About Trava Finance

Trava Finance is a pioneering decentralized finance (DeFi) platform that focuses on providing a flexible and innovative approach to lending and borrowing. The core mission of Trava Finance is to democratize the financial system by enabling users to create and manage their own lending pools, thus providing greater control and customization over their financial activities. By leveraging the power of blockchain technology, Trava Finance aims to offer a secure, transparent, and efficient alternative to traditional financial services.

Trava Finance stands out in the DeFi space due to its unique combination of features and user-centric approach. The platform’s flexibility allows users to tailor their lending and borrowing strategies to their specific needs, whether they are individual investors or institutional players. Furthermore, Trava Finance is committed to enhancing the overall user experience by providing advanced tools and analytics, ensuring that users can make informed decisions and optimize their returns.

Trava Finance was established with the vision of creating a more accessible, transparent, and efficient financial system through the use of decentralized finance (DeFi) principles. The project’s inception was driven by the need to address the limitations and inefficiencies of traditional financial systems, particularly in the areas of lending and borrowing. By leveraging blockchain technology, Trava Finance aims to provide a decentralized platform that offers greater flexibility, security, and user control.

Development History and Key Milestones

Since its launch, Trava Finance has achieved several significant milestones that have contributed to its growth and development. Key milestones include:

- Launch of Mainnet: Trava Finance successfully launched its mainnet, providing users with access to its decentralized lending platform. This launch marked a crucial step in the project’s journey, laying the foundation for future growth and innovation.

- Integration with Major DeFi Platforms: Trava Finance has integrated with several leading DeFi platforms, enhancing its interoperability and expanding its user base. These integrations enable users to leverage the benefits of Trava Finance’s platform while accessing a broader range of financial services.

- Continuous Security Enhancements: Security is a top priority for Trava Finance. The platform undergoes regular smart contract audits and implements robust security measures to protect users’ assets. These efforts ensure that Trava Finance remains a secure and reliable platform for lending and borrowing activities.

- User-Centric Innovations: Trava Finance continuously innovates to enhance the user experience. The platform offers advanced analytics tools, customizable lending pools, and comprehensive support services, ensuring that users have all the resources they need to manage their assets effectively.

Competitors and Market Position

Trava Finance operates in a competitive DeFi landscape, with several other platforms offering similar services. Notable competitors include Aave, Compound, and MakerDAO. Each of these platforms has its strengths and unique features, but Trava Finance differentiates itself through its focus on customizable lending pools and interoperability with multiple blockchains.

- Aave: Aave is a leading DeFi platform known for its diverse range of lending and borrowing options. It offers unique features such as flash loans and credit delegation, making it a popular choice among DeFi users.

- Compound: Compound is another major player in the DeFi space, providing a user-friendly platform for lending and borrowing various cryptocurrencies. It is renowned for its algorithmic interest rate model, which adjusts rates based on supply and demand.

- MakerDAO: MakerDAO is well-known for its stablecoin, DAI, which is used extensively in the DeFi ecosystem. The platform offers collateralized debt positions (CDPs), allowing users to borrow DAI against their crypto assets.

Despite the competition, Trava Finance’s unique value proposition lies in its customizable lending pools and its commitment to supporting multiple blockchains. This approach not only enhances the platform’s flexibility and scalability but also broadens its appeal to a diverse range of users.

Trava Finance offers a range of features and innovations that set it apart from other DeFi platforms. These include:

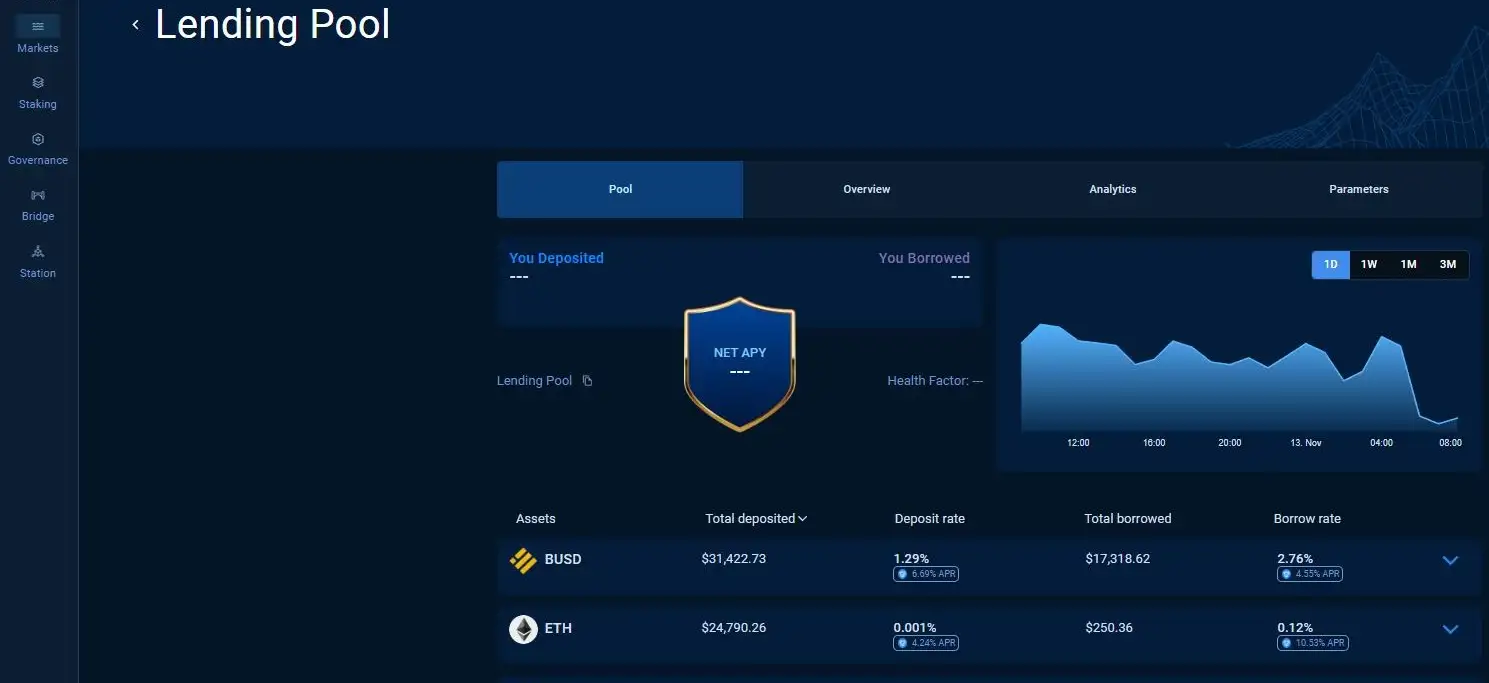

- Customizable Lending Pools: Users can create and manage their own lending pools, allowing for tailored financial solutions that meet their specific needs. This feature provides greater control and flexibility compared to traditional lending platforms.

- Advanced Analytics Tools: Trava Finance provides users with sophisticated analytics tools to help them make informed decisions. These tools offer insights into market trends, lending pool performance, and risk assessment, enabling users to optimize their strategies.

- Interoperability: The platform supports multiple blockchains, enhancing liquidity and facilitating cross-chain transactions. This interoperability ensures that users can access and utilize digital assets across different networks, broadening the scope of financial opportunities available to them.

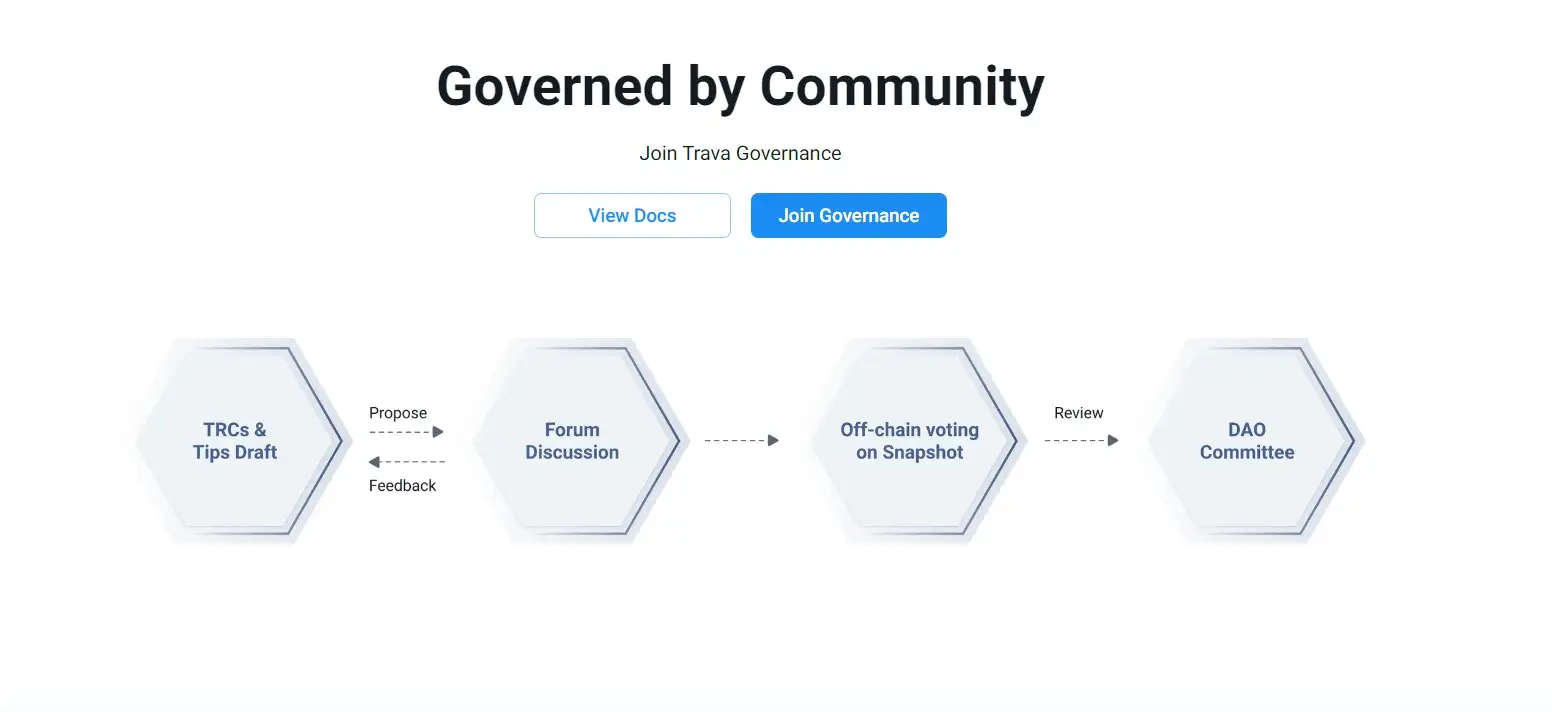

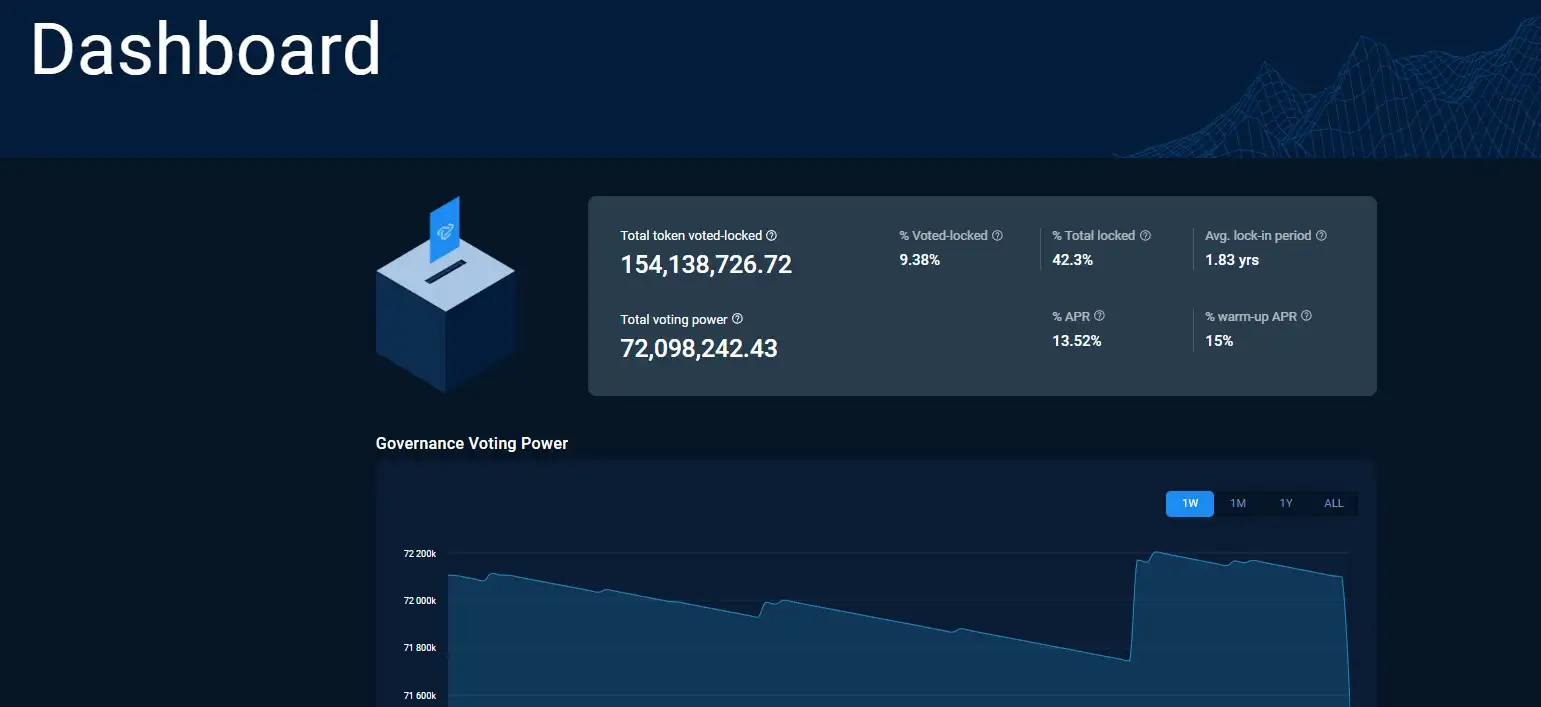

- Decentralized Governance: TRAVA token holders can participate in the governance of the platform, voting on proposals and changes to the protocol. This decentralized governance model ensures that the platform evolves in a way that aligns with the interests of its community.

- Security and Compliance: Trava Finance prioritizes security and compliance, implementing regular smart contract audits and adhering to industry best practices. These measures ensure that the platform remains secure and trustworthy, providing users with peace of mind when participating in lending and borrowing activities.

In summary, Trava Finance’s comprehensive ecosystem, user-centric approach, and commitment to innovation position it as a leading player in the DeFi space.

To get started with Trava Finance, follow these steps:

- Create an Account: Visit the Trava Finance website and click on 'Get Started.' Register by providing the necessary details.

- Connect Wallet: Link your preferred cryptocurrency wallet (e.g., MetaMask) to the Trava platform.

- Acquire TRAVA Tokens: Purchase TRAVA tokens from supported exchanges like PancakeSwap or Gate.io.

- Explore Lending Pools: Navigate to the lending pools section on the Trava Finance app and choose a pool to participate in, either as a lender or borrower.

- Staking and Rewards: Stake your TRAVA tokens in chosen pools to earn rewards and interest. Detailed staking guides can be found in the Trava Finance Documentation.

- Governance Participation: Engage in governance by voting on proposals using your TRAVA tokens. Participate in shaping the future of the platform.

For detailed guides and tutorials, please refer to the Trava Finance Documentation.

Trava Finance Token

Trava Finance Reviews by Real Users

Trava Finance FAQ

To create a custom lending pool, log into the Trava Finance app, navigate to the lending pools section, and select the option to create a new pool. Follow the prompts to customize your pool's parameters and launch it.

Trava Finance employs rigorous security measures, including regular smart contract audits, insurance mechanisms, and advanced encryption protocols to ensure the safety of user assets.

Staking TRAVA tokens allows you to earn rewards, receive interest on your deposits, and gain access to premium features within the Trava Finance ecosystem.

Trava Finance supports multiple blockchains by integrating cross-chain functionality, allowing users to lend and borrow assets across different blockchain networks, enhancing liquidity and flexibility.

Unique features of Trava Finance include customizable lending pools, advanced analytics tools, and a comprehensive reward system, setting it apart from other DeFi platforms like Aave and Compound.

You Might Also Like