About RealtyX

RealtyX is a decentralized real estate investment platform redefining how property ownership and rental income are accessed in the Web3 world. By merging blockchain technology with Real-World Assets (RWA), RealtyX enables users to purchase tokenized shares in actual properties and receive bi-weekly rental income, all while retaining full governance rights through property-specific tokens called RST. The platform is built on the Base network and is designed to offer secure, compliant, and user-governed exposure to global real estate markets.

RealtyX provides an on-chain ecosystem where users can participate in community-led property governance, passive income distribution, and utility integrations like lending and staking. As one of the emerging leaders in RWAfi, RealtyX aims to bridge the gap between DeFi and traditional real estate by making property investment accessible, liquid, and rewarding for global Web3 participants through secure smart contracts and DAO mechanisms.

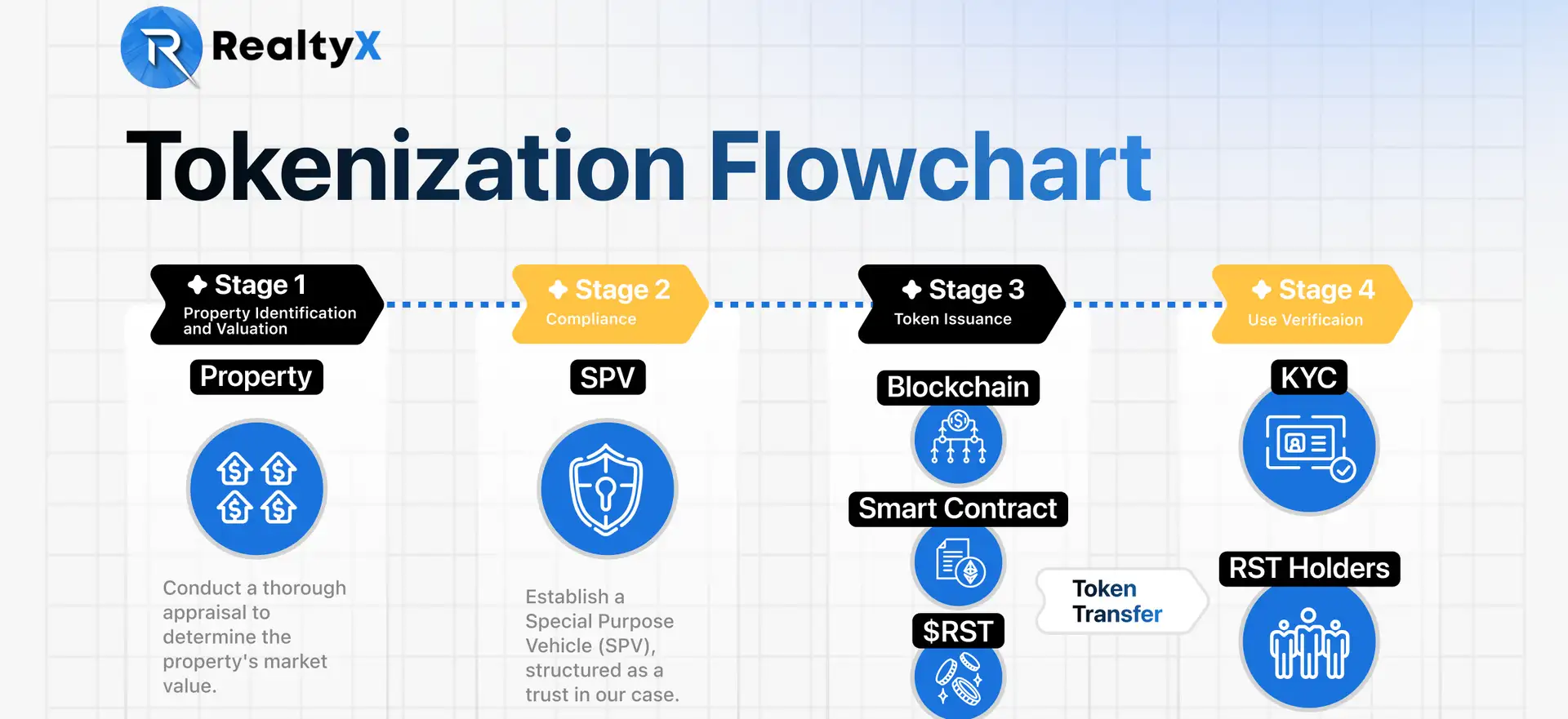

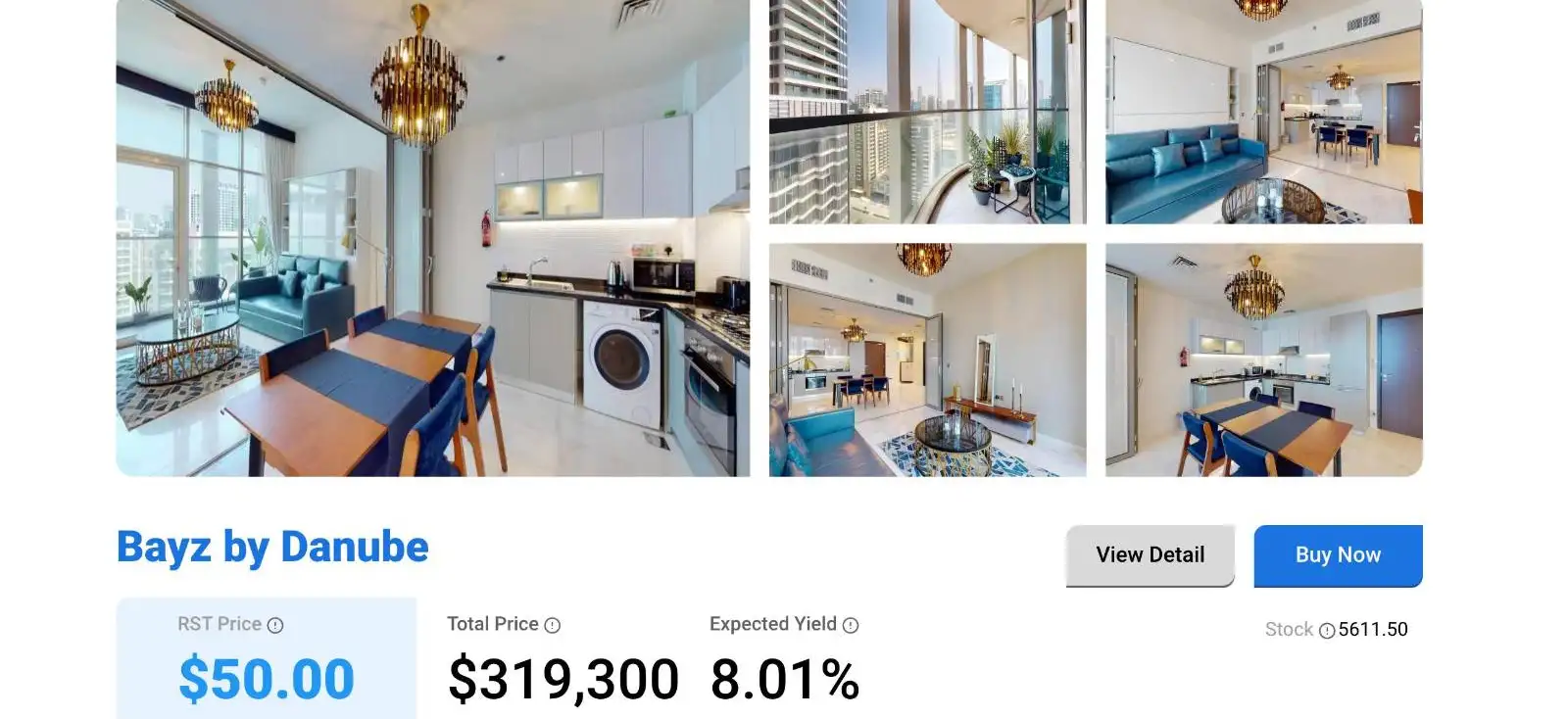

RealtyX is transforming traditional real estate ownership through tokenization, enabling fractional ownership, community governance, and passive income generation directly on-chain. Launched as a pilot platform and developed by a team of real estate professionals, blockchain developers, and Web3 strategists, RealtyX leverages the ERC-20 standard to issue RealtyX SPDD Tokens (RST). Each RST represents a stake in a real property held in trust, giving holders both proof of ownership and governance rights over rental income distribution and property-related decisions.

The platform operates through property-specific decentralized governance structures known as Special Purpose Decentralised Divisions (SPDDs). SPDD members vote on matters including rental distributions, smart contract upgrades, and even the sale of tokenized properties. Properties are managed locally by licensed professionals, with rental income distributed bi-weekly in USDC directly to users' wallets on the Base network. The system is structured to be legally resilient—even in the event RealtyX ceases operations, RST holders retain their property interests through an underlying trust structure.

RealtyX has a global roadmap: starting in Dubai, where high yields and crypto-friendly regulations create strong market potential, the platform will expand to Japan, Europe, Hong Kong, and Southeast Asia by 2026. Future features include a property booking system, multi-chain integrations, and a larger Utility Vault ecosystem offering DeFi tools like lending, bridging, and yield optimization. RealtyX has been recognized by premier Web3 accelerators such as SpringX Move and WOW Summit, validating its innovation in the RWA space.

What makes RealtyX especially relevant is its emphasis on legal compliance and security. Properties are held by a licensed trustee and audited annually, while all users must complete KYC verification before purchasing RST. Despite this, the platform maintains user custody through wallet integration and smart contracts, preserving the decentralization ethos. Similar RWA-focused platforms include RealT, Brickken, and Propy, though RealtyX differentiates itself with DAO-native governance, frequent payouts, and deep utility integrations via the Vault system.

RealtyX offers a unique set of features that combine real-world property ownership with the benefits of blockchain technology:

- Tokenized Property Access: Buy fractional real estate through RST tokens, each representing a stake in a property trust.

- Passive Income in USDC: Receive bi-weekly rental distributions directly to your wallet on the Base network.

- SPDD Governance: Participate in decentralized decision-making, including property sales and income distribution.

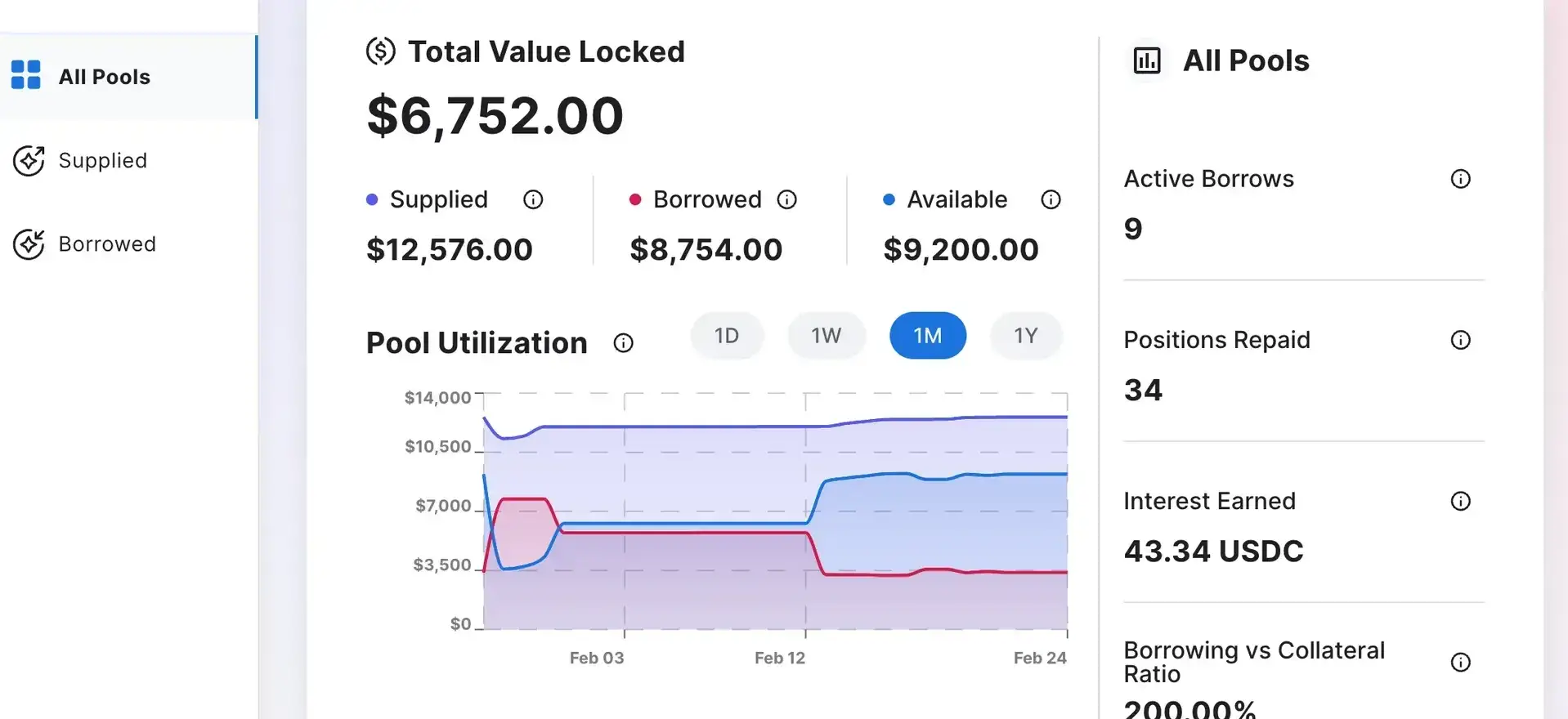

- Utility Vault Integrations: Use RST in DeFi strategies like lending, mining, and bridging with partner protocols.

- Secure Legal Framework: Properties are held in legally compliant trusts with third-party audits and no exposure to platform risk.

- Multichain and Global Expansion: RST is built on Base with future deployments planned for Ethereum, Plume, and Apechain.

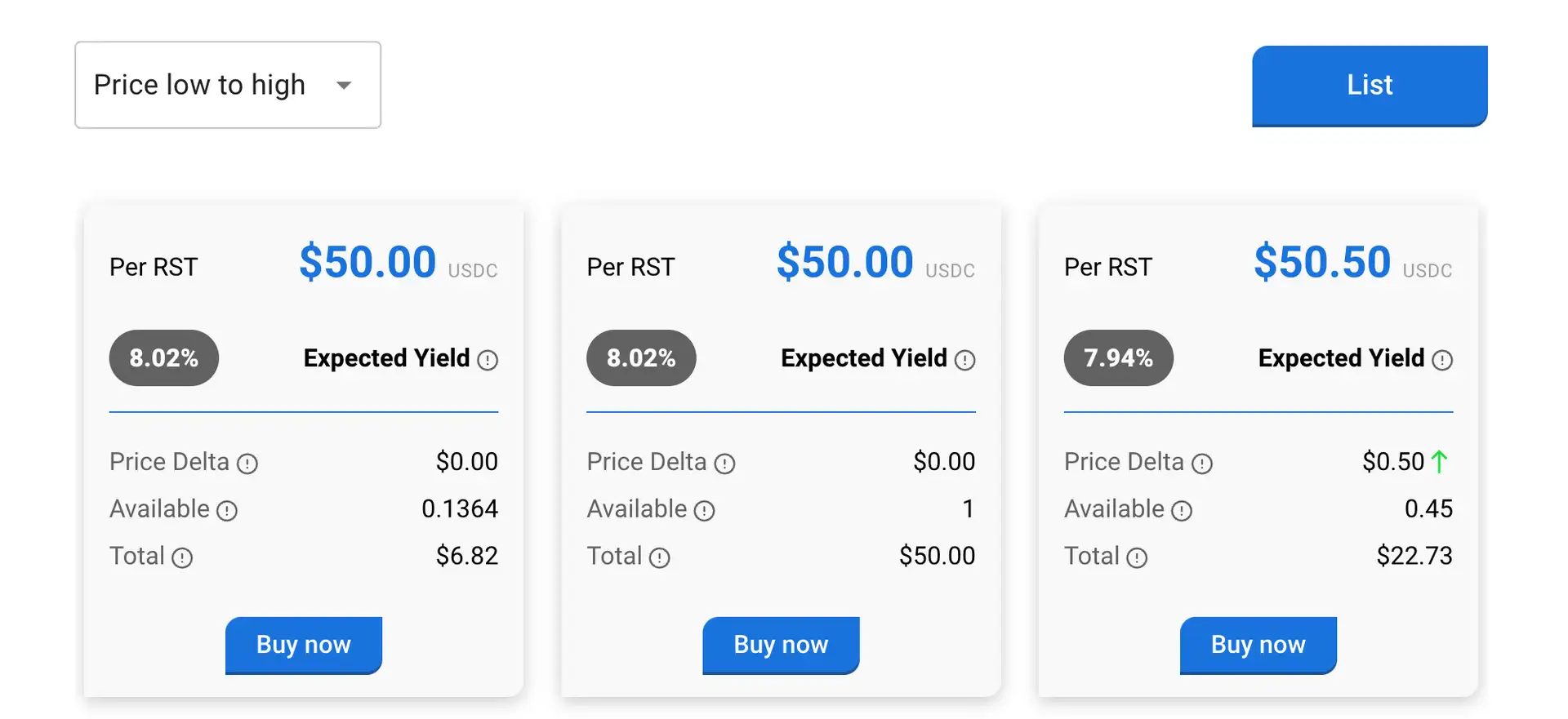

- Flexible Exit: Sell RST tokens via the integrated secondary market or set custom sell orders.

- Verified Property Management: Each property is maintained and rented by licensed local agents, ensuring steady income flow.

Getting started with RealtyX is easy and secure. Follow these steps to begin your journey into tokenized real estate:

- Step 1: Visit the official website at realtyx.co and click "Sign Up" to create an account.

- Step 2: Connect your EVM-compatible wallet such as MetaMask or WalletConnect.

- Step 3: Complete KYC verification by uploading a valid government-issued ID for compliance.

- Step 4: Purchase RST tokens in the primary market using supported cryptocurrencies via Coinbase (Ethereum, Polygon, Base).

- Step 5: Alternatively, trade RST on the secondary market using Base USDC.

- Step 6: Earn bi-weekly rental income automatically distributed in USDC to your connected wallet.

- Step 7: Access Utility Vault features like mining, lending, and bridging, using your RST as collateral or staking input.

- Step 8: When ready, list your RST on the secondary market to exit your position at your preferred price.

RealtyX Reviews by Real Users

RealtyX FAQ

If a property's market value rises by at least 10%, RealtyX initiates a community vote among RST holders in the associated SPDD. If the majority approves the sale, the property is listed and sold by licensed professionals. Upon a successful transaction, all RST holders receive their proportional share of the profits in USDC directly to their wallet. After the sale, the corresponding RST is retired, and holders will no longer earn rental income from that asset.

The Utility Vault offers exclusive DeFi features for RST holders, turning real estate ownership into an on-chain yield strategy. By holding RST, users gain access to features like token mining, lending, and bridging in collaboration with partner protocols. These utilities amplify the value of your ownership and offer additional rewards beyond rental income. Rules may vary by feature. Visit the Utility Vault at realtyx.co for live options.

Yes, the platform is designed for community-driven governance through SPDDs, and no prior real estate experience is needed. As an RST holder, you can vote on rental income distribution, property sales, and other proposals. Voting is handled via an intuitive interface, and RealtyX offers educational materials to guide users through the process. This democratizes real estate access and empowers holders to shape outcomes directly on realtyx.co.

RST holders remain legally protected even if RealtyX ceases to operate. Each property is held in an independent trust structure, separate from the DAO or platform. Income and ownership rights are preserved via smart contracts and legally binding frameworks. RST remains valid proof of your asset share, and you retain full claim over income and resale opportunities. RealtyX's legal model ensures continuity, decentralization, and immutability. Learn more at realtyx.co.

RealtyX begins in Dubai due to its strong real estate yields (8–12%), robust market growth, and crypto-friendly regulation. These conditions make it ideal for launching tokenized assets. The roadmap includes expansion into Japan, Europe, Hong Kong, and Southeast Asia by 2026, with plans for $100M+ in RWA assets. Each expansion is subject to legal feasibility and market potential.

You Might Also Like