About Relend Network

Relend Network is a decentralized finance platform that provides innovative lending and borrowing solutions using blockchain technology. It allows users to access a secure and transparent lending ecosystem where assets are exchanged without the need for intermediaries, powered by smart contracts. The platform focuses on improving liquidity and solving credit-related challenges within the DeFi space.

By leveraging decentralized infrastructure, Relend enables greater access to financial services for a global audience. The platform prioritizes risk management and efficiency, aiming to foster a dynamic, user-controlled financial system.

The vision behind Relend Network is to establish a robust credit infrastructure that underpins the DeFi sector. With decentralized lending services, the platform opens up global access to financial tools, allowing individuals and institutions to interact with blockchain assets without the need for traditional intermediaries. This empowers users with the freedom to manage their own financial futures while leveraging blockchain technology's inherent transparency and security.

Relend is also deeply inspired by the growing importance of risk management in DeFi. The platform partners with organizations like RiskDAO to integrate advanced risk assessment tools, ensuring that users can confidently engage in lending and borrowing activities. These risk mitigation strategies help users minimize exposure to volatility and potential losses.

Additionally, Relend's relending feature allows users to recycle liquidity across multiple lending cycles, maximizing asset efficiency. By enabling participants to continuously lend and borrow, the platform seeks to create a scalable and dynamic financial ecosystem where liquidity never stagnates.

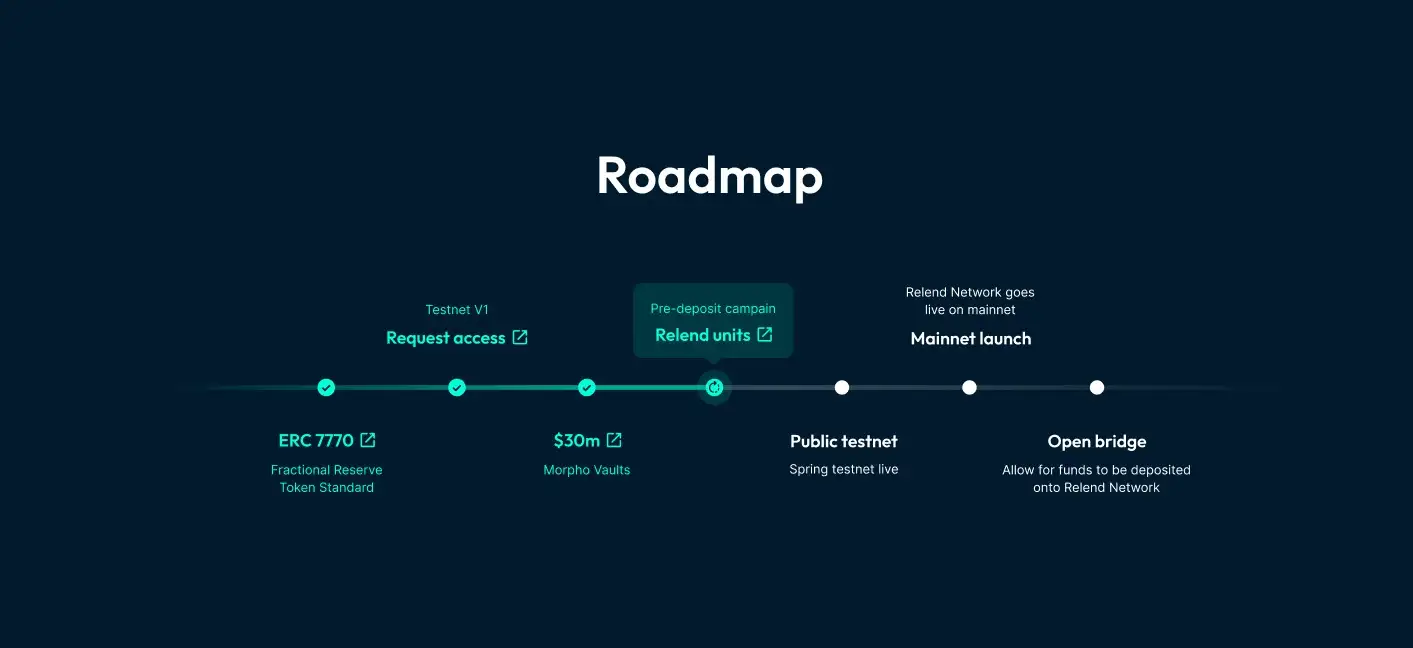

The roadmap for Relend Network is ambitious and revolves around key milestones, such as launching the core lending protocol, which is designed to offer an efficient lending experience through blockchain technology. The team is prioritizing partnerships with entities like RiskDAO, which specialize in risk management, to improve the safety and reliability of the platform. Moreover, the focus on audits and smart contract optimization reflects a strong commitment to security, ensuring that users can confidently participate in the decentralized lending process.

Future milestones include expanding cross-platform integrations with other DeFi protocols. This will allow Relend to become a comprehensive financial network, providing users with enhanced services beyond basic lending, such as leveraging multi-chain capabilities and interoperability. To stay updated with the latest roadmap, visit the documentation at Relend Network's documentation.

Relend Network has been backed by strategic partnerships that focus on risk management and decentralized finance. Though specific founders and team members are not directly named on the official pages, the platform collaborates closely with RiskDAO, highlighting a focus on security and governance. This partnership suggests that the development team prioritizes integrating risk management strategies from the earliest stages of protocol development.

The Relend Network offers a testnet program for developers and early adopters to experiment with its functionalities. This early access program is critical for gathering feedback and addressing any potential issues before the full platform launch. Users can test the lending protocols, assess risk management features, and explore smart contract interactions. By participating, they can directly influence the final product while gaining insights into the platform’s potential for handling decentralized credit operations.

Participation in the beta program grants developers the opportunity to engage with cutting-edge blockchain technology while contributing to the platform’s growth. Early access helps ensure that the final release will be user-friendly, secure, and scalable. Interested parties can visit the official testnet page on Relend Testnet for more details and sign-up options.

Relend Network Activities

Relend Network Suggestions by Real Users

Relend Network FAQ

Relend Network prioritizes security through rigorous smart contract audits and partnerships like RiskDAO, which provide advanced risk management. This helps ensure that the platform is protected against vulnerabilities and market risks. Learn more on the documentation page.

Yes, Relend Network allows users to continuously engage in multiple lending cycles using the platform’s relending feature. This ensures that liquidity can be recycled, optimizing the use of your assets for ongoing loans. For more details, visit the Relend website.

RiskDAO provides critical risk assessment tools that ensure safe lending practices on Relend. This partnership helps mitigate security vulnerabilities and manage market volatility, ensuring a safer experience for all users. For further information, check out the official documentation.

The Relend testnet allows early adopters to experiment with lending protocols and provide feedback, helping to improve the final product. By joining, users can influence platform development while testing new features. Sign up through the testnet page.

Yes, Relend Network plans to expand by integrating with additional DeFi protocols, which will enhance its ecosystem. These integrations include cross-chain lending and better interoperability for users. Stay informed by visiting the Relend site.

You Might Also Like