About Rebalance Finance

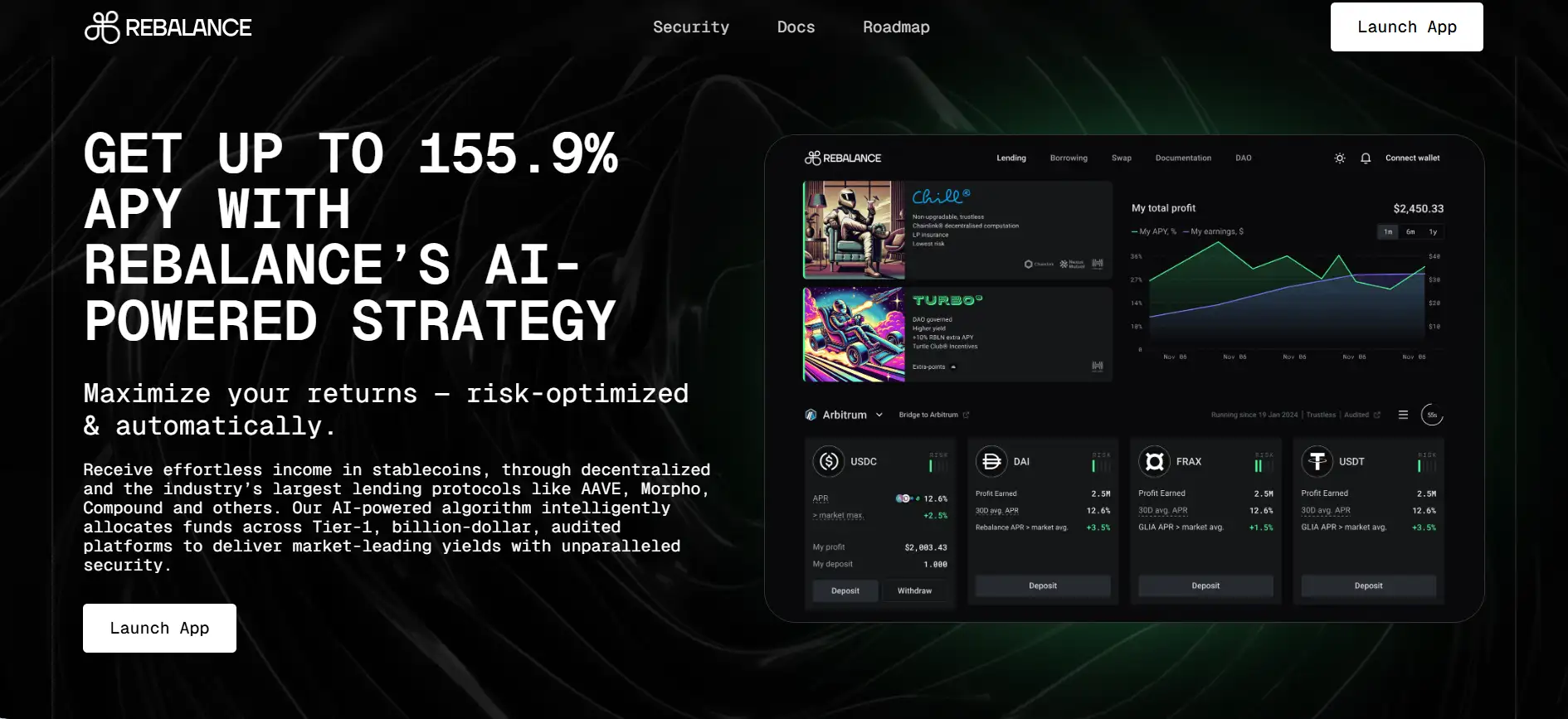

Rebalance Finance is an advanced, AI-powered DeFi protocol focused on delivering automated, risk-optimized yield on stablecoins through integrations with top-tier lending protocols. It simplifies yield farming by intelligently reallocating user funds across audited platforms such as AAVE, Compound, and Morpho, maximizing returns while minimizing exposure to volatility. With its innovative use of the Efficient Allocation Model (EAM), Rebalance Finance offers a hands-free way to generate consistent passive income on-chain.

The platform leverages Chainlink Automation for decentralized computations and executes reallocations through secure, non-upgradable smart contracts. By incorporating advanced analytics, security audits, and DAO governance, Rebalance Finance stands out as a next-gen DeFi protocol that bridges algorithmic investing with user-controlled decentralization. It provides a seamless experience for both newcomers and experienced users seeking stablecoin yield generation without constant manual management.

Rebalance Finance began with a mission to make yield farming simple, safe, and scalable. The project was meticulously researched and launched with a mathematical foundation, utilizing blockchain data analysis and simulation modeling from as early as Q4 2023. The core team prioritized building an adaptive, risk-optimized strategy capable of monitoring APRs in real time and reallocating assets to the most rewarding, low-risk lending pools. This strategy, named the Chill® Strategy, powers the protocol today by constantly rebalancing funds across Tier-1 DeFi protocols.

In 2024, the platform matured with private security audits from Hacken and 4ire Labs, the release of a user-friendly DApp, and a live deployment on Ethereum and additional chains like Binance Smart Chain and Base. Throughout this period, Rebalance integrated support for popular stablecoins including USDC, USDT, and DAI. Its backend was powered by Chainlink Decentralized Computation, ensuring that both the performance analytics and execution logic remained trustless and tamper-proof.

What sets Rebalance apart is its commitment to transparency, decentralization, and continuous improvement. Through the upcoming Rebalance DAO, users will govern core decisions, including community fund allocation. Additional innovations include a Rebalance Yield-Bearing Token that combines returns from tokenized real estate, RWAs, stablecoin strategies, and even venture capital allocations, aiming for diversified returns of up to 30% APY. Rebalance also introduces real-world applications through partnerships focused on tokenizing real estate and traditional financial instruments, pushing DeFi into mainstream utility.

Unlike platforms such as AAVE or Compound, which require manual user engagement, Rebalance Finance offers a fully automated approach. It allows users to simply deposit assets and let the system handle all adjustments in the background, reducing stress and exposure to market inefficiencies. This positions Rebalance in the same lane as yield optimization platforms like Yearn Finance, but with stronger AI integration, multi-chain support, and greater emphasis on risk mitigation.

Rebalance Finance offers an impressive set of features and advantages that place it among the most innovative DeFi yield platforms:

- AI-Powered Optimization: Uses algorithmic strategies to intelligently reallocate funds and maximize stablecoin yields.

- Chainlink Integration: Relies on Chainlink Automation® to power decentralized and trustless computation.

- Cross-Protocol Yield Farming: Seamlessly interacts with AAVE, Compound, Morpho, and more.

- Risk-Optimized Strategy: The Chill® Strategy continuously analyzes market risk and yield potential to maintain optimal allocations.

- Security-First Infrastructure: Non-upgradable smart contracts with audit verifications from Hacken and 4ire Labs.

- Upcoming DAO Governance: Community-driven decision-making for fund allocations and strategic roadmap updates.

- Future Real World Asset Support: Roadmap includes tokenized real estate, stocks, and bonds for diversified income generation.

Getting started with Rebalance Finance is seamless, even for users new to DeFi investment strategies:

- Step 1: Visit Rebalance Finance and click on "Launch App."

- Step 2: Connect your wallet using MetaMask or another supported provider.

- Step 3: Choose the stablecoin you wish to deposit (USDT, USDC, or DAI).

- Step 4: Review estimated APY and confirm deposit to begin earning automated yield through the Chill® strategy.

- Step 5: Monitor your portfolio’s performance through the dashboard; rebalancing happens automatically.

- Step 6: Stay updated by following the roadmap or engaging with the community as DAO governance goes live.

Rebalance Finance FAQ

The Efficient Allocation Model (EAM) at the core of Rebalance Finance is powered by real-time data and Chainlink Automation®. It continuously monitors APRs across lending protocols like AAVE and Compound, and recalculates risk-reward dynamics. Once a better opportunity is found, it triggers a smart contract-based reallocation of funds without user intervention. This ensures your assets are always positioned for the best possible yield with the least risk exposure.

The Chill® strategy is built on advanced mathematical modeling and operates fully on-chain. Unlike aggregators that may rely on centralized data or partial automation, Rebalance Finance executes its decisions via non-upgradable smart contracts. Chill® constantly scans yield markets and applies risk-adjusted optimization to reallocate capital only when necessary, minimizing gas fees and risk while maximizing returns.

Rebalance Finance is actively expanding to include tokenized real estate, stocks, bonds, and metals via licensed partners in the US and EU. These assets will feed into its multi-stream yield token, blending high-return RWA strategies with crypto-native yield sources. This helps users tap into traditional finance yield with the flexibility of DeFi. As part of the roadmap, RWAs will be managed through the same AI-driven strategies for seamless integration and optimization.

The upcoming Rebalance DAO will allow community members to participate in protocol decisions. Token holders will vote on fund allocation strategies, RWA partnerships, risk parameters, and new integrations. Funds held in the DAO treasury are controlled by multi-signature smart contracts and governed through transparent on-chain proposals. This ensures that Rebalance Finance evolves with the interest of its users, not just the founding team.

Rebalance Finance deploys multiple layers of protection: non-upgradable smart contracts, audits by Hacken and 4ire Labs, and Chainlink’s decentralized backend. Additionally, the protocol includes emergency features like pausability and timelocked provider updates. This allows rapid response to threats while protecting funds. Every decision by the admin is controlled by multisig and public timelocks, making security actions transparent and trackable on-chain.

You Might Also Like