About Term Finance

Term Finance is a decentralized fixed-rate lending protocol that enables crypto users to borrow and lend digital assets through transparent, on-chain auctions. Designed for predictable financing and secure capital allocation, Term Finance empowers borrowers to lock in known borrowing costs and allows lenders to secure reliable, fixed yields.

Operating with principles inspired by traditional tri-party repo markets, Term Finance combines institutional-grade lending infrastructure with the composability and transparency of DeFi. By matching borrowers and lenders through weekly auctions, it creates a more stable, capital-efficient, and permissionless market for fixed-income crypto products.

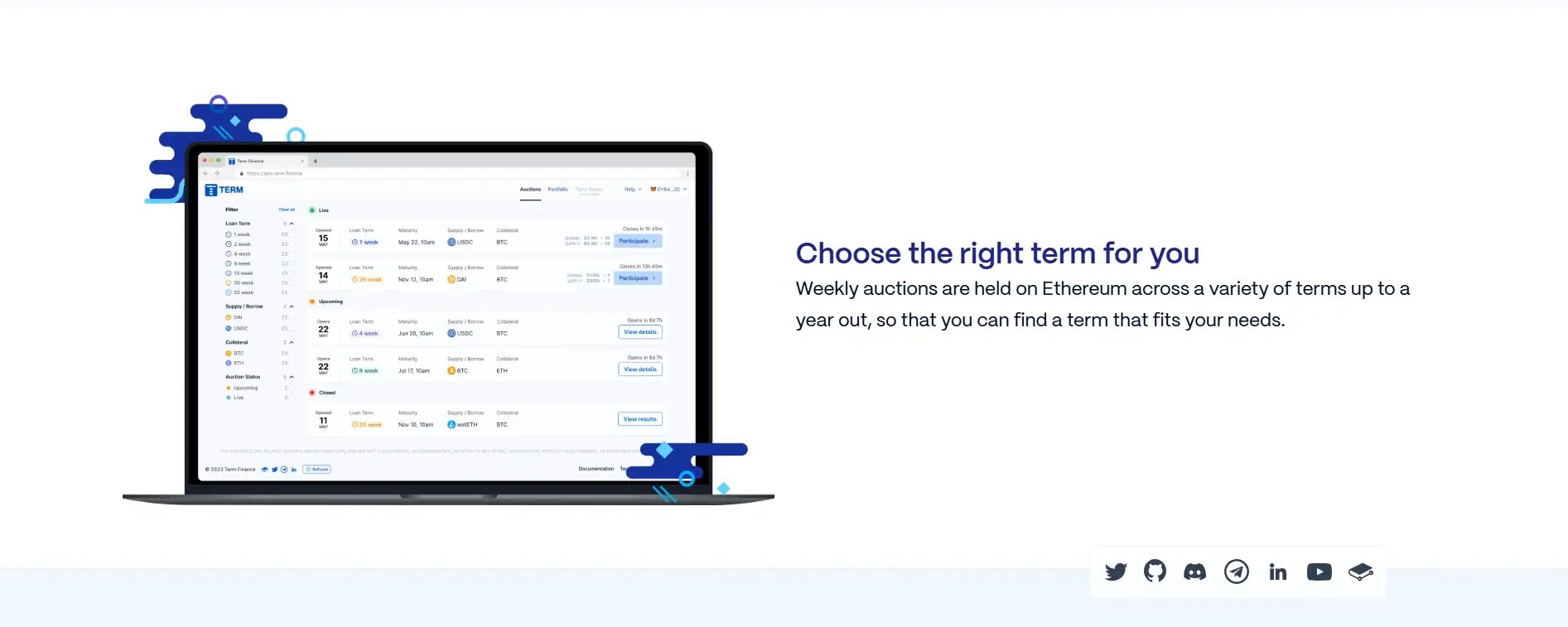

Term Finance is redefining the structure of crypto lending through a novel mechanism: on-chain fixed-rate loan auctions. Unlike most DeFi lending protocols that offer variable rates influenced by utilization-based models, Term Finance enables predictable loan terms via a market-driven auction system. These auctions occur weekly on Ethereum and offer loan terms ranging from a few weeks to several months, depending on the available collateral and token pairs.

Each auction functions similarly to a sealed-bid treasury auction. Borrowers submit bids stating how much they want to borrow and the maximum interest rate they’re willing to pay. Lenders submit offers with the amount they are willing to lend and their minimum required rate. Once the auction ends, the protocol determines a single clearing rate where supply meets demand — all accepted bids and offers are executed at this rate. Participants outside this range are excluded, and their assets are returned.

After the auction, successful borrowers receive the loaned assets, while lenders receive Term Repo Tokens (ERC-20) that represent their fixed-term lending positions. These tokens can be held until maturity or traded in secondary markets for liquidity. At maturity, borrowers must repay the principal and interest to reclaim their collateral, while lenders redeem their Term Tokens for full repayment.

Term Finance also allows for the management of loan positions post-auction. Borrowers can monitor collateralization in real time via subgraph integrations, ensuring their loans stay above the required maintenance margin ratio. If a borrower's collateral value drops below the required threshold or the loan is not repaid during the 12–24-hour maturity window, liquidation mechanisms are triggered. This ensures protocol solvency while applying only the minimum liquidation necessary to restore margin ratios.

Currently, Term supports loans backed by a wide range of crypto collateral types, including wETH, weETH, wstETH, cbBTC, BTC.b, sAVAX, and more. Auction results from recent periods show loan rates ranging from 2.5% to 16%, highlighting how the system captures real-time credit risk and market demand dynamics.

In contrast to variable-rate platforms like Aave or Compound, Term Finance delivers certainty. Its focus on fixed terms and non-custodial operations makes it especially appealing to professional traders, DAOs, and treasury managers seeking rate transparency and long-term planning. With a DeFi Safety score of 93% and audits by top-tier firms like Sigma Prime and Runtime Verification, the protocol balances innovation with institutional-grade security.

Backed by prominent investors including Coinbase Ventures, Electric Capital, and Blizzard, and led by a team of experts from TradFi and DeFi sectors, Term Finance is building the infrastructure to support a more predictable, transparent, and scalable crypto lending market.

Term Finance offers unique advantages in the fixed-rate DeFi lending space:

- Predictable Lending Rates: All loans are issued with a fixed rate and duration, reducing exposure to interest rate volatility.

- Transparent Auction Mechanism: Weekly auctions determine a fair, market-driven clearing rate for all participants.

- Non-Custodial Protocol: Funds and collateral are always held by smart contracts; users retain full custody throughout the loan term.

- Collateral Flexibility: Support for multiple types of collateral, including wETH, BTC.b, sAVAX, weETH, and more.

- Tradable Loan Positions: Lenders receive Term Tokens (ERC-20), which can be sold before maturity to access liquidity.

- Loan Rollovers: Borrowers can roll existing positions into new terms to maintain funding without needing to unwind.

- Rigorous Security: Regular audits and a 93% DeFi Safety score ensure user protection and platform integrity.

- Institutional-Grade Design: Built to mirror TradFi repo markets while embracing DeFi’s decentralization and transparency.

Term Finance provides a user-friendly process for fixed-rate crypto lending and borrowing:

- Step 1: Visit term.finance and launch the app.

- Step 2: Browse the list of upcoming or open auctions, filtering by term length, collateral type, or token.

- Step 3: As a borrower, submit bids indicating how much you wish to borrow and your max interest rate; as a lender, input the amount you want to lend and your minimum acceptable rate.

- Step 4: Lock your collateral (if borrowing) or your lending capital into the smart contract; you may cancel or adjust tenders anytime before the auction closes.

- Step 5: When the auction ends, the protocol determines a clearing rate; qualifying bids and offers are filled, and others are refunded.

- Step 6: Borrowers receive assets and manage collateral; lenders receive ERC-20 Term Tokens redeemable at maturity for principal plus interest.

- Step 7: At maturity, repay (borrowers) or redeem (lenders) your position within the settlement window; failing to repay can trigger liquidation.

Term Finance FAQ

Term Finance uses a sealed-bid auction mechanism where borrowers and lenders submit rates anonymously; the protocol calculates a single clearing rate that matches supply and demand, ensuring every accepted participant borrows or lends at the same fair, market-driven rate on Term Finance.

If your bid or offer falls outside the clearing rate range, it is considered “left on the table,” meaning your funds are automatically returned to your wallet; this ensures that no assets are stuck or misused within the Term Finance protocol.

Yes — when lending through Term Finance, you receive Term Repo Tokens (ERC-20) which represent your lending position and can be transferred or traded for liquidity prior to loan maturity, offering flexibility in an otherwise fixed-term model.

Term Finance requires that borrower collateral maintains a minimum margin ratio; if this ratio is breached, smart contracts initiate a controlled liquidation process to cover the debt and protect lenders, ensuring protocol health on Term Finance.

Term loans are non-callable by design, meaning repayment must occur at maturity to maintain a stable and predictable lending environment; however, borrowers can negotiate buybacks or participate in rollovers on Term Finance to exit or extend their position.

You Might Also Like