About Toros Finance

Toros Finance is a smart DeFi asset management protocol that simplifies access to leveraged strategies and automated yield optimization. Built atop the secure dHEDGE infrastructure, Toros Finance delivers robust, battle-tested automated vaults that remove the complexity of trading, rebalancing, or managing leverage. The protocol offers two core product lines: Leverage Tokens and Yield Vaults, each tailored for different market views and investor risk appetites.

Whether users are seeking to amplify exposure to BTC or ETH without the risk of liquidation, or earn stablecoin-based delta-neutral yields, Toros vaults automate every function—position management, compounding, rebalancing—freeing users from manual strategies. Toros’ unique value lies in minimizing risk while maximizing capital efficiency, using dynamic smart contract logic that continuously optimizes user positions across multiple blockchains, including Optimism, Arbitrum, Base, and Polygon.

Toros Finance is a next-generation DeFi protocol focused on providing accessible, smart, and secure access to complex trading strategies. The platform is built on top of the audited and decentralized dHEDGE infrastructure, leveraging its security and transparency to offer automated vaults that deliver either leveraged exposure or yield optimization. Users can deposit assets into pre-programmed vaults that execute high-level strategies using perpetual contracts, money markets, or delta-neutral models without needing technical knowledge or manual intervention.

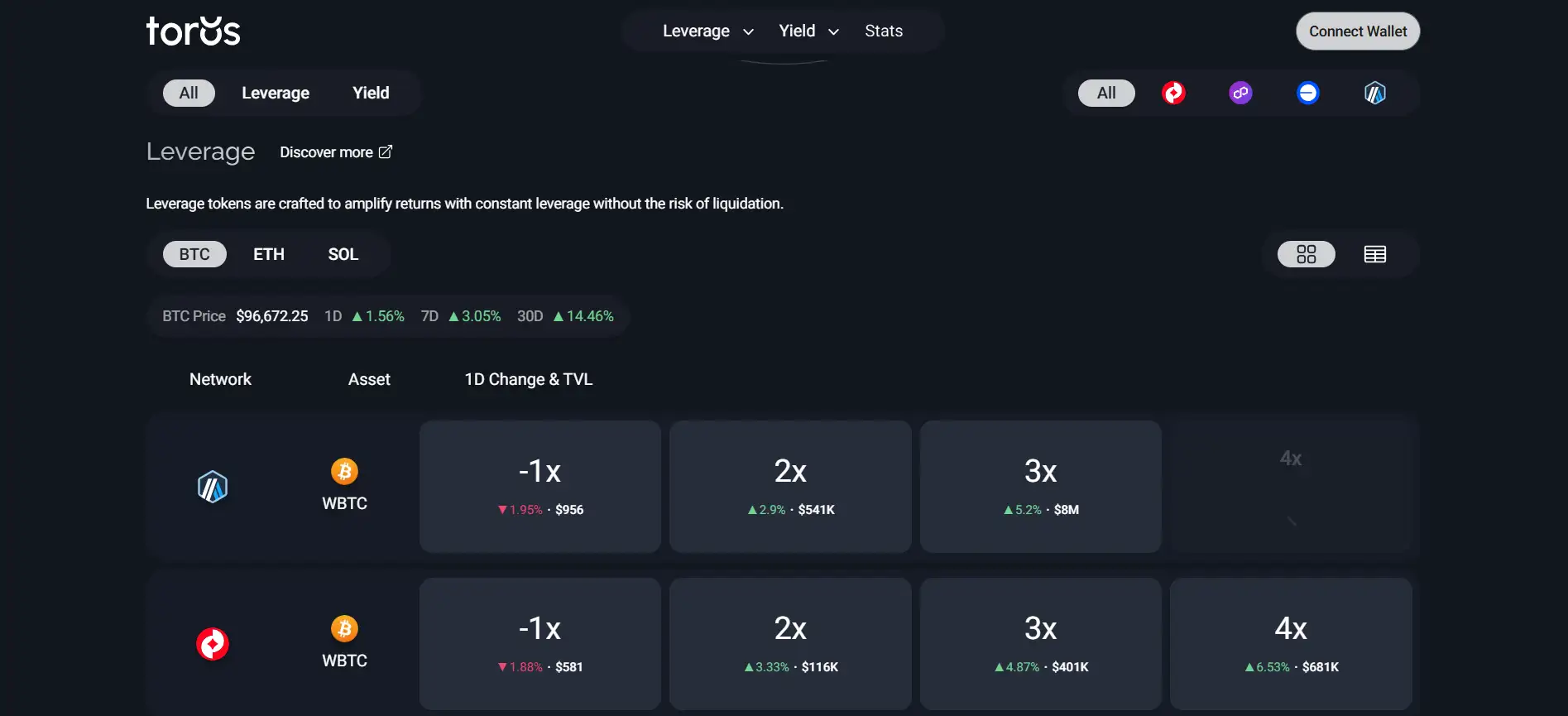

The Leverage Vaults give directional exposure to major crypto assets like BTC, ETH, and SOL, offering fixed leverage levels (e.g., 2x, 3x, 4x) without the traditional risk of forced liquidations. These vaults dynamically rebalance within a safe target leverage range, increasing exposure when price trends are favorable and reducing it during downturns. The protocol uses both money market-based leverage (via Aave, Compound) and perpetual contracts to provide flexible risk-return options. Unlike traditional leveraged tokens or perps, Toros vaults smartly avoid volatility decay through threshold-based rebalancing.

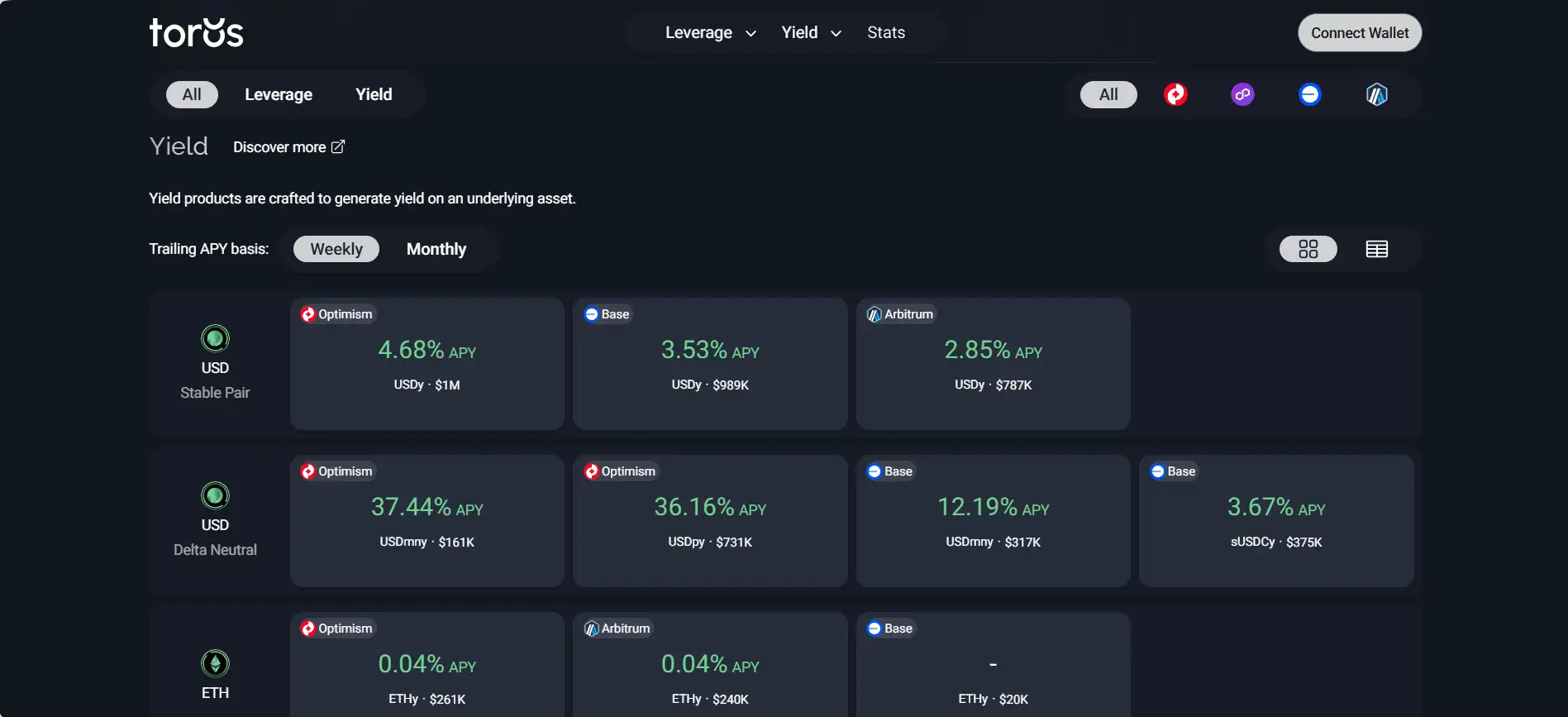

On the yield side, Toros Yield Tokens allow users to earn passive income via stablecoin strategies (USDy), delta-neutral farming (USDmny, USDpy), and ETH-based LP models (ETHy). These vaults feature auto-compounding, smart reallocation, and risk-weighted balancing, adapting to market conditions to extract maximum yield. Users can choose from strategies tailored to different risk appetites—from low-volatility stablecoin yields to high-yield delta-neutral vaults.

Currently, the platform supports over $2.2 billion in lifetime volume and is deployed across Optimism, Arbitrum, Base, and Polygon. The ecosystem is part of a broader DeFi vision enabled by dHEDGE and supported by protocols such as Flat Money, mStable, and dHEDGE itself. Its competitors include yield aggregators like Yearn Finance and leveraged ETF providers like Ribbon Finance, though Toros uniquely avoids liquidation risk and is fully automated.

Toros Finance delivers a wide range of features that help it stand out in both DeFi yield farming and leverage trading:

- Non-Liquidatable Leverage: Toros tokens offer leveraged exposure to BTC, ETH, and more—without the risk of forced liquidation.

- Smart Vault Automation: Rebalancing and trade execution are automated via smart contracts built on dHEDGE.

- Delta-Neutral Yield Strategies: Earn market-neutral yield with long/short LP structures that cancel out directional volatility.

- Stablecoin Optimization: Vaults like USDy continuously rebalance between top farms to maximize stablecoin APY.

- Multiple Risk Profiles: From conservative USDy to aggressive BTCBULL4X, users can select vaults aligned with their strategy.

- Cross-Chain Availability: Active on Arbitrum, Base, Polygon, and Optimism with seamless integration for multichain users.

- Institutional-Grade Security: Vaults are deployed using audited and transparent smart contracts from dHEDGE.

Getting started with Toros Finance is designed to be intuitive for both experienced DeFi users and newcomers:

- Visit the App: Go to toros.finance and connect your wallet (MetaMask or WalletConnect).

- Choose Your Strategy: Select a Leverage Vault or Yield Vault based on your market outlook and risk tolerance.

- Deposit Assets: Fund your chosen vault using the accepted token (e.g., ETH, USDC, BTC). Deposits are instant and self-custodial.

- Monitor Performance: All vaults display APY, TVL, and historical returns in real-time. Track performance directly in your dashboard.

- Withdraw Anytime: Exit positions with low slippage using Chainlink oracle pricing. Smart contracts rebalance to preserve leverage ranges.

- Stay Informed: Follow Toros announcements and strategy insights on Twitter, and Discord.

Toros Finance FAQ

Toros Finance uses smart automated vaults that dynamically adjust leverage levels in response to price changes, ensuring users are never forcibly liquidated. When asset prices move unfavorably, the vaults automatically reduce exposure, staying within a target leverage ratio (e.g., 2.8x to 3.2x for a 3x vault). This intelligent rebalancing mechanism protects users from the abrupt liquidations common in traditional perps or margin trading. Learn more on Toros Finance.

Toros Finance offers two types of leverage tokens: perpetuals-based and money market-based. Perpetual tokens provide higher leverage with fewer restrictions but carry higher borrowing costs. Money market tokens (using protocols like Aave and Compound) offer lower leverage but reduced decay and interest fees. Both use automated rebalancing to manage risk and prevent liquidation. Compare vaults at Toros Finance.

Delta Neutral Yield vaults on Toros use long/short strategies to eliminate price exposure while earning yield from LP fees and protocol incentives. These vaults balance volatile assets with hedging positions (e.g., WETH/USDC), adjusting exposure as prices move to maintain neutrality. Users earn steady returns regardless of market direction, making these vaults ideal for passive, risk-managed yield farming. Explore options at Toros Finance.

USDy is Toros' automated stablecoin yield aggregator that reallocates capital across multiple protocols to find the best APY opportunities. It features continuous compounding, dynamic strategy switching, and multi-protocol exposure to reduce risk. Whenever a higher-yielding or safer strategy is found, USDy shifts funds automatically—keeping your capital efficient and productive at all times. Stake stablecoins with USDy at Toros Finance.

Yes, slippage can occur when exiting a vault, especially under volatile market conditions. Toros Finance uses Chainlink oracles to calculate token value, but actual market prices may differ slightly. Typically, slippage is under 1%, but users are advised to account for up to 2–3% when withdrawing from high-leverage positions. Higher leverage means higher slippage risk, so monitor your positions accordingly. Full details at Toros Finance.

You Might Also Like