About SRWA

SRWA is a cutting-edge decentralized finance (DeFi) platform revolutionizing the integration of traditional financial systems (TradFi) with blockchain-powered decentralized systems. At its core, SRWA enables users to tokenize real-world assets (RWAs), facilitating seamless conversion between physical assets, tokens, and cash. By bridging the gap between traditional finance and DeFi, SRWA empowers users to harness the best of both worlds, offering liquidity, transparency, and efficiency in managing assets.

The SRWA platform provides an innovative approach to managing physical assets, transforming them into tokenized representations. These Real-World Asset (RWA) tokens can then be used for transactions, lending, savings, or cash conversions. By offering this level of flexibility, SRWA opens the door for a more inclusive financial ecosystem that allows individuals and businesses to optimize their asset utilization.

SRWA is a platform designed to bridge the gap between traditional finance and decentralized finance through the tokenization of real-world assets (RWAs). Its key offering lies in enabling users to vault their physical assets securely, mint RWA tokens as proof of ownership, and access a liquid, efficient global market for transactions. This approach not only enhances asset liquidity but also unlocks new opportunities for decentralized financial participation.

The SRWA ecosystem includes several critical components:

- RWA Vaulting: Users can deposit physical assets, which are securely vaulted and tokenized into RWA tokens. These tokens serve as proof of ownership, allowing for instant and efficient transactions on the blockchain.

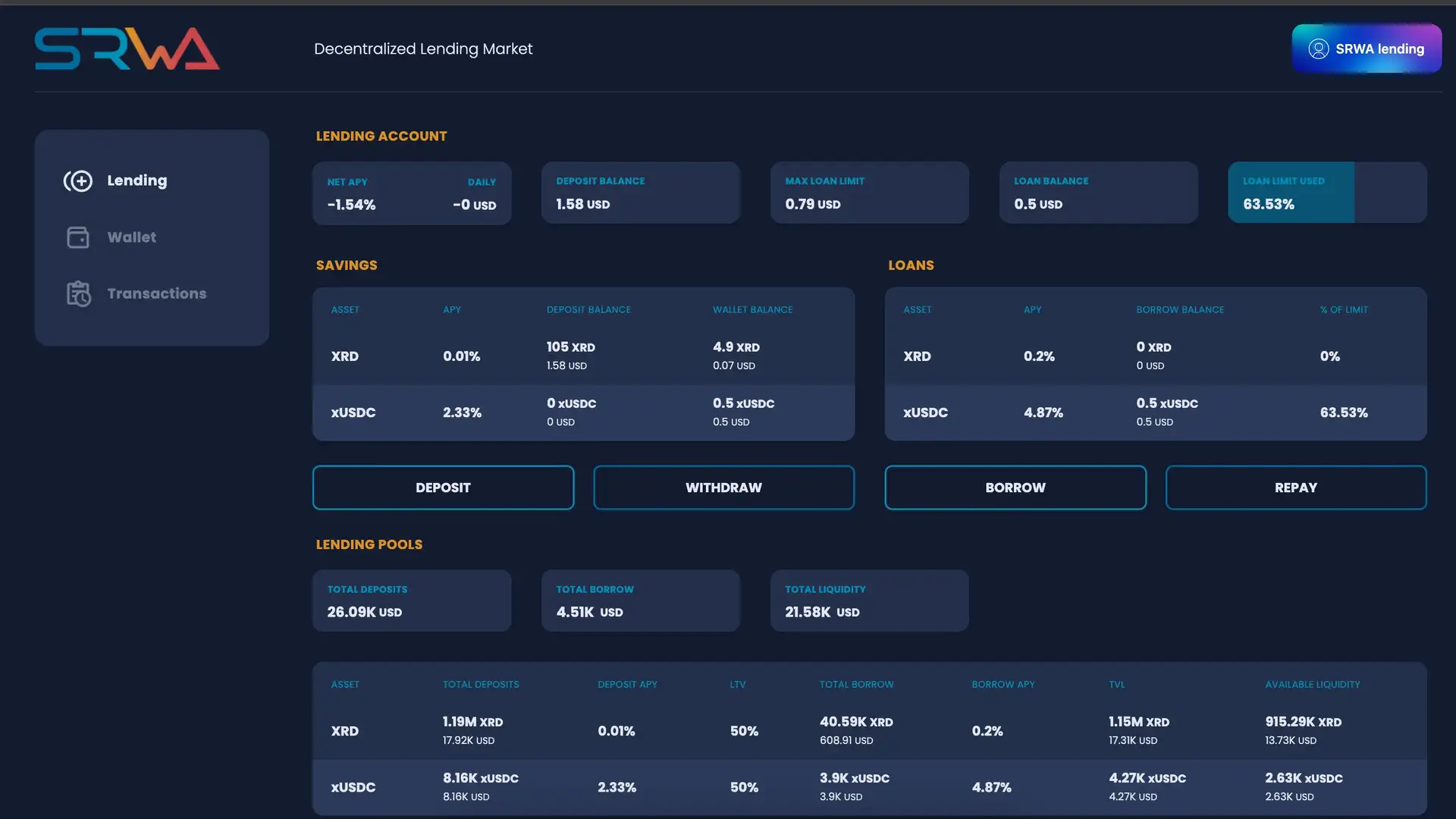

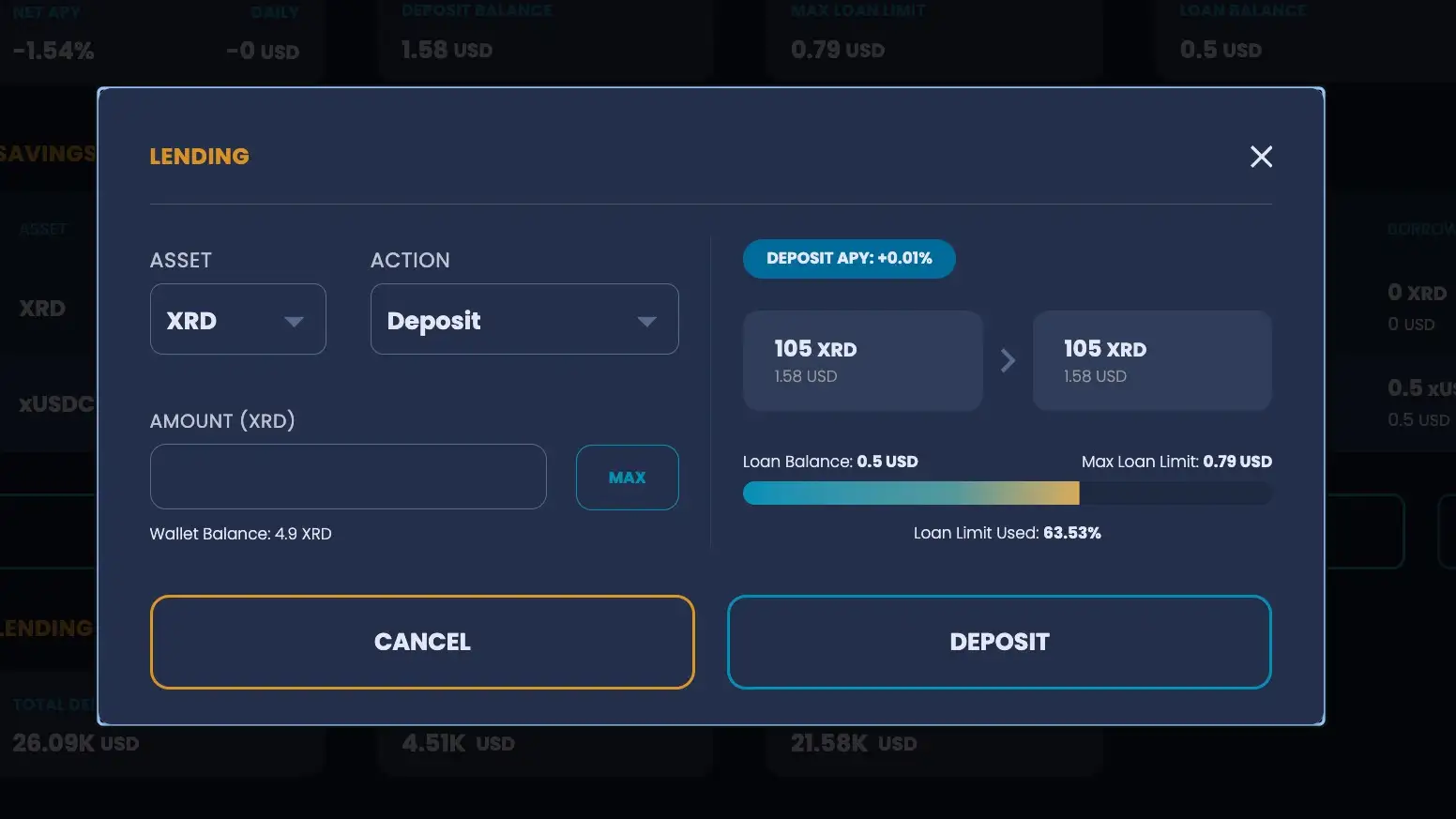

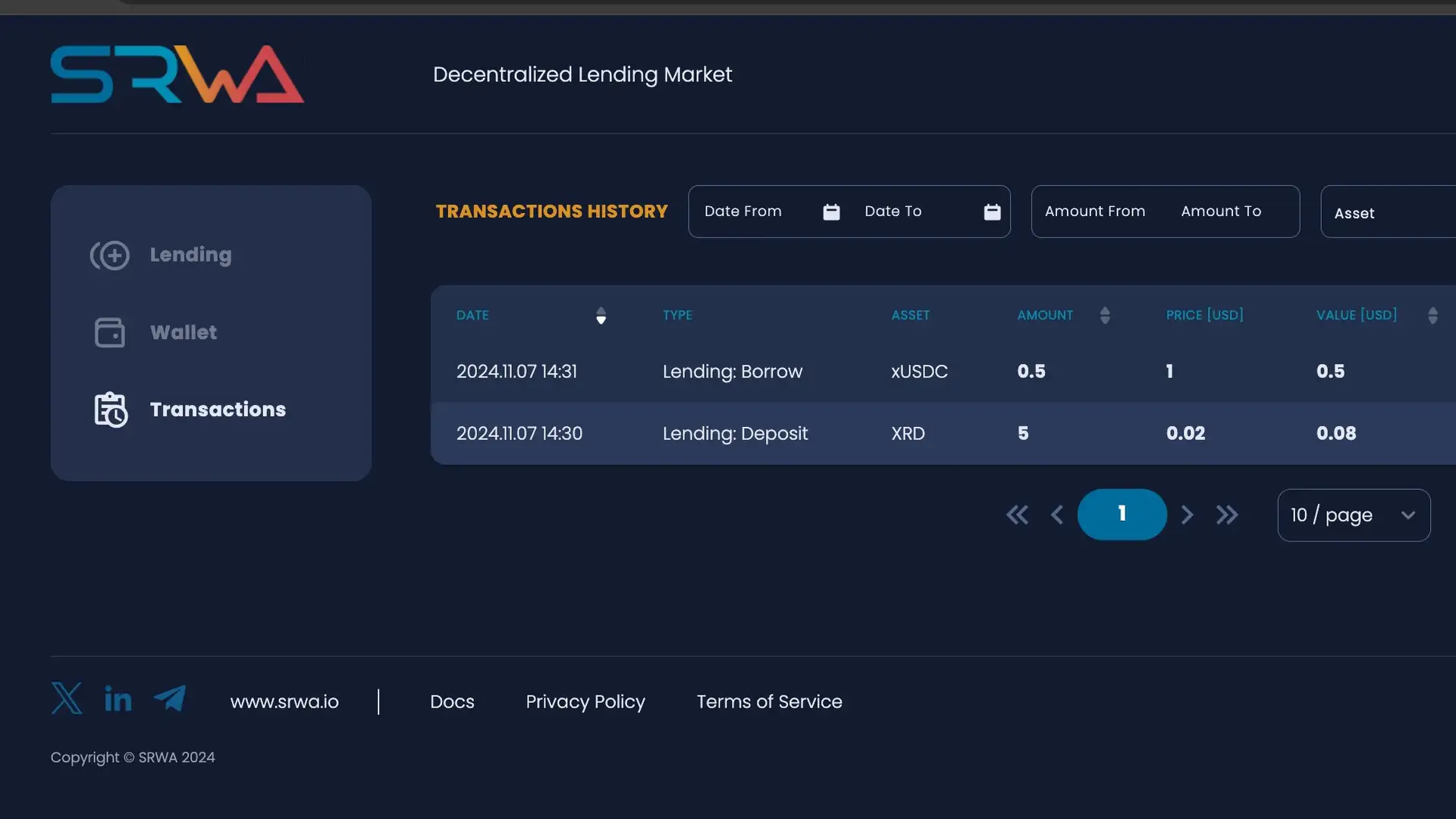

- Decentralized Lending Market: The platform offers a decentralized lending ecosystem where users can deposit digital assets to earn variable yields or borrow funds against their collateral. This model fosters an inclusive financial environment while ensuring security and transparency.

- SRWA Validator Node: Users can stake XRD tokens with the SRWA validator to support the Radix network and earn staking rewards. With a low-fee policy, the validator node enhances user incentives while contributing to network stability.

SRWA’s vision centers on creating an inclusive and efficient financial ecosystem by utilizing the Radix distributed ledger. Its focus on RWA tokenization sets it apart from other DeFi platforms, many of which are limited to purely digital assets. SRWA’s approach allows it to address real-world financial needs while maintaining the advantages of blockchain technology.

Since its inception, SRWA has emphasized delivering innovative solutions that prioritize security, scalability, and user accessibility. By combining the robustness of Radix’s technology with advanced DeFi capabilities, SRWA ensures an intuitive user experience and dependable infrastructure. This enables the platform to cater to both seasoned DeFi enthusiasts and newcomers looking to explore decentralized finance.

Competitors of SRWA include platforms like MakerDAO, AAVE, and Compound, which also offer lending and borrowing services. However, SRWA distinguishes itself by incorporating real-world asset tokenization into its ecosystem, making it a leader in bridging traditional and decentralized financial systems.

- Tokenization of Real-World Assets: SRWA allows users to securely vault physical assets and mint RWA tokens, ensuring liquidity and usability in the DeFi space. This unique feature expands asset accessibility and utility.

- Decentralized Lending Market: The lending market provides users with the ability to deposit assets for variable yields or borrow against their collateral, enhancing financial flexibility and accessibility.

- Seamless Asset Conversion: The platform facilitates instant conversion between RWAs, tokens, and cash, offering users unparalleled efficiency and convenience in asset management.

- Staking Rewards via Validator Node: Users can stake XRD tokens to earn rewards while contributing to the Radix network’s security and scalability. The low-fee validator policy maximizes user returns.

- Security and Scalability: Leveraging the Radix distributed ledger, SRWA offers a secure, scalable, and user-friendly platform for managing assets and engaging with DeFi applications.

- User-Centric Design: The platform’s interface is intuitive and accessible, designed to cater to users with varying levels of DeFi experience.

- Global Accessibility: SRWA's infrastructure enables users worldwide to access its financial tools and resources, fostering a more inclusive ecosystem.

- Create an Account: Visit the official SRWA website and register for an account. Complete the verification process if required for vaulting physical assets.

- Vault Physical Assets: Deposit eligible physical assets into secure vaults managed by SRWA. These assets will be tokenized into RWA tokens, providing digital proof of ownership.

- Access RWA Tokens: Use the minted RWA tokens to transact within the SRWA ecosystem or convert them into cash as needed.

- Explore the Lending Market: Deposit digital assets into the SRWA lending market to earn yield or use them as collateral for borrowing.

- Stake XRD Tokens: Support the Radix network by staking XRD tokens with the SRWA validator to earn rewards.

- Utilize Resources: Review the detailed documentation available on SRWA’s GitBook for a comprehensive guide on platform features and functionality.

- Engage with the Community: Join SRWA’s community channels to stay updated on new developments, feature updates, and additional resources.

SRWA Reviews by Real Users

SRWA FAQ

SRWA sets itself apart by enabling users to securely vault physical assets, which are then tokenized into Real-World Asset (RWA) tokens. Unlike traditional DeFi platforms that focus solely on digital assets, SRWA bridges the gap between traditional finance (TradFi) and blockchain technology. This approach ensures liquidity and usability while introducing a practical way to integrate real-world value into the DeFi ecosystem. Learn more at SRWA website.

SRWA employs secure vaulting facilities to protect all deposited physical assets. These facilities are managed using advanced security protocols and are regularly audited for compliance. The platform’s reliance on the Radix distributed ledger ensures that ownership records are immutable, transparent, and tamper-proof. This combination of physical security and blockchain integrity guarantees a safe and reliable environment for tokenizing real-world assets. Visit SRWA website for details.

Yes, you can use SRWA to generate passive income through its decentralized lending markets. By depositing digital assets, users earn variable yields, which are funded by borrowers. Additionally, these deposited assets can serve as collateral, enabling you to unlock liquidity without selling your holdings. This dual-purpose lending market fosters financial flexibility while maximizing returns for participants. Explore the lending features at SRWA website.

SRWA’s integration with the Radix network brings enhanced security, scalability, and usability to its platform. The Radix ledger’s innovative design ensures fast, low-cost transactions and high throughput. This makes the entire ecosystem more efficient and accessible, especially for users interacting with Real-World Asset (RWA) tokens. Additionally, staking opportunities through the SRWA validator node offer rewards for supporting the network. Learn more at SRWA website.

To convert tokenized assets into cash using SRWA, start by vaulting eligible physical assets. Once tokenized into RWA tokens, you can transact with these tokens in the SRWA ecosystem or convert them directly into cash through the platform. The conversion process is seamless, transparent, and backed by blockchain technology. Full details on this process are available at the SRWA website.

You Might Also Like