About STRX FINANCE

STRX Finance is a decentralized finance (DeFi) platform built on the TRON blockchain, designed to optimize the staking and lending of TRX, the native cryptocurrency of the TRON network. The project aims to provide users with a secure, efficient, and flexible way to earn yield on their TRX holdings through an innovative liquid staking mechanism. Unlike traditional staking, where assets are locked up for a fixed period, STRX Finance allows users to stake TRX and still retain the ability to unstake and move their assets freely, offering unparalleled flexibility in managing their crypto holdings.

At its core, STRX Finance seeks to address the limitations of conventional staking models by integrating DeFi functionalities. Users who stake TRX receive SFI tokens, which serve as a receipt for their staked assets. These SFI tokens can be utilized across various DeFi protocols for lending, trading, and liquidity provision, allowing users to earn additional income streams while their TRX remains staked. This dual-earning capability positions STRX Finance as a unique player in the DeFi space, catering to both passive stakers and active DeFi participants.

STRX Finance is a comprehensive decentralized finance platform that has been developed to leverage the power of the TRON blockchain, focusing on optimizing the staking and lending of TRX assets. Since its inception, STRX Finance has been at the forefront of innovation within the TRON ecosystem, offering solutions that simplify the staking process while maximizing potential returns for users. The platform's unique liquid staking model is designed to provide users with the flexibility to stake their TRX without the traditional constraints associated with staking, such as long lock-up periods and penalties for early withdrawal.

The STRX Finance platform operates on a straightforward premise: allow users to stake TRX and receive SFI tokens as a representation of their staked assets. These SFI tokens are crucial because they can be utilized in various DeFi activities, including lending, trading, and liquidity mining, creating multiple avenues for users to generate additional income from their initial stake. This dual-earning potential sets STRX Finance apart from traditional staking services, which often require users to lock their assets without offering additional benefits.

One of the key aspects of STRX Finance is its integration with TRON's governance model. Through TRON Super Representative voting, SFI holders can participate in the decision-making process that governs block production and the overall security of the TRON network. This participatory model not only enhances the utility of the SFI token but also encourages user engagement by giving them a voice in the ecosystem's governance.

Furthermore, STRX Finance has strategically positioned itself within the TRON ecosystem by forming partnerships with major energy rental platforms. These partnerships enable users to rent bandwidth and energy, further maximizing their staking rewards. This integration of energy rental services into the platform's core offerings underscores its commitment to providing comprehensive solutions for TRON users, making it easier to earn and compound rewards through the ecosystem.

As STRX Finance continues to evolve, it faces competition from other TRON-based DeFi platforms such as Sun.io and JustLend. However, STRX Finance differentiates itself by focusing on liquid staking and providing users with the ability to seamlessly integrate their staked assets into various DeFi protocols. This unique combination of features makes STRX Finance a compelling choice for both new and experienced DeFi users looking to maximize their TRX yields.

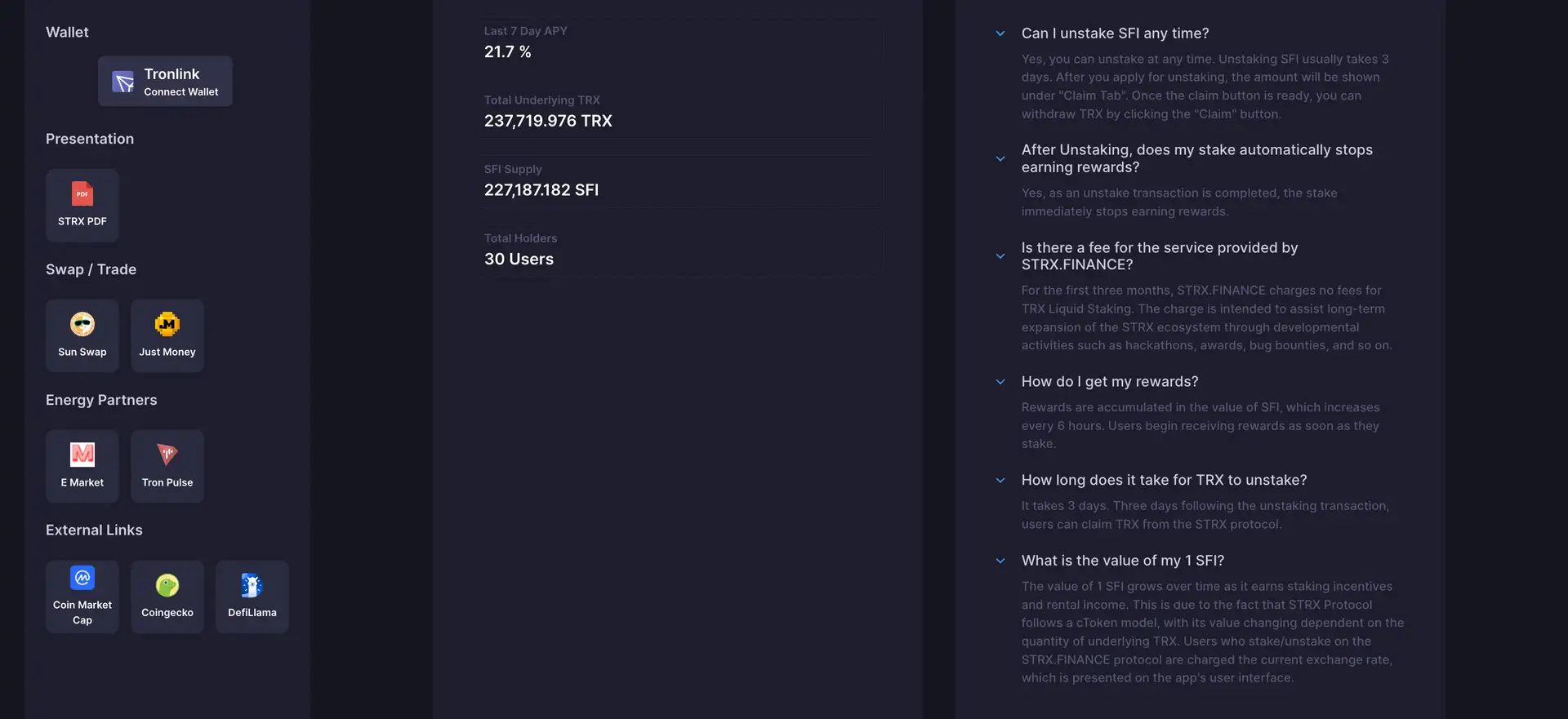

- Liquid Staking: Stake and unstake TRX at any time without penalties, providing flexibility and continuous earning potential.

- High Yield: Earn up to 40% APY by participating in TRON’s staking and lending mechanisms.

- DeFi Integration: Use SFI tokens in various DeFi protocols for lending, trading, and liquidity mining, creating multiple income streams from staked assets.

- Governance Participation: Vote for TRON Super Representatives using SFI tokens, influencing the network's block production and overall governance.

- Security: The protocol is secured by multisig wallets and has undergone multiple audits to ensure the safety of user funds.

- Transparency: All transactions and rewards are transparent and verifiable on the TRON blockchain, enhancing trust in the platform.

- Energy Rental Integration: Maximize staking rewards by renting bandwidth and energy through integrated partnerships with major energy rental platforms.

- Comprehensive Ecosystem: The platform's broad integration with TRON's DeFi and governance systems makes it a versatile tool for maximizing TRX yields.

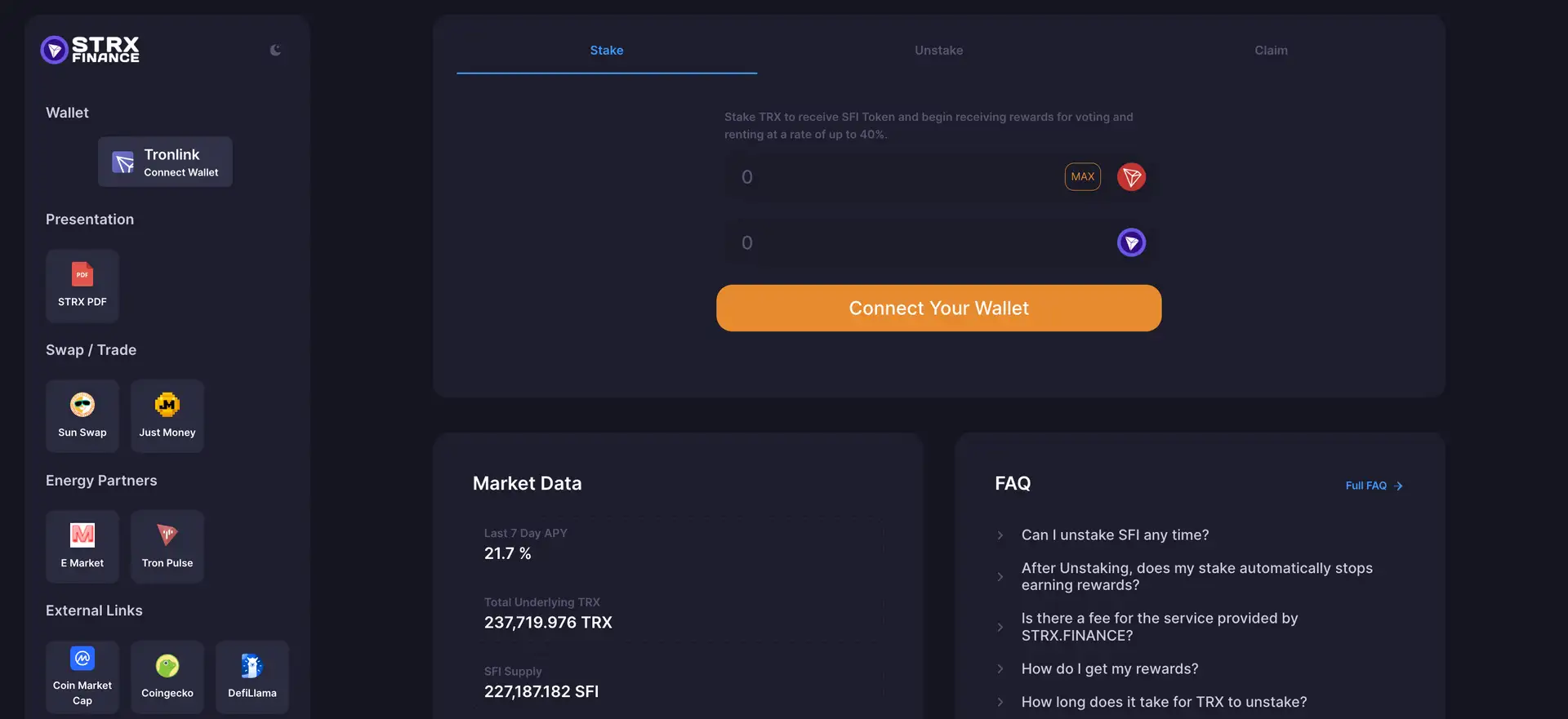

- Create a TRON Wallet: First, set up a TRON-compatible wallet like TronLink or Trust Wallet.

- Acquire TRX: Purchase TRX through a cryptocurrency exchange such as Binance or Huobi.

- Connect to STRX Finance: Go to the STRX Finance website and connect your TRON wallet.

- Stake TRX: Choose the amount of TRX you want to stake and confirm the transaction in your wallet. You will receive SFI tokens in return, representing your staked assets.

- Participate in DeFi: Use your SFI tokens to earn additional yield by participating in DeFi activities such as lending, trading, and liquidity mining through the platform.

- Monitor Your Staking: Regularly check your staking status and rewards through the STRX Finance dashboard to ensure optimal returns.

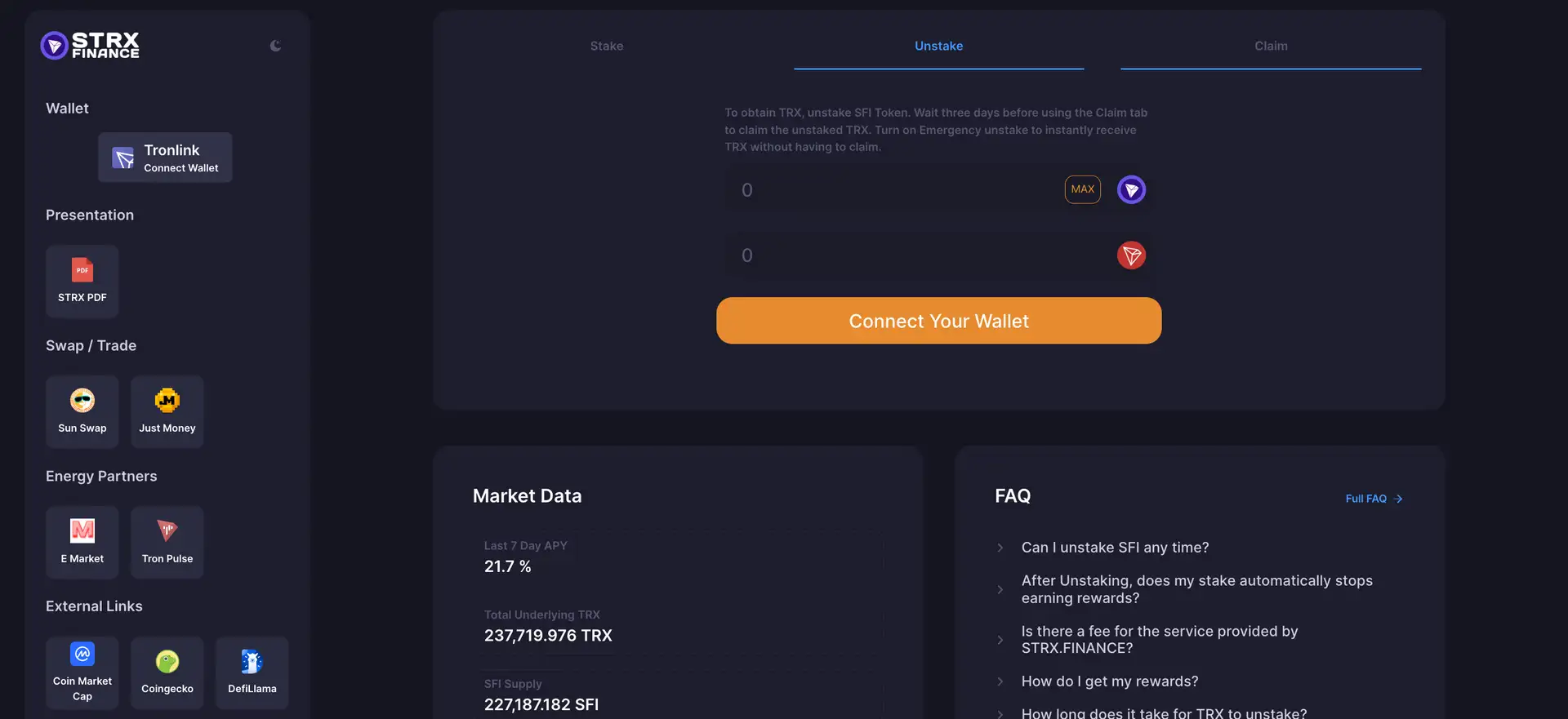

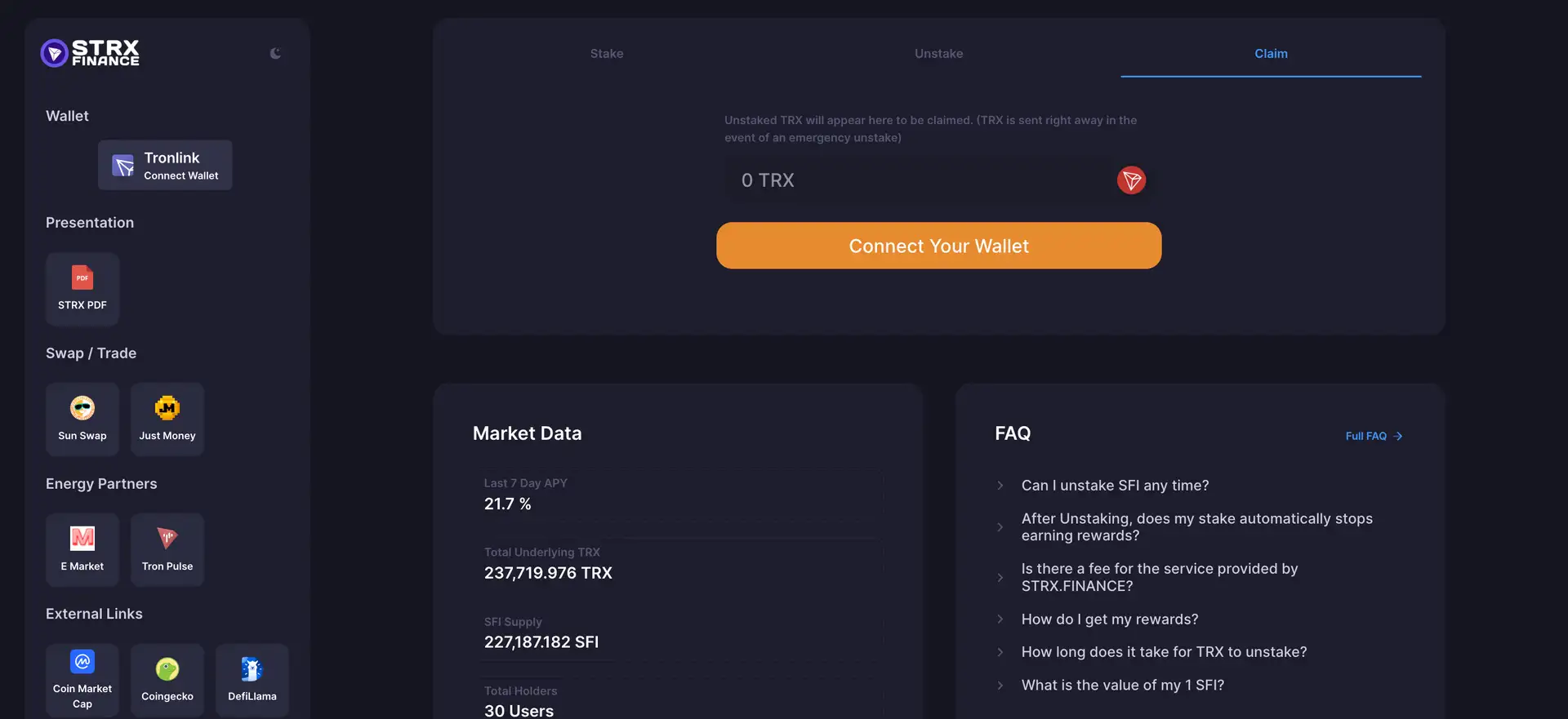

- Unstake TRX: When you want to unstake your TRX, simply initiate the unstaking process through the STRX Finance platform and convert your SFI tokens back into TRX.

- Stay Informed: Follow STRX Finance on social media and their official blog to stay updated on the latest developments, features, and opportunities within the platform.

For more detailed guides and support, visit the STRX Finance documentation.

STRX FINANCE Reviews by Real Users

STRX FINANCE FAQ

STRX Finance utilizes a unique liquid staking model that allows you to stake your TRX and receive SFI tokens as proof of your stake. These tokens can be used across various DeFi platforms while your TRX remains staked, giving you the flexibility to earn additional income streams without locking up your assets.

Yes, by staking TRX on STRX Finance and receiving SFI tokens, you gain voting rights for TRON Super Representatives. This allows you to influence network decisions, such as block production, while still earning staking rewards.

STRX Finance stands out due to its liquid staking model, which allows users to unstake their TRX at any time without penalties. Moreover, it offers the ability to use SFI tokens in a variety of DeFi activities, creating additional earning opportunities while your TRX is staked.

No, STRX Finance does not impose a minimum staking amount, making it accessible to all users, whether you have a small or large amount of TRX. This inclusivity allows everyone to benefit from staking and DeFi integration.

You can easily monitor your staking rewards and the performance of your SFI tokens through the STRX Finance dashboard. This user-friendly interface provides real-time updates on your earnings and staked assets.

You Might Also Like