About UniDex

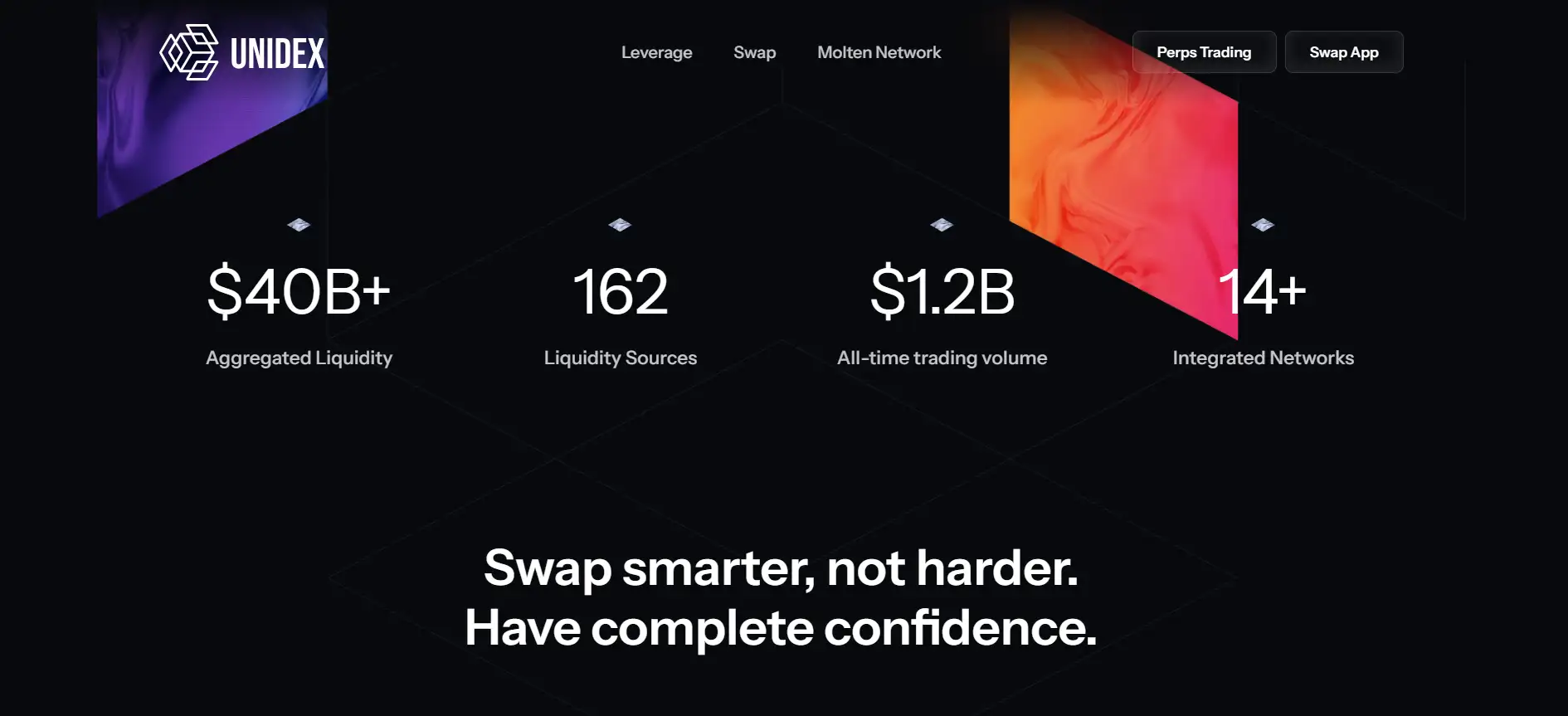

UniDex is a decentralized finance (DeFi) platform designed to optimize trading across the ecosystem through powerful aggregation. By acting as a meta-aggregator for both perpetual contracts and token swaps, UniDex provides unmatched access to liquidity, advanced order routing, and the best fill rates in DeFi. With over $27B in aggregated liquidity and connections to 130+ sources, UniDex ensures traders never need to worry about finding the best price—it’s always guaranteed.

Built for both retail traders and developers, UniDex offers a seamless, high-performance trading experience that combines smart order routing, zero-latency execution, and comprehensive SDKs for dApps and bots. The platform also introduces “Trading Accounts”—smart contract wallets enabling users to manage multi-chain trading without needing to switch networks. This positions UniDex as a hub for next-gen DeFi innovation, aggregating value across swaps, leverage, and cross-chain execution.

UniDex serves as a comprehensive DeFi trading aggregator that connects traders to the most efficient rates across the ecosystem. Whether executing token swaps or trading perpetual contracts (perps), UniDex finds and executes trades with the deepest liquidity across 130+ integrated sources. Through a unified trading interface and advanced backend architecture, it delivers optimal pricing and minimal slippage, regardless of trade size or market conditions.

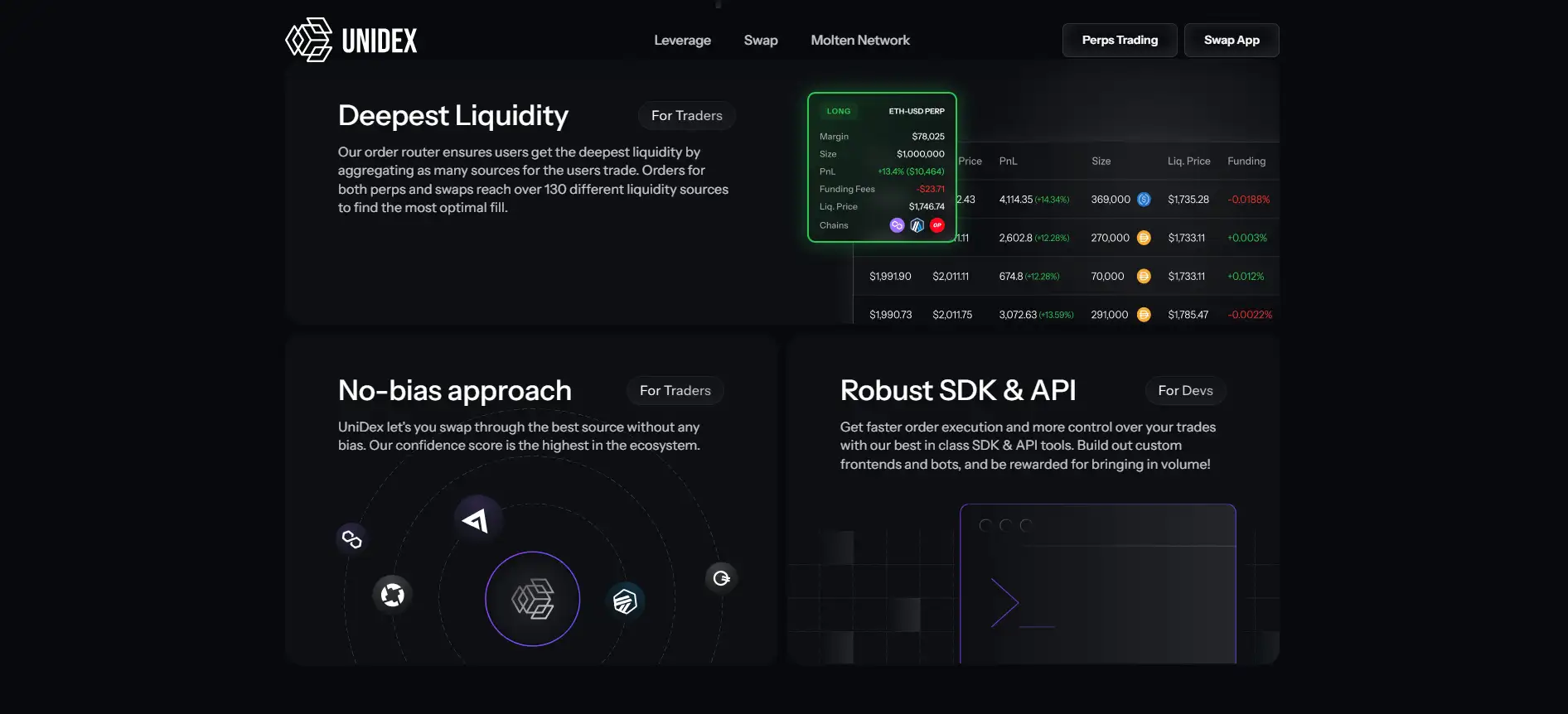

The platform features two core aggregators: one for swaps and another for perps. The Swap Aggregator compares and aggregates prices across 15+ DEX aggregators and supports both instant execution and gasless batch auctions. The Perp Aggregator routes leverage trades through protocols like GMX, MUX, and Perpetual Protocol—allowing users to split trades across multiple venues for maximum fill and efficiency.

To further enhance the trading experience, UniDex introduces a smart contract-based Trading Account. This non-custodial wallet is generated when a user first connects and enables cross-chain trades without manual network switching. Users can bundle up to 10 transactions in one (e.g., approvals, deposits, and orders), optimizing for gas and speed. Behind the scenes, UniDex also powers the Molten Network, a dedicated Layer 3 built on the Orbit stack to enable CEX-like performance in a DeFi setting.

With its intent-based architecture and composable pool design, UniDex is building a permissionless platform for creating customizable trading strategies and asset pools. This includes support for custom ETFs, long-tail crypto assets, indices, and more. In this way, UniDex competes with major aggregators like Matcha and 1inch, while carving out its own lane in perp aggregation and developer tooling.

UniDex provides traders and developers with cutting-edge features and significant advantages:

- Perpetual Aggregation: Access the deepest perp liquidity across multiple DEXs. Trades are split and routed for optimal pricing with no manual effort.

- Meta-Aggregated Swaps: Aggregates multiple swap aggregators to guarantee the lowest execution price on any ERC-20 trade.

- Trading Account System: Non-custodial smart wallets auto-generated for cross-chain trading without switching networks.

- Cross-Chain Support: Trade on 12+ networks including Arbitrum, Optimism, Base, zkSync, and more.

- One-Click Trading: Combine multiple actions (approval, deposit, trade) in a single transaction for faster execution and gas efficiency.

- Molten Network Integration: Built-in L3 designed for high-frequency DeFi trading, offering ultra-low latency.

- SDK and API Access: Developers can build bots, dashboards, and apps on UniDex and earn rewards by driving volume.

Getting started with UniDex is fast and requires no KYC or off-chain onboarding. Here’s how you can begin trading with full aggregation power:

- Step 1 – Connect Your Wallet: Head to unidex.exchange and connect your browser wallet (MetaMask, Rabby, Trust Wallet).

- Step 2 – Generate Your Trading Account: The platform auto-generates a Trading Account smart wallet. You’ll sign one message and get immediate access.

- Step 3 – Deposit Funds: Use any supported EVM chain and deposit stablecoins to your Trading Account. Select your network and input amount.

- Step 4 – Start Trading: Use the Swap or Perp interface to execute trades with unmatched liquidity and confidence.

- Step 5 – Explore Advanced Tools: Use batch transactions, automated strategies, or integrate UniDex’s SDK to build custom frontends or bots.

- Step 6 – Stay Informed: Join the UniDex community on Twitter for updates, support, and new integrations.

UniDex FAQ

UniDex uses a dual-layer aggregation engine to route your trade across 130+ liquidity sources. For swaps, it compares prices from 15+ aggregators. For perps, it splits orders between multiple decentralized perp protocols like GMX, MUX, and Perpetual Protocol. This ensures you always get the deepest liquidity and best fill in the DeFi ecosystem. Learn more at UniDex.

A Trading Account is a smart contract wallet automatically created when you first connect your wallet to UniDex. It allows cross-chain, one-click trading across multiple perp DEXs without switching networks. You can deposit funds from 12+ chains, batch up to 10 transactions, and maintain full custody. This offers a CEX-like experience while preserving DeFi-level control. Explore it on UniDex.

UniDex supports trades on over 12 EVM-compatible chains, including Arbitrum, Optimism, Base, Fantom, zkSync, and more. You can trade any ERC-20 token or perp market listed on integrated DEXs. Molten, UniDex’s native token, is also deployed across these networks and serves governance and utility functions. Full list available on UniDex.

Yes. UniDex offers a full SDK and API suite for developers. You can build trading bots, dashboards, or custom frontends using the aggregated order router and earn volume-based rewards. This makes UniDex not only a trading terminal but also a DeFi infrastructure layer for projects looking to embed optimized trading. Developer docs are available via UniDex.

Gasless batch auctions on UniDex allow traders to set limit orders aggregated across 8 sources without needing gas fees or native tokens. They are MEV-protected and can even be used to trade airdrops on new chains. This feature ensures optimal price execution with zero upfront cost—especially useful during volatile markets or illiquid token launches. Try it at UniDex.

You Might Also Like