About UniLend Finance

UniLend Finance is a decentralized finance (DeFi) platform that integrates lending, borrowing, and spot trading services into a unified protocol. Launched with the mission of breaking the boundaries of traditional finance, UniLend enables users to unlock the full potential of their assets by providing an all-in-one solution for managing and utilizing crypto assets. Unlike traditional financial systems that limit users' capabilities based on geographical or economic constraints, UniLend empowers users globally by giving them full control over their financial activities.

At its core, UniLend aims to provide a fully decentralized and permissionless platform where any asset can be listed and utilized for various financial services. This approach contrasts sharply with existing DeFi platforms that often restrict users to a limited set of assets. By removing these barriers, UniLend opens the door to a more inclusive and expansive financial ecosystem where users have access to a broader range of opportunities.

The significance of UniLend in the DeFi industry lies in its innovative approach to asset utilization. The platform's ability to combine multiple financial services into a single protocol not only simplifies the user experience but also enhances the efficiency of asset management. As DeFi continues to evolve, platforms like UniLend that offer comprehensive solutions are likely to play a pivotal role in shaping the future of decentralized finance.

UniLend Finance is a trailblazing DeFi platform that emerged with the goal of revolutionizing the decentralized finance landscape by combining lending, borrowing, and spot trading functionalities into a single, cohesive protocol. Launched in response to the limitations of existing DeFi platforms, UniLend set out to create a more inclusive financial ecosystem where users can maximize the utility of their crypto assets without the restrictions imposed by traditional financial systems or competing DeFi platforms.

Since its inception, UniLend has achieved several key milestones that have solidified its position as a leader in the DeFi space. One of the most significant developments was the launch of UniLend V2, which introduced enhanced features such as more efficient collateral management, improved liquidity mining, and advanced risk management mechanisms. These upgrades have made the platform more robust and user-friendly, catering to a growing community of DeFi enthusiasts and professionals alike.

UniLend's approach to decentralized finance is distinct from its competitors due to its open and permissionless nature. Unlike platforms like Compound and Aave, which limit the assets that can be listed and used within their ecosystems, UniLend allows for the listing of any ERC20 token. This flexibility provides users with unparalleled access to a diverse range of assets, enhancing the platform's appeal to a broader audience.

Another key differentiator is UniLend's integrated approach. While platforms like Yearn Finance focus primarily on yield optimization and others like Uniswap specialize in decentralized trading, UniLend brings together multiple DeFi services into a single protocol. This not only simplifies the user experience but also reduces the complexity of managing multiple platforms and assets, making it easier for users to optimize their financial activities.

UniLend's competitors, such as MakerDAO, Synthetix, and Curve Finance, also offer unique DeFi solutions, but they often focus on specific niches within the decentralized finance ecosystem. UniLend's comprehensive approach allows it to address multiple financial needs under one roof, making it a versatile platform for both novice and experienced users.

Over the years, UniLend has continued to expand its ecosystem through strategic partnerships and integrations with other DeFi protocols and blockchain platforms. These collaborations have further enhanced the platform's functionality and reach, allowing UniLend to offer a wider range of services and assets to its users. The platform's commitment to innovation and inclusivity ensures that it remains at the forefront of the DeFi industry, continually evolving to meet the needs of its growing user base.

For more information, you can visit UniLend's official website here.

UniLend Finance offers a range of key benefits and features that distinguish it from other DeFi platforms:

- Permissionless Asset Listing: Unlike many DeFi platforms that limit the types of assets that can be listed, UniLend allows for any ERC20 token to be listed on the platform. This feature opens up the platform to a wider array of assets, providing users with greater flexibility and choice.

- Integrated DeFi Services: UniLend combines lending, borrowing, and spot trading into a single protocol, simplifying the user experience and reducing the need for multiple platforms. This integration makes it easier for users to manage their assets and maximize their returns.

- Governance Participation: The platform is governed by its users through the UFT token. Token holders can propose and vote on key decisions, ensuring that the platform evolves according to the community’s preferences.

- Staking and Rewards: Users can stake their UFT tokens to earn rewards, which include a share of the platform’s fees and other incentives. This staking mechanism not only provides income for users but also contributes to the platform’s security and stability.

- Advanced Risk Management: UniLend employs sophisticated risk management strategies using smart contracts and decentralized oracles, minimizing the risks associated with collateralization and liquidation. This makes the platform safer and more reliable for users.

- Interoperability: The platform is designed to be interoperable with other DeFi protocols and blockchain networks. This enhances its utility and allows for seamless integration with a broader range of services, making it more versatile for users.

- Liquidity Incentives: Liquidity providers are rewarded with UFT tokens, encouraging the provision of liquidity to the platform and ensuring that it remains highly liquid and functional.

Getting started with UniLend Finance is a straightforward process that involves the following steps:

- Create a Wallet: The first step is to create a cryptocurrency wallet that supports ERC20 tokens. Popular options include MetaMask, Trust Wallet, and Coinbase Wallet. Ensure that your wallet is properly secured with a strong password and backup phrase.

- Fund Your Wallet: Once your wallet is set up, you’ll need to fund it with ETH or another ERC20 token to interact with the UniLend platform. You can purchase ETH on popular exchanges like Binance or Coinbase and then transfer it to your wallet.

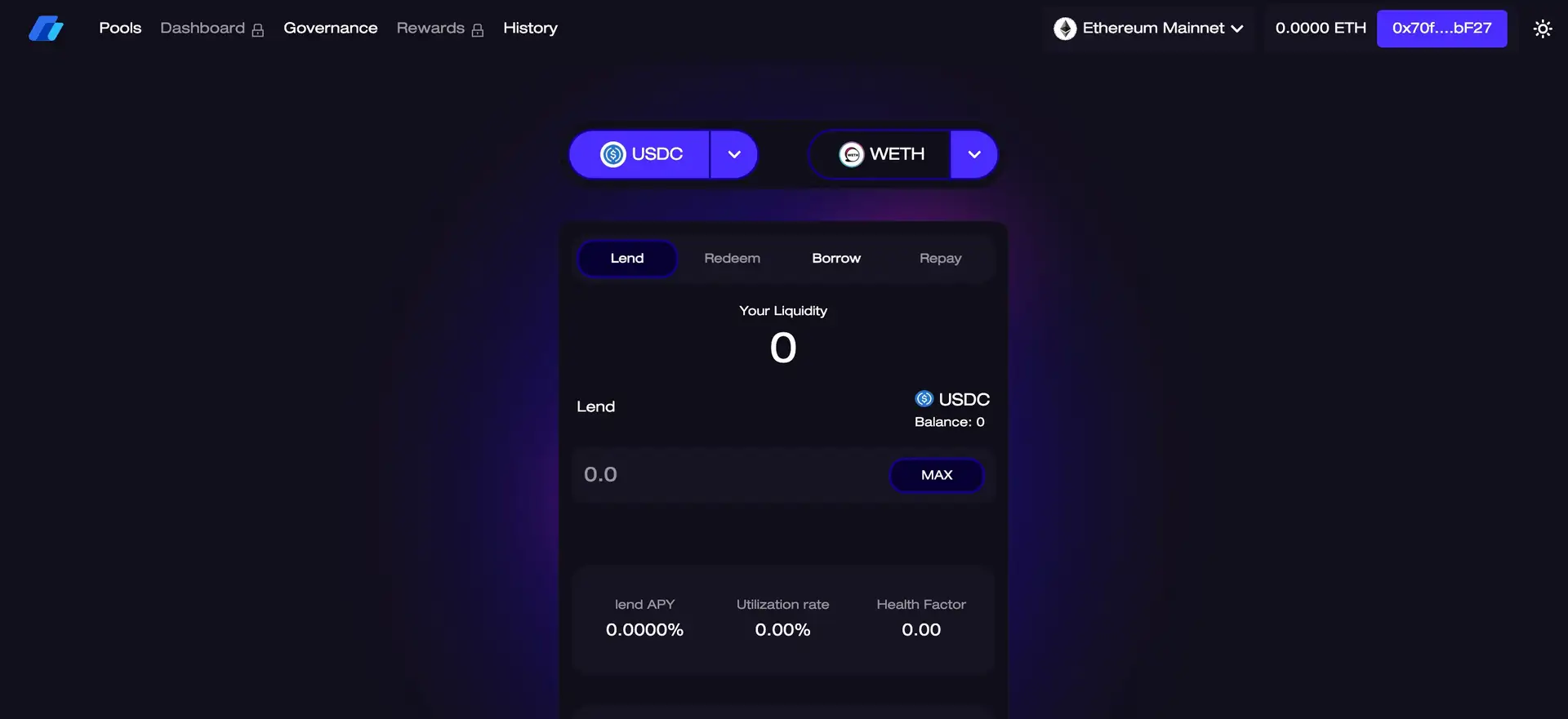

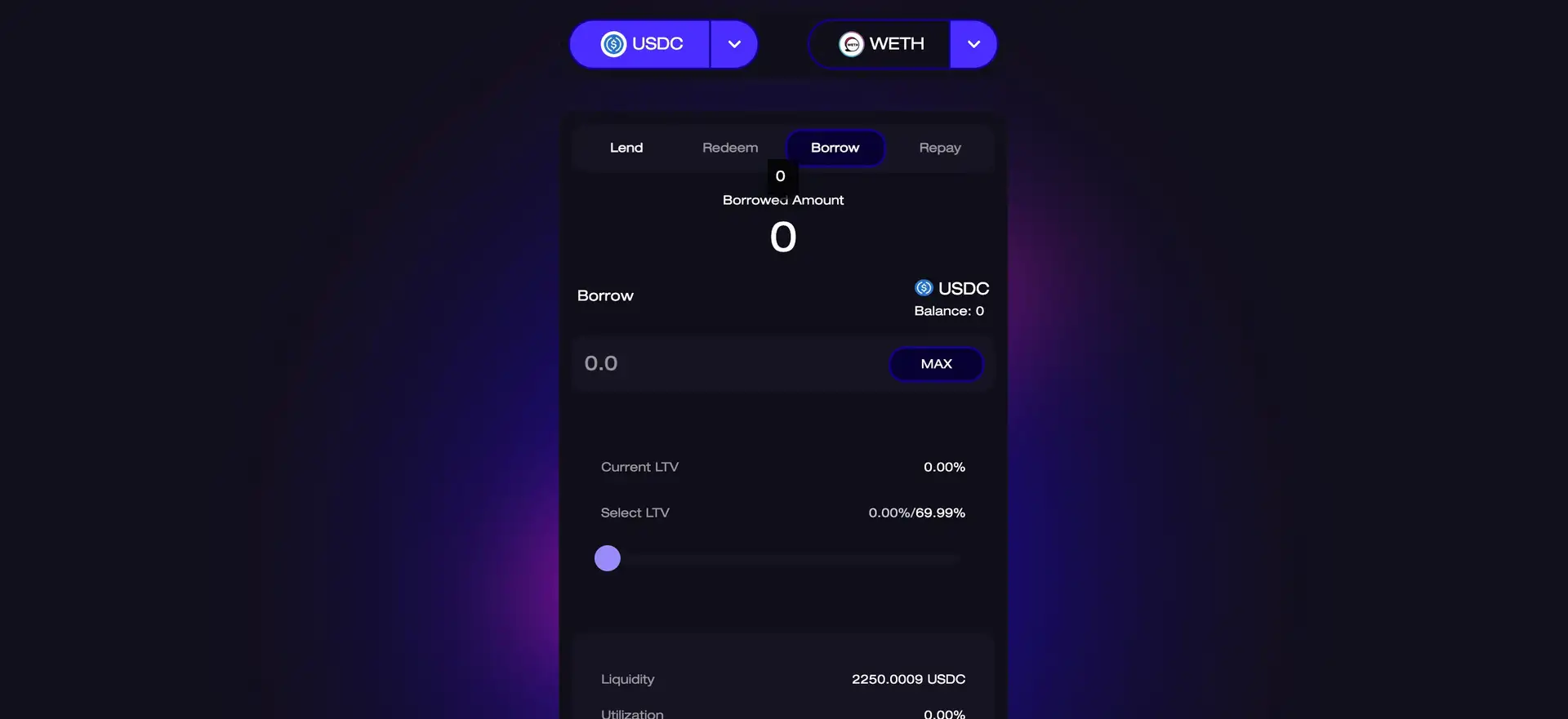

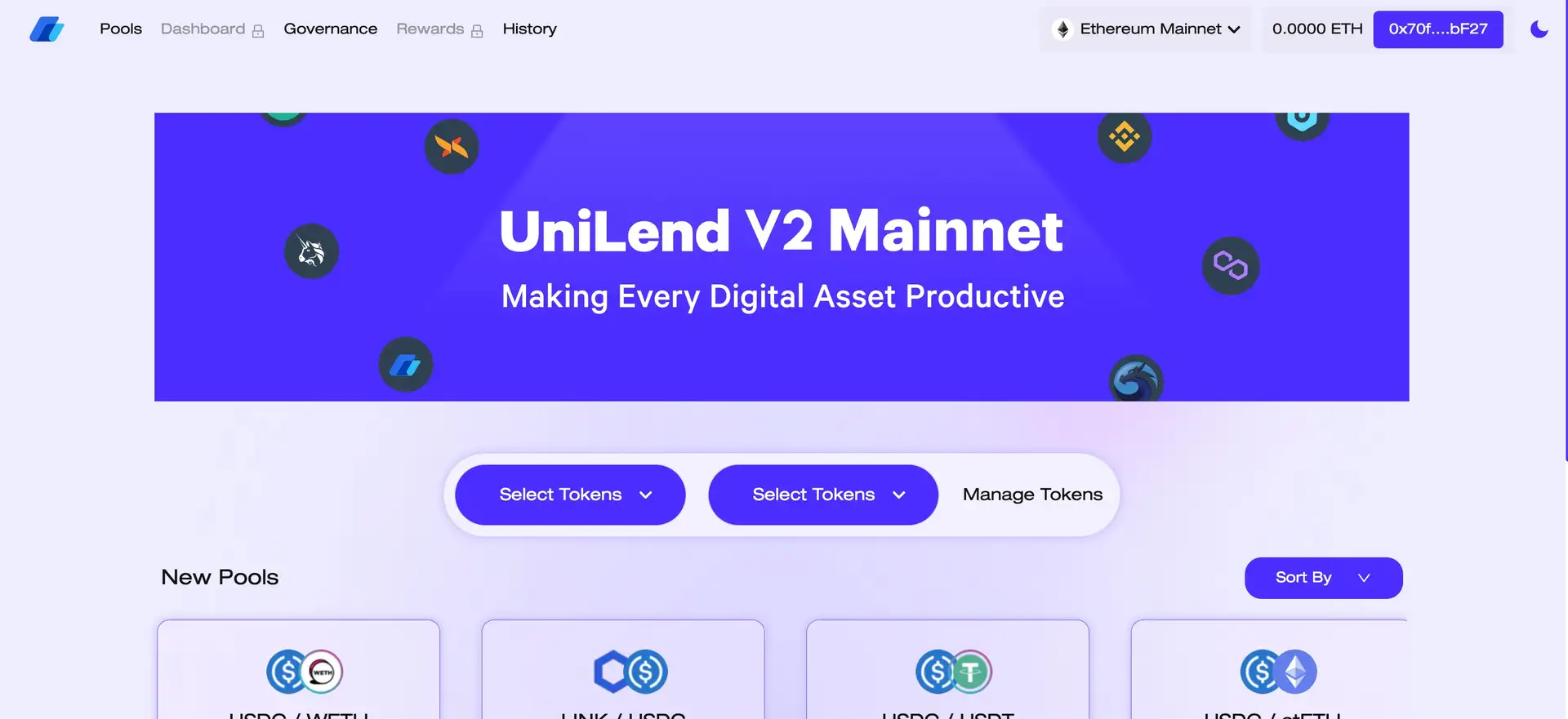

- Connect to UniLend: Visit the UniLend V2 platform and connect your wallet. Click on the "Connect Wallet" button on the top right corner of the website and follow the instructions to link your wallet.

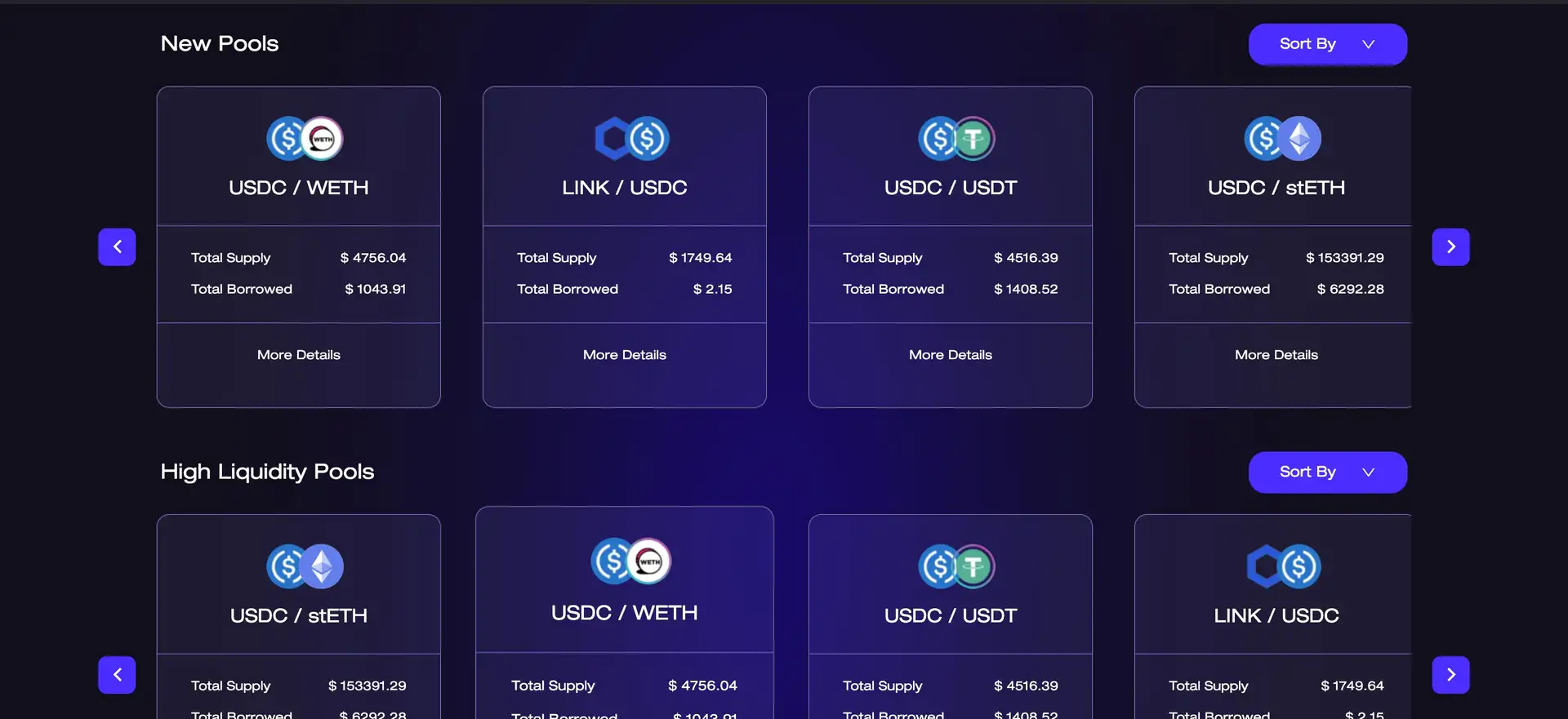

- Explore DeFi Services: Once your wallet is connected, you can start exploring the various services offered by UniLend, including lending, borrowing, and trading. Navigate through the platform's intuitive interface to select the services you wish to use.

- Participate in Governance: If you hold UFT tokens, you can participate in the platform’s governance by voting on proposals. This is done through the governance section of the UniLend platform, where you can view ongoing proposals and cast your vote.

- Stake UFT Tokens: To earn rewards, consider staking your UFT tokens. Navigate to the staking section, choose the amount of UFT you wish to stake, and follow the on-screen instructions to complete the process. Staking not only provides rewards but also supports the platform's security and governance.

- Provide Liquidity: If you’re interested in providing liquidity, you can do so by staking your tokens in the liquidity pools available on UniLend. This process is similar to staking and allows you to earn rewards for contributing to the platform's liquidity.

UniLend Finance Reviews by Real Users

UniLend Finance FAQ

UniLend stands out due to its permissionless asset listing capability, allowing any ERC20 token to be listed and utilized on the platform. Unlike Aave or Compound, which have a limited selection of supported assets, UniLend provides a more inclusive and flexible platform, catering to a broader range of crypto assets.

UniLend employs advanced risk management strategies through smart contracts and decentralized oracles to minimize the risks associated with collateralization and liquidation. This system ensures that users' assets are protected, making the platform safer and more secure compared to traditional DeFi platforms.

Yes, UniLend's governance is designed to be inclusive. While holding more UFT tokens gives you a proportionally larger vote, even those with a small amount of UFT can participate in the platform's decision-making process. This ensures that all users have a voice in the platform's evolution.

UniLend incentivizes liquidity providers by offering UFT token rewards, which can be staked for additional returns. Unlike other platforms that may focus solely on staking or lending, UniLend provides a comprehensive reward structure that integrates liquidity provision, staking, and governance participation, making it more attractive for users to contribute to the platform's liquidity.

UniLend is committed to continuous innovation. Future developments include enhancing cross-chain compatibility, integrating more DeFi services, and expanding the governance model to include more community-driven initiatives. These efforts aim to further decentralize the platform and broaden its ecosystem, keeping UniLend at the forefront of the DeFi industry.

You Might Also Like