About Reflexer

Reflexer is the creator of RAI, a decentralized, non-pegged stable asset designed to operate without reliance on fiat currencies or traditional pegs. Unlike other stablecoins that aim to track USD or other fiat values, Reflexer introduces a novel monetary system that uses algorithmic incentives and dynamic pricing to create a fully on-chain, Ethereum-backed asset with an independent price float.

The core of Reflexer lies in its GEB (Generalized Elasticity Basket) framework, which governs how RAI is minted, managed, and stabilized over time. This system uses a feedback mechanism that continuously adjusts RAI’s target redemption price based on market dynamics, creating a floating stable asset. With smart contract architecture that progressively minimizes governance and empowers automation, Reflexer positions itself as a trust-minimized, transparent financial primitive within the DeFi ecosystem.

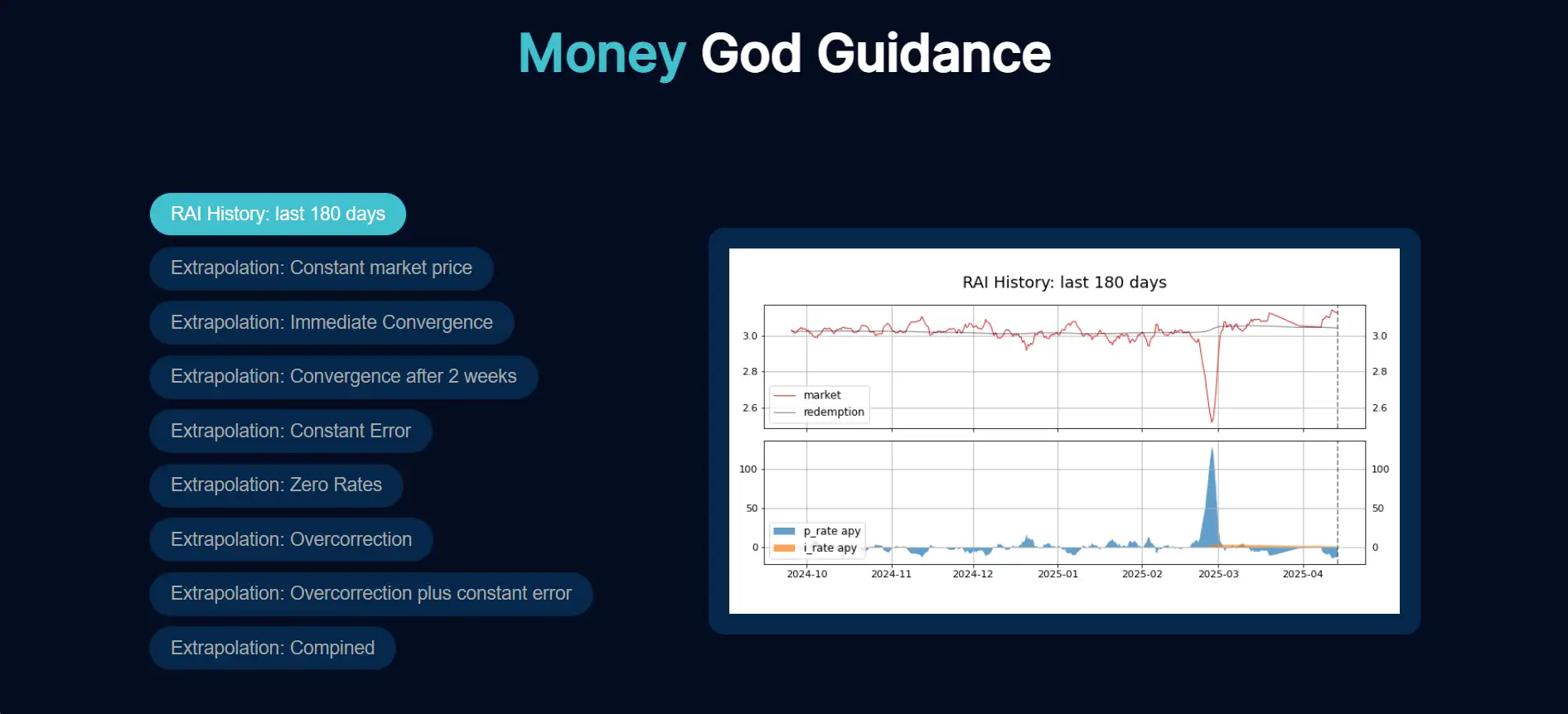

Launched as a response to the vulnerabilities of fiat-pegged stablecoins, Reflexer set out to design a self-stabilizing asset that doesn’t depend on external financial systems. At its core, RAI is backed solely by ETH, and its stability mechanism centers around a variable called the redemption rate, which changes based on the deviation between market price and redemption price. This mechanism incentivizes market participants — both borrowers (SAFE users) and holders — to help bring RAI’s price in line with protocol-defined targets.

Reflexer’s innovation stems from building on the MCD (Multi-Collateral DAI) codebase and enhancing it with features such as discount auctions, insurance mechanisms for borrowers, automatic parameter adjustments, and even ungovernance tools for removing centralized control over time. Its goal is not just decentralization, but also minimalism in protocol operation, giving the community long-term ownership and automation control over core processes. RAI operates using non-rebase mechanics, meaning the number of tokens in a wallet remains static — only the redemption price floats.

The platform has embraced a staged roadmap for governance minimization. This includes transferring responsibility to algorithmically-driven smart contracts for setting system parameters like debt ceilings, redemption rates, and auction limits. Contracts such as the Stability Fee Treasury, Accounting Engine, and Liquidation Engine are increasingly automated, ensuring protocol longevity and resistance to human interference. As automation takes over, the role of FLX (Reflexer’s governance and backstop token) diminishes — making the system more autonomous.

Furthermore, Reflexer has expanded RAI to multiple chains, including Fantom, Polygon, Avalanche, Solana, Arbitrum, and Optimism. Integrations with Uniswap, SushiSwap, and others enable robust trading activity. In addition, unique financial products such as RAI-based money markets, synthetic assets, and portfolio rebalancing tools are being built by the community — turning RAI into a versatile DeFi primitive. The broader initiative, Money God League, seeks to bring non-pegged assets like RAI into mainstream use through community-led innovation.

Reflexer and its RAI system offer several unique advantages that make it a powerful addition to the DeFi ecosystem:

- Non-Pegged Stability: RAI’s value is stabilized using a managed float, reducing dependency on fiat-based pegs and centralized oracles.

- ETH-Only Collateral: RAI is fully backed by Ethereum, eliminating exposure to centralized or real-world collateral risks.

- Redemption Rate Mechanism: Instead of using fixed rates, RAI uses a continuously updated rate to devalue or revalue itself based on market activity.

- Governance Minimization: Through the use of audited automation tools, Reflexer reduces human control over the protocol.

- FLX Token Safety Net: FLX stakers act as the first defense layer during market imbalances, and FLX is used in protocol auctions to backstop the system.

- Multi-chain Availability: RAI is supported across Fantom, Arbitrum, Avalanche, Polygon, Solana, and Optimism for broad ecosystem access.

- Advanced Use-Cases: Developers can integrate RAI into options, synthetic assets, money markets, arbitrage bots, and DAO reserve strategies.

Getting started with Reflexer and RAI is simple for any DeFi user looking to experience a non-pegged stable asset:

- Step 1: Visit reflexer.finance and connect your Web3 wallet on the Dashboard.

- Step 2: Deposit ETH into a SAFE to mint RAI — a process similar to borrowing DAI on Maker.

- Step 3: Monitor the RAI redemption rate and manage your SAFE accordingly, either repaying RAI or minting more.

- Step 4: Stake FLX if you want to participate in system backstopping and future governance minimization votes.

- Step 5: Trade or use RAI on supported DEXs like Uniswap, SushiSwap, and KyberSwap across supported networks.

- Step 6: Join the community via Discord to explore building tools, products, or integrations around RAI.

Reflexer FAQ

RAI maintains a floating value using a unique mechanism called the redemption rate. Instead of tracking a fixed USD peg, the system adjusts the target redemption price up or down based on whether RAI is trading above or below its target. This incentivizes SAFE users (who mint RAI) and RAI holders to push the market price toward equilibrium. This floating model makes Reflexer the first protocol to use a self-adjusting stable asset that avoids fiat dependencies entirely.

RAI offers a way to gain ETH-like exposure with reduced volatility. Because it is fully backed by ETH and governed by a managed float regime, it responds to market changes gradually. For DAOs, this means less exposure to sharp ETH price drops but still benefiting from ETH’s upside. Holding RAI in a treasury allows for diversified reserve management without the risks of fiat-pegged coins or centralized stablecoin issuers.

The redemption rate is the key driver of RAI’s monetary policy. A positive redemption rate means the target price of RAI is increasing, encouraging RAI holders to buy and SAFE users to repay debt. A negative rate means RAI is being devalued, pushing RAI holders to sell and SAFE users to mint more. These rates change gradually, enabling the RAI system to self-correct imbalances without needing a fixed peg.

FLX is a backstop and governance token within the Reflexer system. When RAI debt cannot be covered by collateral, new FLX is minted and auctioned off to cover it. This makes FLX the protocol’s final line of defense. Additionally, FLX will gradually assume control of remaining governance elements — such as oracles or liquidation settings — until Reflexer is fully governance minimized and operates autonomously.

Yes — one of the most innovative features of RAI is that it introduces an intrinsic interest rate via the redemption rate. This allows developers to build unique RAI-based money markets, options platforms, yield optimizers, or even arbitrage bots. The redemption rate can be used as a financial primitive in DeFi, creating use-cases that are not possible with fixed-peg stablecoins. Reflexer is already seeing developers explore this across multiple EVM chains.

You Might Also Like