About Tren Finance

Tren Finance is a next-generation decentralized finance protocol that pioneers a fully autonomous, AI-powered approach to stablecoin borrowing and capital optimization. Its primary innovation lies in TrenOS, a proprietary ecosystem of intelligent agents that manage everything from risk assessment to liquidity provisioning without human bias or delay. By automating core financial operations using artificial intelligence, Tren Finance establishes a self-adaptive infrastructure capable of navigating and evolving with real-time market dynamics.

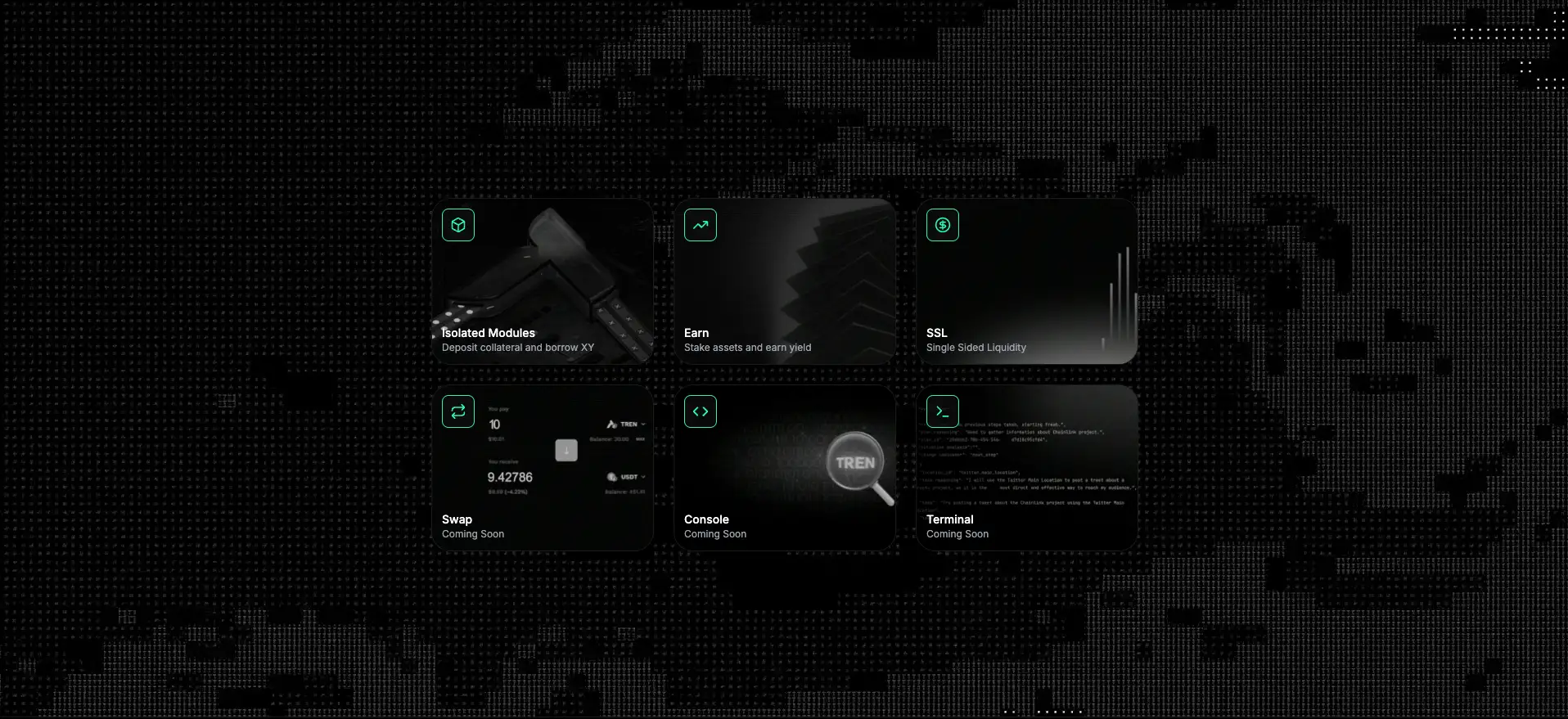

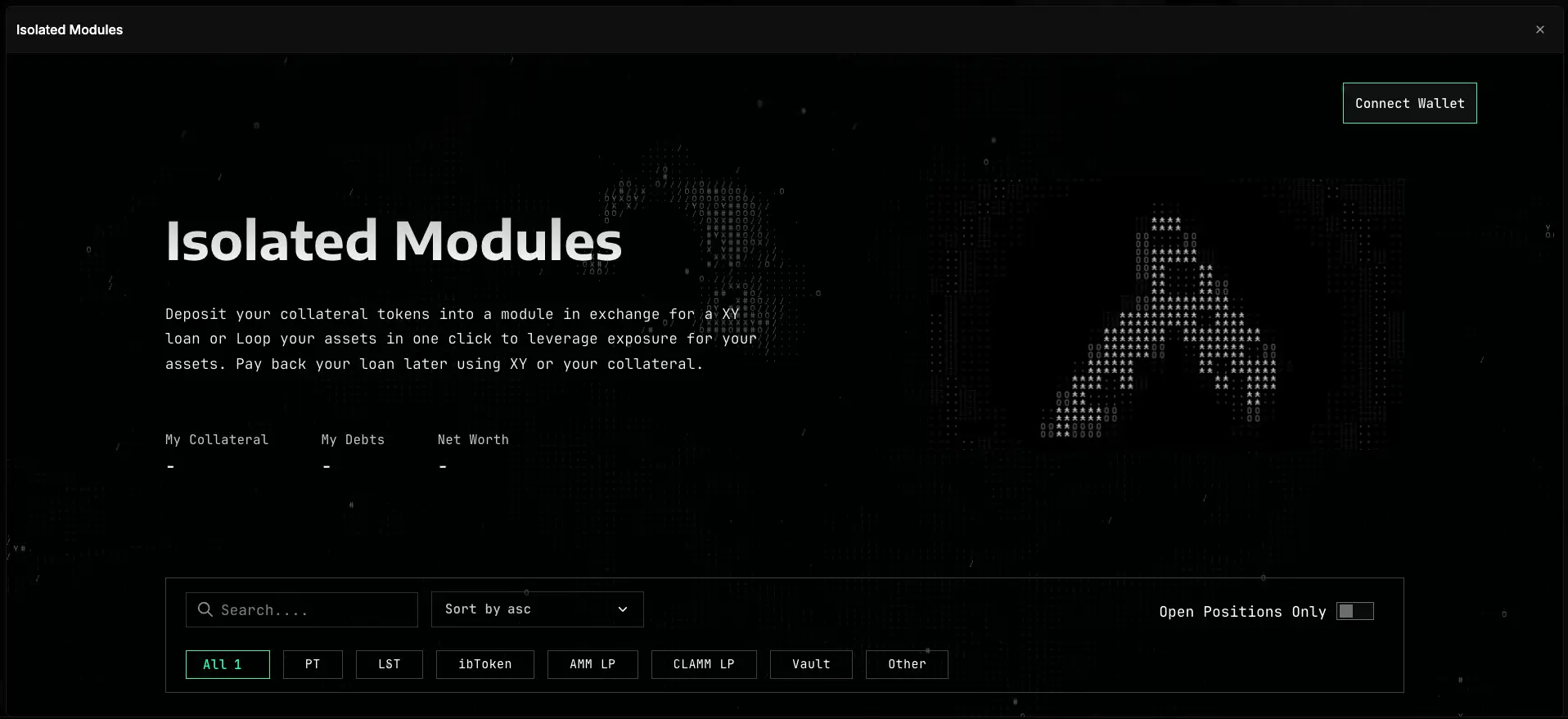

The platform is designed for advanced capital efficiency, offering users the ability to collateralize assets such as LP tokens, restaked positions, and deposit receipts in isolated modules—significantly mitigating systemic risk. With TrenOS, governance transitions from human multisigs to fully autonomous operations through stages of AI-assisted and semi-autonomous decision-making. This novel architecture creates a financial system that learns, adapts, and optimizes itself over time, making Tren Finance a transformative player in the evolution of decentralized finance.

Tren Finance is a groundbreaking platform in the world of decentralized finance, pushing the boundaries with its autonomous AI-driven system known as TrenOS. This system replaces traditional human-governed models with a network of specialized AI agents that analyze real-time market data and autonomously execute protocol-level decisions. From interest rate optimization to liquidity allocation and risk mitigation, each function is dynamically handled by AI—eliminating inefficiencies and bias found in traditional DeFi.

The governance evolution within Tren Finance is a key differentiator. Initially operating with AI-assisted governance, the platform uses multi-signature validation for AI-generated recommendations. Over time, this evolves into semi-autonomous governance, where AI manages routine operations independently. Eventually, the system reaches full autonomy—where AI manages core financial processes without human involvement, while maintaining oversight mechanisms to ensure security and stability.

The protocol's modular design enables users to interact with isolated financial modules, which contain risk to specific asset classes. This separation allows high-risk assets to be listed without impacting the entire system, providing unmatched flexibility. Users can deposit assets like Curve LP tokens, Aave deposit receipts (e.g., aWETH), or restaked PT tokens as collateral to access 0% interest loans, looping leverage strategies, or stablecoin liquidity via the XY token.

Liquidity optimization is achieved through adaptive pool management. AI agents constantly monitor usage patterns and market dynamics to rebalance capital across pools, while fee structures are dynamically adjusted to match volatility conditions. With real-time risk analysis and predictive modeling, the protocol minimizes exposure to volatility and liquidation risks—setting a new standard in DeFi safety and capital efficiency.

In comparison to other platforms like Aave, Compound, and Curve, Tren Finance stands apart with its self-improving intelligence and granular capital management capabilities. It doesn't just offer DeFi tools—it engineers a living, learning financial infrastructure that evolves with the market and user needs.

Tren Finance offers a wide range of innovative features and benefits that position it as a leader in the next era of decentralized finance:

- AI-Governed Protocol: At the core of Tren Finance lies TrenOS, a self-improving AI network that autonomously manages borrowing, lending, risk, and governance—minimizing human error and increasing operational precision.

- Isolated Module Architecture: Users interact with compartmentalized markets, reducing systemic risk and allowing safe experimentation with emerging assets. Risk is contained at the module level.

- Dynamic Collateral Management: Unlike static models, Tren Finance uses real-time analysis to adjust collateral requirements based on market volatility, liquidity depth, and asset correlation.

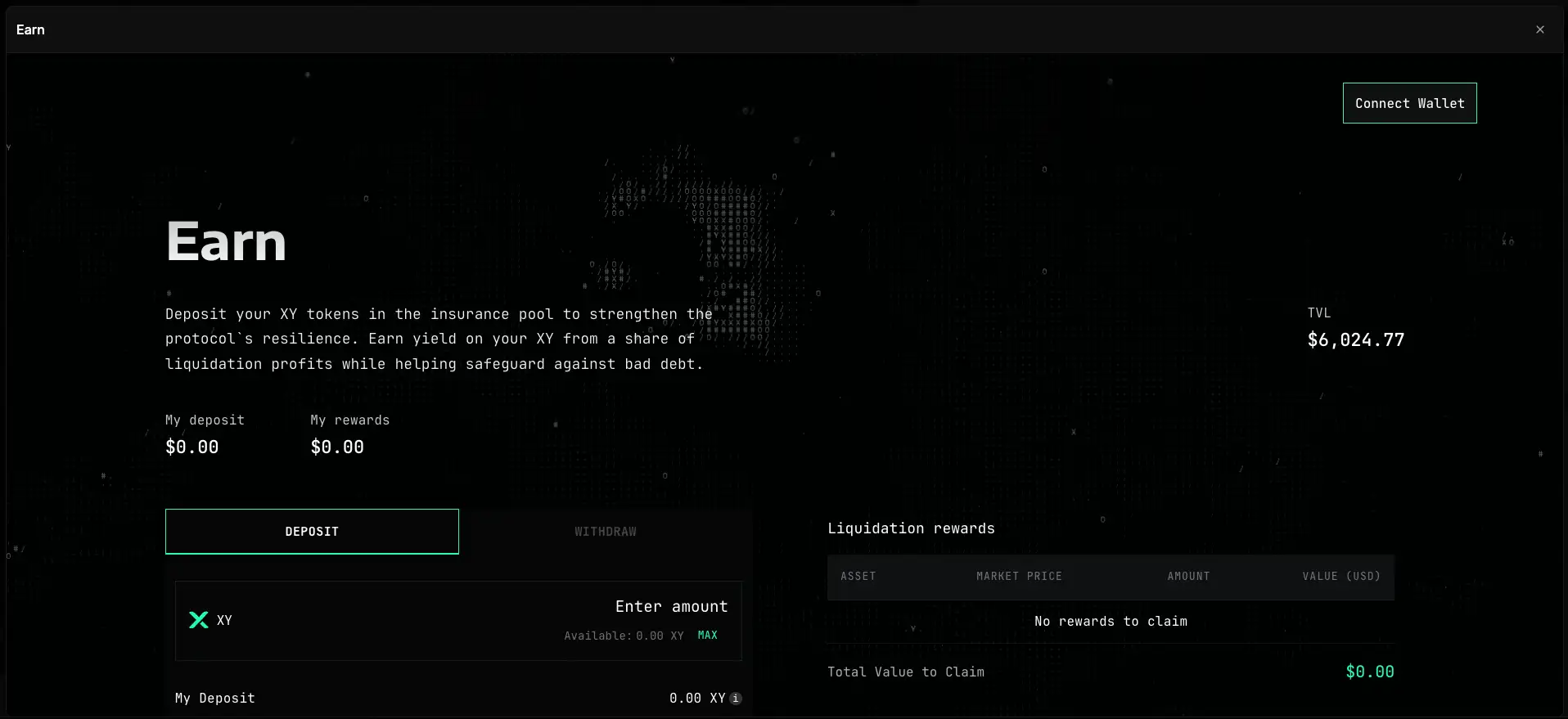

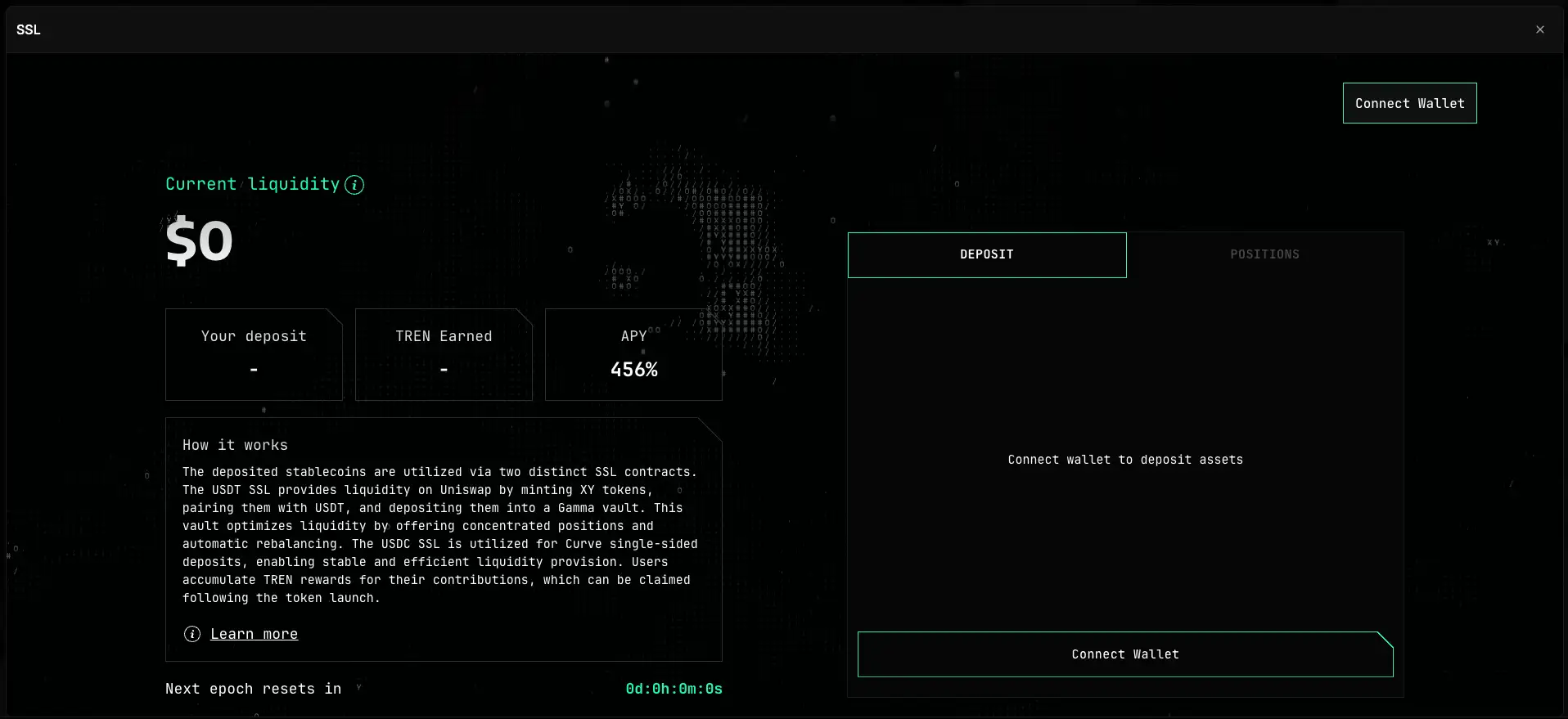

- Single-Sided Liquidity (SSL): Users can provide stablecoins without impermanent loss risks to earn yield and support the protocol’s synthetic dollar, XY.

- XY Stablecoin: A synthetic, overcollateralized stablecoin powered by LayerZero’s OFT standard, allowing multi-chain interoperability without bridging or wrapping.

- Hooks Engine: Programmable smart contract layers called Hooks allow users to build leveraged or delta-neutral positions, enable auto-rollovers, and integrate with third-party DeFi strategies.

- FlashMint Technology: Enables on-demand, zero-risk flash loans for arbitrage, refinancing, and strategy execution with infinite liquidity and AI-managed risk controls.

- Higher Capital Efficiency: Leverage up to 10x on assets such as LP tokens or PT tokens, transforming base yields into significantly higher APY while remaining delta-neutral.

- Automated Liquidations: AI agents predict and execute liquidations with minimal user disruption, protecting both borrowers and the protocol’s integrity.

- Decentralized Governance via veTREN: Users who lock TREN tokens into veTREN gain voting power and share in the allocation of protocol rewards through Gauges.

Tren Finance provides a seamless entry into the world of autonomous DeFi through its innovative platform powered by AI-driven financial agents. Here's how users can get started with Tren Finance and unlock enhanced capital efficiency:

- Step 1: Connect Your Wallet: Visit Tren Finance and connect a supported wallet such as MetaMask, WalletConnect, or any EVM-compatible wallet.

- Step 2: Choose a Strategy: Decide how you want to interact with the protocol. You can use LP Tokens like Curve 3pool to collateralize and borrow XY, Money Market Tokens such as aWETH from Aave to gain access to low-interest liquidity or delta-neutral positions, or Restaked & PT Tokens to amplify yield with up to 10x looping leverage.

- Step 3: Deposit Collateral: Supply supported assets into an Isolated Module to collateralize and manage risk independently from the rest of the protocol.

- Step 4: Borrow XY: Borrow the protocol’s native synthetic dollar, XY, at competitive or 0% interest rates, depending on your collateral and market conditions.

- Step 5: Execute Advanced Strategies: Use Hooks to build complex strategies including recursive lending, auto-rollovers, delta-neutral positioning, or leverage amplification.

- Step 6: Earn Yield: Stake assets in SSL pools or other modules to earn protocol rewards while enhancing liquidity in the system.

- Step 7: Participate in Governance: Lock your TREN tokens to mint veTREN and gain voting power in TrenDAO to influence revenue allocation through Gauges.

- Need Help? Visit the official documentation for tutorials, detailed strategy guides, and protocol explanations.

Tren Finance Reviews by Real Users

Tren Finance FAQ

Tren Finance has built-in fail-safes across its TrenOS AI network to prevent rogue actions. Each agent requires consensus from other agents and real-time data validation before executing protocol changes. If an agent behaves abnormally, an emergency override can pause its function. Additionally, a dynamic rate limiter system prevents extreme or abrupt adjustments. Users can rest assured knowing that Tren Finance operates with a multi-tiered safety architecture tailored for autonomous systems.

Interest rates in Tren Finance are optimized in real-time by its Interest Rate Optimizer AI, which assesses multiple data streams such as market demand, utilization levels, and liquidity depth. Instead of relying on rigid formulas, the AI adjusts rates gradually to maintain protocol balance, reduce volatility shocks, and maximize capital efficiency.

Yes, Tren Finance allows users to deposit their concentrated LP NFTs (like from UniswapV3) as collateral and borrow XY. They can use the borrowed XY to short the underlying asset or build delta-neutral strategies. This enables users to preserve their LP yield while actively minimizing impermanent loss risk through AI-driven hedging techniques.

Hooks are smart contract extensions that automate strategies like auto-rollovers, looping leverage, and hedging operations on assets such as restaked and PT tokens. Within Tren Finance, Hooks empower users to gain up to 10x yield amplification while the AI network continuously manages risk thresholds, APY timing, and liquidity positions in the background.

Yes, Tren Finance features the Open AI Agent Framework, which lets developers build, train, and submit their own AI agents. Contributors can use protocol tools and historical datasets to simulate and test behavior. If approved through governance and performance checks, custom agents can become part of the active protocol layer—offering a revolutionary way to co-create the future of autonomous DeFi.

You Might Also Like