About Raydium

Raydium is a cutting-edge decentralized exchange (DEX) and automated market maker (AMM) built on the Solana blockchain. Unlike traditional DEXs, Raydium integrates with the Serum order book, allowing for deep liquidity and efficient trade execution. This hybrid model enables users to access both liquidity pools and the central limit order book, offering faster transactions, lower fees, and superior price discovery.

As a key player in the Solana DeFi ecosystem, Raydium provides advanced trading functionalities, including yield farming, staking, and token swaps. The platform’s innovative liquidity aggregation ensures that traders get the best available prices while liquidity providers earn rewards for contributing to the ecosystem. By leveraging Solana’s high-speed and low-cost transactions, Raydium delivers a seamless and scalable DeFi trading experience.

Raydium is one of the most advanced decentralized finance (DeFi) platforms on the Solana blockchain, offering fast, low-cost, and highly liquid trading solutions. Unlike conventional AMMs, Raydium connects directly with the Serum order book, ensuring that liquidity is shared across the entire Solana ecosystem rather than being confined to individual pools.

The platform was designed to address the limitations of Ethereum-based DEXs, such as high transaction fees, slow confirmation times, and fragmented liquidity pools. By utilizing Solana’s high-speed blockchain, Raydium processes transactions in sub-seconds with negligible fees, making it an ideal choice for both retail traders and institutional investors.

Key functionalities of Raydium include:

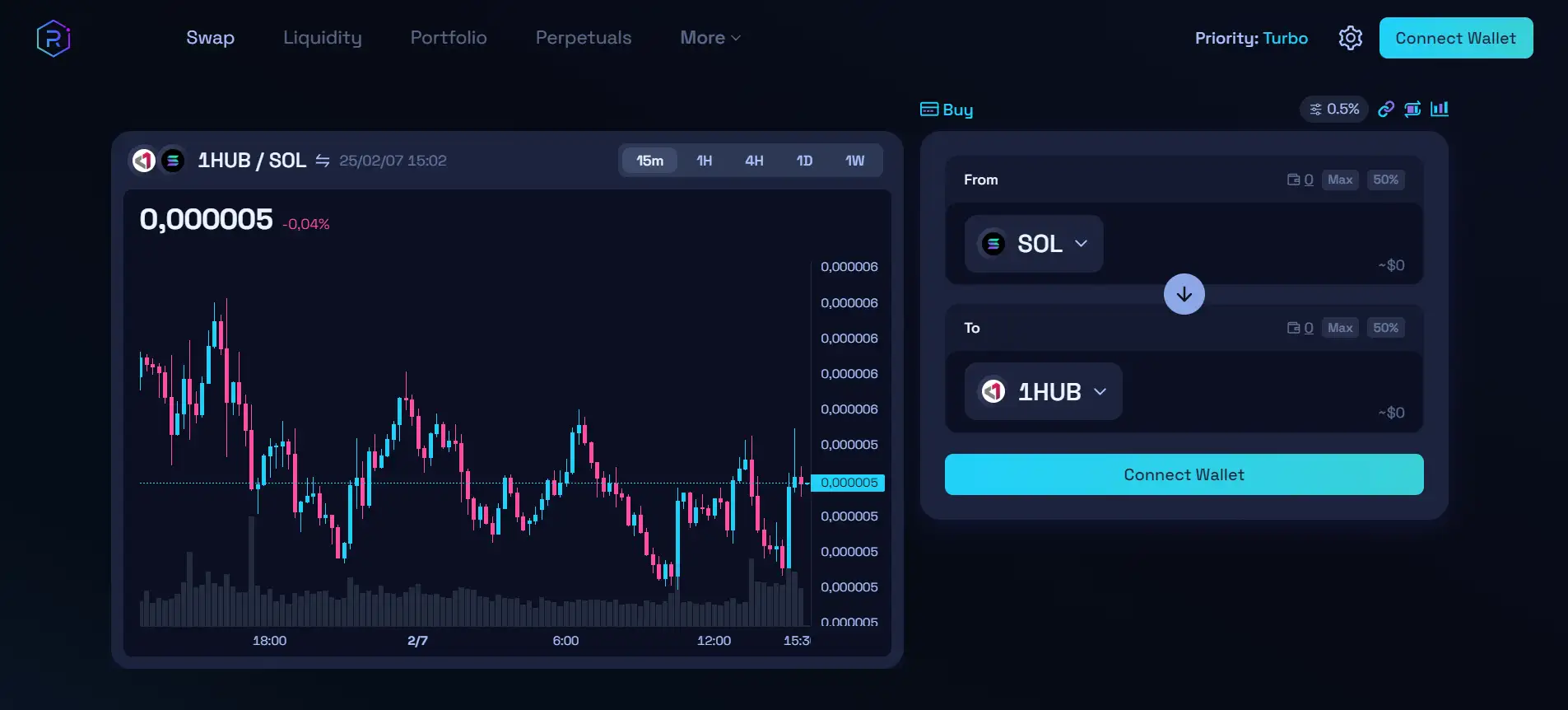

- Swaps & Limit Orders: Instantly swap tokens or place limit orders with access to deep liquidity pools and the Serum order book.

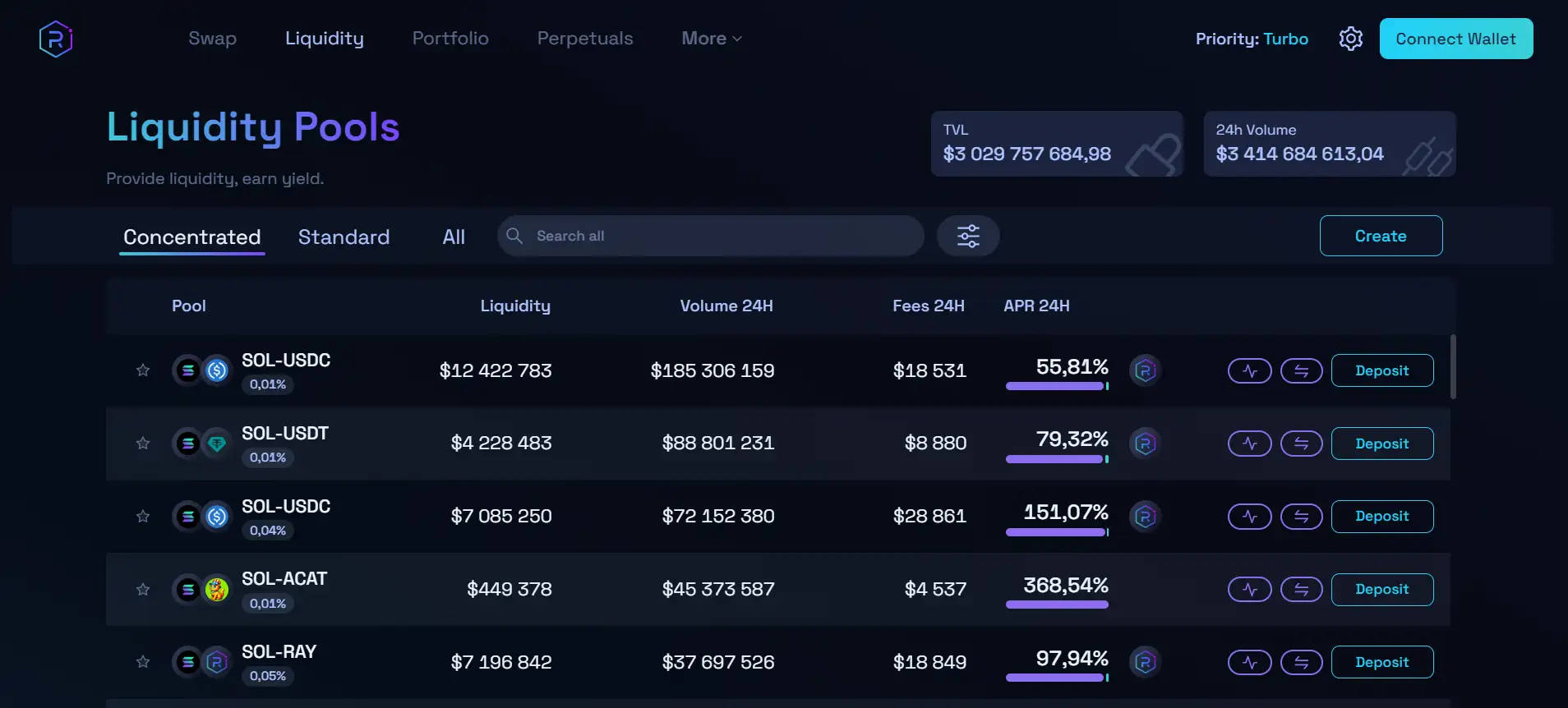

- Yield Farming: Users can provide liquidity to various pools and earn RAY token rewards.

- Staking: Holders of RAY tokens can stake their assets to earn additional yield.

- Launchpad (AcceleRaytor): A decentralized IDO platform that enables new projects to raise capital and distribute tokens efficiently.

- Fusion Pools: Dual-yield farms where liquidity providers earn both RAY rewards and additional partner tokens.

Raydium competes with other major DEXs and AMMs, including Uniswap, SushiSwap, and PancakeSwap. However, Raydium’s integration with Serum, Solana’s high-performance blockchain, and unique liquidity model give it a distinct advantage in terms of speed, efficiency, and cost-effectiveness.

Raydium offers several key benefits that set it apart in the DeFi space:

- Lightning-Fast Transactions: Built on the Solana blockchain, Raydium enables near-instant transactions with low fees.

- Deep Liquidity Access: By integrating with the Serum order book, Raydium offers superior price execution compared to traditional AMMs.

- Yield Opportunities: Users can participate in yield farming, staking, and liquidity mining to earn passive income.

- Permissionless Token Swaps: Traders can instantly swap any SPL tokens without relying on centralized exchanges.

- IDO Launchpad (AcceleRaytor): A platform for early-stage crypto projects to distribute tokens and raise funds.

- Fusion Pools: Liquidity providers earn dual rewards, receiving RAY tokens plus additional partner tokens.

Getting started with Raydium is easy. Follow these steps to access Solana’s leading DEX:

- Visit the Official Website: Go to Raydium to explore available features.

- Set Up a Solana Wallet: Use wallets like Phantom or Solflare to connect to Raydium.

- Deposit Solana (SOL): You'll need SOL tokens to pay for transactions on the network.

- Start Trading: Swap tokens, provide liquidity, or stake assets to earn rewards.

- Explore Yield Farming: Join Fusion Pools or liquidity mining programs to maximize earnings.

- Stay Updated: Follow Raydium’s Twitter and Discord for the latest updates.

Raydium FAQ

Raydium connects directly to the Serum order book, giving traders access to deeper liquidity and better prices compared to traditional AMMs. This integration ensures lower slippage and more efficient trade execution. Instead of being limited to individual liquidity pools, orders are matched with the entire Solana DeFi ecosystem, making Raydium one of the fastest and most cost-effective DEXs.

Fusion Pools on Raydium allow liquidity providers to earn dual rewards instead of just one. In addition to earning RAY token rewards, users receive bonus tokens from partnered projects. This creates a higher earning potential and provides exposure to new ecosystem tokens. Check out the latest Fusion Pools on Raydium’s official website.

Yes, Raydium supports limit orders through its integration with the Serum order book. Unlike traditional AMMs where trades execute at market price, users can set specific buy or sell prices, giving them more control over their trades. This feature is a major advantage for traders who want to avoid price slippage. Start placing limit orders now on Raydium.

AcceleRaytor is Raydium’s IDO platform that ensures fair token launches through automated and transparent distribution. Unlike traditional launches that are vulnerable to bots and price manipulation, AcceleRaytor uses structured pools that prevent unfair price spikes. Participants contribute to an IDO pool and receive tokens proportionally. Stay updated on upcoming IDOs at Raydium’s website.

Not always. Due to impermanent loss, the ratio of tokens you withdraw may be different from what you deposited. This occurs because trading activity changes the proportion of assets in the pool over time. However, liquidity providers earn trading fees and staking rewards, which can offset these fluctuations.

You Might Also Like