About Tenderize

Tenderize is a decentralized protocol that reimagines how liquid staking operates by introducing a truly composable and decentralized model called Liquid Staking 2.0. Designed to address the limitations of centralized liquid staking protocols, Tenderize empowers users to retain validator choice, reduce fragmentation, and preserve network decentralization while unlocking DeFi utility for their staked assets.

With innovative tools like TenderSwap, tTokens, and upcoming multi-validator staking pools, Tenderize allows users to stake with their preferred validators and maintain liquidity for their positions. The protocol is built to serve not only retail stakers, but also solo validators, staking services, and index product developers — all while fostering a permissionless and transparent ecosystem.

Tenderize is pioneering a new paradigm in liquid staking infrastructure, distinguishing itself from conventional players like Lido, StakeWise, and Rocket Pool. While traditional protocols concentrate stake in a small number of validators and require centralized liquidity management, Tenderize introduces validator-specific liquid staking tokens (tTokens) and shared liquidity pools through TenderSwap, enhancing both decentralization and capital efficiency.

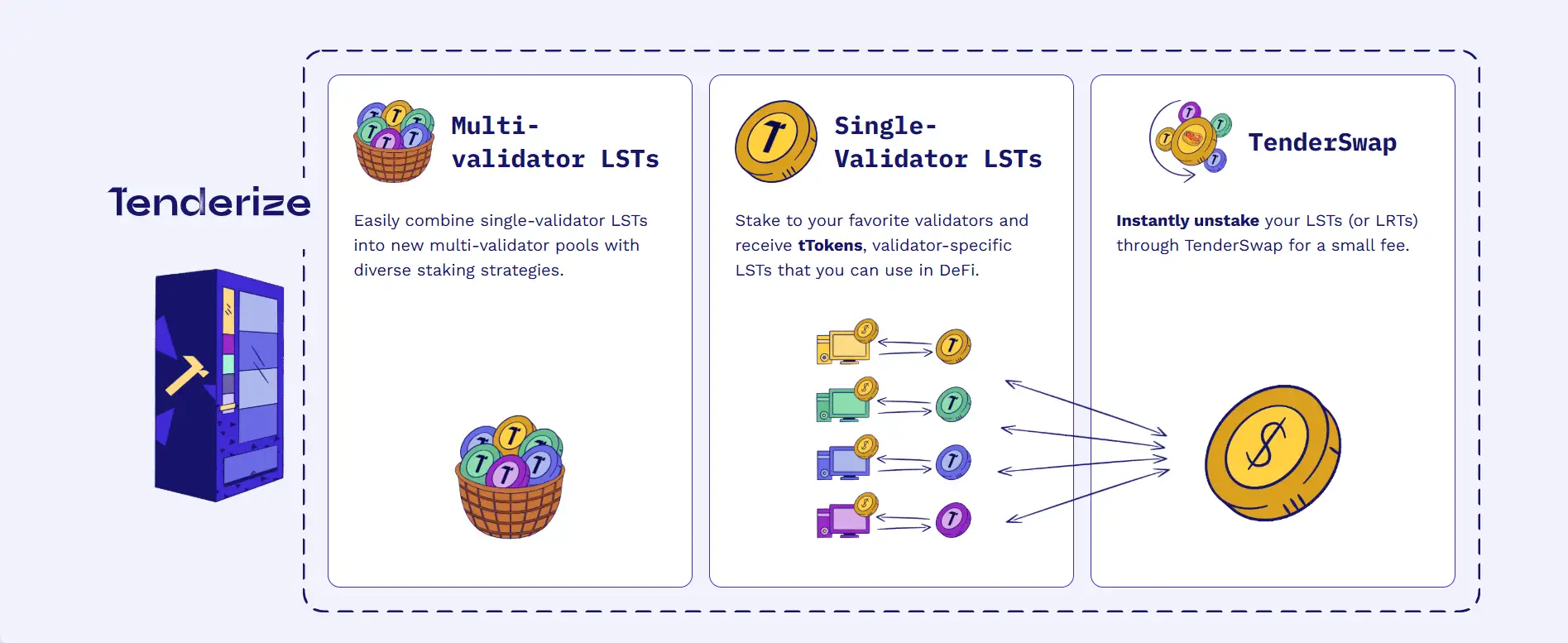

At the core of Tenderize’s approach are single-validator LSTs, which allow users to stake tokens (e.g., MATIC, GRT, LPT) to specific validators and receive tTokens in return. These tokens automatically reflect staking rewards through an elastic supply model and can be used across DeFi protocols. Each tToken is linked to a specific validator, offering transparency in performance and risk. This design ensures that users remain in control of validator selection and that staking incentives remain aligned across the ecosystem.

The protocol also supports the creation of multi-validator LSTs, a significant upcoming feature that will allow users to create diversified baskets of staked assets with automatic rebalancing. These products offer broader exposure to staking yields while minimizing reliance on any single validator, thus improving both performance consistency and decentralization.

To address liquidity challenges, Tenderize introduces TenderSwap, a purpose-built decentralized exchange for LSTs and LRTs. Unlike AMMs like Uniswap or Curve, TenderSwap leverages a shared liquidity model where all tTokens for a single asset (e.g., tGRT) utilize the same liquidity pool. This minimizes capital inefficiency and slippage while offering users instant unstaking options for a small dynamic fee.

TenderSwap also supports an innovative NFT-based unstaking mechanism, where users receive ERC-721 NFTs representing their unstaking claims. These NFTs can be traded or redeemed, enabling market participants to engage in time-risk arbitrage or provide liquidity in return for redemption rewards. This flexibility opens new opportunities for sophisticated DeFi traders, relayers, and liquidity providers.

Currently supporting MATIC, GRT, LPT, and ETH via lpETH, Tenderize plans to expand into networks like Hyperliquid and Bittensor as part of its 2025 roadmap. The upcoming launch of the $WAGYU token will power the governance layer via veToken mechanisms and incentivize protocol-wide participation and decision-making.

Through its modular architecture, efficient liquidity models, and validator-first philosophy, Tenderize offers a scalable and decentralized alternative in the growing LSTFi space, paving the way for broader integration across lending, borrowing, and asset management protocols.

Tenderize provides numerous benefits and features that redefine the future of liquid staking and LSTFi ecosystems:

- Validator-Specific tTokens: Stake with your chosen validator and receive liquid tokens that transparently reflect individual validator performance.

- Multi-Validator Pools: Create diversified LSTs with automatic rebalancing for better decentralization and reduced validator risk.

- TenderSwap: Access instant liquidity for tTokens through shared pools and efficient unstaking with dynamic fees.

- Elastic Supply Rewards: Staking rewards are auto-reflected in tToken balances, requiring no manual claiming or compounding.

- DeFi Integration: Use tTokens as collateral, in DEXes, liquidity pools, or lending platforms, enabling capital-efficient strategies.

- ERC-721 NFT Unstaking: Instantly trade or redeem unlock NFTs during staking withdrawals, bringing flexibility and liquidity to the unstaking process.

- Protocol Governance via $WAGYU: Soon users will be able to stake $WAGYU for veWAGYU and participate in decentralized governance decisions.

- Security & Transparency: Open-source contracts, third-party audits, and real-time validator metrics ensure user trust and protocol resilience.

Tenderize offers a seamless onboarding experience whether you're a validator, DeFi user, or first-time staker:

- Step 1: Visit tenderize.me and connect your crypto wallet.

- Step 2: Choose an asset to stake — currently supported: MATIC, GRT, LPT, and ETH via lpETH.

- Step 3: Select a validator (for single-validator staking) and deposit tokens to mint tTokens representing your staked position.

- Step 4: Use your tTokens across DeFi protocols for lending, liquidity mining, or trading.

- Step 5: To unstake, either initiate standard unstaking or use TenderSwap for instant redemption at a small fee.

- Step 6: If standard unstaking is used, receive an ERC-721 unlock NFT and redeem it upon maturity or sell it on a secondary market.

- Step 7: Stay informed and participate in governance through the upcoming launch of $WAGYU and veToken mechanics.

Tenderize FAQ

tTokens are designed with an elastic supply model that increases as staking rewards accrue and decreases in slashing events, maintaining price parity with the underlying asset naturally, without relying on external oracles or feeds on Tenderize.

TenderSwap uses a shared liquidity model for all tTokens of a given asset, avoiding the need for separate pools, which results in reduced slippage, improved capital efficiency, and instant unstaking capabilities directly on Tenderize.

If your chosen validator is slashed, the corresponding tToken supply adjusts downward to reflect the penalty, ensuring your balance accurately represents your net stake; this direct tie to validator performance promotes transparency and accountability on Tenderize.

When unstaking via Tenderize, you receive an ERC-721 unlock NFT representing your claim, which can be traded or sold before maturity, giving you flexible liquidity options during the thawing period on Tenderize.

Yes, Tenderize supports user-created multi-validator LSTs, allowing you to compose diverse, auto-rebalancing staking pools using single-validator tTokens — a feature designed to promote decentralization and user autonomy on Tenderize.

You Might Also Like