About TrueFi

TrueFi is a modular credit protocol bringing the traditional debt market on-chain through fully transparent, programmable lending infrastructure. Designed for both crypto-native institutions and real-world financial entities, TrueFi connects lenders, borrowers, and portfolio managers using smart contracts governed by the community through the TRU governance token. Its platform facilitates trustless credit, enabling users to participate in lines of credit, asset vaults, and diversified portfolios—all with real-time visibility and control.

Since its launch in 2020, TrueFi has originated over $1.7 billion in loans and paid more than $40 million in interest to lenders. Its mission is to make credit markets more efficient and accessible through blockchain technology, leveraging transparency, governance, and composable finance. Whether you're seeking yield on USDC or aiming to fund institutional borrowers, TrueFi’s infrastructure opens the doors to compliant, secure, and profitable decentralized lending.

TrueFi is a decentralized credit protocol that transforms how institutional and individual participants engage in lending and borrowing by bringing on-chain debt markets to life. Unlike traditional platforms that rely on intermediaries or opaque decision-making, TrueFi ensures transparency, compliance, and governance via community-controlled smart contracts. Built on Ethereum and compatible EVM chains, TrueFi offers several credit products tailored to different capital needs and risk profiles.

At the core of TrueFi is its suite of decentralized credit vaults, which include:

- Lines of Credit: Continuous borrowing models for vetted borrowers, offering flexible drawdowns and repayments.

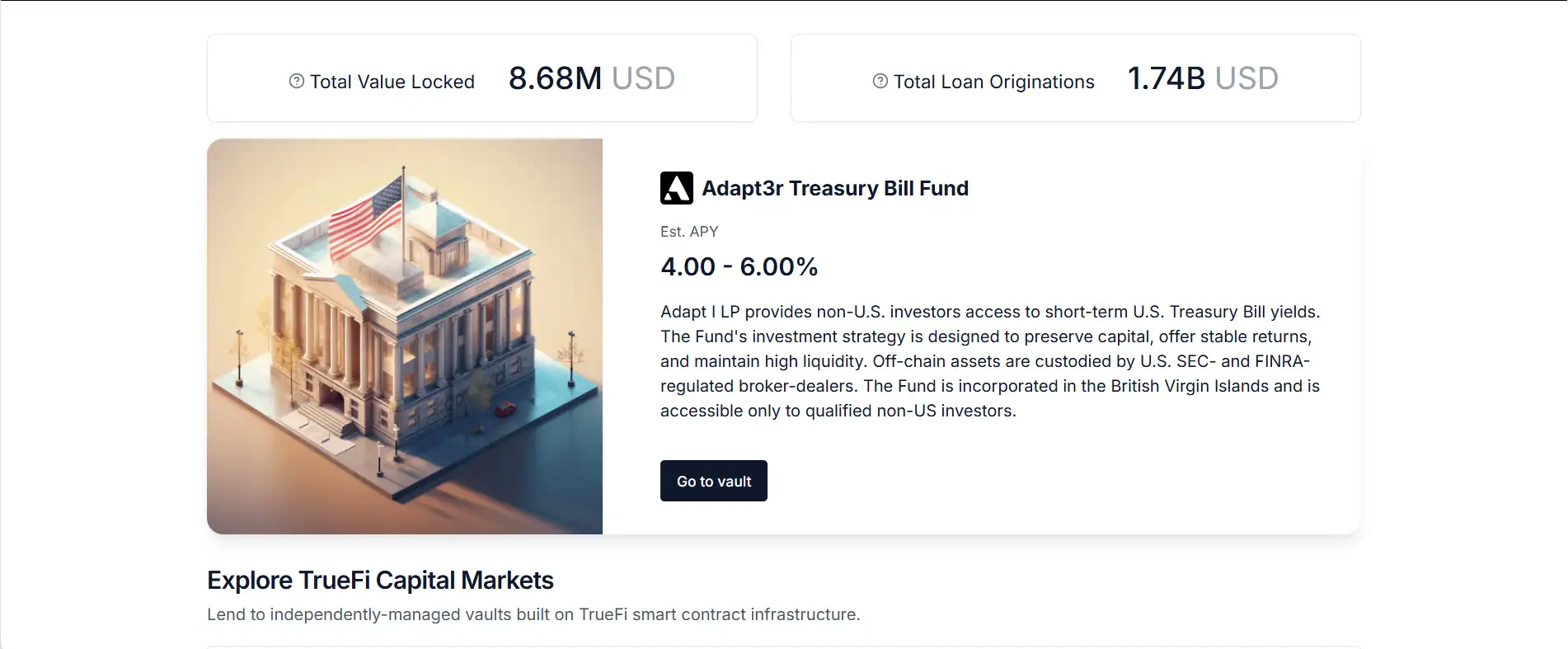

- Asset Vaults: Used for financing off-chain, Real World Asset (RWA) transactions and portfolios.

- Credit Vaults: Enable unitranche and multi-tranche debt deals directly on-chain.

The protocol is governed by TRU token holders, who vote on onboarding new borrowers, approving portfolio managers, and setting treasury and fee structures. This decentralized model has allowed TrueFi to fund both crypto-native borrowers and traditional fintech institutions while ensuring that lending terms and performance remain public and auditable.

All TrueFi vaults follow the ERC-4626 standard, ensuring compatibility with DeFi integrations and consistent behavior across vault products. Lenders receive LP tokens that represent their proportional share in the vault and can track performance and redemption options via the platform interface. Portfolio managers are required to undergo governance-based approval, ensuring that capital is allocated only to trusted operators.

With support from prominent investors like a16z, Founders Fund, and BlockTower, and coverage in major media outlets such as Bloomberg and CoinDesk, TrueFi stands out as one of the most credible DeFi credit infrastructures in the space. While competitors like Goldfinch and Maple Finance offer similar RWA-focused lending solutions, TrueFi’s protocol-first architecture and DAO governance offer a higher degree of flexibility and user control.

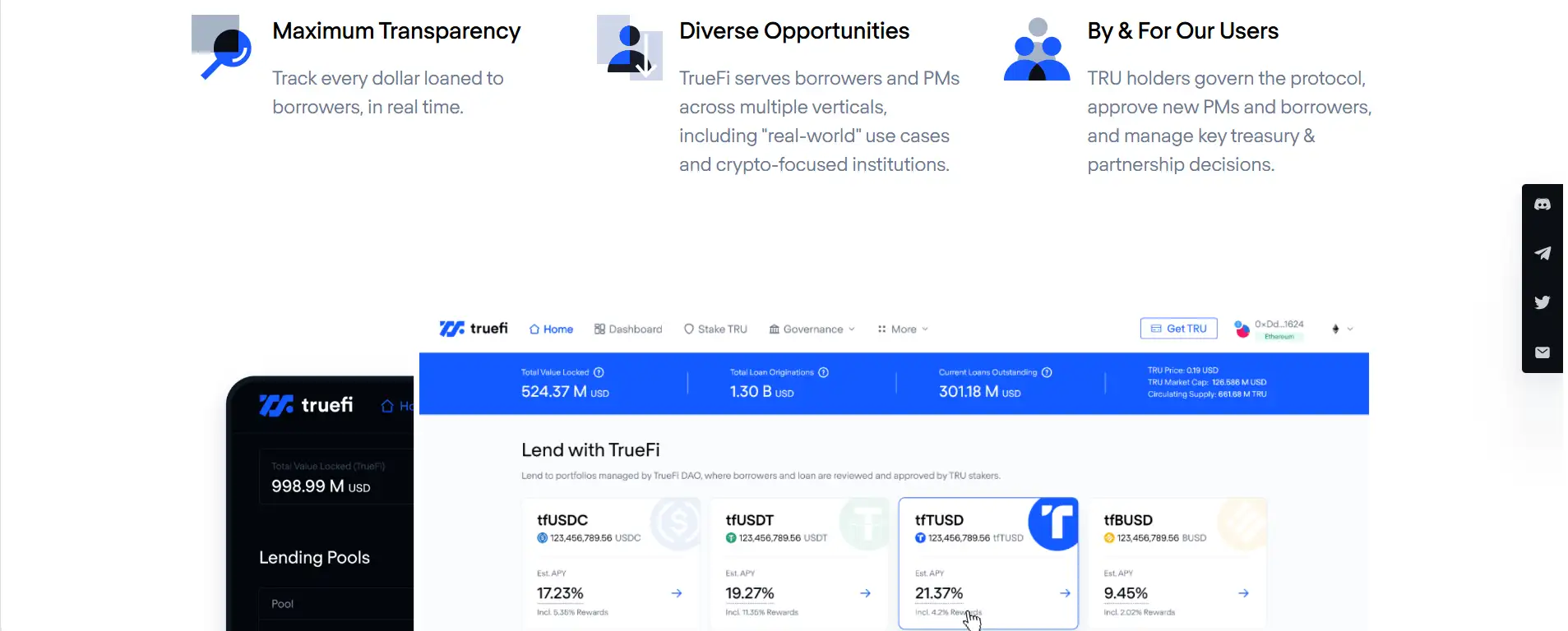

TrueFi provides several advantages for lenders, borrowers, and credit managers that differentiate it in the DeFi credit market:

- Fully Transparent Lending: Track every dollar in real-time across all vaults, borrowers, and repayment schedules.

- Decentralized Governance: All decisions are voted on by TRU token holders, including borrower onboarding and manager selection.

- Diverse Credit Products: Participate in Lines of Credit, Asset Vaults, or Credit Vaults tailored to various strategies.

- Compliant Infrastructure: KYC-required permissioned pools allow institutional investors to meet regulatory standards.

- ERC-4626 Vault Design: Enables compatibility with DeFi interfaces and standardized vault interactions.

- Real-World Asset Support: Bridge traditional finance and crypto by accessing yield through fintech, trading firms, and credit funds.

- Protocol-Level Fee Transparency: Fees are visible, accrued automatically, and distributed to the DAO treasury.

TrueFi makes it easy for lenders and credit participants to access vetted opportunities across crypto and real-world finance. Here’s how to get started:

- Visit the App: Go to app.truefi.io and connect your wallet.

- Explore Opportunities: Browse available lending pools and review risk profiles, interest rates, and borrower details.

- Complete KYC (if required): Some permissioned pools may require identity verification through a partner like Archblock.

- Approve & Deposit: Use the standard approve and deposit functions to lend tokens. You will receive LP tokens as proof of position.

- Track & Redeem: Monitor your earnings and withdraw when liquidity is available or upon vault maturity. Returns are visible in real-time.

- Participate in Governance: Use TRU tokens to vote on borrower applications, PM approvals, and protocol improvements via Snapshot or Forum.

- Join the Community: Stay updated via Twitter, and the TrueFi Forum.

TrueFi FAQ

TrueFi offers full on-chain transparency for all loans, allowing lenders to view the exact amount lent, the borrower, repayment status, and vault-level data in real time. Each transaction is executed via smart contracts and publicly auditable, making TrueFi one of the most open credit platforms in DeFi. Lenders can access dashboards directly through TrueFi.

Lines of Credit on TrueFi provide flexible, continuous capital access to approved borrowers. Once granted access, borrowers can draw and repay at will, with interest accrued only on the borrowed portion. This structure allows for dynamic capital management while ensuring lenders earn yield on deployed capital. Learn more via TrueFi.

TRU token holders govern the protocol by voting on key actions, including onboarding new borrowers and portfolio managers, managing treasury allocations, and setting fee policies. All proposals are made publicly and voted on via community governance tools like Snapshot. This ensures that TrueFi remains community-owned and driven. Get involved on the TrueFi Forum.

No. Some permissioned pools on TrueFi require KYC verification to comply with regulatory standards. These pools are typically managed by institutional portfolio managers and involve Real World Assets (RWAs). Verification is handled via trusted third parties such as Archblock. Users can still participate in open-access pools without verification.

When lending to a TrueFi vault, users receive LP tokens representing their share. Withdrawals depend on the vault’s configuration—some allow anytime redemption if liquidity is available, while others may lock funds until maturity. Withdrawals are processed via the

withdrawfunction on the smart contract. Always review vault terms on TrueFi before lending.

You Might Also Like