About stabble

Stabble is a cutting-edge decentralized finance (DeFi) protocol built on the Solana blockchain, designed to revolutionize the way liquidity is managed and trading is executed in the DeFi space. At its core, Stabble seeks to address and resolve key challenges that have plagued decentralized exchanges (DEXs), such as liquidity fragmentation, high slippage, and impermanent loss. By introducing innovative solutions like frictionless liquidity and arbitrage pools, Stabble aims to create a more efficient, seamless, and user-friendly trading environment for all participants.

The protocol leverages the high throughput and low transaction costs of the Solana network to enable near-instantaneous trade execution with minimal price impact. This is particularly important in the fast-paced world of cryptocurrency trading, where even slight delays or price discrepancies can lead to significant losses. Stabble’s advanced features, such as protocol-managed liquidity and smart order execution, ensure that trades are not only executed efficiently but also at the best possible prices, thus providing a better experience for traders and liquidity providers alike.

Moreover, Stabble’s mission extends beyond just improving the trading experience; it also focuses on maximizing the returns for liquidity providers by minimizing risks like impermanent loss, which has been a significant concern in traditional AMM-based DEXs. The protocol achieves this through its unique liquidity management strategies and arbitrage mechanisms, which are designed to optimize capital efficiency and ensure that liquidity providers receive the highest possible returns on their investments.

Stabble was developed in response to the growing need for more efficient liquidity management and trading solutions within the decentralized finance (DeFi) ecosystem, particularly on the Solana blockchain. The project emerged from the recognition that traditional automated market maker (AMM) models, such as those used by Uniswap and other Ethereum-based DEXs, often suffer from significant inefficiencies, including high slippage, impermanent loss, and suboptimal capital utilization. These challenges have long hindered the growth and adoption of DeFi, particularly for large-scale traders and liquidity providers.

The Stabble protocol introduces several key innovations aimed at addressing these inefficiencies. One of its core features is the concept of protocol-managed liquidity. Unlike traditional DEXs, where liquidity is provided by users who face the risk of impermanent loss, Stabble’s liquidity pools are managed directly by the protocol. This allows for more efficient liquidity allocation, reducing the risk of impermanent loss and ensuring that liquidity is always available where it is needed most. This system not only protects liquidity providers but also ensures that traders can execute large orders with minimal price impact.

Another significant innovation introduced by Stabble is the use of margin liquidity pools. These pools are designed to be up to 8,000 times more capital-efficient than traditional AMM pools, such as those found on Uniswap V3. This means that Stabble can provide deep liquidity with a much smaller amount of capital, reducing the cost of liquidity provision and making the entire system more efficient. Additionally, the protocol’s smart order execution system ensures that trades are routed through the most efficient liquidity pools, minimizing slippage and maximizing the value of each trade.

Stabble also implements a unique arbitrage mechanism that leverages the protocol’s internal liquidity to eliminate price discrepancies across different pools. This not only enhances the overall pricing efficiency of the protocol but also reduces the reliance on external arbitrageurs, who often extract value from the system. By keeping arbitrage opportunities within the protocol, Stabble ensures that more value is retained within the ecosystem, benefiting both traders and liquidity providers.

Since its inception, Stabble has achieved several key milestones, including the successful deployment of its smart liquidity pools and integration with multiple Solana-based decentralized exchanges. These developments have positioned Stabble as a leading liquidity management protocol within the Solana ecosystem, competing with other prominent DeFi platforms such as Raydium. However, what sets Stabble apart is its unique approach to liquidity management and its commitment to providing a frictionless, efficient, and user-friendly trading experience.

In addition to its technical innovations, Stabble is also focused on fostering a strong and engaged community. The protocol’s governance model allows token holders to participate in key decisions regarding the future development of the platform, ensuring that it evolves in a way that meets the needs of its users. This community-driven approach is central to Stabble’s vision of creating a decentralized, user-centric financial system that empowers individuals and promotes financial inclusion.

Overall, Stabble represents a significant advancement in the DeFi space, offering a highly efficient and innovative solution to some of the most pressing challenges in decentralized trading and liquidity management. Its combination of advanced technology, user-friendly design, and community-driven governance makes it a standout platform in the rapidly growing Solana ecosystem.

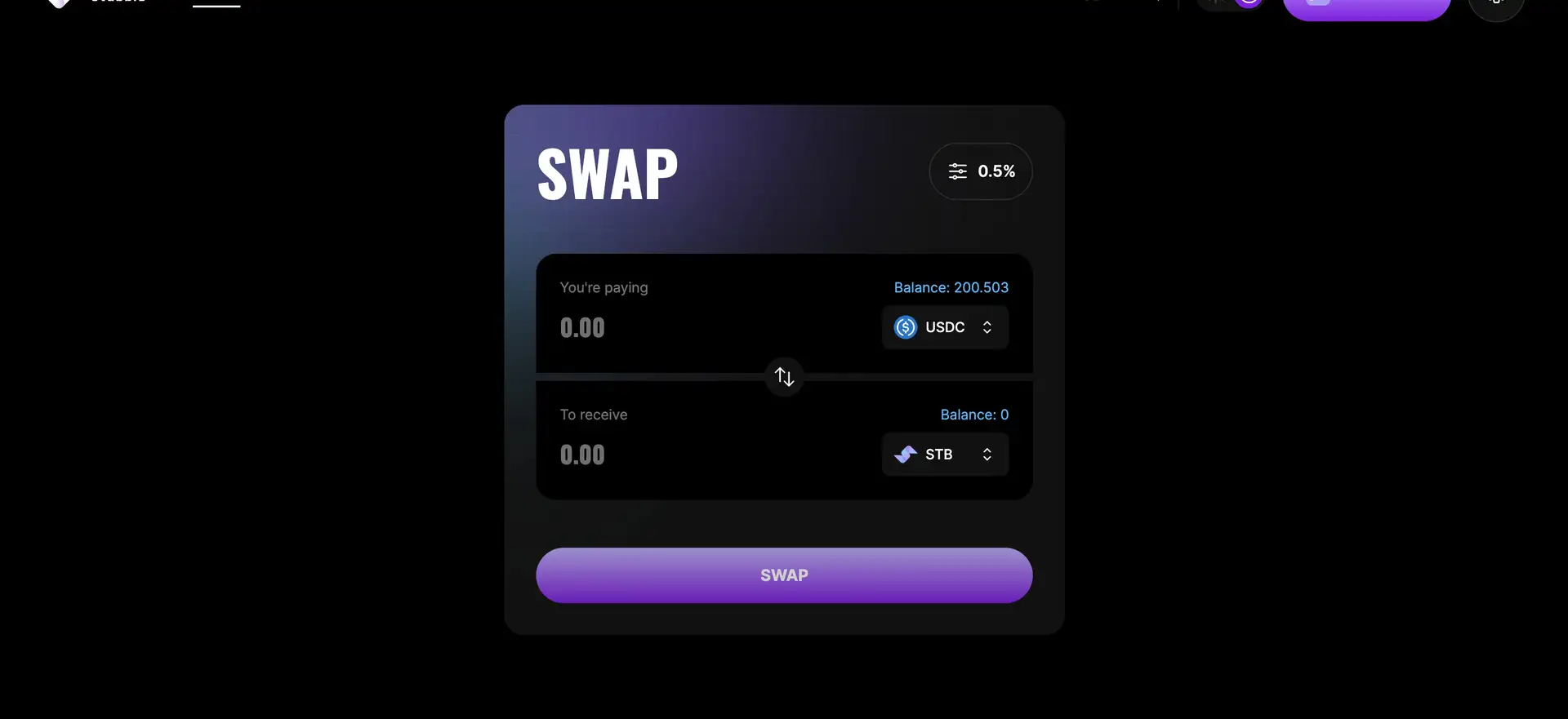

- Frictionless Trading Experience: Stabble’s advanced smart order execution system ensures that trades are executed with near-zero price impacts, providing a seamless and efficient trading experience. By routing trades through the most optimal liquidity pools, the protocol minimizes slippage and ensures that traders receive the best possible prices.

- Protocol-Managed Liquidity: Unlike traditional AMMs where liquidity provision is entirely user-driven, Stabble’s liquidity pools are managed directly by the protocol. This approach reduces the risks associated with impermanent loss and ensures that liquidity is allocated efficiently across the ecosystem. By managing liquidity in this way, Stabble provides a more stable and reliable trading environment.

- Smart Liquidity Routing: Stabble’s liquidity routing algorithm intelligently distributes liquidity across different pools, optimizing capital efficiency and minimizing the cost of liquidity provision. This system ensures that even large trades can be executed without significantly impacting the market price, making Stabble an attractive platform for both retail and institutional traders.

- Arbitrage Pools: Stabble’s internal arbitrage mechanism helps eliminate price discrepancies across different liquidity pools, enhancing the overall pricing efficiency of the protocol. By keeping arbitrage opportunities within the system, Stabble reduces the reliance on external arbitrageurs and ensures that more value is retained within the ecosystem.

- Yield Farming & Governance: Users can stake $STB tokens to earn rewards and participate in the governance of the protocol. By locking up $STB tokens, users receive veSTB tokens, which grant voting power and additional benefits such as fee discounts. This incentivizes long-term participation and aligns the interests of the community with the growth and success of Stabble.

- High Capital Efficiency: The use of margin liquidity pools in Stabble allows for significantly higher capital efficiency compared to traditional AMM models.

- Create an Account: Visit the Stabble platform and sign up for an account. This is your first step to accessing all the features offered by the protocol.

- Connect a Wallet: Link your Solana compatible wallet (such as Phantom or Sollet) to the Stabble platform. This allows you to interact with the protocol and manage your assets seamlessly.

- Stake $STB Tokens: Acquire $STB tokens and stake them to earn rewards. Staking is essential for participating in governance and maximizing your returns through the platform.

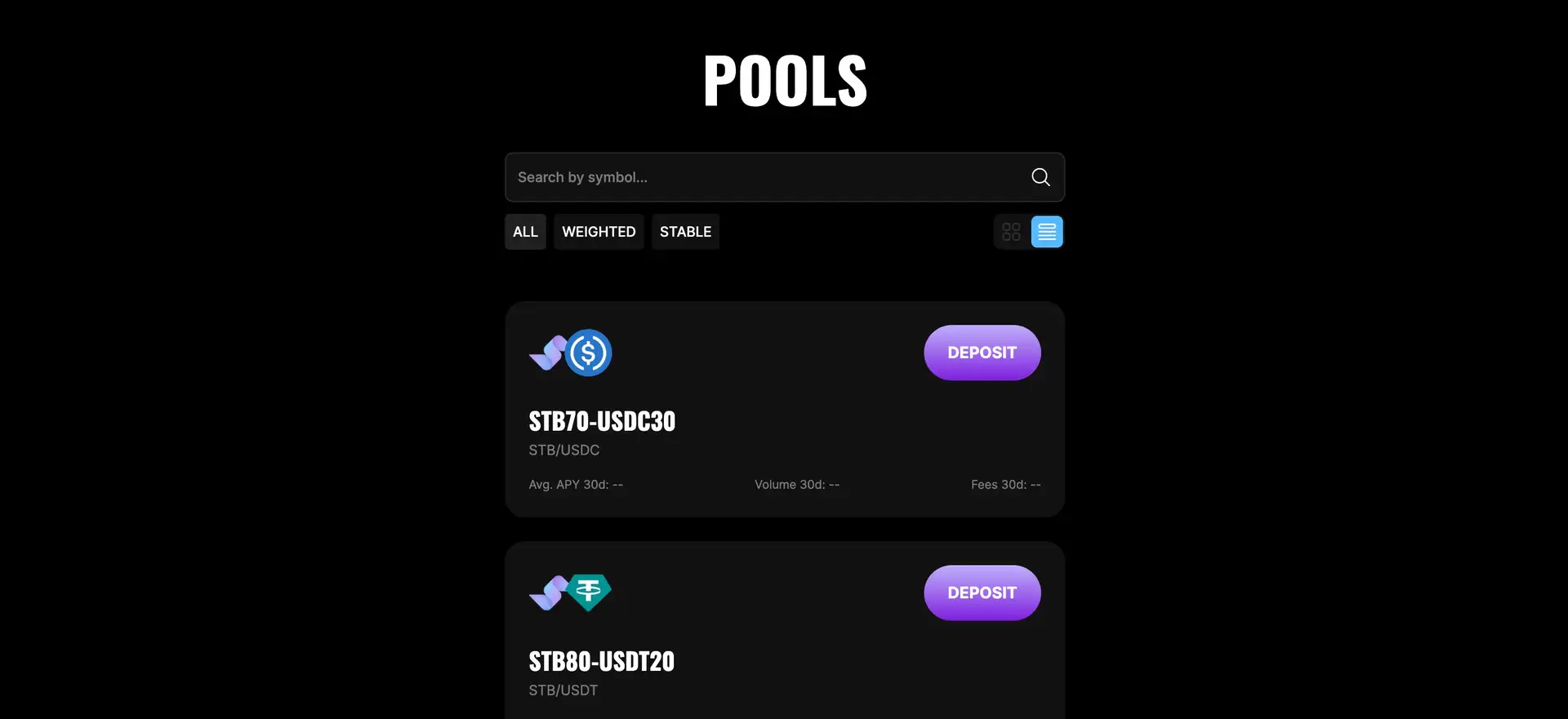

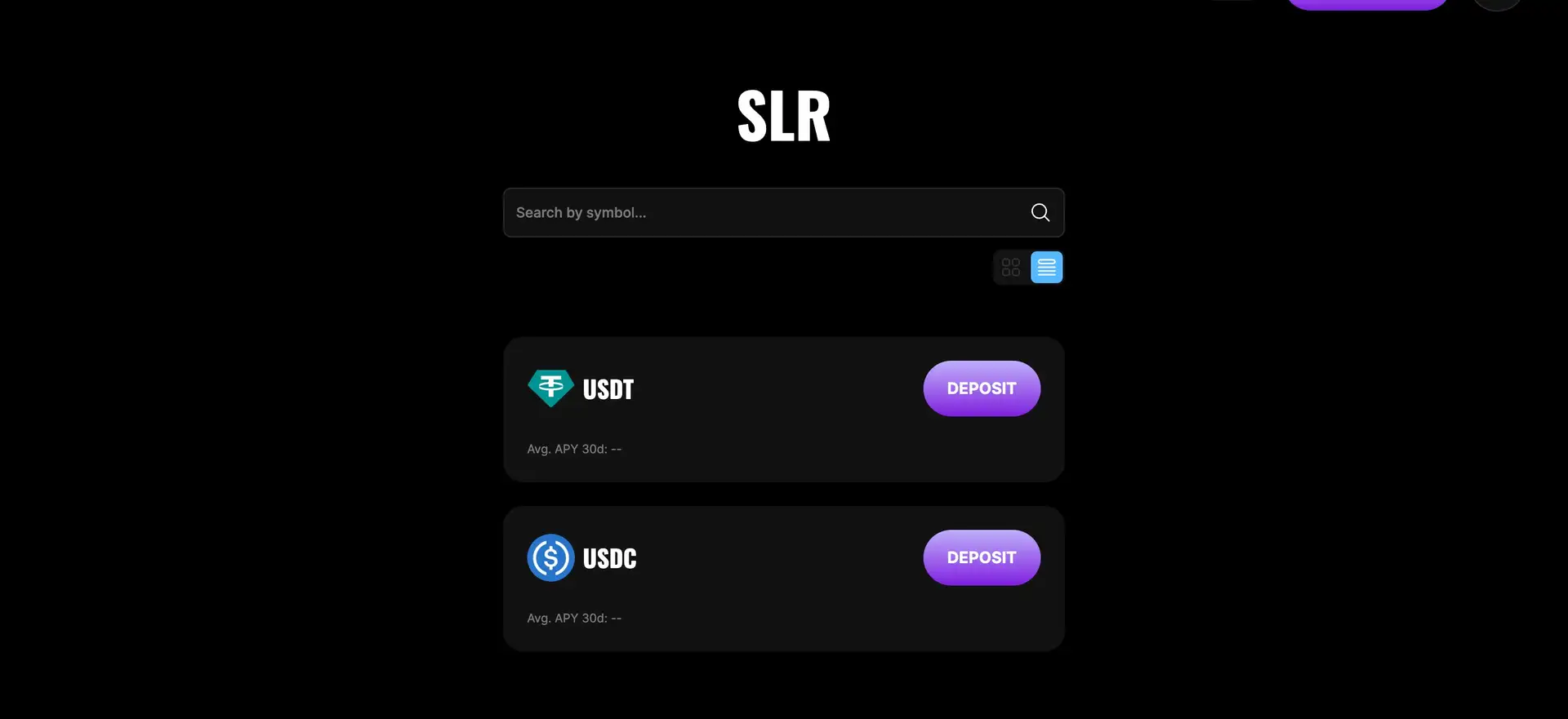

- Provide Liquidity: Choose a liquidity pool on Stabble and deposit your assets. By providing liquidity, you can earn yields while supporting the protocol’s trading operations.

- Explore Features: Utilize the advanced trading and liquidity management tools offered by Stabble to optimize your DeFi experience. Take advantage of arbitrage opportunities, yield farming, and more to enhance your returns.

- Stay Informed: Regularly visit the Stabble Documentation to keep up with updates, guides, and detailed tutorials on how to get the most out of the protocol.

stabble Activities

stabble Reviews by Real Users

stabble FAQ

Stabble uses advanced smart order execution and liquidity routing algorithms that intelligently distribute trades across the most optimal liquidity pools. This ensures that trades are executed with minimal slippage, providing a seamless trading experience with near-zero price impact.

Unlike traditional AMMs where users manage liquidity provision, Stabble manages liquidity directly through the protocol. This approach reduces the risk of impermanent loss and ensures more efficient allocation, providing a more stable environment for both traders and liquidity providers.

You can maximize your rewards by staking $STB tokens to receive veSTB, which offers governance power and additional benefits like fee discounts. The longer you lock your tokens, the higher your potential rewards, aligning your interests with the protocol’s long-term growth.

Stabble employs an internal arbitrage mechanism that automatically corrects price discrepancies across different liquidity pools. This reduces the need for external arbitrageurs, retaining more value within the ecosystem and improving overall pricing efficiency.

Margin liquidity pools on Stabble are designed to be up to 8,000 times more capital-efficient than traditional AMM pools. This high capital efficiency allows for deeper liquidity with less capital, reducing costs and enhancing the overall efficiency of the trading system.

You Might Also Like