About TheStandard.io

TheStandard is a groundbreaking DeFi borrowing protocol that empowers users to unlock liquidity from their crypto portfolios while earning yield — all without relinquishing control of their assets. Built around innovative Smart Vaults, TheStandard.io lets users borrow the decentralized stablecoin USDs at 0% interest, while simultaneously generating yield on deposited collateral.

Focused on self-custody, flexibility, and capital efficiency, TheStandard redefines DeFi borrowing by offering dynamic NFTs as collateral containers, automated yield optimization, and novel tools like discounted debt repayments. It’s DeFi borrowing, yield farming, and composability — all wrapped into one smart, trustless experience.

TheStandard is designed to be a full-stack decentralized borrowing and yield generation protocol, built around the concept of Smart Vaults — non-custodial, on-chain wallets that allow users to borrow against their crypto assets while simultaneously deploying those assets into yield-generating strategies. What makes TheStandard.io exceptional is its ability to deliver 0% interest borrowing without compromising user ownership, optionality, or capital productivity.

At the core, users deposit supported assets (such as ETH, WBTC, ARB, LINK, GMX and others) into a Smart Vault. These assets become eligible for dual-purpose use: as collateral to mint the stablecoin USDs, and as contributors to yield-earning pools via integration with Uniswap V3 and other platforms. Users can create a Smart Vault in minutes with their Web3 wallet and are not required to pass KYC or give up custody.

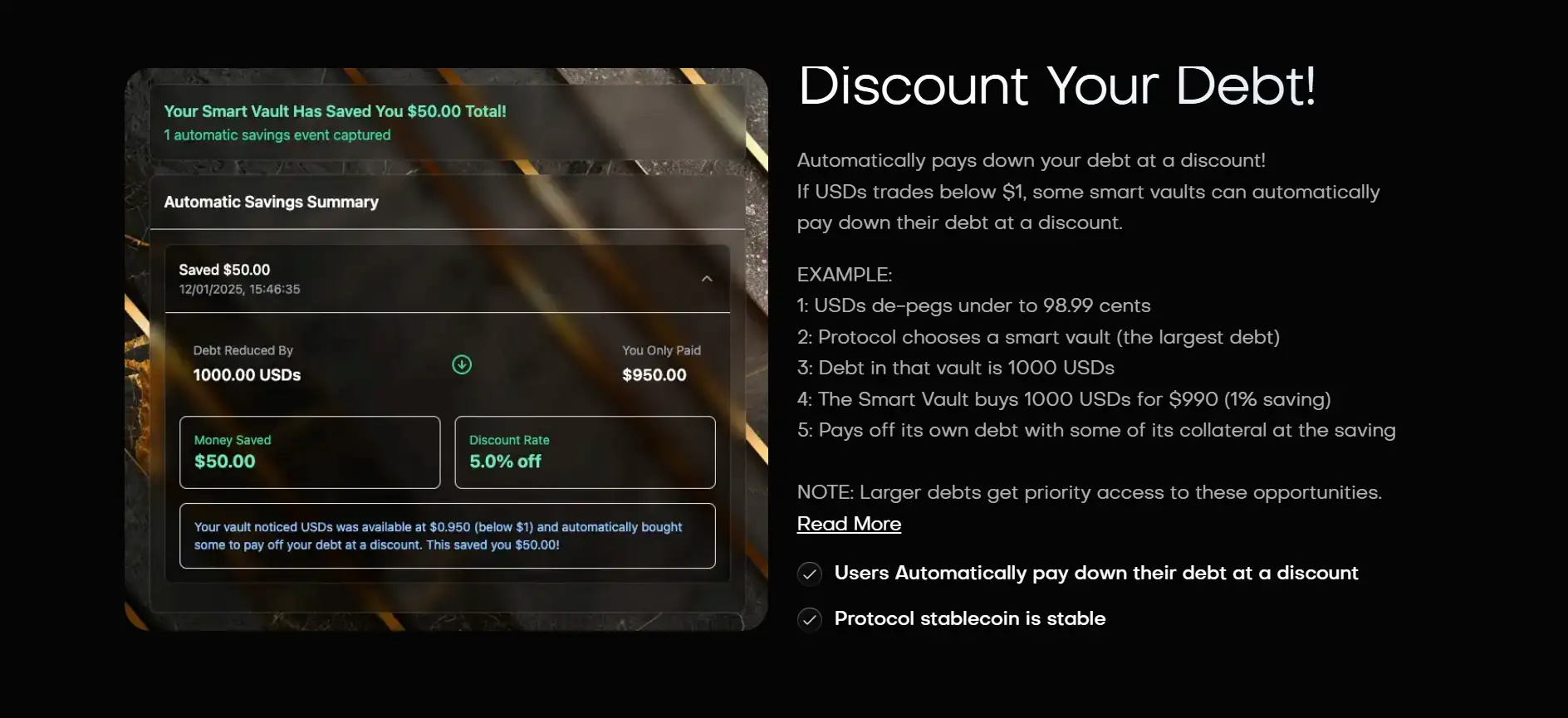

One of the key differentiators of TheStandard is the 0% interest rate. Unlike protocols such as SkyMoney or Abracadabra, where borrowing incurs interest or stability fees, TheStandard charges no recurring interest. Instead, a one-time minting fee is applied when borrowing USDs. Moreover, if USDs temporarily loses its peg, the protocol can use collateral to buy back debt at a discount — a mechanism that reduces systemic risk and helps restore peg stability.

Every Smart Vault is represented as a dynamic NFT, providing users with the option to transfer or sell their vault. This opens new doors for composability in DeFi, as these NFTs can be used in external protocols or sold in marketplaces like OpenSea or Blur. Users can also trade portions of their locked collateral directly from within the Smart Vault, enhancing flexibility and risk management.

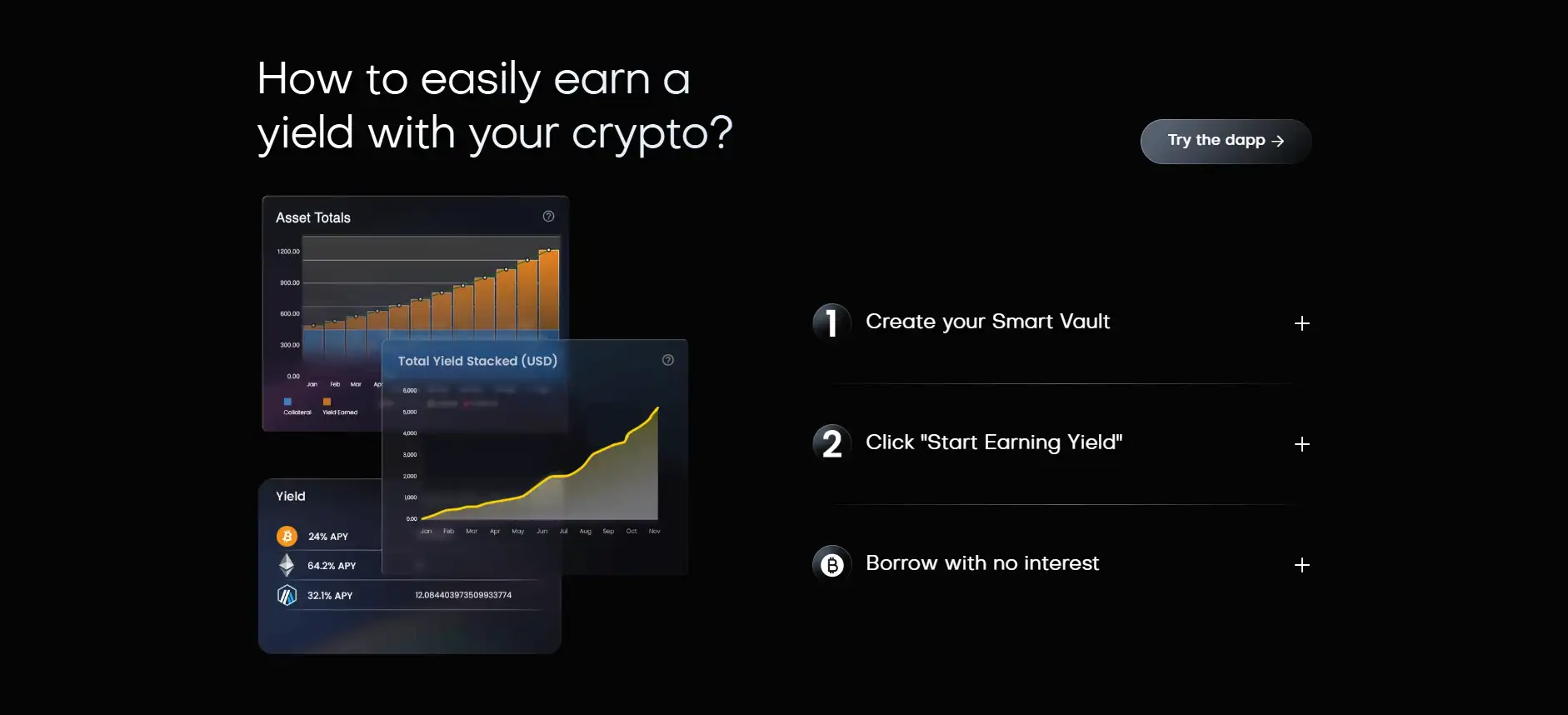

Yield generation is highly optimized via auto-compounding strategies. Users don’t need to actively manage their liquidity — the protocol reallocates and rebalances capital into the most productive V3 liquidity pools and trading corridors. Whether you stake LINK, WBTC, or PAXG, your assets are always earning while remaining available as collateral.

The protocol’s governance token, TST (The Standard Token), enables holders to participate in DAO decision-making and earn additional yield when paired with USDs in the Yield Account. Users can stake TST+USDs to earn a share of protocol fees and gain exposure to discounted crypto liquidations, giving additional utility to governance participation.

With support for cross-chain scalability, real-time vault health indicators, and an emphasis on user autonomy, TheStandard.io is aiming to become the premier destination for decentralized, interest-free crypto borrowing and passive yield generation.

TheStandard offers powerful features that make it a standout platform in the DeFi borrowing and yield ecosystem:

- 0% Interest Borrowing: Users can borrow USDs with no ongoing interest charges, reducing cost and repayment pressure.

- Yield-Bearing Collateral: Collateral earns passive income via optimized Uniswap V3 pools, even while loans are active.

- Smart Vault NFTs: Each vault is represented as a dynamic, transferable NFT — tradeable or sellable like any other asset.

- Discounted Debt Repayment: If USDs depegs, vaults may automatically repurchase debt at a discount — reducing borrower exposure.

- Composability & Flexibility: Add/remove collateral, trade collateral, and manage loans — all with self-custody and no lock-ins.

- TST Token Governance: Participate in DAO governance, earn fee revenue, and unlock higher yield potential in the Yield Account.

- Real-Time Health Monitoring: Visual indicators for collateral ratios, vault health, and liquidation risks.

- Full User Control: Every transaction requires wallet signature. No intermediaries, no custodians — your keys, your crypto.

TheStandard makes it easy to start borrowing, earning, and managing your DeFi portfolio:

- Step 1: Visit thestandard.io and click “Open Dapp”.

- Step 2: Connect your Web3 wallet (e.g. MetaMask) to the Arbitrum network.

- Step 3: Create a Smart Vault by selecting USDs or EUROs as your borrow currency.

- Step 4: Deposit your chosen collateral (ETH, WBTC, ARB, LINK, etc.) into the vault.

- Step 5: Choose the amount of USDs to borrow, confirm the minting fee, and receive funds instantly — all at 0% interest.

- Step 6: Let your vault earn yield automatically, or use the Yield Account to stake TST + USDs for even higher returns.

- Step 7: Trade, repay, or add more collateral at any time. If needed, sell your vault NFT or transfer it to another wallet.

TheStandard.io FAQ

TheStandard automatically routes your deposited collateral into Uniswap V3 yield-earning pools using delta-neutral strategies, so your assets generate returns while remaining locked in your Smart Vault — letting you borrow USDs at 0% interest and earn yield at the same time on TheStandard.io.

If USDs drops below $1, TheStandard may automatically buy it back at a discount using vault collateral, effectively paying down the debt for less than the original value — a discounted repayment feature that helps both vault owners and protocol peg stability on TheStandard.io.

Yes — each Smart Vault on TheStandard.io is a dynamic NFT that can be traded or transferred like any other NFT, giving you full flexibility to manage, sell, or move your debt and collateral at any time.

TheStandard uses a unique model where protocol costs are covered through yield generation and one-time minting fees, allowing users to borrow against their crypto at 0% interest — with no recurring payments, no compounding debt, and no loan expiration pressure on TheStandard.io.

Staking an equal amount of TST and USDs in the Yield Account gives you access to protocol fee rewards and liquidated crypto assets sold at a discount, making it one of the most profitable and compounding yield strategies available on TheStandard.io.

You Might Also Like