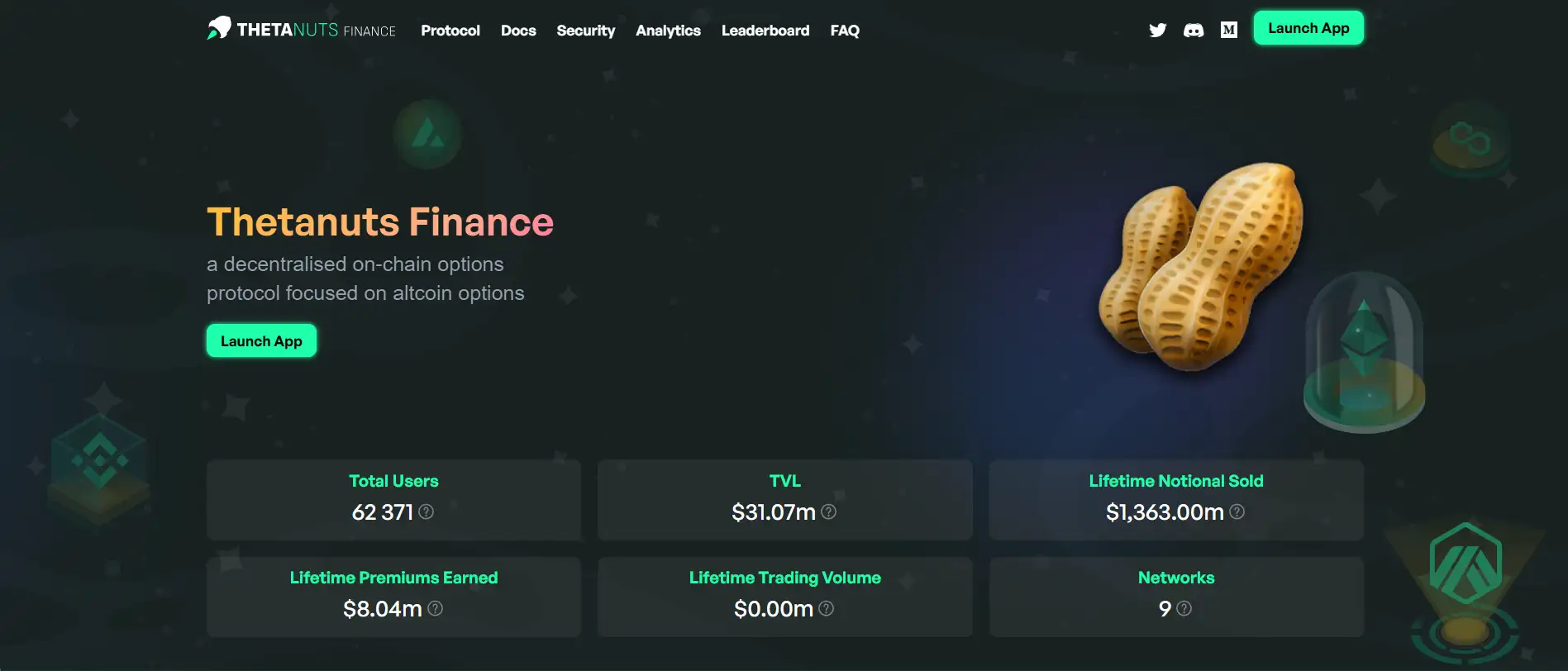

About Thetanuts Finance

Thetanuts Finance is a decentralized on-chain options protocol that redefines the landscape of structured products within DeFi by concentrating on altcoin options. The platform delivers a streamlined and capital-efficient experience, enabling users to either go long or short on on-chain options through a proprietary v3 architecture. Thetanuts Finance has emerged as one of the most prominent DeFi platforms focusing on altcoin coverage, differentiating itself by addressing the unmet demand for structured derivatives products on non-major assets.

The protocol initially launched in 2021 with Basic Vaults that sold European-style, cash-settled options. Since then, it has undergone substantial transformation culminating in the launch of the v3 upgrade, which introduces a modular system combining Basic Vaults, a Lending Market, and an AMM under a unified interface. As an on-chain, trustless, and composable platform, Thetanuts Finance empowers DeFi users to earn premiums, speculate on volatility, and hedge exposure to altcoins—all while contributing to a more decentralized financial future.

Thetanuts Finance is a next-generation decentralized protocol tailored for the on-chain options market, with a distinctive focus on altcoins rather than only supporting major assets like ETH or BTC. Launched in September 2021, the project began by offering Basic Vaults that enabled users to sell out-of-the-money (OTM) European-style options to accredited market makers. These vaults generated passive income via premiums while maintaining a fully collateralized structure, setting the foundation for what would become one of DeFi’s most innovative derivatives platforms.

The protocol experienced rapid growth, securing an $18 million seed round in April 2022 from prominent investors like Polychain Capital, Paradigm, GSR, Wintermute, and Jump. Another $17 million Series A round followed in April 2023. During this period, Thetanuts Finance expanded its product offerings to include Stronghold, Long Vaults, Degen Vaults, and Wheel Vaults. However, the most transformative milestone arrived in late 2023 with the launch of Thetanuts Finance v3.

The v3 architecture revolutionizes the user experience by integrating multiple financial layers—including Basic Vaults, a Lending Market, and Uniswap v3 Pools—under a seamless interface. This allows users not only to sell options but also to go long, close positions early, and arbitrage pricing inefficiencies. Drawing on inspiration from platforms like Aave and Uniswap, the protocol emphasizes composability, security, and capital efficiency. Notably, Basic Vault LP tokens are now fungible assets that serve as collateral across different modules.

Competitors of Thetanuts Finance include structured product platforms like Ribbon Finance, and Stryke, but none have matched Thetanuts’ focus on altcoin options. With support across Ethereum, BNB Chain, Polygon, Arbitrum, Filecoin, and more, the platform is strategically positioned for multi-chain adoption. TVL stands at over $31M, with more than 62,000 users and over $1.3B in lifetime notional volume.

Thetanuts Finance provides numerous benefits and features that make it a standout project in the DeFi options market:

- Altcoin Options Focus: Unlike most competitors, Thetanuts centers its platform on altcoin derivatives, addressing high-volatility assets that are typically underserved in the options space.

- Unified v3 Architecture: Combines Basic Vaults, Lending Market, and AMM into a seamless interface, enhancing UX and capital efficiency.

- Flexibility & Liquidity: Users can close positions early via the AMM, avoiding traditional lock-in periods and unlocking liquidity with LP tokens.

- Battle-Tested Infrastructure: Built using resilient frameworks like Aave v2 and Uniswap v3, and audited by top-tier firms such as Peckshield and Zokyo.

- Multi-Chain Support: Currently available across 9 networks, including Ethereum, BNB Chain, Polygon, Arbitrum, and Filecoin, with plans to expand further.

- Diverse Yield Streams: Earn through option premiums, lending interest, trading fees, and potential token incentives.

- Transparent Pricing: Free-market mechanisms allow for arbitrage opportunities and fair pricing, moving away from implied volatility-based models.

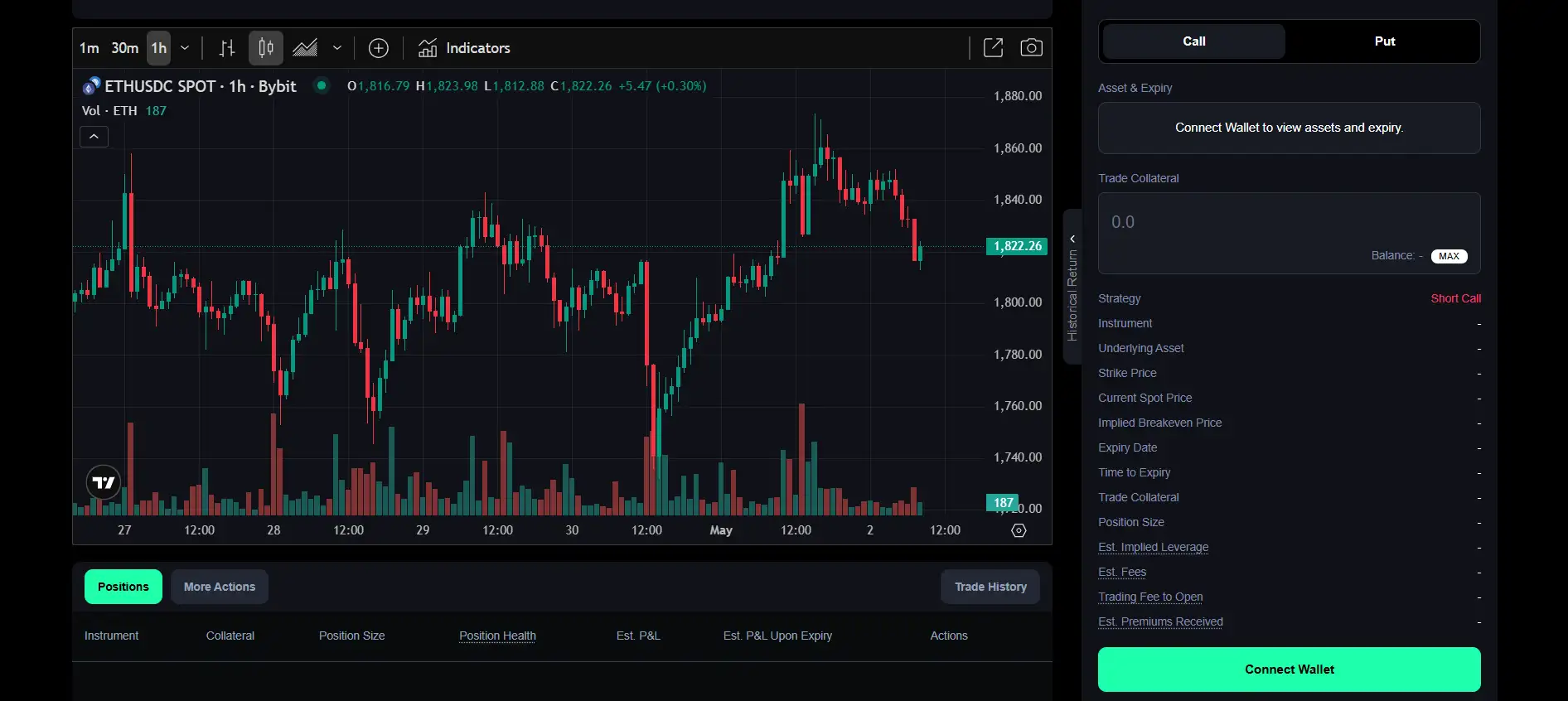

Thetanuts Finance offers a user-friendly experience for newcomers and DeFi veterans alike. To get started, follow these steps:

- Visit the Platform: Head over to the Thetanuts Finance App and connect your Web3 wallet (e.g., MetaMask, WalletConnect).

- Select a Network: Choose your preferred blockchain from supported networks like Ethereum, BNB Chain, Polygon, and more.

- Explore Modules: Navigate between the Basic Vaults, Lending Market, or AMM interfaces to view available options strategies.

- Provide Collateral or Open Positions: Deposit crypto assets into vaults to sell options or enter long positions via the AMM. LP tokens will be minted accordingly.

- Monitor & Adjust: Check P&L, close positions early through the AMM, or roll over positions using auto-roll functionality at the end of each epoch.

- Track Performance: Use the integrated Dune Analytics dashboard to analyze protocol performance and your personal metrics.

- Join the Community: Stay up-to-date through Twitter, Discord, and Medium channels.

Thetanuts Finance FAQ

Thetanuts Finance enables early exit through the Automated Market Maker (AMM), a key innovation in its v3 upgrade. Previously, users had to wait for the end of the epoch to unlock their capital. Now, users holding Basic Vault LP tokens can simply swap them through the AMM, unlocking immediate liquidity. This design gives users significantly more flexibility and enhances capital efficiency—especially valuable in volatile markets. The feature is part of the unified v3 interface available via Thetanuts Finance.

Basic Vault LP tokens are more than just position markers—they are the foundation of the entire Thetanuts v3 ecosystem. When a user deposits assets into a vault (e.g., ETH, USDC), they receive LP tokens representing their stake in the option-selling strategy. These tokens can then be used across modules, including the Lending Market and AMM, turning passive positions into actively tradable and collateralizable instruments. This interoperability is key to Thetanuts’ capital-efficient design, accessible via Thetanuts Finance.

Instead of duplicating what’s already available for majors like ETH and BTC, Thetanuts Finance targets the untapped potential in the altcoin derivatives market. Altcoins often have high volatility and lack structured yield opportunities, making them perfect candidates for options-based strategies. By focusing on altcoins, Thetanuts addresses a critical gap in DeFi and brings sophisticated tools to tokens that are traditionally overlooked. Full details are available on Thetanuts Finance.

Unlike traditional options protocols that use implied volatility models, Thetanuts v3 introduces free market pricing. This means that options are priced by market participants through the AMM rather than a fixed formula. If users believe an option is mispriced, they can exploit this by arbitraging the difference, either buying undervalued options or selling overpriced ones. This dynamic setup rewards active traders and is accessible through the Thetanuts interface.

Thetanuts Finance v3 consolidates multiple layers of yield generation under one ecosystem. Users can earn from five different sources: option premiums, lending interest, trading fees, and two types of token incentives—including future emissions of $NUTS and other potential rewards. This all-in-one approach enhances user earnings without requiring them to interact with separate protocols. You can explore this integrated model on the official Thetanuts Finance platform.

You Might Also Like