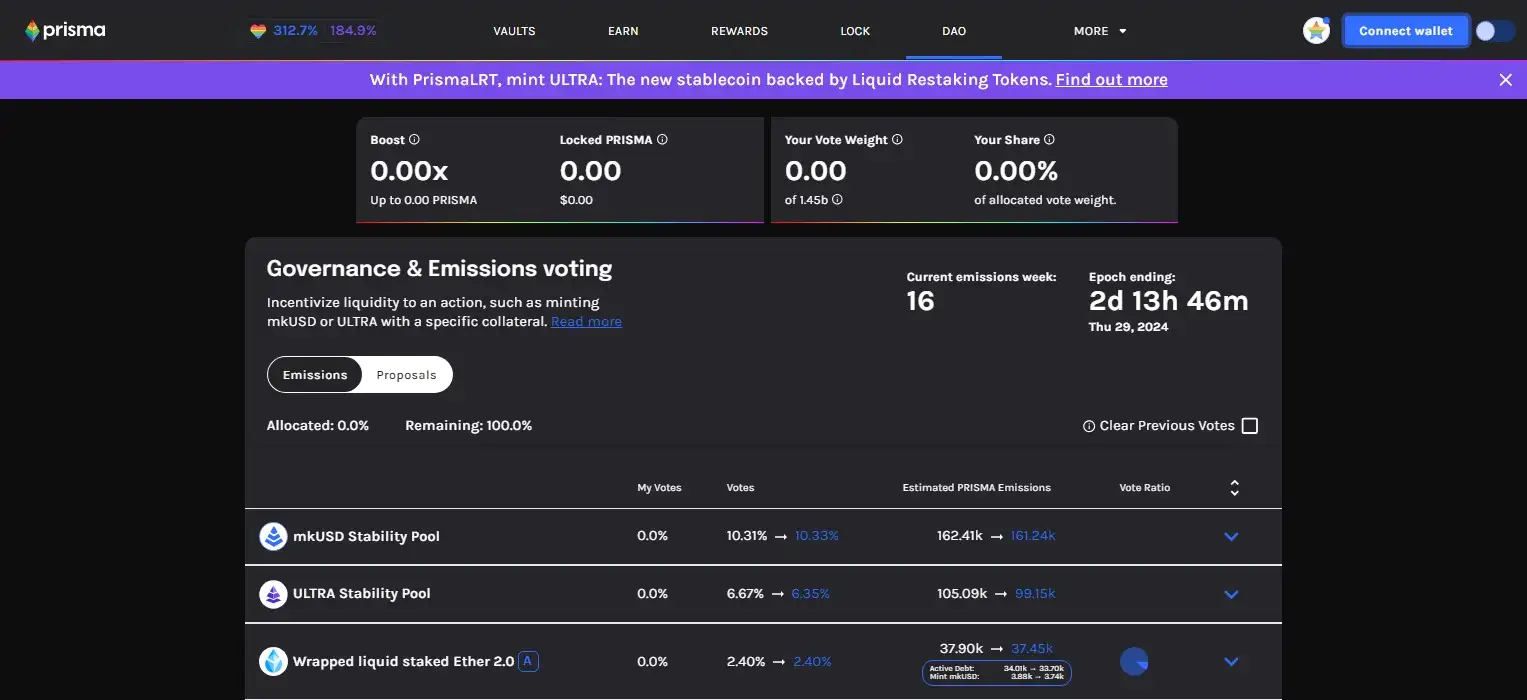

One of the key features of Prisma Finance is its decentralized governance model, managed by the Prisma DAO. This governance structure empowers ULTRA token holders to make decisions about critical aspects of the protocol, including the parameters for minting mkUSD, the emission schedule for ULTRA tokens, and the fee structures applied to various transactions within the platform. By decentralizing these decisions, Prisma Finance ensures that the protocol remains aligned with the interests of its community, promoting transparency and fairness.

Competitors in the space include Liquity and Frax Finance, both of which offer stablecoin solutions with different approaches to collateral and governance. Liquity is known for its LUSD stablecoin, which is collateralized by ETH and provides a decentralized borrowing mechanism. On the other hand, Frax Finance offers a fractional-algorithmic stablecoin that combines collateral with algorithmic mechanisms to maintain its peg. While these platforms have established themselves as leaders in the stablecoin space, Prisma Finance differentiates itself through its specific focus on liquid staking tokens and its strong commitment to decentralization and community governance.

Looking ahead, Prisma Finance plans to continue expanding its ecosystem by integrating with additional DeFi platforms and exploring new opportunities for users to maximize the utility of their staked assets. The project is also focused on enhancing its governance model, providing more tools and mechanisms for the community to participate in decision-making processes. As the DeFi landscape continues to evolve, Prisma Finance is well-positioned to be a key player, offering a unique and valuable service to users who wish to optimize their returns on staked assets while maintaining full control over their financial activities.

The Prisma Finance platform offers a wide array of benefits and features that set it apart in the DeFi space:

- Immutable and Secure: Built on the Liquity framework, Prisma Finance ensures that its protocol remains immutable and secure, offering users a high level of confidence in the safety of their assets.

- Utilization of Liquid Staking Tokens (LSTs): The platform allows users to maximize the potential of their liquid staking tokens by enabling them to mint mkUSD, a stablecoin that is fully collateralized by these LSTs. This provides additional liquidity and DeFi opportunities without sacrificing staking rewards.

- Decentralized Governance: The platform is governed by the Prisma DAO, allowing ULTRA token holders to participate in key decisions regarding the protocol’s future, such as adjusting collateral parameters and emissions schedules.

- Incentivized Ecosystem: Users who lock their ULTRA tokens can earn enhanced yields and access various DeFi strategies, creating a strong incentive for active participation within the ecosystem.

- Capital Efficiency: Prisma Finance offers flexible collateral parameters, enabling users to leverage their assets more effectively within the DeFi space. This enhances the overall capital efficiency of the platform, making it a more attractive option for users looking to maximize their returns.

- Partnerships and Integrations: The platform has integrated with major DeFi protocols such as Curve and Convex Finance, providing users with additional opportunities to earn rewards and participate in the DeFi ecosystem.

- Focus on Decentralization: Prisma Finance emphasizes decentralization in both its governance and operational structure, ensuring that the platform remains resilient and aligned with the interests of its community.

To start using Prisma Finance, follow these detailed steps:

- Prepare Your Wallet: Ensure you have a Web3 wallet like MetaMask installed, which is compatible with the Ethereum network.

- Acquire Liquid Staking Tokens (LSTs): Obtain LSTs such as wstETH or sfrxETH from platforms like Lido or Rocket Pool, which you will use as collateral within the Prisma Finance protocol.

- Connect Your Wallet to Prisma Finance: Visit the Prisma Finance platform and connect your wallet by clicking the “Connect Wallet” button. Follow the on-screen instructions to complete the connection.

- Deposit Collateral: Navigate to the collateral section of the platform, select your LSTs, and deposit them into the protocol to be used as collateral for minting mkUSD.

- Mint mkUSD: Once your collateral is deposited, you can mint mkUSD, the stablecoin issued by Prisma Finance. The amount of mkUSD you can mint is determined by the value of your collateral.

- Explore DeFi Opportunities: Use your newly minted mkUSD across various DeFi platforms to earn rewards. You can participate in liquidity pools on platforms like Curve and Convex Finance, where you can earn additional rewards and yield.

- Participate in Governance: To influence the future of the protocol, acquire ULTRA tokens and participate in governance decisions through the Prisma DAO. Stake your tokens to increase your voting power and earn boosted rewards.

For more detailed instructions and to explore the platform further, visit the Prisma Finance documentation.

Prisma Finance Token

Prisma Finance Reviews by Real Users

Prisma Finance FAQ

mkUSD is unique because it’s fully collateralized by Liquid Staking Tokens (LSTs), unlike other stablecoins that are often backed by traditional assets like ETH or fiat equivalents. This design leverages the staking rewards of LSTs, offering users additional liquidity while still benefiting from staking yields. This makes mkUSD both a stable and productive asset within the Prisma Finance ecosystem.

Prisma Finance is built on the Liquity framework, which is designed to be immutable once deployed. This means that the core smart contracts cannot be altered or tampered with, ensuring a high level of security for all users. Additionally, by leveraging the decentralized governance model through the Prisma DAO, any changes to protocol parameters are made transparently and democratically.

Yes, by staking your ULTRA tokens, you can increase your voting power in the Prisma DAO and also earn boosted rewards. This dual incentive ensures that participants are both contributing to the governance of the platform and benefiting financially from their engagement. The more ULTRA tokens you stake, the greater your influence and potential rewards within the Prisma Finance ecosystem.

Prisma Finance promotes decentralization through its governance model, where all key decisions are made by the community via the Prisma DAO. Token holders of ULTRA have the power to propose and vote on changes, ensuring that the protocol evolves in a way that reflects the interests of its users. This approach reduces the risks associated with centralization and aligns the platform’s development with the community’s vision.

Liquid Staking Tokens (LSTs) are at the heart of Prisma Finance. They serve as the collateral that backs the minting of mkUSD. By using LSTs, users can continue to earn staking rewards while also leveraging their assets within the DeFi space. This dual utility enhances the productivity of staked assets, making Prisma Finance a powerful tool for maximizing returns in the DeFi ecosystem.

You Might Also Like