About RadLock

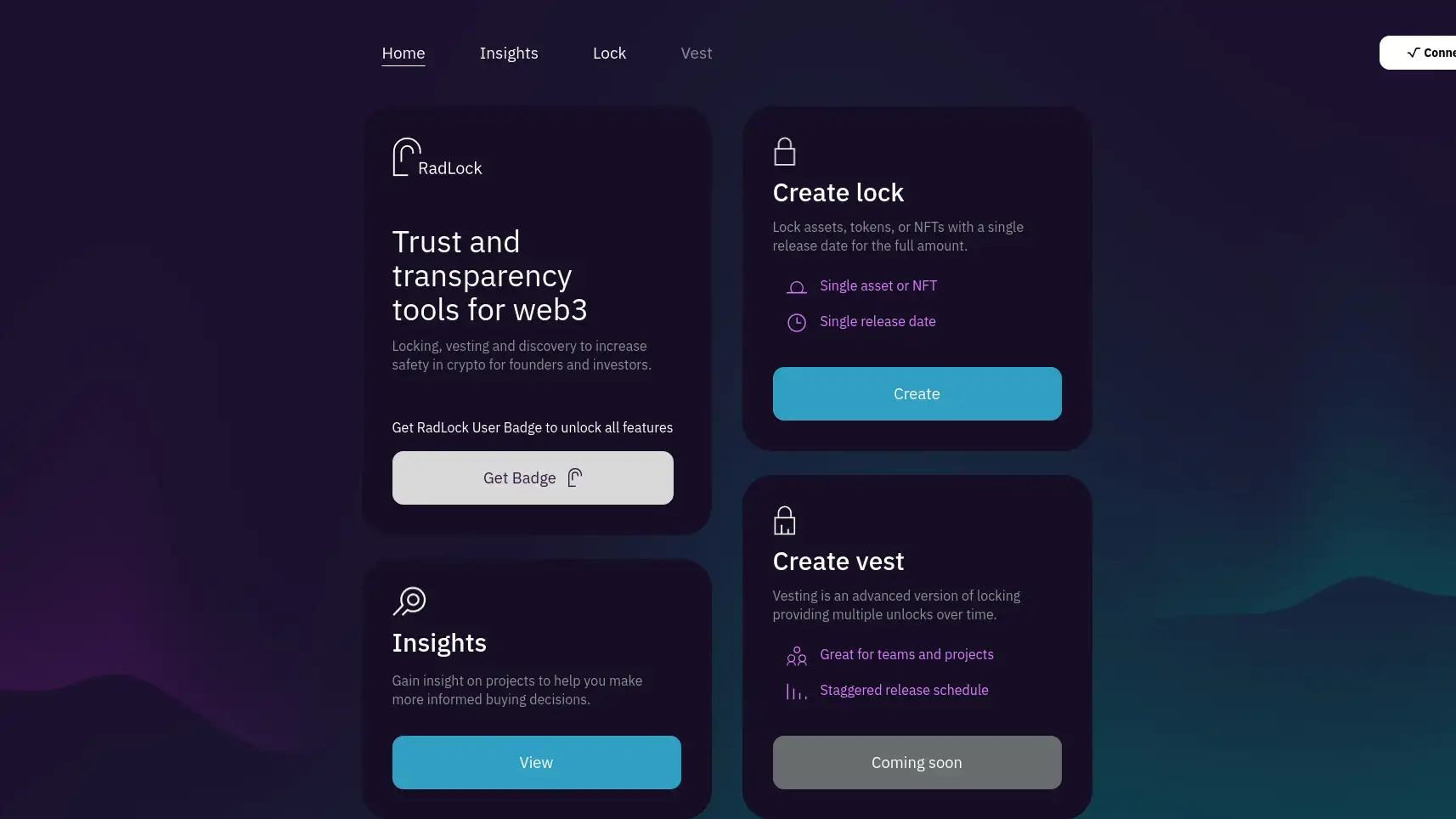

RadLock is an innovative platform built within the Radix ecosystem to ensure security, transparency, and trust for both investors and project developers. The platform addresses critical challenges in the crypto and decentralized finance (DeFi) sectors, particularly the risks associated with "rug pulls" and misaligned incentives between project teams and their communities. RadLock’s mission is to instill confidence in the burgeoning Radix decentralized ledger technology (DLT) ecosystem by introducing robust tools like token locking, vesting, and a launchpad.

RadLock is a next-generation decentralized platform designed to enhance trust and security within the Radix ecosystem. The platform was conceptualized and developed to address a pressing issue in the cryptocurrency space: the prevalence of rug pulls and misaligned incentives in DeFi projects. By providing advanced tools for liquidity locking, token vesting, and other transparent mechanisms, RadLock seeks to protect investors while empowering developers to build sustainable projects.

One of RadLock’s primary features is liquidity locking, which ensures that funds cannot be withdrawn from a project's liquidity pool without prior notice or fulfillment of specific conditions. This feature mitigates the risk of rug pulls and allows developers to demonstrate their commitment to a project's long-term success. Additionally, RadLock offers team vesting schedules, a feature that gradually releases tokens to project teams over time. This creates an alignment of incentives between the developers and their community, ensuring that team members remain committed to the project's growth and success.

RadLock also incorporates NFT locking, a feature that allows NFTs to be locked with staggered release mechanisms based on pre-defined milestones. This adds another layer of security and transparency to the platform, making it suitable for a wide range of use cases, from tokenized assets to presale investments.

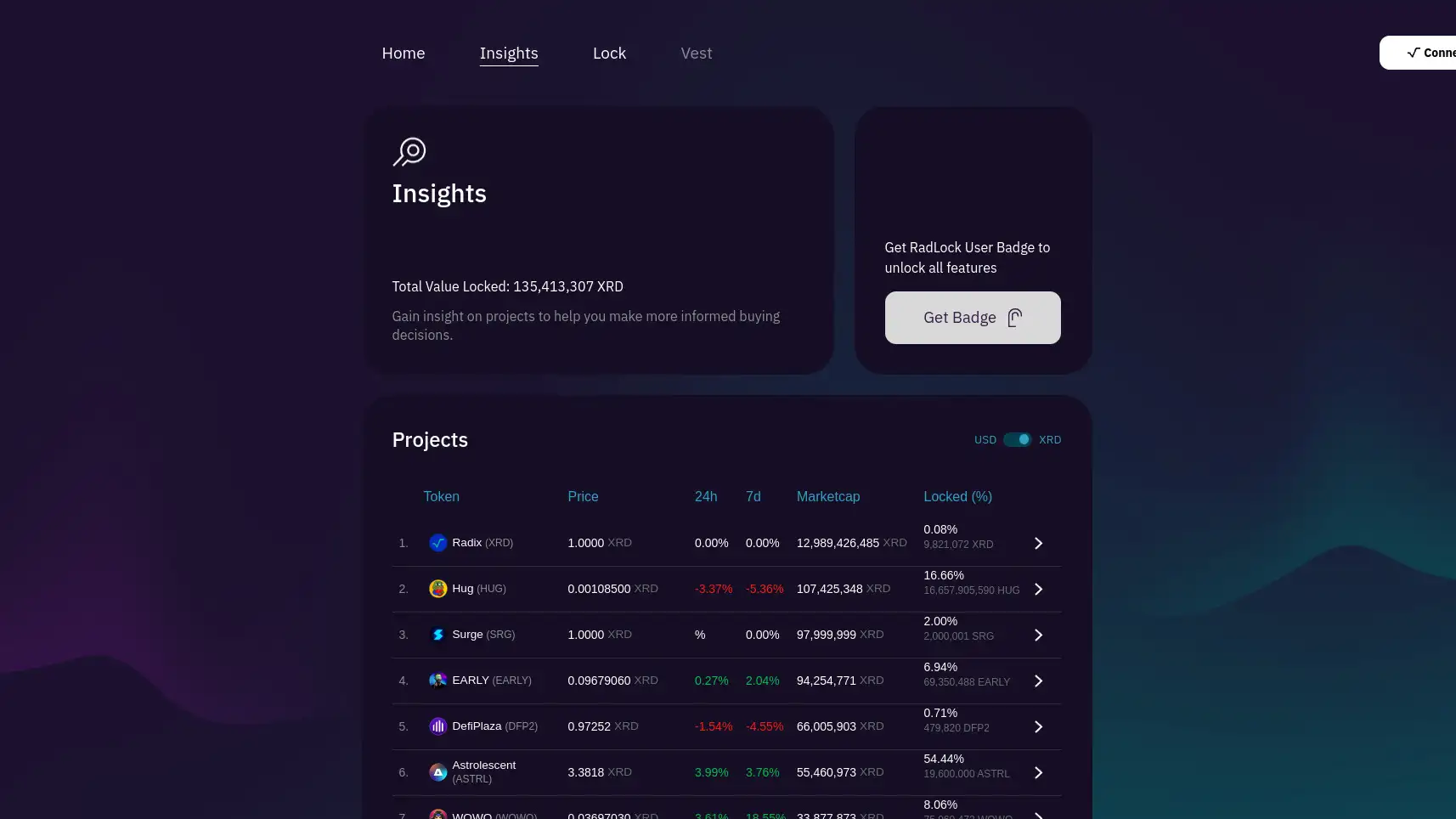

The platform’s intuitive dashboard provides real-time updates on locked liquidity, vested tokens, and other metrics, enabling investors to make informed decisions. Investors also benefit from tools like project leaderboards, which highlight top-performing projects within the Radix ecosystem, and detailed analytics that offer insights into various projects’ security and performance.

Competitors in the space include traditional liquidity locking platforms like Team Finance and Unicrypt, but RadLock distinguishes itself through its deep integration with Radix and its emphasis on community trust and transparency.

- Enhanced Security for Investors: RadLock provides tools like liquidity locking and vesting schedules, reducing risks associated with rug pulls and abrupt sell-offs. Investors can trust projects using RadLock’s services.

- Commitment to Transparency: All locked tokens, NFTs, and liquidity are visible on RadLock’s dashboard, ensuring complete transparency for both investors and project developers.

- Alignment of Incentives: Through team vesting schedules, RadLock ensures that project teams remain committed to their projects over the long term, aligning their incentives with those of their community.

- Customizable NFT Locks: The NFT locking feature allows for staggered release mechanisms, making it suitable for various applications.

- Support for Builders: Developers can use RadLock’s liquidity locking and vesting tools, increasing their credibility in the market.

- Radix Ecosystem Integration: RadLock is uniquely positioned to cater to the needs of Radix developers, offering tailored solutions.

- Visit the RadLock Platform: Go to RadLock to explore the platform’s features.

- Create an Account: Sign up for an account by providing your email and setting up a password. Verify your email to activate your account.

- Connect Your Wallet: Use a wallet compatible with the Radix ecosystem, such as Radix Wallet.

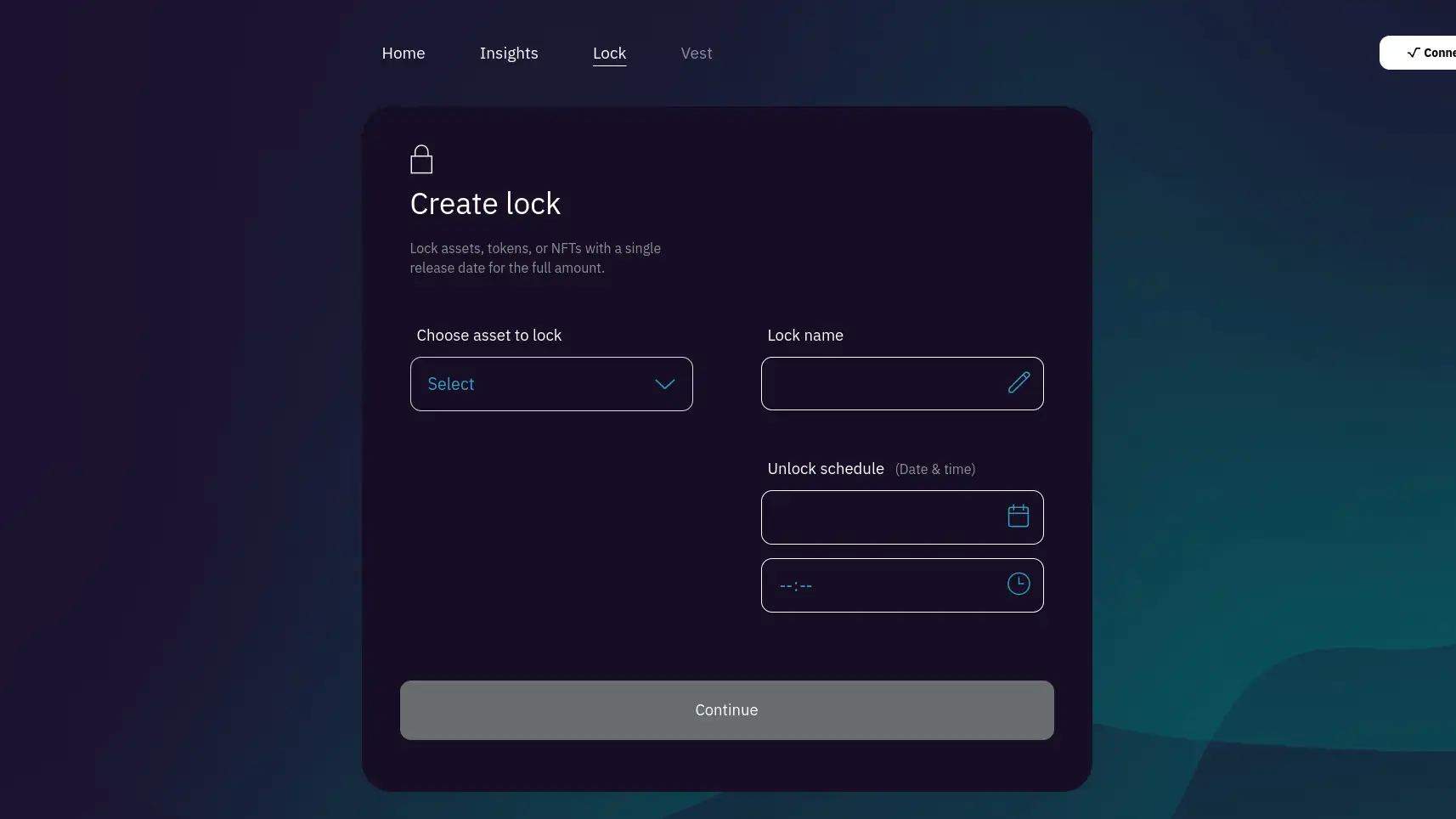

- Explore Locking Options: Access the dashboard to explore liquidity locking, vesting schedules, and NFT locking.

- Monitor Your Locks: Use RadLock’s dashboard for real-time updates and analytics.

- Access Support: Use RadLock’s support resources, including FAQs and tutorials.

Follow these steps to utilize RadLock effectively and ensure security in your crypto endeavors.

RadLock Reviews by Real Users

RadLock FAQ

RadLock stands out due to its seamless integration within the Radix ecosystem. Unlike other platforms, RadLock focuses on providing complete transparency by enabling developers to lock liquidity with a visible dashboard that tracks locked funds in real-time. This gives investors confidence that the liquidity is securely locked. Explore more features on the official RadLock platform.

The NFT locking feature on RadLock allows developers to lock NFTs with staggered release schedules based on specific milestones. This is ideal for presale investments or tokenized projects, as it aligns the release of NFTs with the achievement of predefined goals, increasing transparency and accountability. Learn more on the RadLock platform.

Yes, RadLock offers a highly intuitive dashboard where investors can track the progress of locked liquidity, vested tokens, and other parameters. The real-time project updates ensure that investors have access to the most up-to-date information, allowing them to make well-informed decisions. Visit the RadLock website to see the dashboard in action.

RadLock’s team vesting schedules provide a structured release of tokens to project teams over a specified timeline. For developers, it aligns incentives with long-term project success, ensuring sustained commitment. For investors, it offers assurance that the team is dedicated to the project’s growth and will not engage in sudden sell-offs. For more details, explore RadLock’s vesting tools.

RadLock minimizes the risk of rug pulls by locking project liquidity in a secure manner. This ensures that funds cannot be abruptly withdrawn by developers, providing peace of mind to investors. By using RadLock’s services, developers demonstrate their commitment to security and trust. Discover how RadLock builds trust in the Radix ecosystem.

You Might Also Like