About TribeOne Defi

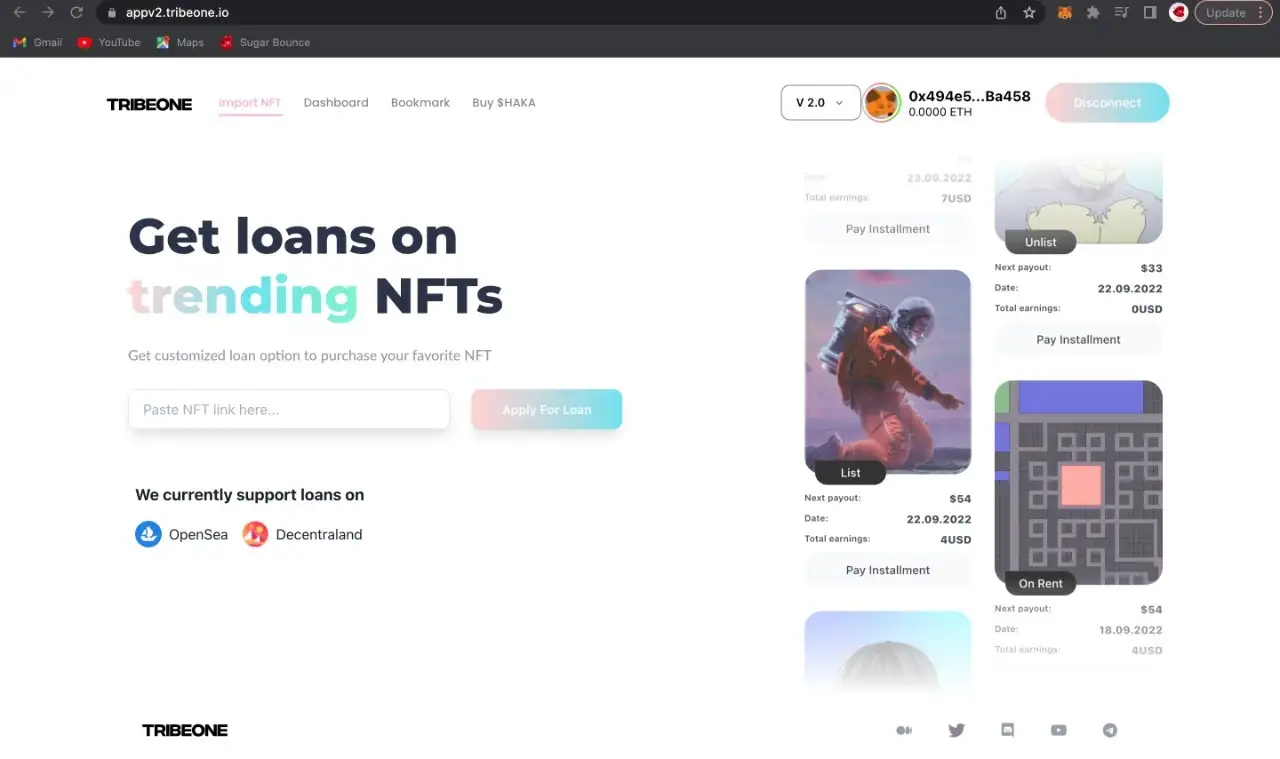

TribeOne is a decentralized finance (DeFi) platform that revolutionizes the financial services industry by incorporating non-fungible tokens (NFTs). The platform's mission is to democratize access to financial services, making them more accessible and inclusive for all users. By leveraging the power of DeFi and NFTs, TribeOne aims to create a seamless and transparent financial ecosystem where users can utilize their digital assets for various financial purposes.

TribeOne focuses on providing NFT-backed lending and borrowing services, allowing users to unlock liquidity without selling their valuable digital assets. This innovative approach bridges the gap between traditional finance and the emerging world of digital assets, offering users a unique blend of financial services. With a user-friendly interface and a commitment to security and transparency, TribeOne stands out as a pioneering platform in the DeFi space.

TribeOne was developed to address the growing need for decentralized financial services that cater to the digital asset community. The platform's history is marked by significant milestones, including the launch of its NFT lending decentralized application (dApp) and strategic partnerships with various NFT marketplaces. These milestones have solidified TribeOne's position as a leading player in the DeFi space.

The platform offers a range of financial services, including lending and borrowing options that use NFTs as collateral. This approach provides users with the flexibility to leverage their digital assets without having to sell them, thus preserving their value. TribeOne operates without intermediaries, ensuring transparency, security, and lower costs for users. The platform's decentralized nature allows for a more inclusive financial ecosystem where anyone can participate, regardless of their geographic location or financial background.

TribeOne's ecosystem is continuously expanding through partnerships with key players in the NFT and DeFi spaces. These collaborations enhance the platform's offerings and provide users with a broader range of services. The integration with NFT marketplaces, for example, allows users to easily use their NFTs as collateral for loans, further enhancing the platform's utility.

The project also places a strong emphasis on security, employing advanced cryptographic techniques and smart contract audits to ensure the safety of users' assets. Transparency is another core value, with the platform providing users with clear and detailed information about all transactions and processes.

In terms of competition, TribeOne faces challenges from other DeFi platforms such as Aave and Compound, which also offer decentralized lending and borrowing services. Additionally, NFT-focused projects like NFTfi present direct competition by providing similar NFT-backed financial services. Despite this, TribeOne differentiates itself through its unique blend of DeFi and NFT functionalities, user-friendly interface, and strong emphasis on security and transparency.

TribeOne continues to innovate and expand its offerings, with future plans including the introduction of new financial products and services that cater to the evolving needs of the digital asset community. The platform is committed to staying at the forefront of the DeFi revolution, providing users with cutting-edge financial solutions that empower them to make the most of their digital assets.

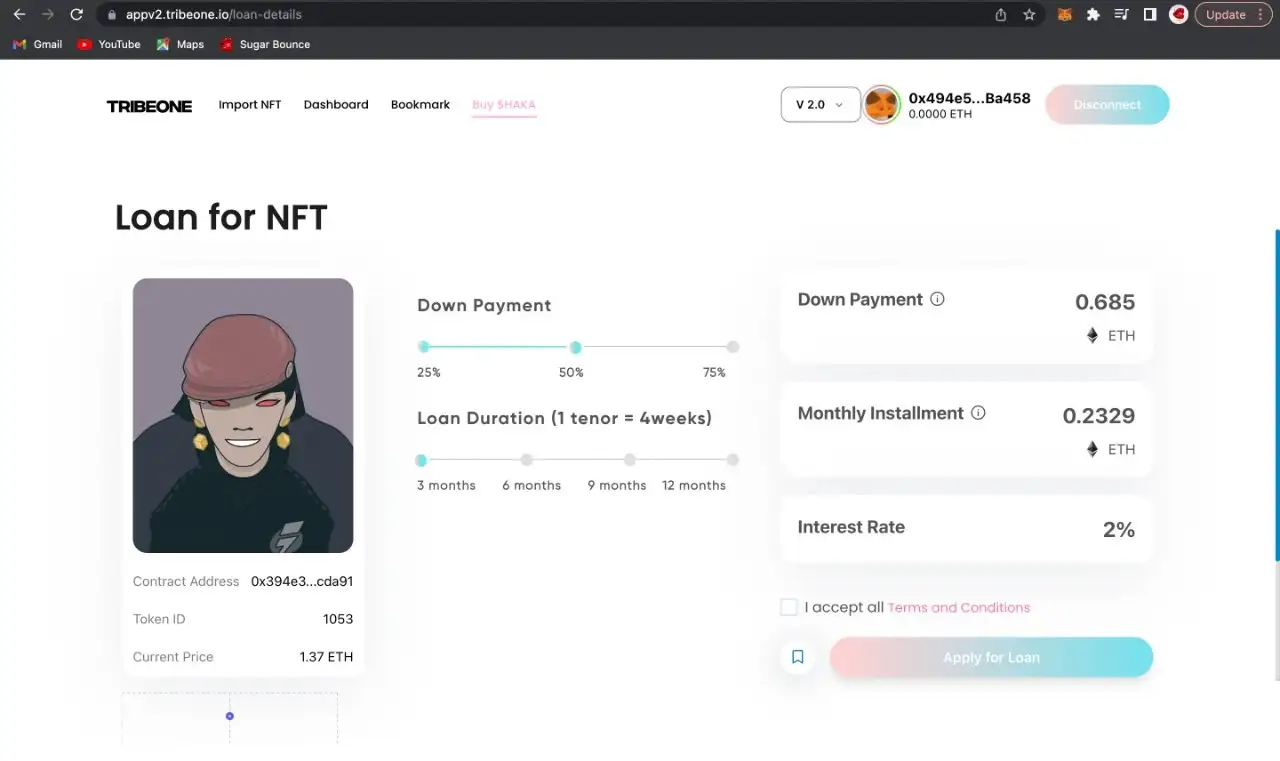

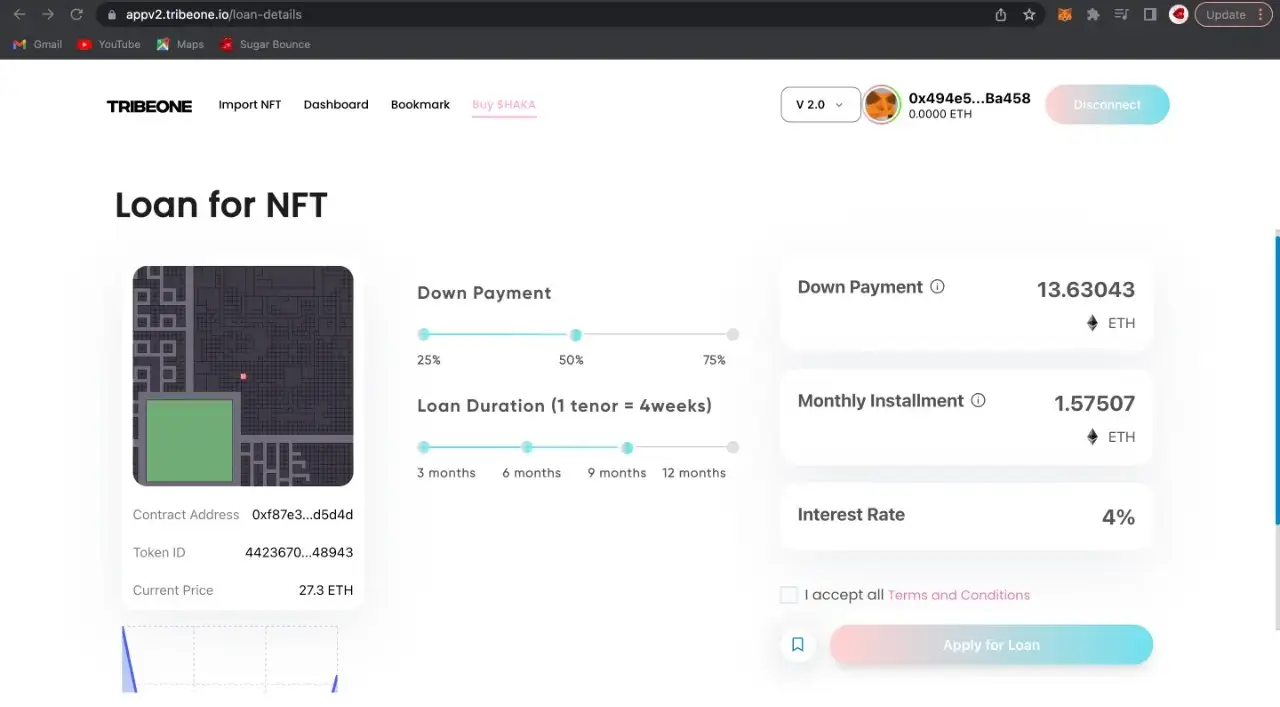

- NFT-Backed Loans: Users can secure loans using their NFTs as collateral, unlocking liquidity without selling their assets.

- Decentralized Platform: Operates without intermediaries, ensuring transparency and security.

- Diverse Loan Options: Offers various loan types to meet different user needs, including short-term and long-term loans.

- Partnerships: Collaborates with NFT marketplaces to expand its ecosystem and offer better services, enhancing the utility and reach of the platform.

- User-Friendly Interface: Intuitive design for easy navigation and use, making it accessible to both beginners and experienced users.

- Security: Employs advanced cryptographic techniques and regular smart contract audits to ensure the safety of users' assets.

- Transparency: Provides clear and detailed information about all transactions and processes, fostering trust and confidence among users.

- Community Engagement: Active engagement with the community through social media, forums, and regular updates, ensuring users are always informed and involved.

- Innovative Financial Products: Continuously developing new financial products and services to cater to the evolving needs of the digital asset community.

- Create an Account: Visit the TribeOne website and sign up for an account.

- Connect Wallet: Link your crypto wallet to the platform to access its features. Supported wallets include MetaMask, Trust Wallet, and others.

- Explore Options: Browse through the available financial services, including lending and borrowing options, and choose the ones that best suit your needs.

- Use NFTs as Collateral: Select your NFTs to use as collateral for loans. Ensure that the NFTs meet the platform's criteria for collateral.

- Apply for a Loan: Follow the step-by-step process to apply for and receive a loan. This includes specifying the loan amount, selecting the collateral, and agreeing to the terms.

- Manage Your Loans: Once you have received a loan, you can manage it through your account dashboard. This includes making repayments, checking loan status, and adjusting terms if needed.

- Stay Informed: Keep up to date with the latest news, updates, and developments by following TribeOne on social media and joining their community forums.

TribeOne Defi Reviews by Real Users

TribeOne Defi FAQ

TribeOne ensures the security of your NFT-backed loans by employing advanced cryptographic techniques and regular smart contract audits. The platform uses secure and transparent protocols to protect your assets. Additionally, TribeOne collaborates with reputable security firms to conduct thorough audits, ensuring that all vulnerabilities are identified and mitigated. Users can trust that their NFTs and other digital assets are safeguarded against potential threats.

Yes, you can use multiple NFTs as collateral for a single loan on TribeOne. This feature allows you to combine the value of several NFTs to secure a larger loan amount. By diversifying your collateral, you also reduce the risk associated with the value fluctuations of individual NFTs. Simply select the NFTs you wish to use, and the platform will calculate the total collateral value to determine your loan eligibility.

If the value of your NFT collateral drops significantly during the loan period, TribeOne has mechanisms in place to manage this risk. The platform may issue a margin call, requiring you to add more collateral to maintain the loan's value. If you cannot provide additional collateral, your NFTs may be liquidated to cover the loan amount. This process ensures that both borrowers and lenders are protected from significant losses due to market volatility.

TribeOne integrates with various NFT marketplaces to provide seamless access to collateral options for users. By partnering with leading marketplaces, TribeOne allows users to easily use their NFTs from these platforms as collateral for loans. This integration expands the ecosystem and enhances the platform's utility, making it easier for users to leverage their digital assets without the need to transfer them between different services.

For an NFT to be eligible as collateral on TribeOne, it must meet certain criteria. The platform evaluates the NFT's market value, liquidity, and provenance to ensure it is suitable for collateral. Additionally, the NFT should be listed on a supported marketplace and comply with TribeOne's quality standards. These criteria help maintain the security and reliability of the lending process, ensuring that both borrowers and lenders have confidence in the collateral's value.

You Might Also Like