About Treehouse

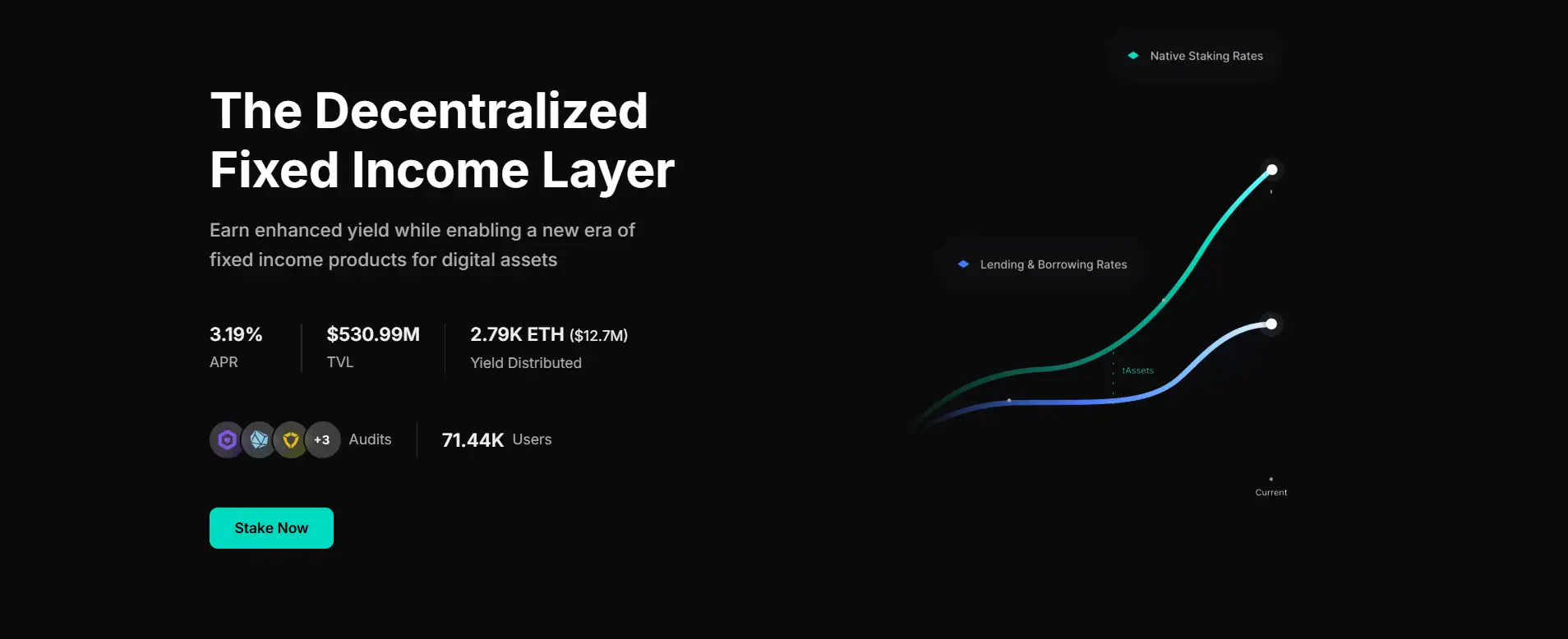

Treehouse is building the future of decentralized fixed income through a protocol that unifies yield primitives, benchmark rates, and participation infrastructure. At its core, Treehouse allows users to earn enhanced yield while contributing to a new financial layer for digital assets. With a robust infrastructure and a growing ecosystem, Treehouse is transforming passive staking into an active, fixed income opportunity.

Through innovative products like tAssets and DOR (Decentralized Offered Rates), Treehouse provides a platform where digital asset holders can stake, supply, borrow, and participate in rate formation. The protocol’s secure, audited architecture supports over $530 million in TVL and has distributed over $12.7 million in yield, making Treehouse a frontrunner in next-generation DeFi fixed income.

Treehouse is a protocol-layer solution for building a decentralized fixed income market around crypto-native assets. Its key innovation lies in creating a sustainable, transparent yield generation mechanism through interest rate arbitrage and decentralized benchmark rates. With over 71,000 users, $530M+ TVL, and a rapidly expanding ecosystem, Treehouse is solidifying its role as the fixed income backbone of DeFi.

The protocol’s first major product, tAssets, utilizes dynamic arbitrage strategies to enhance staking returns. Users can stake native assets or Liquid Staking Tokens (LSTs), supply collateral, borrow, and re-stake—generating rewards that combine PoS yield, lending yield, and market efficiency yield (MEY). This model is similar in purpose to solutions like Lybra Finance, Ondo Finance, and Pendle, but Treehouse takes it a step further by integrating benchmark rates.

These rates, known as DORs (Decentralized Offered Rates), serve as real-time benchmarks for interest rates on-chain. Powered by a participant-driven model, DORs are formed by five unique roles: Operators, Panelists, Referencers, Delegators, and End Users. Anyone in the Treehouse ecosystem can contribute to rate setting and benefit from staking or delegation. The inaugural DOR, the Treehouse Ethereum Staking Rate (TESR), is setting the standard for on-chain rate accuracy, decentralization, and transparency.

Security and transparency are foundational to Treehouse. The protocol has undergone multiple audits and includes an insurance fund and active bug bounty program to mitigate risks. Its roadmap includes tETH L2 expansion, integration with top DeFi protocols, launch of new DOR rates, and Treehouse Academy—a knowledge center for fixed income education in crypto.

The ecosystem is also gamified through the GoNuts program, where users can earn “nuts” (points) by staking, holding, or contributing liquidity. Squirrel-themed NFTs unlock multiplier boosts and other community-driven perks. With its emphasis on yield, rate integrity, and composability, Treehouse is defining what the next era of fixed income in DeFi will look like.

Treehouse offers an innovative suite of fixed income products and protocol features:

- tAssets Yield Strategies: Boost yield via interest rate arbitrage using native assets or Liquid Staking Tokens (LSTs).

- DOR Reference Rates: Decentralized benchmark interest rates enabling the creation of on-chain fixed income products.

- Participant-Led Governance: Five-role model ensures rate accuracy and decentralization through Operators, Panelists, and Delegators.

- Composability Across DeFi: Use tAssets as collateral, liquidity, or delegate to DOR governance participants.

- Secure Architecture: Audited codebase, insurance fund, and bug bounty program maintain user trust and platform safety.

- Community Incentives: Earn GoNuts points and NFTs for staking, liquidity provisioning, and governance involvement.

Treehouse makes it easy to begin earning and participating in the on-chain fixed income revolution:

- Visit the Official Website: Start at the Treehouse homepage to explore tAssets, DOR, and community programs.

- Connect a Wallet: Use a Web3 wallet to access staking, borrowing, and campaign features directly on the dApp.

- Stake Native Tokens: Deposit supported native assets or LSTs to start earning PoS yield and Market Efficiency Yield.

- Hold or Supply tAssets: Use tAssets as collateral, delegate them in DOR governance, or contribute to LP pools.

- Earn and Participate: Engage in the GoNuts program, join the Squirrel Council, or apply to become a DOR participant.

Treehouse FAQ

Treehouse combines staking, lending, and borrowing into a smart interest rate arbitrage strategy that boosts returns on native assets and Liquid Staking Tokens (LSTs). By automating this cycle through its tAssets product, Treehouse allows users to earn more than standard staking rewards—creating a sustainable, decentralized fixed income instrument directly on-chain.

The DOR (Decentralized Offered Rates) system acts as the foundation for on-chain benchmark interest rates. It enables Treehouse to offer reliable, decentralized references like the Treehouse Ethereum Staking Rate (TESR), which power a new class of DeFi fixed income products. Through Treehouse, DOR ensures accurate, community-driven rate formation without relying on centralized oracles.

Yes, users can earn additional rewards through the GoNuts program, which incentivizes liquidity provision, tAsset holding, governance participation, and NFT ownership. Users collect “nuts” points for their contributions and can unlock exclusive boosts. Treehouse gamifies fixed income by turning users into active ecosystem participants who benefit from multiple yield streams.

Treehouse is not just a yield aggregator—it is building a new fixed income layer for digital assets. With products like tAssets for automated yield strategies and DOR for rate standardization, Treehouse offers structured, benchmark-driven income strategies. It combines gamification, security, and deep DeFi composability, setting it apart from traditional staking or lending protocols.

Anyone can contribute to DOR governance as a Delegator, Referencer, or Panelist. Non-technical users can delegate their assets to trusted Operators or Panelists and help decentralize rate formation. Treehouse offers an open structure where community participation, not technical skill, is the primary requirement to support transparent fixed income markets.

You Might Also Like