About Rage Trade

Rage Trade is a cutting-edge multi-chain perpetual aggregator designed to unify liquidity across EVM L2s, L1s, AppChains, and Cosmos chains. Offering an experience comparable to centralized trading apps, Rage Trade ensures that traders can enjoy optimal execution, deep liquidity, and seamless management of positions across multiple chains without sacrificing the principles of decentralization.

At its core, Rage Trade aims to bring the full power of on-chain perps into a single, intuitive platform. Through aggregated routing, incentive programs, and cross-chain bridging capabilities, Rage Trade empowers traders to navigate the decentralized landscape more efficiently than ever before, setting a new standard for DeFi trading infrastructure.

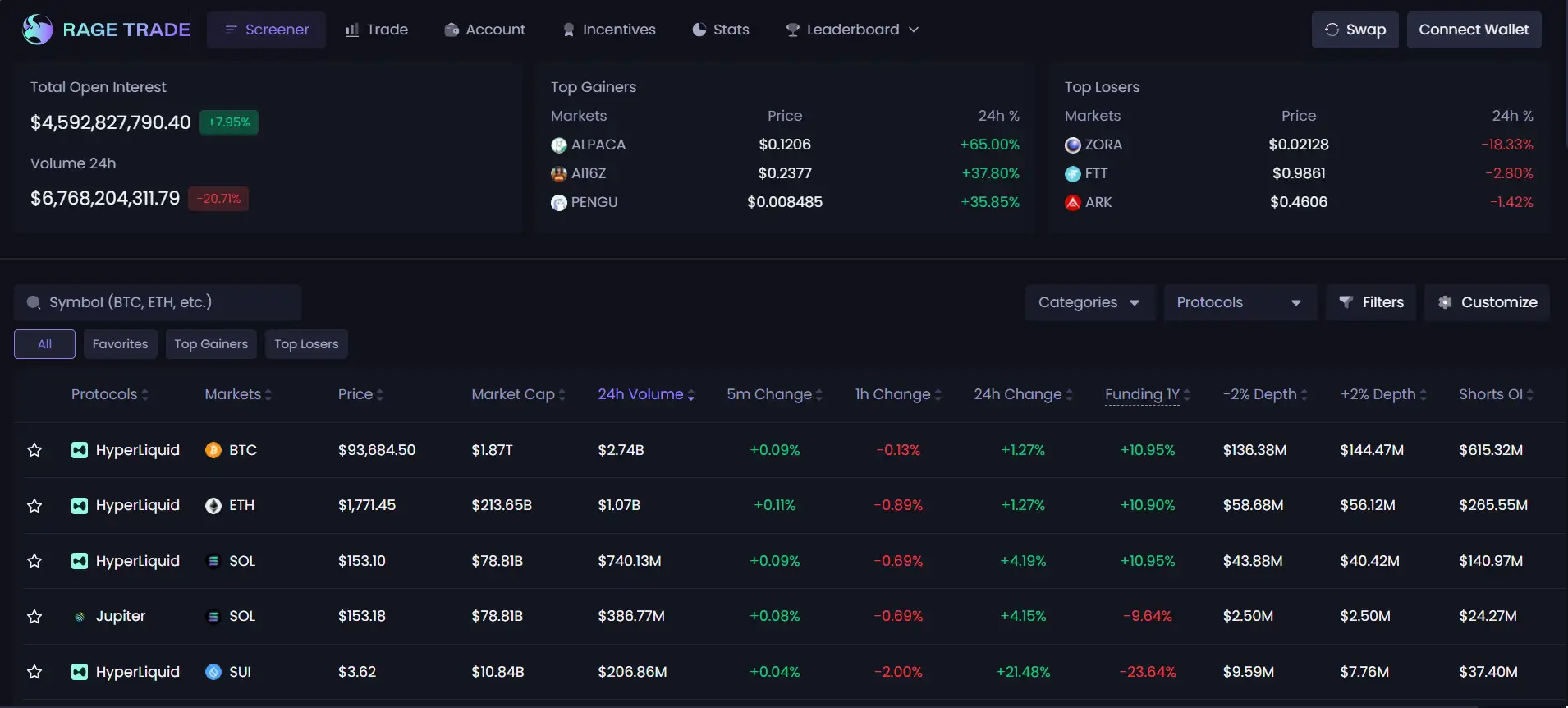

Rage Trade acts as a powerful liquidity aggregator for perpetual futures, bringing together fragmented liquidity from different decentralized exchanges (DEXes) and networks into one unified interface. By offering aggregated routing, traders can always secure the best execution by accessing the best price, lowest fees, optimal funding rates, and even token incentives—all through a familiar CEX-like trading UI. Whether trading on Arbitrum, Optimism, or specialized appchains like Hyperliquid and Aevo, users can manage everything from a single dashboard.

Through its smart routing system, Rage Trade ensures that every trade is optimized for performance, automatically selecting the most favorable trading route across integrated platforms. Traders also benefit from enhanced collateral management, allowing cross-margining, multi-wallet support, and account abstraction features that streamline the on-chain trading experience to a level comparable with traditional centralized platforms.

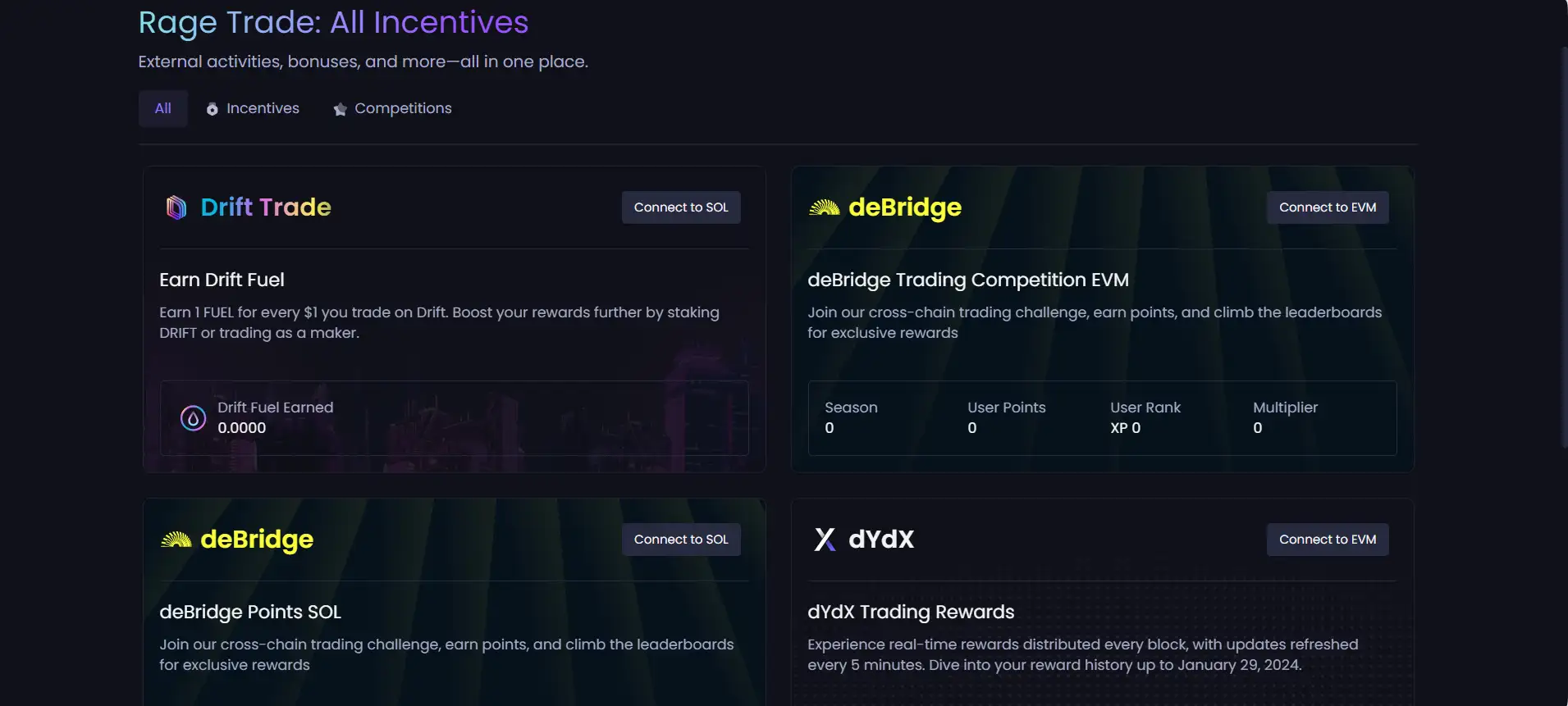

Another key element of Rage Trade is its broad array of incentive programs. With active point farming, trading competitions, and partner DEX rewards, Rage users are continuously motivated to trade actively across all aggregated protocols. Users can access these incentives transparently from a dedicated dashboard, making the platform highly attractive for volume-driven traders looking to maximize rewards.

Looking ahead, Rage Trade plans to expand into new ecosystems like Solana, Berachain, and beyond, standardizing the perpetual trading experience across multiple networks. By decentralizing the frontend, leveraging governance voting for new integrations, and reinforcing ties with ecosystems like Hyperliquid, Rage Trade is positioning itself as the go-to aggregator for the future of on-chain derivatives trading, competing with platforms like GMX, dYdX, and Aevo.

Rage Trade brings numerous benefits and features that redefine on-chain perpetual trading:

- Unified Liquidity Aggregation: Access liquidity from multiple chains and DEXes through a single, streamlined trading platform.

- Best Execution Routing: Rage intelligently selects the best price, funding rate, and fees available, ensuring optimal trading outcomes for users.

- Cross-Chain Collateral Management: Manage your trading collateral across multiple chains with ease through smart bridging and swapping integrations.

- Incentive Programs: Participate in point farming, trading competitions, and airdrop farming directly through the Rage platform.

- Familiar Trading Experience: Enjoy a UI/UX designed to mirror traditional trading apps, ensuring an easy learning curve for CEX traders entering DeFi.

- Decentralized Frontend Vision: Future governance will allow token holders to vote on new integrations and influence the direction of Rage Trade’s expansion.

Rage Trade makes it quick and intuitive to begin your multi-chain trading journey:

- Connect Your Wallet: Visit Rage Trade and connect your favorite EVM-compatible wallet like MetaMask or Rabby.

- Choose Order Type: Select whether you want to place a Market or Limit order for your desired asset.

- Customize Your Trade: Toggle Long/Short, set your leverage, select your collateral type, and input position size.

- View Optimal Routes: Instantly view the best execution paths by price, funding rate, and available rebates.

- Place and Manage Positions: After executing a trade, manage your positions, add/remove collateral, or set Take Profit/Stop Loss from the intuitive Positions dashboard.

- Earn Incentives: Participate in active trading competitions, airdrop campaigns, and referral programs to maximize your rewards.

Rage Trade FAQ

Rage Trade aggregates liquidity and execution routes from multiple decentralized exchanges (DEXes), providing users with the best price, lowest fees, optimal funding rates, and token incentives — all from a single dashboard. Instead of manually switching between platforms, traders on Rage Trade can access everything through unified smart routing, saving time, maximizing profits, and minimizing slippage across multi-chain networks.

Through powerful integrations like LiFi and custom smart routing, Rage Trade allows users to bridge, swap, and manage collateral across 9+ chains seamlessly. With just one click, users can adjust their margin positions without manually transferring assets between networks, making on-chain trading as smooth as a centralized platform while preserving full decentralization.

Rage Trade offers a dedicated Incentives Dashboard where users can track ongoing point farming programs, trading competitions, fee rebates, and airdrop opportunities. Traders at Rage Trade can select routes offering extra emissions or bonuses, maximizing their yield while executing their normal trading strategies — no extra effort required.

Rage Trade plans to open-source its frontend code and host it on IPFS, allowing anyone to contribute to its expansion. Governance token holders will be able to vote on new integrations and proposed upgrades, ensuring that the future of Rage is shaped directly by its community. This model empowers users while reinforcing Rage’s commitment to decentralization.

Rage Trade has chosen Hyperliquid as the primary venue for its $RAGE token deployment and liquidity. By reinvesting into Hyperliquid’s ecosystem, Rage strengthens both its token’s stability and its trading infrastructure. This strategic alignment enables Rage Trade to pioneer liquidity aggregation across emerging appchains and grow a vibrant, connected trading ecosystem for on-chain perpetuals.

You Might Also Like