About Veda

Veda is a powerful native yield infrastructure designed to simplify complex DeFi operations for protocols and end users. By abstracting away traditional interactions with underlying DeFi primitives, Veda enables a seamless experience where yield is natively embedded in the protocol and user interfaces.

Whether through DeFi strategists or AI-driven automation, Veda tokenizes yield generation and integrates it directly into dApps, wallets, and vaults. This positions the platform as a foundational layer for the next generation of DeFi applications, where yield is no longer a separate step but a built-in protocol feature.

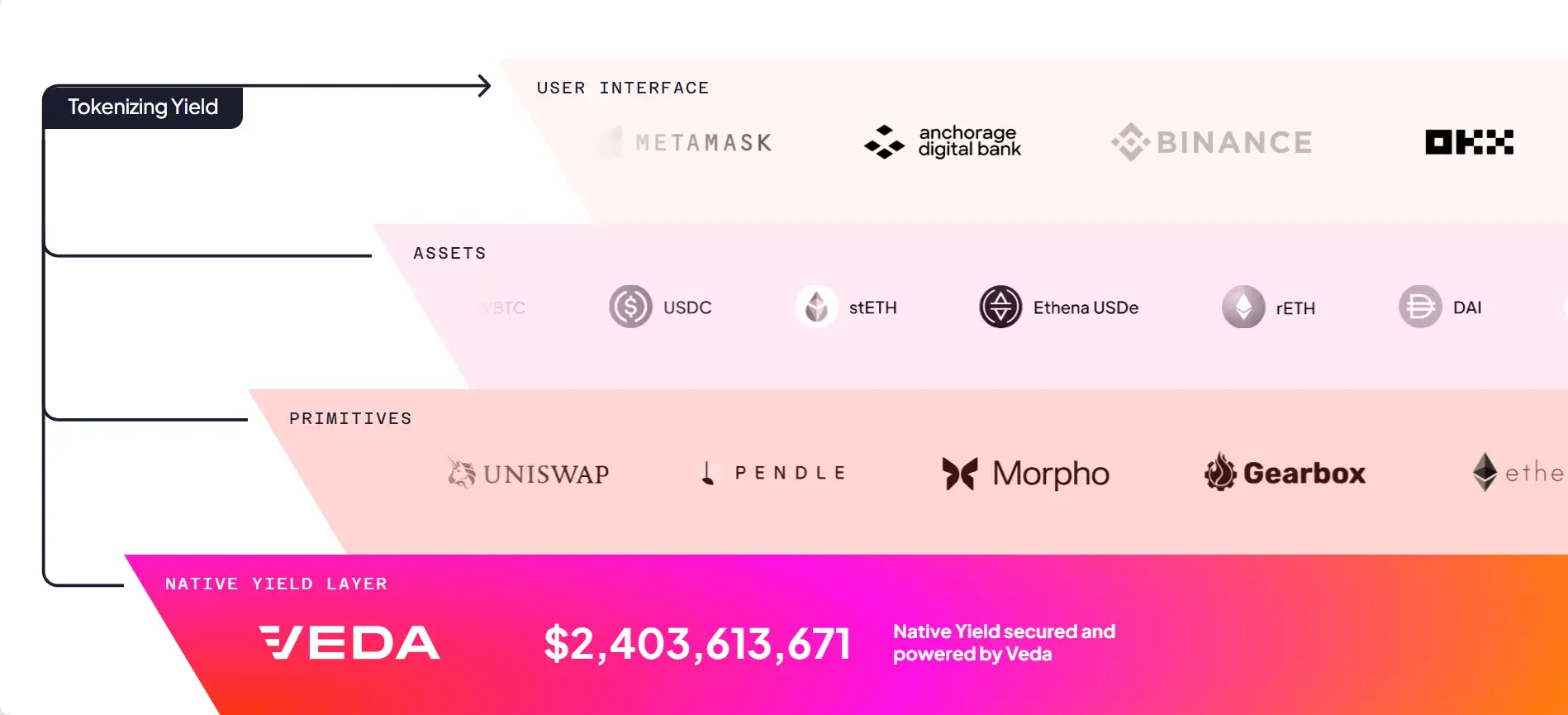

Veda offers a revolutionary approach to on-chain yield generation by building a native infrastructure layer that tokenizes and abstracts DeFi complexity. Rather than asking users to navigate dozens of protocols, manage LP positions, or switch between assets, Veda transforms these processes into a smooth, backend experience. Through its modular architecture, Veda connects capital to strategies in real-time, offering dynamic allocations, risk controls, and cross-chain functionality—all behind a single interface.

The core architecture includes a Native Yield Layer that secures and automates capital deployment across multiple DeFi strategies. For users, this results in higher yields, lower gas fees (thanks to batch transaction processing), and simplified onboarding. For protocols, it offers the ability to plug in natively to Veda’s infrastructure and immediately offer embedded yield, eliminating the friction of user education or custom integrations. This significantly increases both conversion and retention for DeFi applications.

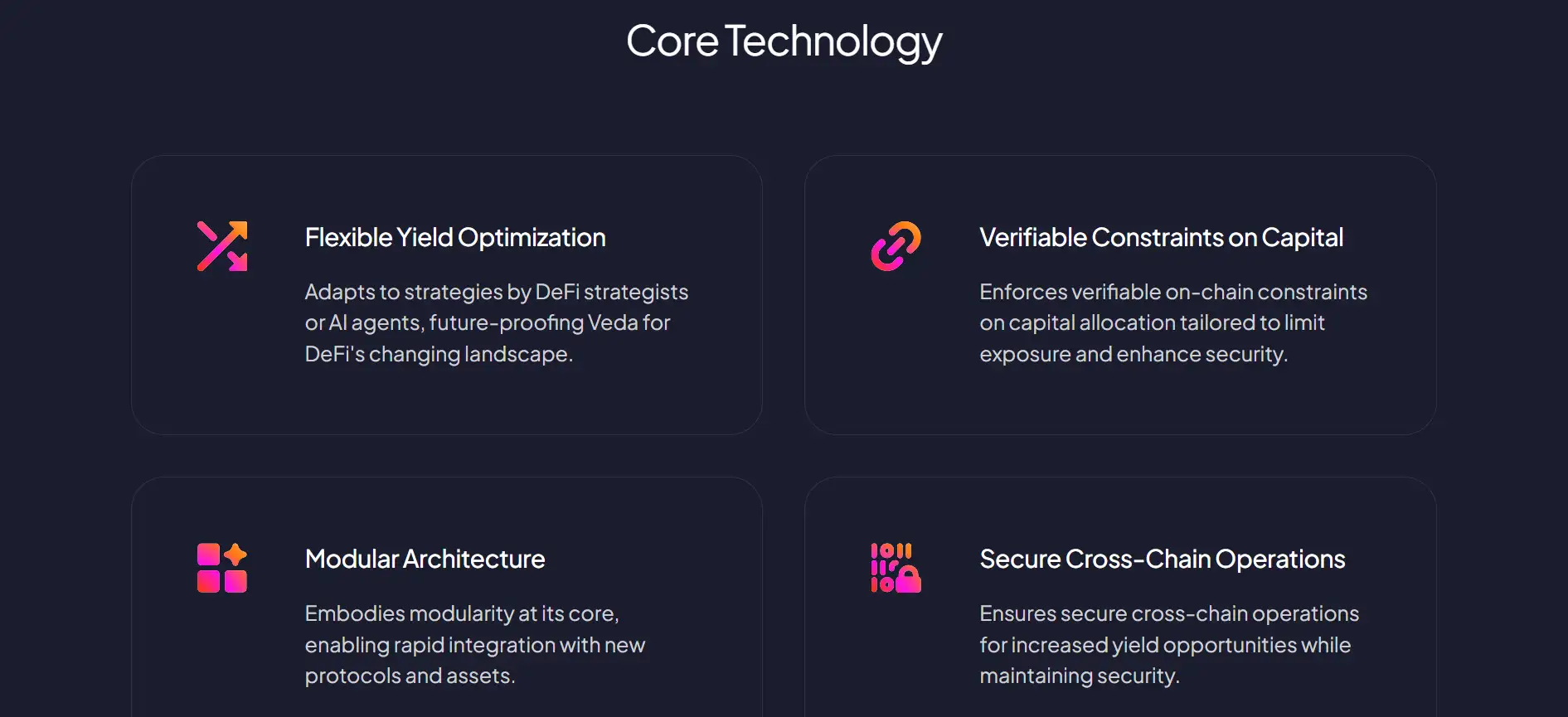

The technology stack powering Veda features several key innovations: Flexible Yield Optimization, which allows strategists and AI agents to optimize return profiles; Verifiable On-Chain Constraints for secure capital management; Secure Cross-Chain Capabilities for liquidity allocation across Ethereum L1 and L2s; and an inherently modular system that ensures seamless integration with new strategies and protocols as DeFi evolves.

By acting as a middleware between assets and strategy, Veda helps protocol builders focus on UX while ensuring back-end sophistication. It has already enabled integrations with EtherFi Liquid, pumpBTC, Bedrock, and Lombard, unlocking new DeFi vaults for assets like Bitcoin and modular tokens like cmETH and scUSD. These partnerships validate Veda’s potential as the de facto yield layer across the modular and cross-chain DeFi landscape. Key players offering similar capabilities include yearn.fi, Enzyme, and Balancer, but none combine yield tokenization, UI integration, and cross-chain flexibility as natively as Veda does.

Veda provides numerous benefits and features that position it as a core infrastructure layer in the modular DeFi economy:

- Tokenized Yield: Protocols and dApps can embed automated yield generation into their UI, offering users a frictionless experience without technical knowledge of underlying DeFi strategies.

- Cross-Chain Liquidity Allocation: A single vault on Ethereum Mainnet can deploy capital across all supported L2s, removing the complexity of bridging and liquidity fragmentation.

- Modular Infrastructure: Veda’s architecture is built for rapid integration with any DeFi strategy, asset, or protocol, allowing futureproof scalability.

- AI-Driven Optimization: Yield strategies can be managed by flexible algorithms or autonomous agents to ensure performance and risk alignment.

- Verifiable Capital Constraints: Capital management is enforced by smart contracts that apply strict rules for exposure, improving trust and stability.

- Low Gas and UX Improvements: Users benefit from gasless rebalancing and a consistent UX, which increases retention and onboarding across ecosystems.

- Secure Integrations: Each vault and capital strategy is verifiably safe, with security-first principles baked into cross-chain operations.

- DeFi Ecosystem Support: Already integrated with prominent DeFi products like Ether.Fi and pumpBTC, confirming adoption across multiple sectors.

Veda is easy to integrate and use, whether you're a protocol builder or an end user:

- For Users: Head over to the Veda website and click “Launch App” to explore available vaults.

- Connect Wallet: Use a supported wallet (e.g., MetaMask) to connect to the platform and view your eligible assets and opportunities.

- Deposit Assets: Select the token (e.g., ETH, BTC, scUSD) you wish to deposit and choose from available vaults that suit your risk/reward preference.

- Earn Yield: Once deposited, your assets are deployed via Veda’s infrastructure, earning optimized yield without further manual input.

- Track Performance: Use the interface to monitor returns, switch vaults, or redeem your assets at any time.

- For Builders: Integrate Veda's SDK or APIs into your app to offer native yield to your users. Start by reading the Veda Documentation.

- Join the Community: Engage with the team on Discord or follow updates via Veda's Blog.

Veda FAQ

Veda offers native cross-chain liquidity deployment, allowing vaults on Ethereum Mainnet to allocate capital across supported L2s without requiring the user to manually bridge assets. By abstracting the bridging process within its infrastructure, Veda eliminates friction and significantly improves the user experience, making cross-chain DeFi participation seamless and secure.

Veda vaults are built with a dual audience in mind: beginners benefit from automated vault strategies and gasless rebalancing, while advanced users can choose more specialized vaults, configure risk parameters, or integrate directly via APIs. This balance ensures accessibility without sacrificing control, making it a versatile tool across experience levels.

AI agents can be plugged into Veda’s modular backend to optimize yield strategies in real-time. These agents assess liquidity conditions, APYs, and risk factors, then adjust allocations accordingly. This dynamic integration allows Veda to adapt to rapidly changing DeFi conditions and maintain high performance while staying secure.

Yes, Veda is designed to be natively cross-chain. Protocols on rollups, L2s, and even non-EVM compatible chains can integrate with Veda’s infrastructure. Its modular framework supports flexible deployment, allowing ecosystem builders to embed native yield in their apps regardless of the base chain.

Veda applies verifiable on-chain constraints and real-time monitoring to ensure each vault adheres to strict security parameters. Capital allocation rules are enforced through smart contracts, and off-chain strategies are governed by constraints that limit exposure. This approach gives users and protocols confidence in the long-term stability of Veda yield products.

You Might Also Like