About Vaultka

Vaultka is a specialized DeFi platform designed to serve as the ultimate liquidity layer for Perpetual Decentralized Exchanges (Perp DEXs). Built on Arbitrum and expanding into Solana, Vaultka offers automated vault strategies, lending products, and index investments to meet a wide variety of yield-seeking and risk-sensitive user needs. The platform bridges traditional liquidity provisioning with modern DeFi mechanics to empower retail users, institutions, and traders alike.

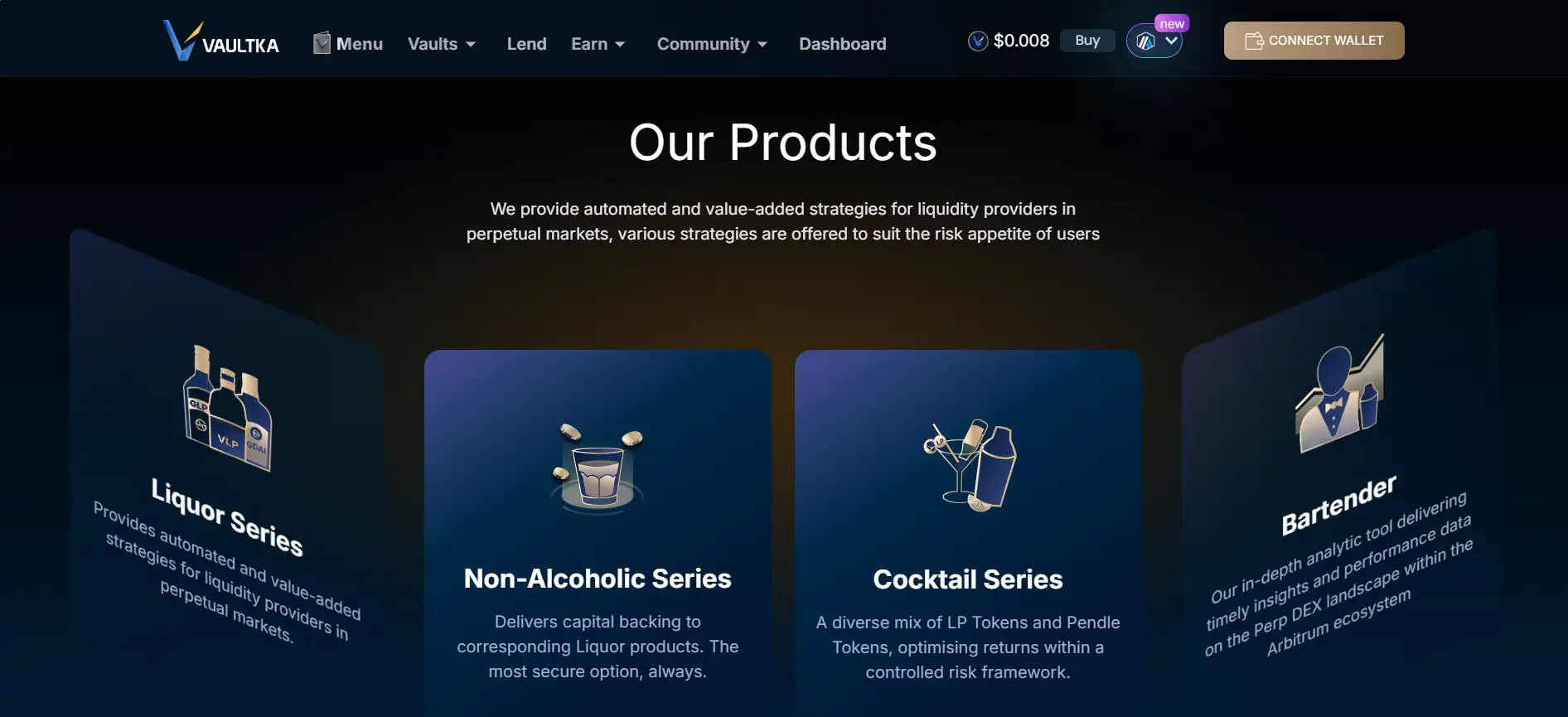

Through innovative vault design and protocol-level integrations, Vaultka enables users to gain exposure to Perp DEX LP tokens with enhanced capital efficiency, diversified index strategies, and risk-managed returns. It pioneers a unique classification system—Liquor, Cocktail, and Non-Alcoholic Series—to categorize its product offerings and provide intuitive access to tailored DeFi yield strategies.

Vaultka is at the forefront of innovation in the decentralized derivatives sector, acting as a catalyst for capital efficiency across Perp DEX ecosystems. As a comprehensive yield infrastructure, Vaultka offers structured vault strategies for liquidity providers (LPs), customized index investments, and stablecoin-backed lending—all designed around the operational models of Perp DEXs like GMX, Vela Exchange, Gains Network, Level Finance, and HMX.

The platform’s flagship vaults—branded as the Liquor Series—focus on automated exposure management for LP tokens. Each vault is tailored to specific LP assets such as GLP, gDAI, VLP, GM, and HLP. These strategies include delta-neutral positioning, leveraged yield farming, and hedging mechanisms, all executed through audited smart contracts. These "one-click" solutions enable both novice and seasoned users to participate in complex LP structures with simplified execution.

For users seeking broader exposure, Vaultka’s Cocktail Series offers index-style products like “MOJITO” (LP Index) and “MARTINI” (Governance Token Index). These are designed to diversify returns and reduce risk through exposure to multiple Perp DEX tokens. The platform also offers Non-Alcoholic Series vaults for stablecoin holders. These pools back leveraged strategies with capital and use reward-split or pay-in-advance mechanisms based on utilization rates and strategy risk.

Vaultka’s commitment to user empowerment is reflected in its advanced analytics suite, “Bartender.” This tool aggregates data on funding rates, LP yield, open interest, and protocol upgrades—enabling users to make data-driven decisions. Vaultka also prioritizes security, undergoing audits from Hacken, Zokyo, and Halborn, and operates with a multisig wallet and Hypernative threat monitoring.

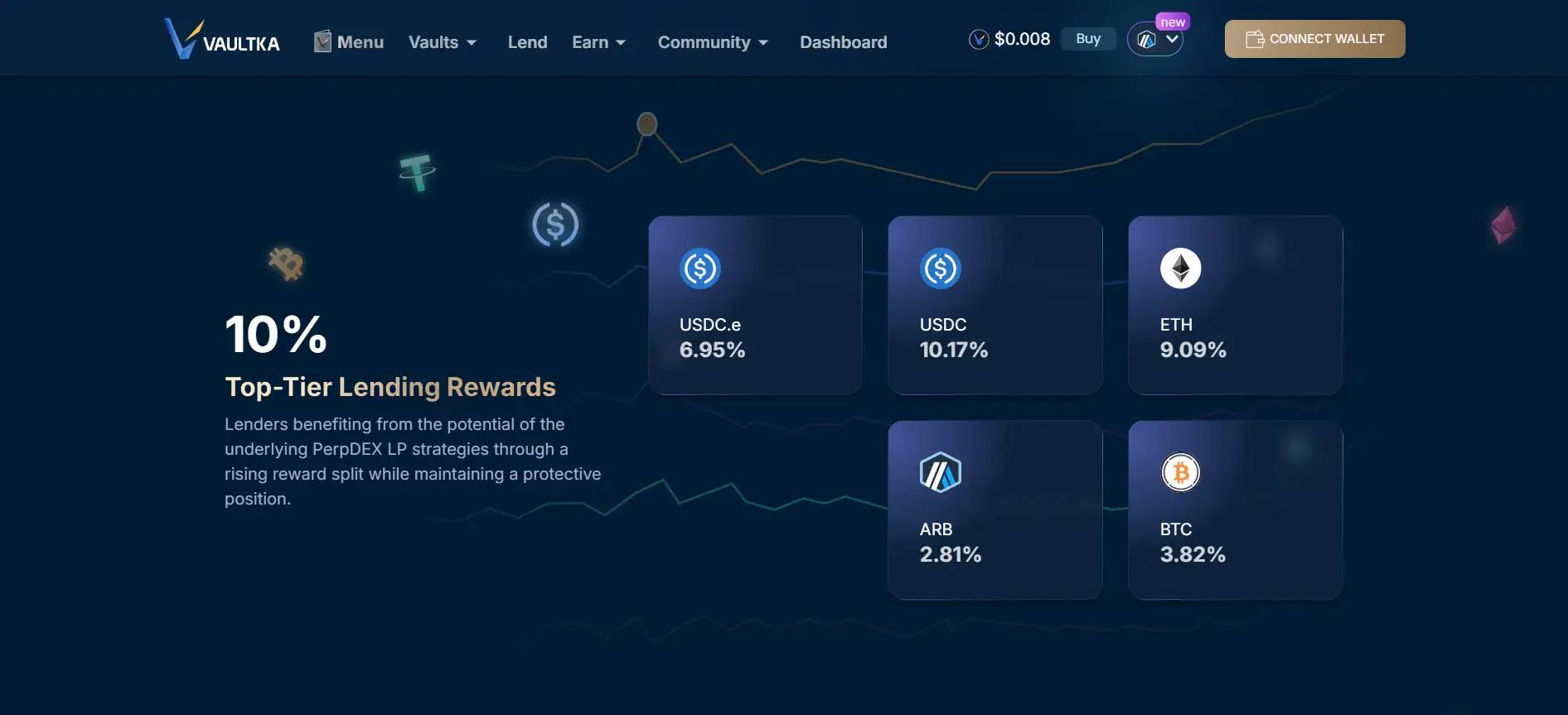

With Vaultka V2, the platform introduces a lending layer with collateralized borrowing, dynamic interest rates, and treasury-backed liquidity, offering capital efficiency and high-yield opportunities in one-click strategies like 6.66x JLP leverage. The protocol is also expanding to Solana, leveraging Jupiter Perpetuals and LSTs for new product rollouts.

Compared to competitors such as Ribbon Finance, Pendle, and Gearbox, Vaultka stands apart with its Perp DEX-exclusive positioning, full product stack (from LP strategy to lending), and simplified execution model. It’s not just another yield protocol—it’s the Perp DEX liquidity layer.

Vaultka provides a highly curated suite of features and advantages that differentiate it in the DeFi and Perp DEX landscape:

- Specialized Perp DEX Focus: Entire protocol tailored to maximizing capital efficiency across perpetual exchanges on Arbitrum and beyond.

- Liquor Series Vaults: Includes delta-neutral, leveraged, and compounding vaults for GLP, GM, HLP, and other Perp LP tokens.

- Index Token Products: Cocktail Series allows diversified exposure through LP and governance token indexes.

- Stablecoin Lending Vaults: Backed by lending interest models such as pay-in-advance and reward-split based on utilization.

- Dynamic Analytics Suite: Bartender aggregates critical protocol and market metrics for informed decision-making.

- Vaultka V2: Introduces collateralized lending, leveraged yield strategies, and enhanced capital reuse.

- Enterprise-Grade Security: Audited by Hacken, Zokyo, and Halborn, with proactive threat detection via Hypernative.

- Multichain Expansion: Rooted in Arbitrum, but expanding to Solana with LST and JLP strategies.

Vaultka makes it easy to start earning real yield from Perp DEX LPs with its streamlined onboarding:

- Connect Wallet: Head to Vaultka and connect your wallet (supports Arbitrum and soon Solana).

- Select a Vault: Choose from the Liquor, Cocktail, or Non-Alcoholic series based on your risk appetite and strategy type.

- Deposit Tokens: Allocate Perp DEX LPs or stablecoins into your chosen vault using the simple UI.

- Enable Strategies: Click to activate strategies like delta-neutral compounding, leveraged yield farming, or index exposure.

- Monitor & Adjust: Use the Bartender page to track performance, returns, and key metrics across your vaults.

- Explore Lending: For conservative users, lend USDC.e or gDAI to support vault strategies and earn predictable interest.

- Join the Community: Follow Vaultka’s socials for updates, new vault launches, and ecosystem campaigns.

Vaultka FAQ

Vaultka’s Liquor Series is engineered for users looking to engage with Perp DEX LPs through automated, risk-adjusted vault strategies. Unlike traditional AMM strategies, Liquor vaults focus on perpetual derivatives, offering delta-neutral and leveraged exposure to platforms like GMX, Gains, and Vela. These vaults use smart contracts to auto-hedge market risk and optimize yield—empowering users with one-click access to complex trading mechanisms within the Vaultka ecosystem.

The Non-Alcoholic Series in Vaultka is designed for stablecoin holders seeking secure returns while supporting leveraged vaults. These lending vaults fund Liquor Series strategies and operate under two models: Reward Split and Pay-in-Advance. Rates are dynamically determined by utilization and vault performance, ensuring capital preservation with a passive income profile. It’s ideal for users looking for exposure to Perp DEX yields without taking on market volatility.

Perp DEX LPs differ fundamentally from AMM DEXs because they don’t pair volatile tokens. Platforms like GMX V2 and Vela use stablecoin or asset-specific liquidity pools, which means Vaultka’s LP strategies face zero impermanent loss. This allows users to earn consistent protocol fees and trader PnL exposure without worrying about underlying price divergence—making Vaultka vaults structurally safer than traditional DEX farming options.

Vaultka V2 introduces advanced DeFi features like collateralized borrowing, dynamic interest rates, and one-click leveraged strategies. Users can now deposit assets, borrow against them, and reinvest all within the protocol—maximizing ROI without capital withdrawal. V2 also supports JLP-based high-yield strategies and treasury-backed liquidity, reinforcing both safety and scalability within the Vaultka ecosystem.

Vaultka provides its proprietary analytics suite—Bartender—to deliver real-time insights into the Perp DEX ecosystem. It compiles data like funding rates, LP yield, open interest ratios, and upcoming protocol upgrades. Whether you're a trader, investor, or liquidity provider, Bartender empowers you to stay ahead with performance benchmarks and strategic overviews—directly integrated into the Vaultka dashboard.

You Might Also Like