About Segment Finance

Segment Finance is a pioneering lending and borrowing platform within the Superchain ecosystem. The platform's mission is to establish itself as the premier decentralized money market by offering unparalleled incentives, an extensive range of supported assets, and the deepest liquidity. Segment Finance emphasizes innovation and sustainability, employing advanced tokenomics and reward distribution mechanisms to foster robust and continuous growth.

Segment Finance addresses key inefficiencies in traditional lending and borrowing systems through the strategic application of blockchain technology. The platform not only enhances user experience but also ensures security and transparency, making it a reliable choice for both novice and seasoned investors in the decentralized finance (DeFi) space.

Segment Finance was conceived with the goal of transforming the traditional financial landscape by leveraging the capabilities of blockchain technology. Since its inception, the platform has focused on addressing the inefficiencies and limitations of conventional lending and borrowing systems. Here is a detailed overview of the project's development, key milestones, and position within the DeFi ecosystem.

Development and Milestones:

- Conceptualization: The idea for Segment Finance emerged from a need to create a more efficient and user-centric lending and borrowing platform. The founders aimed to utilize blockchain technology to eliminate intermediaries, reduce costs, and enhance transparency.

- Platform Launch: Segment Finance officially launched its platform on the Superchain, introducing advanced lending and borrowing features. The initial launch included support for multiple cryptocurrencies and offered competitive interest rates to attract users.

- Introduction of Isolated Pools: To manage risk effectively, Segment Finance introduced isolated pools. This feature allows users to segregate different asset classes, thereby preventing risk cross-contamination.

- RWA Lending Integration: Segment Finance expanded its asset base by integrating Real-World Assets (RWAs) into the lending protocol. This move broadened the range of collateral types and provided users with more borrowing options.

- Security Enhancements: The platform has continuously improved its security measures, including regular audits and a comprehensive bug bounty program. These efforts ensure that user funds are protected against potential threats.

- Community and Governance: Segment Finance has fostered a strong community around its platform, actively engaging with users and incorporating their feedback into development. The decentralized governance model allows SEF token holders to participate in decision-making processes, ensuring that the platform evolves according to community needs.

Market Position and Competitors:

Segment Finance operates within the rapidly growing DeFi sector, competing with established platforms like Aave, Compound, and MakerDAO. Each of these platforms offers unique features and services within the lending and borrowing space:

- Aave: Known for its flash loans and diverse range of supported assets.

- Compound: Offers algorithmic, autonomous interest rate protocols.

- MakerDAO: Allows users to generate DAI stablecoin through collateralized debt positions.

Segment Finance differentiates itself through its competitive incentives, variety of supported assets, and innovative features such as isolated pools and RWA lending.

Vision and Future Plans:

Segment Finance aims to continue expanding its ecosystem by introducing new features and supporting a broader range of assets. Future developments may include enhanced staking options, cross-chain compatibility, and further improvements to governance mechanisms. The platform is committed to maintaining a user-centric approach, ensuring that it remains at the forefront of innovation within the DeFi space.

By focusing on continuous development and community engagement, Segment Finance strives to create a sustainable and efficient decentralized money market that meets the evolving needs of its users.

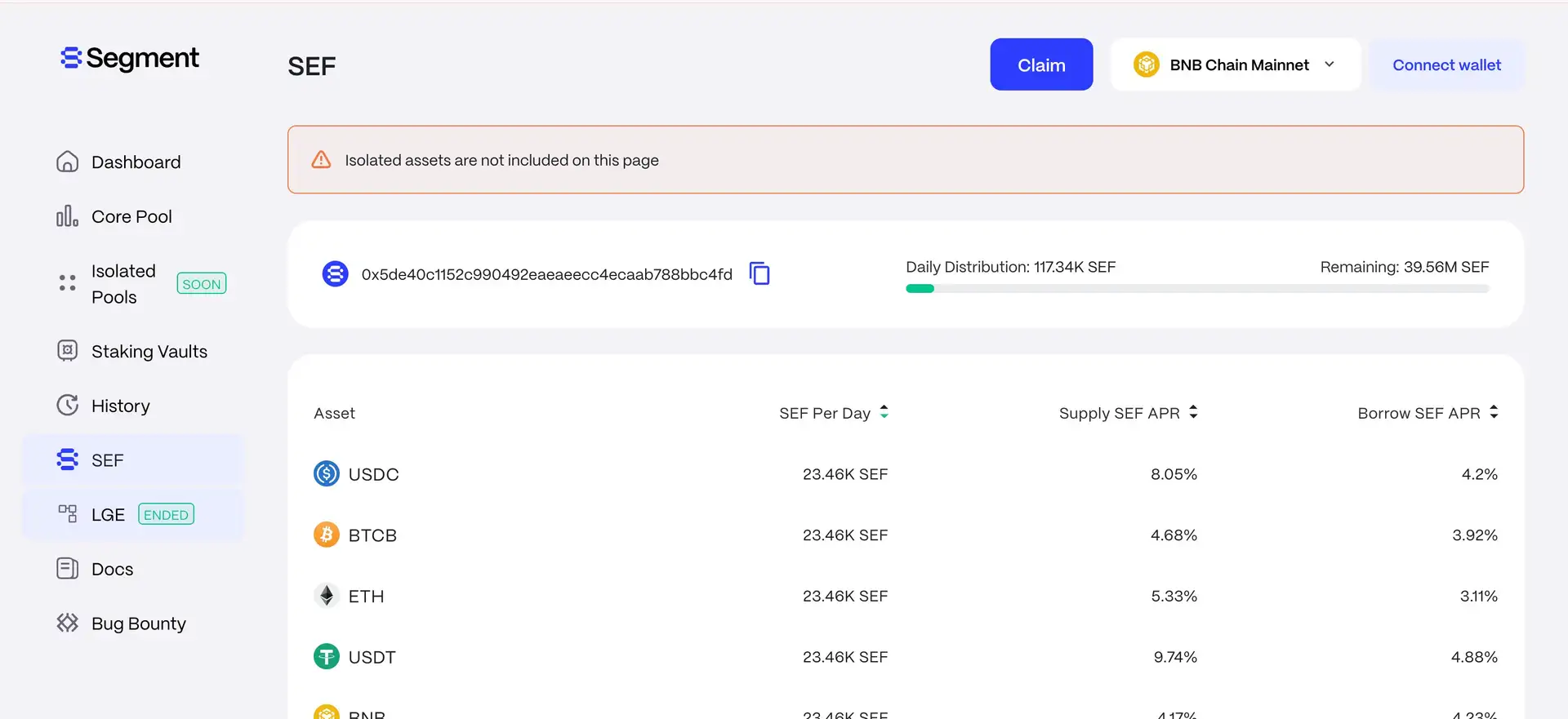

- Competitive Incentives: Segment Finance offers some of the highest rewards for participants in the money market. Users can earn SEF tokens through activities such as supplying, borrowing, and staking assets.

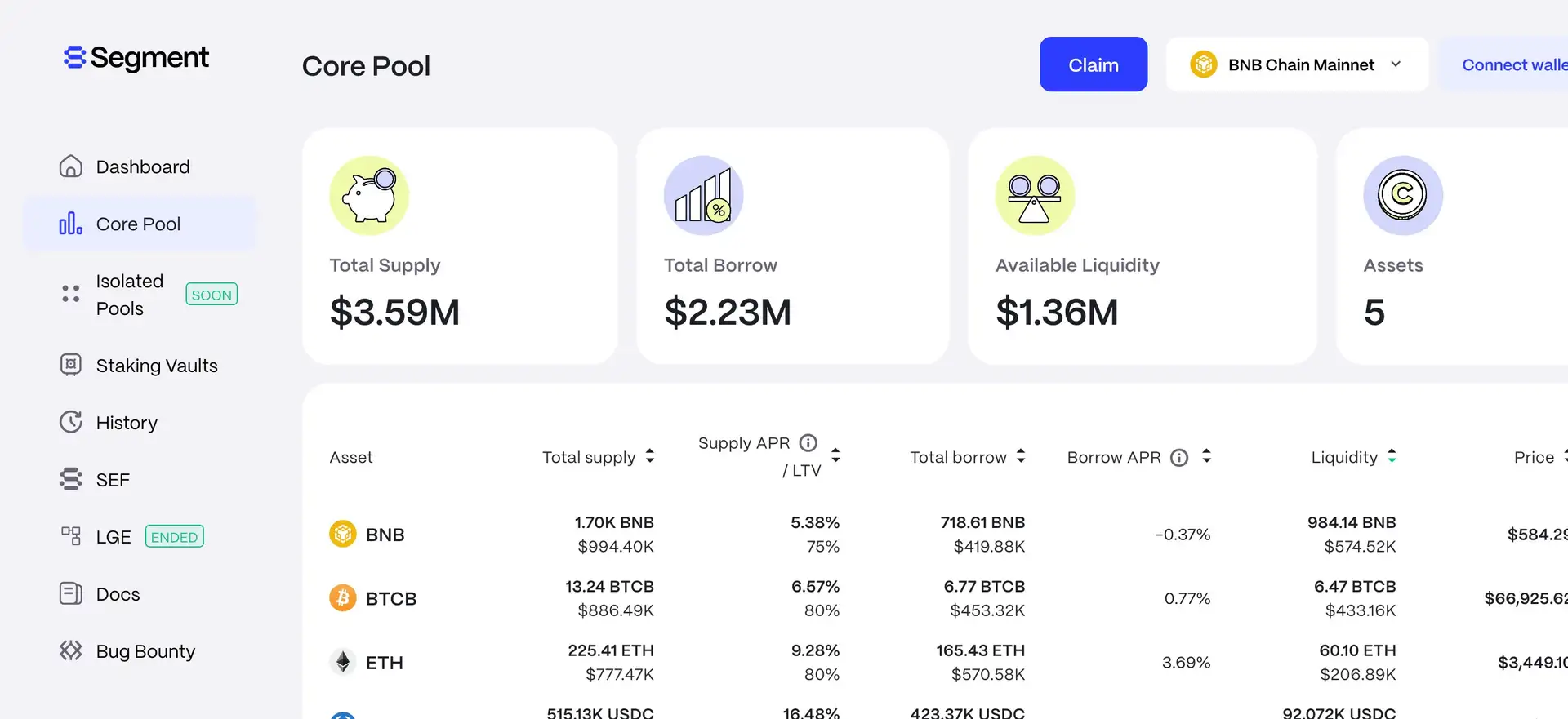

- Variety of Supported Assets: The platform supports a wide range of cryptocurrencies, providing users with flexibility and choice in their lending and borrowing activities. This diversity attracts a broad user base and enhances the platform's utility.

- Deep Liquidity: By incentivizing liquidity providers with SEF tokens, Segment Finance ensures deep liquidity across its markets. This liquidity is crucial for efficient trading and lending operations.

- Isolated Pools: The introduction of isolated pools allows users to manage risk more effectively. Each pool is segregated, preventing risk cross-contamination and providing users with more control over their investments.

- RWA Lending: Segment Finance has integrated Real-World Assets (RWAs) into its lending protocol. This integration expands the range of collateral types and offers users more borrowing options, bridging the gap between traditional finance and DeFi.

- Advanced Safety Features: The platform employs robust security measures, including regular audits and a comprehensive bug bounty program. These efforts ensure that user funds are protected against potential threats and vulnerabilities.

- Decentralized Governance: SEF token holders can participate in the governance of Segment Finance. This decentralized model allows the community to influence key decisions, ensuring that the platform evolves according to user needs.

- User-Friendly Interface: The platform is designed with a user-friendly interface, making it accessible to both novice and experienced users. Clear navigation and comprehensive guides help users make the most of the platform's features.

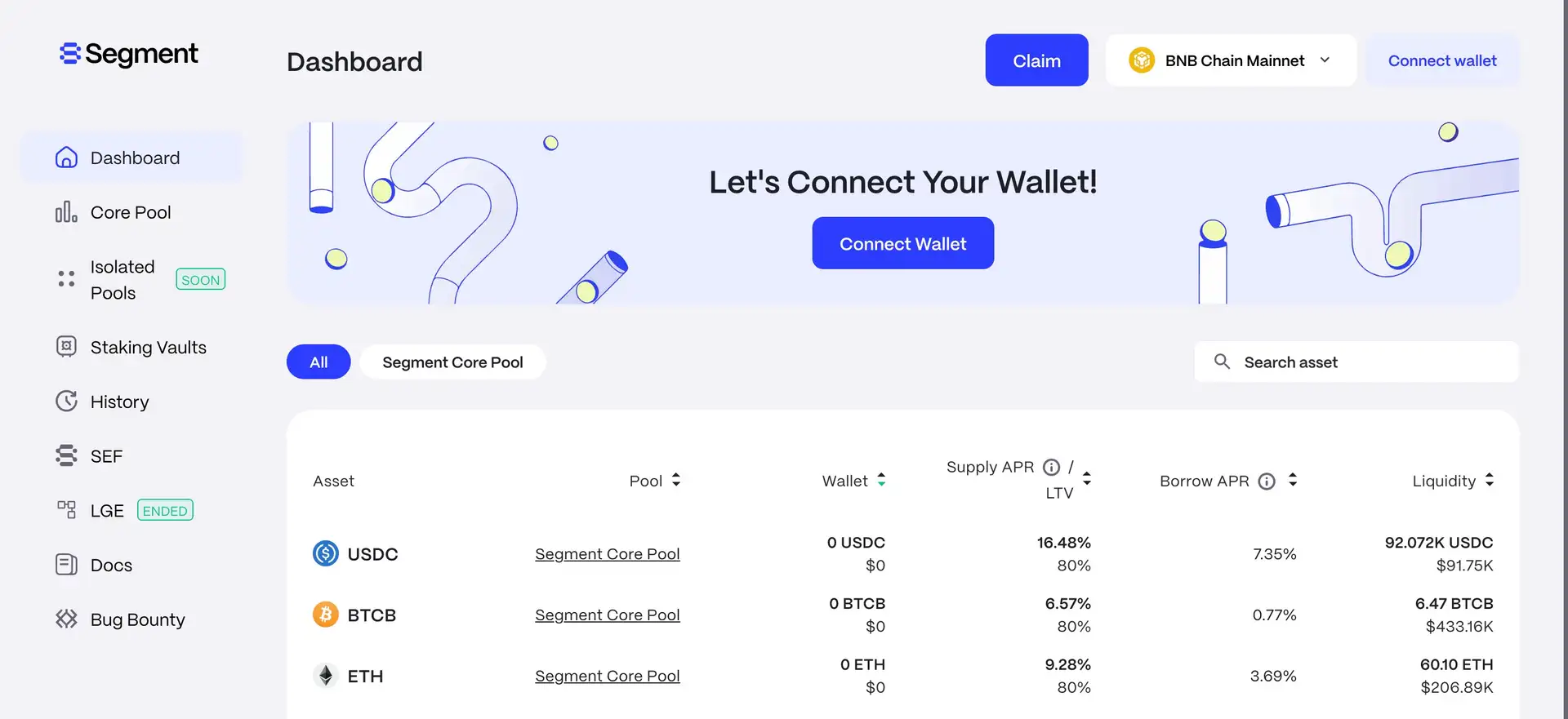

- Create an Account: Visit the Segment Finance app and sign up for an account.

- Connect Wallet: Link your cryptocurrency wallet (e.g., MetaMask) to the platform.

- Supply Assets: Deposit your chosen assets into the platform to start earning rewards.

- Borrow Assets: Use your deposited assets as collateral to borrow other cryptocurrencies.

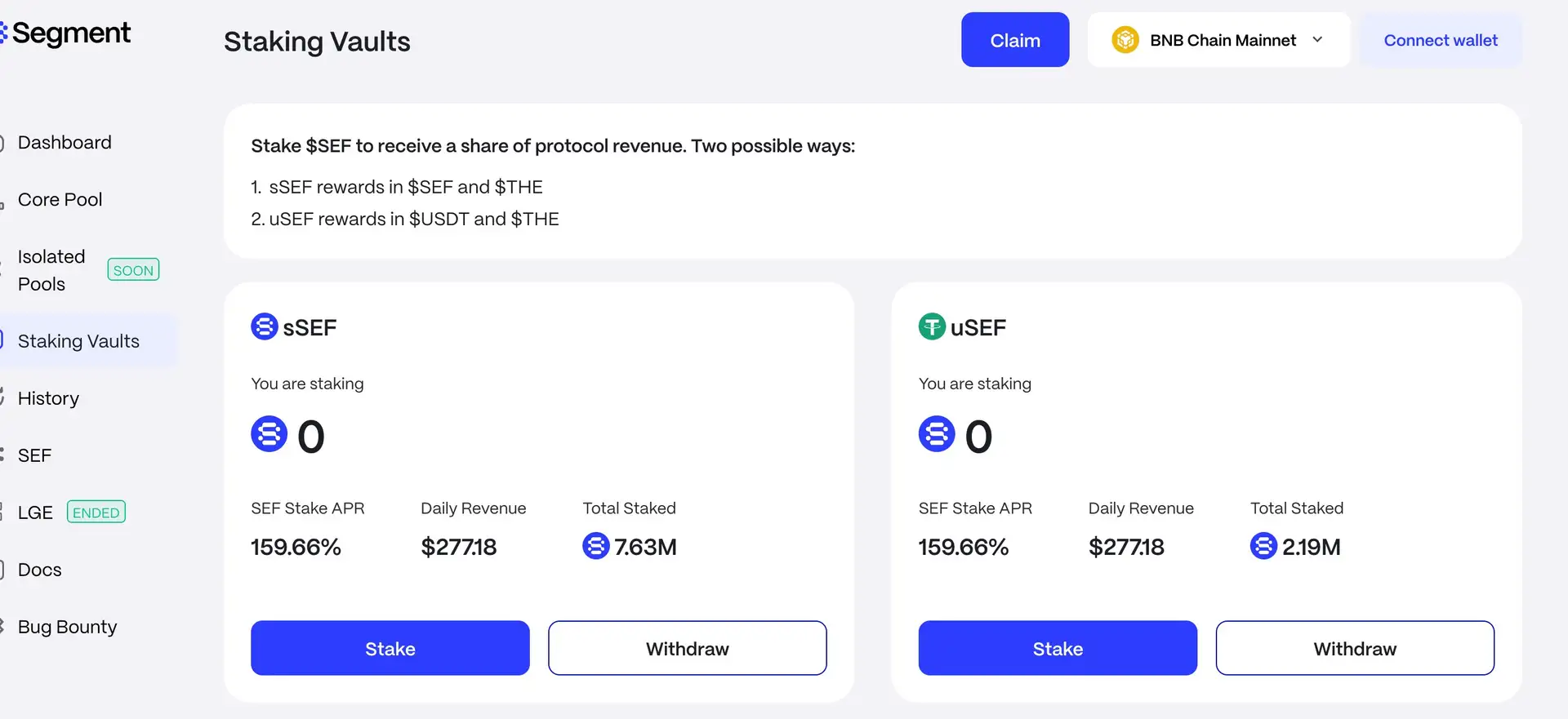

- Staking: Stake SEF tokens to earn additional rewards and participate in governance.

- Explore Features: Familiarize yourself with the platform's various features such as isolated pools and RWA lending.

For detailed guides, visit the Segment Finance Documentation.

By following these steps, users can efficiently start leveraging the benefits of Segment Finance’s advanced DeFi solutions.

Segment Finance Reviews by Real Users

Segment Finance FAQ

The SEF token stands out due to its multifaceted utility, including staking rewards, governance rights, and fee discounts. Additionally, SEF token holders can participate in yield farming and benefit from deflationary mechanisms like token burns.

Yes, users can engage in lending and borrowing activities on Segment Finance without holding SEF tokens. However, holding SEF tokens provides additional benefits such as staking rewards and governance participation.

Segment Finance integrates Real-World Assets (RWAs) into its lending protocol, allowing users to use RWAs as collateral. This feature bridges the gap between traditional finance and DeFi, offering more borrowing options.

Isolated pools on Segment Finance allow users to segregate different asset classes, preventing risk cross-contamination. This feature helps manage risk more effectively and provides users with greater control over their investments.

Segment Finance offers competitive advantages such as high staking rewards, a wide range of supported assets, isolated pools, and the integration of RWAs. These features enhance user experience and attract a diverse user base.

You Might Also Like