About Tectonic Finance

Tectonic is a cutting-edge decentralized money market protocol built on the Cronos blockchain. It provides users with the ability to earn passive income through asset deposits and offers instant liquidity via borrowing against their crypto holdings. The project is designed to leverage the principles of decentralized finance (DeFi) to provide a secure, transparent, and efficient platform for digital asset management.

The mission of Tectonic is to democratize access to financial services by harnessing the power of blockchain technology. The platform aims to offer a seamless and user-friendly experience for both lenders and borrowers, ensuring that financial services are accessible to a broader audience. By integrating DeFi principles, Tectonic strives to enhance financial inclusion and empower users to take control of their financial future.

Tectonic has established itself as a prominent player in the decentralized finance (DeFi) sector, focusing on providing algorithm-driven, non-custodial financial services on the Cronos blockchain. The project’s journey began with a vision to offer users a decentralized platform where they could earn passive income through asset deposits and access instant liquidity by borrowing against their crypto holdings.

History and Development

Tectonic's development has been marked by several key milestones, reflecting its commitment to innovation and user-centric design. The initial launch of the protocol introduced basic lending and borrowing functionalities, which were soon followed by the integration of advanced features such as cross-chain capabilities and enhanced security measures. These developments have positioned Tectonic as a reliable and versatile platform in the DeFi space.

Key Milestones

- Launch of Core Protocol: The initial launch included the basic functionality for earning and borrowing, setting the foundation for future developments.

- Integration with Cronos Chain: Tectonic’s integration with Cronos blockchain has provided users with faster transaction speeds and lower fees, enhancing the overall user experience.

- Introduction of Cross-Chain Capabilities: This feature allows users to interact with assets across different blockchains, increasing the flexibility and utility of the platform.

- Security Enhancements: Ongoing audits and the establishment of an insurance fund have significantly bolstered the platform’s security, providing users with greater confidence in the protocol’s safety.

Community and Governance

Tectonic places a strong emphasis on community involvement and decentralized governance. The TONIC token plays a central role in this aspect, allowing holders to participate in key decisions regarding the protocol’s development. The governance model is designed to be inclusive, ensuring that a diverse range of voices can influence the platform's direction. Community proposals and voting are integral parts of this process, promoting a collaborative approach to innovation and growth.

Competitive Landscape

In the competitive landscape of DeFi lending platforms, Tectonic distinguishes itself through its integration with the Cronos chain and its strong focus on security and community participation. While there are several notable competitors, such as Aave and Compound, Tectonic’s unique features and strategic approach provide it with a competitive edge.

- Aave: Known for its flash loans and wide range of supported assets, Aave is a significant player in the DeFi lending space.

- Compound: Another major competitor, Compound, offers a decentralized lending platform with a strong focus on governance and community involvement.

Despite these competitors, Tectonic's seamless integration with Cronos, robust security measures, and inclusive governance model make it a compelling choice for users seeking a reliable and community-driven DeFi platform.

Future Prospects

Looking ahead, Tectonic aims to continue enhancing its platform by introducing new features and expanding its ecosystem. Plans include the development of additional cross-chain integrations, the launch of new financial products, and further enhancements to the governance model. These initiatives are designed to ensure that Tectonic remains at the forefront of innovation in the DeFi space, providing users with a continually evolving and improving platform.

In conclusion, Tectonic’s history and development reflect its commitment to providing a secure, efficient, and user-friendly DeFi platform. Its integration with Cronos, focus on community governance, and ongoing enhancements position it as a leading player in the decentralized finance sector.

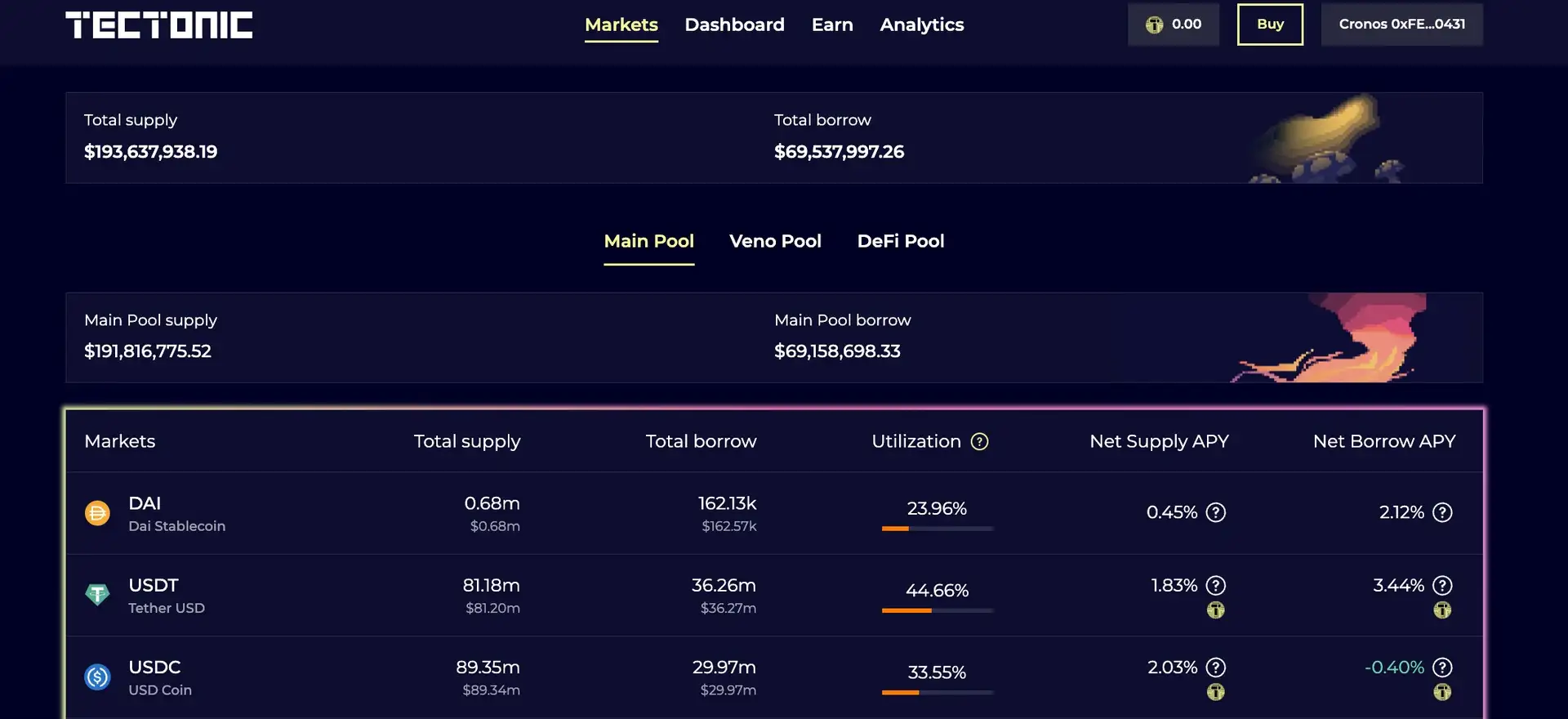

1. Passive Income Generation: Users can deposit a wide range of crypto assets to earn competitive annual percentage yields (APYs). These earnings are accessible immediately, with no lock-up period, providing users with flexibility and immediate access to their returns.

2. Instant Liquidity: Tectonic allows users to unlock liquidity from their crypto assets without the need to sell them. Borrowers can use their deposited assets as collateral to borrow funds instantly, enabling efficient fund management and liquidity access.

3. Security: The platform employs multiple layers of security, including smart contract audits conducted by reputable security firms. Additionally, the Community Insurance Pool acts as a safety net, providing coverage in case of unexpected events or smart contract vulnerabilities.

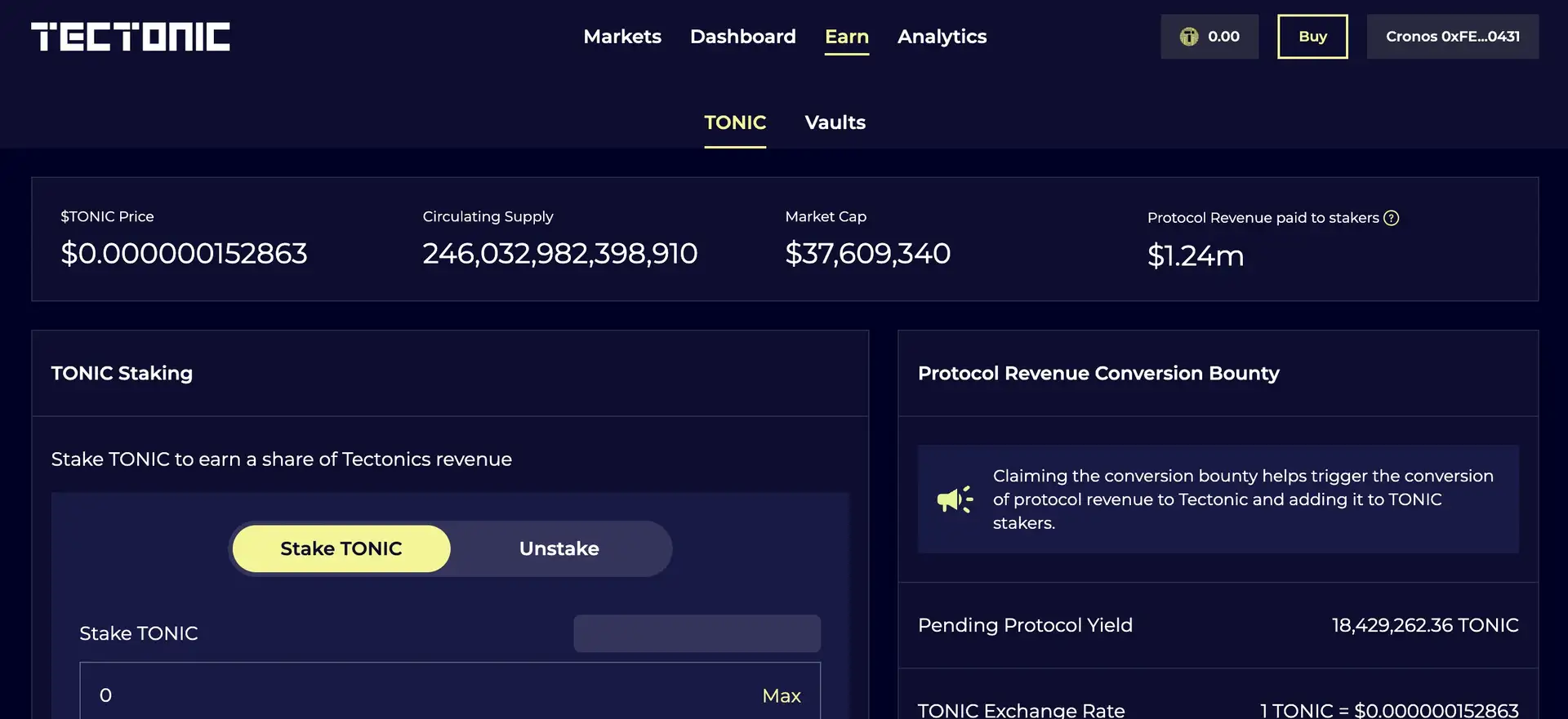

4. Governance and Staking: The TONIC token is central to Tectonic’s governance model, giving holders the ability to propose and vote on changes to the protocol. Staking TONIC tokens in the Community Insurance Pool also provides rewards, encouraging long-term commitment and active participation from users.

5. Cross-Chain Functionality: Tectonic supports cross-chain operations, enhancing its flexibility and utility in the DeFi ecosystem. This feature allows users to interact with assets across different blockchains, increasing the overall utility of the platform.

6. User-Friendly Interface: The platform is designed with a user-friendly interface that simplifies the process of earning, lending, and borrowing crypto assets. This accessibility ensures that both novice and experienced users can navigate the platform with ease.

7. Community Involvement: Tectonic emphasizes community-driven development, where users can actively participate in governance decisions, fostering a sense of ownership and engagement within the ecosystem.

1. Create an Account: Visit the Tectonic website and sign up for an account. Ensure you have a compatible crypto wallet set up for transactions.

2. Deposit Assets: After creating an account, deposit your crypto assets into the Tectonic platform. Navigate to the deposit section, select the asset you wish to deposit, and follow the on-screen instructions.

3. Borrow Funds: If you need liquidity, use your deposited assets as collateral to borrow funds instantly. Go to the borrowing section, choose the asset you want to borrow, and specify the amount.

4. Participate in Governance: Acquire TONIC tokens to participate in governance decisions. Staking your TONIC tokens in the Community Insurance Pool will allow you to earn rewards and contribute to the platform’s security.

5. Stay Informed: Follow the Tectonic whitepaper and community updates for the latest developments and guides. Join the Tectonic community on social media to stay updated and engaged.

6. Explore Features: Take advantage of the platform’s features such as cross-chain functionality and liquidity mining to maximize your returns and enhance your DeFi experience.

By following these steps, users can effectively start using Tectonic and leverage its diverse range of financial services to manage and grow their crypto assets.

Tectonic Finance Token

Tectonic Finance Reviews by Real Users

Tectonic Finance FAQ

The Community Insurance Pool is a safety mechanism within Tectonic. Users can stake their TONIC tokens in this pool to earn rewards and contribute to the platform's security, providing coverage in case of unexpected events or smart contract vulnerabilities.

You can earn passive income on Tectonic by depositing your crypto assets into the platform. These deposits earn competitive annual percentage yields (APYs) without a lock-up period, giving you flexibility and immediate access to your returns.

Cross-chain functionality allows users to interact with assets across different blockchains, enhancing the flexibility and utility of the Tectonic platform. This feature increases the overall utility and accessibility of the platform for a broader range of users.

TONIC tokens are available on several major exchanges, including Crypto.com and Uniswap. These exchanges allow you to easily acquire and trade TONIC tokens.

You Might Also Like