About Rubicon

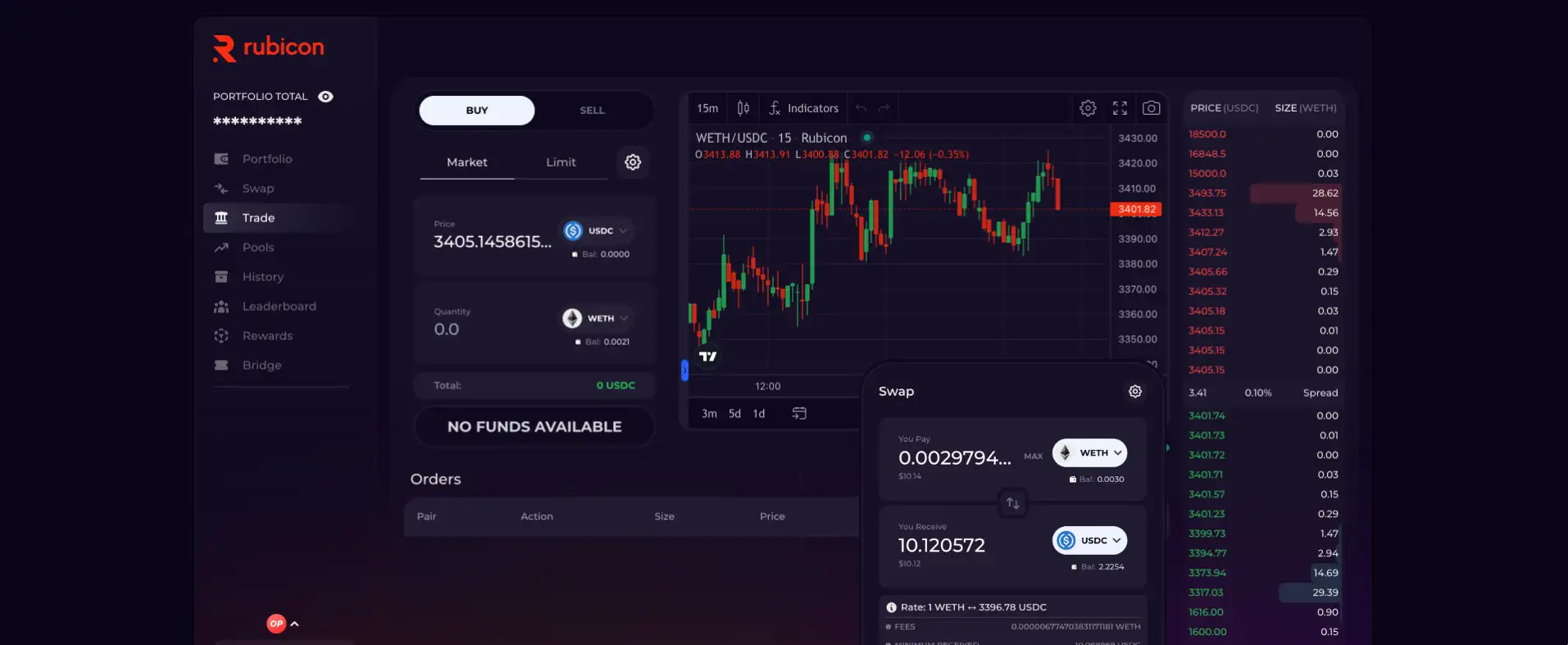

Rubicon is an open, on-chain trading platform that offers a fully decentralized, high-efficiency financial exchange built directly on Ethereum and leading Layer-2 solutions like Optimism, Arbitrum, and Base. By combining classic order book mechanics, automated market-making, and intent-based smart execution, Rubicon provides traders with superior liquidity and unmatched transparency.

With a focus on gasless, MEV-resistant, and non-custodial trading experiences, Rubicon bridges the gap between the performance of centralized exchanges and the ideals of decentralized finance (DeFi). Whether you're a trader seeking optimal execution or a liquidity provider maximizing yield, Rubicon is building the foundational rails for the world's last and most open financial exchange.

Rubicon revolutionizes DeFi trading by integrating three powerful trading layers into a single protocol: Rubicon Classic (on-chain order book), Rubicon Aquila (AMM liquidity pools), and Rubicon Gladius (intent-based trading). Unlike platforms like Uniswap and Curve that focus primarily on AMM models, Rubicon offers full order book capabilities, giving traders tighter spreads and greater price discovery opportunities.

At the core of Rubicon is Gladius, an intent-based off-chain order-matching engine that finalizes trades on-chain. This structure delivers a CEX-like user experience while maintaining complete decentralization. Competitors like dYdX and Perpetual Protocol offer similar hybrid models, but Rubicon stands apart by focusing entirely on ERC-20 spot markets with real-time, permissionless execution.

Rubicon Aquila brings the trusted AMM model of Uniswap V2 into Rubicon’s ecosystem, allowing passive liquidity providers to earn trading fees seamlessly. Meanwhile, Rubicon Classic offers an on-chain central limit order book (CLOB) where professional and algorithmic traders can operate with precision, minimizing slippage and maximizing control.

With integrations across Optimism, Base, and Arbitrum, Rubicon has built a truly multi-chain experience, designed to connect to the future of cross-chain DeFi liquidity. The open-source ethos of Rubicon ensures that anyone can access, contribute, and trade without barriers, setting a new standard for trustless financial marketplaces.

Rubicon offers a comprehensive suite of benefits and features designed to empower every type of DeFi participant:

- Gasless and MEV-Free Trading: Dutch auction model protects users from frontrunning and minimizes gas expenses.

- Superior Execution: Combines AMM, order book, and intent-based layers for optimal liquidity and pricing.

- Non-Custodial Trading: You maintain full custody of your assets — no deposits or withdrawals needed.

- Cross-Layer Support: Trade natively on Ethereum, Optimism, Arbitrum, and Base.

- Programmatic Trading: Open APIs, SDKs, and subgraphs enable advanced market-making bots and trading strategies.

- Open and Transparent: Fully open-source code and verifiable smart contracts.

- Competitive Liquidity: Native and aggregated liquidity to achieve best-in-class execution.

- Incentivized Market Making: Maker rewards and OP incentives for active liquidity providers.

Getting started with Rubicon is fast and simple for traders and developers:

- Step 1: Visit rubicon.finance and launch the Rubicon App.

- Step 2: Connect your Ethereum wallet (e.g., MetaMask) on Ethereum, Optimism, Arbitrum, or Base networks.

- Step 3: Start trading using Swap, Limit Orders, or Market Orders on Rubicon Classic and Gladius.

- Step 4: Provide liquidity via Rubicon Aquila AMM pools or operate a trading bot using the open APIs.

- Step 5: Monitor your trading and liquidity positions in real-time through the Rubicon dashboard.

- Step 6: Join the Rubicon Discord community and participate in governance as the platform moves towards full decentralization.

Rubicon FAQ

Rubicon is a hybrid trading platform that combines order book trading, automated market making (AMM), and intent-based execution. Unlike Uniswap or Curve that rely solely on AMM models, Rubicon offers full central limit order book (CLOB) functionality, providing deeper liquidity, tighter spreads, and professional trading features.

Rubicon Gladius is an intent-based trading system where orders are matched off-chain for efficiency but settled on-chain for full transparency. By separating order matching from execution, Rubicon achieves high-frequency, gasless trading while preserving decentralization and security standards unmatched by many DeFi protocols.

Yes, Rubicon is completely non-custodial. Users always retain full control over their crypto assets, with trades executed directly through smart contracts. There are no deposits or withdrawals into centralized custody. You trade directly from your connected Ethereum wallet at Rubicon.

Rubicon operates natively on Ethereum Mainnet as well as leading Layer-2s including Optimism, Arbitrum, and Base. This multi-chain architecture gives users access to faster, cheaper transactions while maintaining the security of Ethereum. Get started at Rubicon.

Absolutely. Rubicon offers a rich set of open-source APIs, SDKs, and subgraphs for programmatic access. Developers can integrate market-making bots or trading strategies easily via the Rubicon GitHub and even leverage integrations like Hummingbot to automate trading activities.

You Might Also Like