About STRKFarm

STRKFarm is a decentralized yield aggregator built on Starknet that empowers users to maximize returns on their crypto assets through smart, automated strategies. By aggregating yields from across Starknet’s DeFi ecosystem, STRKFarm delivers a seamless staking experience with high APYs, low fees, and user-centric vault architecture. The platform is designed for DeFi beginners, crypto natives, and dApp treasuries alike, offering a simple way to participate in advanced financial opportunities without manual intervention.

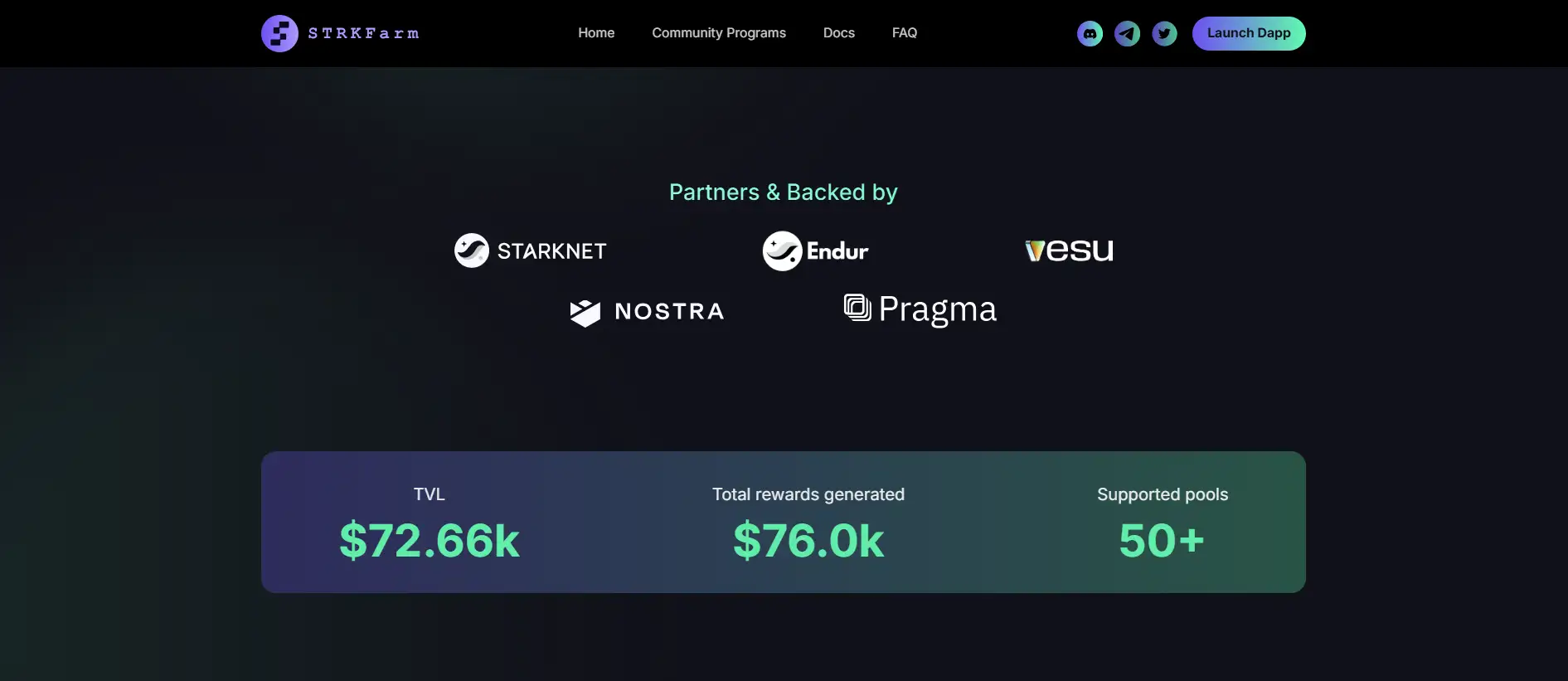

Thanks to Starknet’s scalability and low transaction fees, STRKFarm enables efficient auto-compounding strategies and supports over 50 pools with assets such as STRK, ETH, and USDC. The platform's performance is already notable, with over $76,000 in rewards distributed and a rapidly growing Total Value Locked. STRKFarm continues to optimize and expand its offerings, ensuring users get the most out of their DeFi experience.

STRKFarm serves as Starknet’s go-to platform for automated yield optimization, giving users access to a broad array of DeFi strategies that require no active management. Its architecture centers on vaults that automatically deploy user funds into the most profitable protocols, leveraging data from top Starknet AMMs, yield farms, and liquidity pools. The platform continuously reallocates capital to take advantage of the best APYs while managing risk through diversification and smart contract logic.

At its core, STRKFarm is built with security and transparency in mind. It integrates audited smart contracts, maintains full visibility into yield sources, and provides clear tracking of on-platform balances. Users can deposit tokens like STRK, USDC, or ETH and benefit from optimized vaults such as Auto-Compounding STRK or xSTRK Sensei — which taps into advanced leveraged strategies. The smart routing of assets ensures maximum capital efficiency without requiring users to manually chase new protocols.

The platform has also launched NFT-based features like the OG Farmer program and participated in the Starknet DeFi Spring to further reward early users. It collaborates with major Starknet-native DeFi protocols including zkLend, Nostra, and Endur. In comparison to similar yield aggregators like Yearn Finance or Beefy Finance, STRKFarm offers Starknet-specific optimizations, lower transaction costs, and deeper ecosystem integration.

Currently supporting 50+ pools, the platform’s TVL and reward statistics highlight real and growing user adoption. With advanced upgrades to vault logic, including dynamic xSTRK pricing and DEX-focused routing, STRKFarm continually improves the precision of its returns. By putting ease-of-use and performance first, STRKFarm makes DeFi farming truly accessible and effective for anyone on Starknet.

STRKFarm offers a suite of innovative DeFi features tailored to maximize Starknet yields:

- High-Yield Vaults: Auto-compounding strategies on STRK, ETH, and USDC with rates reaching up to 30%+.

- Starknet-Native Optimization: Built to fully utilize Starknet’s scalability and near-zero fees for efficient yield aggregation.

- xSTRK Sensei Strategy: Leveraged staking strategy offering potentially higher returns, managed via integration with Endur and DEX liquidity.

- Auto Reinvestment: All yields are reinvested automatically, compounding gains without user input or extra gas fees.

- On-Platform Balance Management: Rewards are added to your STRKFarm balance, simplifying the reinvestment process.

- Partner Integration: Strategies powered by zkLend, Nostra, and others, unlocking DeFi Spring benefits and liquidity support.

- User-Centric Design: Simple onboarding for beginners and advanced metrics for experienced yield farmers.

Getting started with STRKFarm is fast and beginner-friendly, even for those new to Starknet:

- Visit the Platform: Navigate to the official STRKFarm website and click on “Launch Dapp.”

- Connect Your Wallet: Use a Starknet-compatible wallet such as Argent or Braavos to connect to the dApp.

- Select a Strategy: Choose from Auto-Compounding vaults, high-yield pools, or the xSTRK Sensei strategy for leveraged staking.

- Deposit Tokens: Supply supported assets like STRK, ETH, or USDC into your chosen vault.

- Track Rewards: All rewards are credited to your STRKFarm balance and auto-compounded — you can monitor them in real-time on the dashboard.

- Withdraw at Any Time: Withdraw your funds through the dApp, or if needed, use external platforms like zkLend for strategies that rely on third-party protocols.

- Join the Community: Stay updated and share ideas via the official Discord and Twitter.

STRKFarm FAQ

STRKFarm rewards are automatically added to your platform balance inside the dApp, not directly to your wallet. This allows the system to auto-compound your earnings and optimize returns over time. You can increase your position by depositing more tokens, and rewards will continue to build in your STRKFarm balance without needing to claim or reinvest manually. View your balance anytime on the STRKFarm dashboard.

The xSTRK Sensei strategy was upgraded on 9 February 2025 to reflect more accurate exchange rates between xSTRK and STRK. This may have temporarily reduced your visible holdings, especially for earlier deposits. The drop is due to a DEX vs Endur price spread during redemptions and is a normal part of leveraged strategy mechanics. Based on current APYs and strategy performance, balances are expected to normalize within 4–6 weeks. Learn more on STRKFarm.

STRKFarm integrates with protocols like zkLend and Nostra that distribute rewards from the DeFi Spring 2.0 program. When you deposit in supported strategies, STRKFarm’s smart contracts automatically receive and apply these rewards proportionally to your balance. You won’t receive tokens directly in your wallet, but your on-platform holdings will increase in value to reflect the DeFi Spring yields. All this is handled transparently within the dApp. Visit STRKFarm for real-time data.

Yes, you can unstake your funds from most STRKFarm strategies at any time via the dashboard. Some strategies, like Auto-Compounding STRK or USDC, are built on zkLend, meaning your funds can be withdrawn directly from that protocol’s interface as well. Always ensure you’re using the correct route based on your strategy. STRKFarm is non-custodial, and withdrawals are available whenever underlying liquidity is accessible.

The price difference between xSTRK and STRK on DEXs reflects the opportunity cost of staking. When market makers accept xSTRK in exchange for STRK, they sacrifice potential staking rewards for 21 days. To offset this, they apply a 0.6–0.8% spread, equivalent to 3 weeks of lost yield at a 12% APY. This is a normal feature of leveraged staking and market dynamics. The spread may narrow or widen depending on current market demand and supply. STRKFarm’s updated model minimizes this impact using DEX routing only.

You Might Also Like