About TProtocol

TProtocol is a groundbreaking decentralized finance (DeFi) project focused on bridging traditional financial assets with the blockchain ecosystem. Its primary goal is to facilitate liquidity and the widespread adoption of real-world asset (RWA) tokens within DeFi. By enabling RWA institutions to borrow USDC against their RWA tokens, TProtocol offers a secure and efficient way to integrate traditional financial assets into the digital economy.

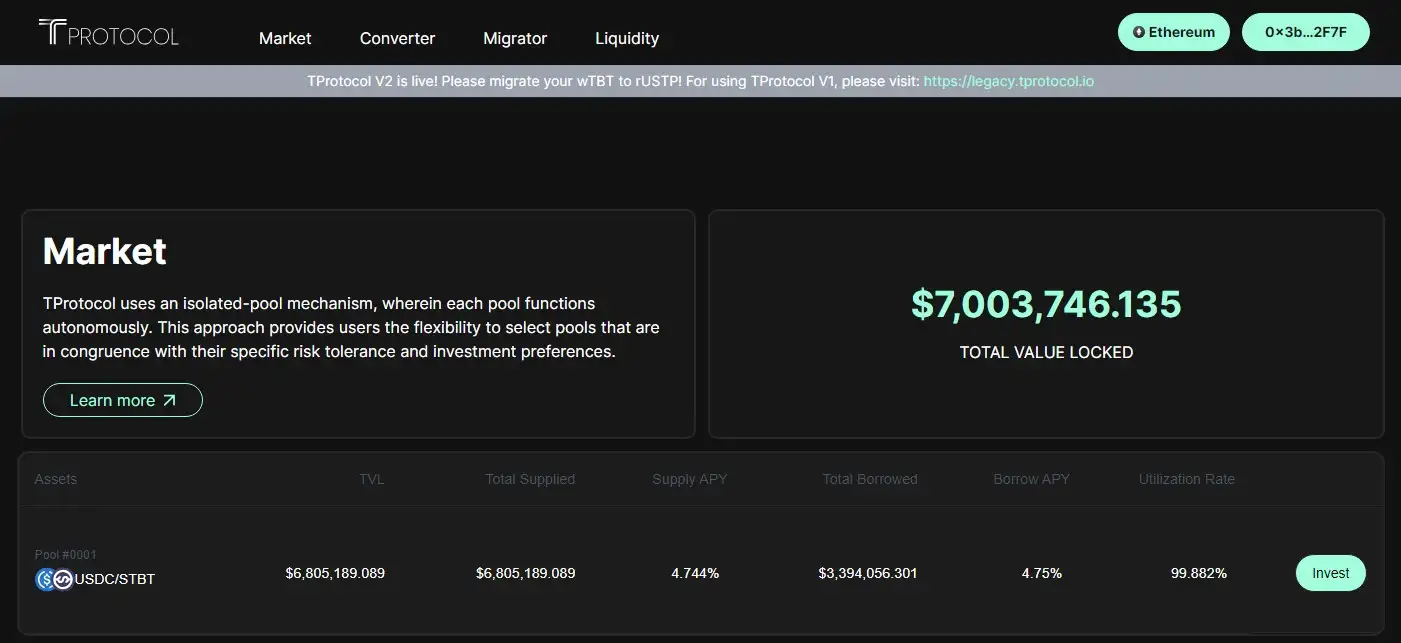

TProtocol operates through separated pools, each designed with specific risk parameters, interest rate models, and liquidation methods tailored to different RWA tokens. This unique approach allows for precise risk management and maximizes capital efficiency. The protocol’s first pool is launched in partnership with Matrixdock, a platform that provides institutional and accredited investors with transparent access to tokenized real-world assets, ensuring an immutable record of ownership and robust risk management through daily proof-of-reserve and full bankruptcy remoteness.

TProtocol was developed to address the gap between traditional financial assets and the blockchain ecosystem, offering a robust solution for integrating real-world assets (RWA) into decentralized finance (DeFi). The protocol's innovative design features separated pools tailored to the specific characteristics of different RWA tokens, allowing for precise risk management and maximizing capital efficiency.

The protocol's mechanism allows RWA institutions to borrow USDC against their RWA tokens in dedicated pools, each with customized risk parameters, interest rate models, and liquidation methods. This approach ensures that the risks associated with different RWA tokens are effectively segregated, providing a safer investment environment for users. The first pool launched by TProtocol is in collaboration with Matrixdock, a digital assets platform that offers institutional and accredited investors transparent access to tokenized real-world assets.

One of the key components of TProtocol is the issuance of promissory note tokens when users deposit USDC into the pools. These tokens represent the user's deposit and accrue interest over time, providing a tangible representation of the user's investment. This mechanism not only ensures transparency but also enhances the security of the investment, as the promissory note tokens are backed by real-world assets.

In terms of governance, TProtocol utilizes the TPS token, which serves as the governance token of the protocol. TPS tokens incentivize the usage of the protocol and reward liquidity providers. The governance model of TProtocol ensures that the community has a say in the protocol's development and decision-making processes, fostering a decentralized and community-driven ecosystem.

TProtocol's approach to integrating real-world assets into DeFi is unique due to its focus on risk segregation and customized pool mechanisms. This method allows users to choose investment pools based on their risk appetite and investment strategy, providing a flexible and user-centric investment platform.

The protocol also emphasizes sustainability and long-term growth, with a focus on providing real yields backed by tangible assets. This approach differentiates TProtocol from other DeFi projects, making it a pioneer in the integration of traditional financial assets into the blockchain ecosystem.

Competitors

TProtocol operates in a competitive landscape with several other projects aiming to bridge traditional financial assets with DeFi. Competitors include:

- Centrifuge: A platform that focuses on bringing real-world assets to DeFi by providing liquidity to businesses through tokenized assets.

- Maple Finance: A DeFi platform that facilitates undercollateralized loans for institutional borrowers, providing a unique approach to integrating traditional finance with blockchain technology.

- Goldfinch: A decentralized credit protocol that allows anyone to be a lender, providing credit to businesses and leveraging blockchain technology to enhance transparency and security.

By focusing on risk segregation, tailored pool mechanisms, and community-driven governance, TProtocol sets itself apart from these competitors, offering a unique and robust solution for integrating real-world assets into the DeFi ecosystem.

- Separated Pool Mechanism: TProtocol offers distinct pools for different RWA tokens, ensuring that risks are isolated. This allows users to choose investments based on their risk appetite, providing a customized investment experience.

- Customized Lending and Borrowing: The protocol tailors interest rate models and risk parameters to the specific characteristics of each RWA token, enhancing capital efficiency and ensuring optimal returns for users.

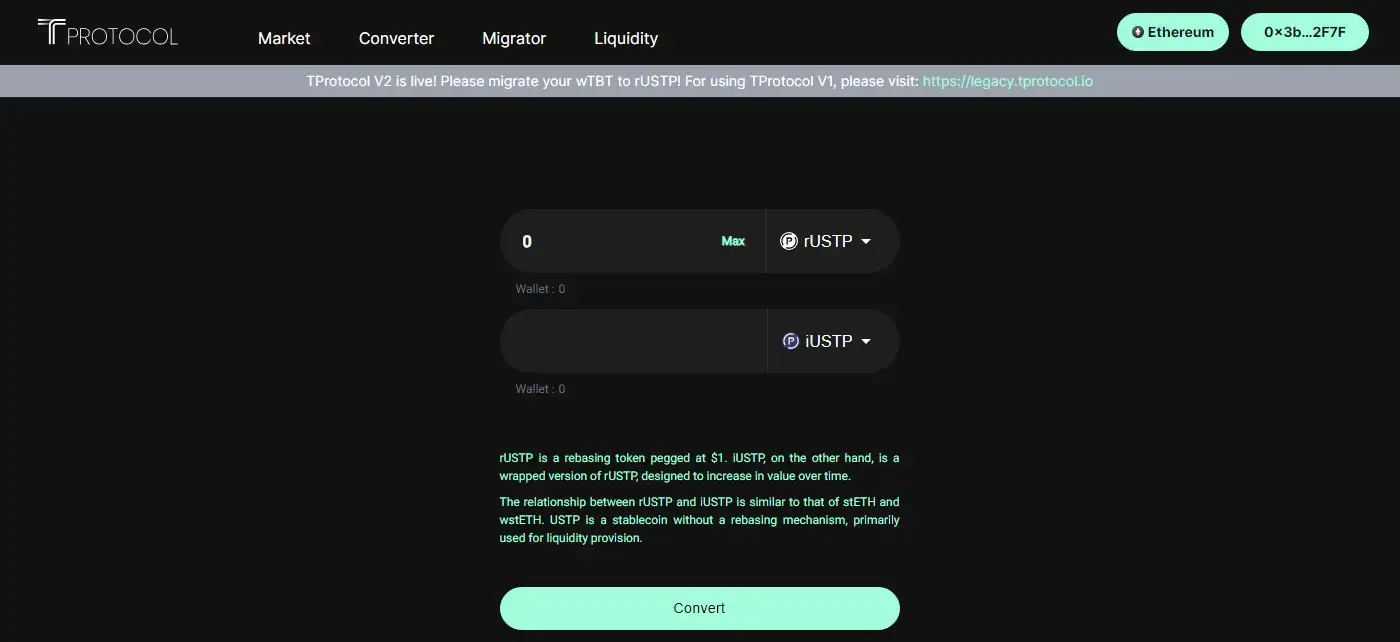

- Promissory Note Tokens: When users deposit USDC, they receive promissory note tokens, which accrue interest over time and represent their deposits. This mechanism provides a transparent and secure way to track investments.

- Decentralized Governance: TPS, the governance token, allows token holders to participate in protocol decisions, ensuring a community-driven approach to development. This fosters a decentralized and transparent ecosystem.

- Yield Opportunities: Users can earn real yields backed by RWA tokens by depositing USDC in various pools. The interest rate reflects the underlying asset's performance, providing a sustainable yield-generating opportunity.

- Robust Security: The protocol's design includes rigorous risk management practices, ensuring that investments are secure. The use of tailored risk parameters and liquidation methods enhances the overall security of the platform.

- Transparent and Immutable Records: Partnering with platforms like Matrixdock ensures that investors have transparent access to tokenized real-world assets, with an immutable record of ownership and daily proof-of-reserve.

- Flexible Investment Options: TProtocol’s approach allows users to diversify their investments across different pools, each with unique risk-reward profiles. This flexibility caters to a wide range of investment strategies.

- Create an Account: Visit the TProtocol platform and sign up for an account. Ensure you complete the necessary KYC (Know Your Customer) requirements if applicable. This process is essential for regulatory compliance and to ensure the security of your investments.

- Deposit USDC: Transfer USDC to your TProtocol wallet. If you do not already have USDC, you can acquire it from various cryptocurrency exchanges such as Coinbase, Binance, or Kraken.

- Select a Pool: Browse through the available pools on the TProtocol platform and select one that matches your investment strategy and risk preference. Each pool will have different RWA tokens, risk parameters, and interest rate models, allowing you to choose the best option for your needs.

- Earn Promissory Notes: Upon depositing USDC into your chosen pool, you will receive promissory note tokens. These tokens represent your deposit and will accrue interest over time. This mechanism ensures that your investment is transparent and secure.

- Monitor Investments: Use the platform dashboard to track your investments. The dashboard provides detailed information about your deposits, interest earned, and overall performance. Regularly monitoring your investments helps you stay informed about your financial growth and make necessary adjustments.

- Participate in Governance: If you hold TPS tokens, you can participate in the governance of the protocol. This includes voting on key decisions and proposals that affect the future of TProtocol. Your participation helps shape the development and direction of the platform.

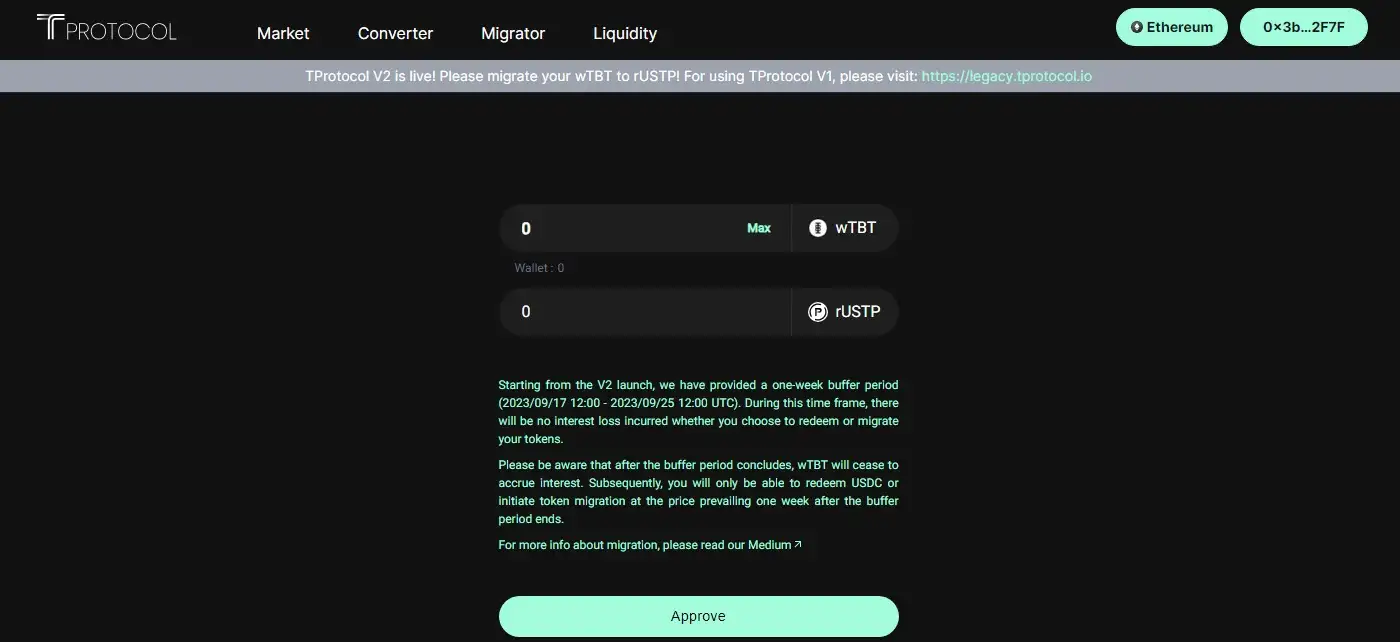

- Withdraw and Redeem: When you want to redeem your investment, you can burn the promissory note tokens and withdraw your USDC. The amount withdrawn will include the principal and any accrued interest. This process ensures that you can easily access your funds when needed.

For detailed guides and more information, visit the TProtocol Documentation.

TProtocol Reviews by Real Users

TProtocol FAQ

TProtocol employs rigorous risk management practices, including tailored risk parameters, interest rate models, and liquidation methods for each pool. Additionally, partnerships with platforms like Matrixdock ensure transparent access to tokenized real-world assets with daily proof-of-reserve and an immutable record of ownership.

When you deposit USDC into TProtocol pools, you receive promissory note tokens. These tokens accrue interest over time and represent your deposit, providing a transparent and secure way to track your investments.

TProtocol's separated pool mechanism ensures that risks are isolated by creating distinct pools for different RWA tokens. This allows users to choose investments based on their risk appetite and provides a customized investment experience.

Yes, you can earn real yields backed by RWA tokens by depositing USDC in various pools. The interest rate reflects the underlying asset's performance, providing a sustainable yield-generating opportunity. Visit the TProtocol platform to learn more.

Matrixdock is a digital assets platform that partners with TProtocol to provide institutional and accredited investors with transparent access to tokenized real-world assets. They ensure an immutable record of ownership and robust risk management practices.

You Might Also Like