About Veno Finance

Veno Finance is a cutting-edge platform specializing in secure and straightforward liquid staking. The project’s mission is to offer users a seamless way to stake their tokens while receiving liquid tokens in return. These liquid tokens can be used across various protocols to maximize staking rewards and enhance overall yield.

At its core, Veno Finance aims to simplify the staking process, making it accessible to a broader audience. The platform achieves this by integrating with multiple blockchain networks, providing users with diverse staking options and opportunities. By focusing on security and performance, Veno Finance ensures that users can trust the platform with their assets.

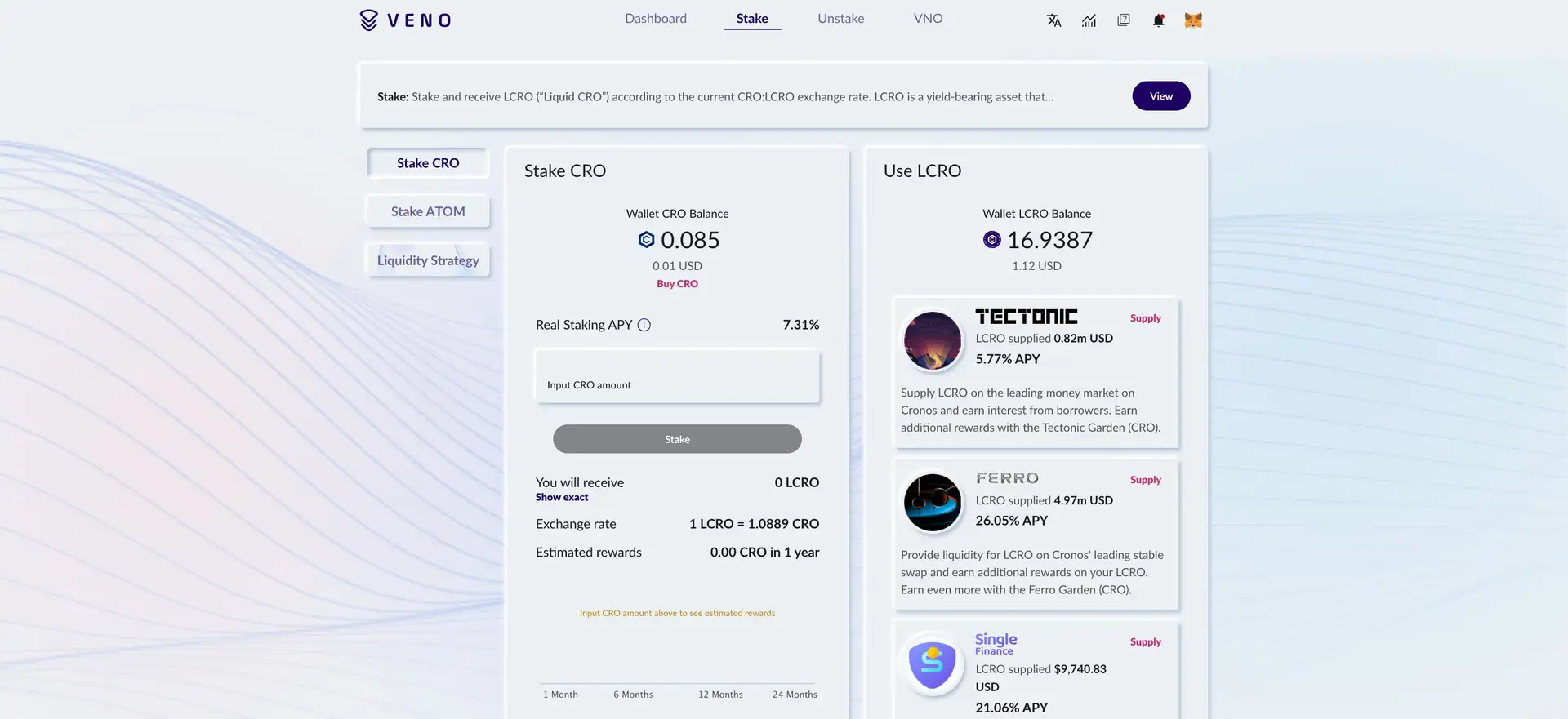

The significance of Veno Finance in the industry lies in its ability to offer enhanced staking rewards through ecosystem partnerships. Users can stake tokens such as CRO, ATOM, ETH, and TIA, receiving corresponding liquid tokens like LCRO, LATOM, LETH, and LTIA. These liquid tokens can be leveraged across partner protocols, providing users with additional avenues to boost their APY.

Overall, Veno Finance is dedicated to creating a robust and user-friendly liquid staking solution that caters to both novice and experienced users. By focusing on ease of use, security, and integration with various blockchain networks, the platform stands out as a leader in the liquid staking space.

Veno Finance has quickly established itself as a notable player in the liquid staking industry. Since its inception, the project has achieved significant milestones, including the integration of multiple blockchain networks and the successful launch of its native token, VNO. This growth trajectory highlights the platform’s commitment to innovation and user-centric development.

The history of Veno Finance is marked by strategic partnerships and continuous improvement. By collaborating with key players in the blockchain ecosystem, Veno Finance has expanded its reach and enhanced its offerings. This collaborative approach has enabled the platform to provide users with a comprehensive staking solution that delivers both security and high performance.

One of the major milestones for Veno Finance was the introduction of its liquid staking service. This feature allows users to stake their tokens and receive liquid tokens in return, which can then be utilized across various protocols for additional rewards. The liquid staking model is designed to offer flexibility and maximize the earning potential for users.

Another significant development in the project’s timeline is the launch of the VNO token. This native token plays a crucial role in the ecosystem, providing various utilities and rewards for users. The introduction of VNO has further strengthened the platform’s value proposition, offering users more incentives to participate in the Veno Finance ecosystem.

In terms of competition, Veno Finance faces rivals like Lido and Rocket Pool. These platforms also offer liquid staking solutions, but Veno Finance differentiates itself through its unique features, such as the use of NFTs for unbonding periods and its extensive ecosystem partnerships.

Moreover, the platform’s focus on security and performance sets it apart from competitors. By utilizing enterprise-grade staking infrastructure, Veno Finance ensures that users’ assets are safe and the staking process is efficient. This commitment to excellence has earned the platform a reputation as a reliable and trustworthy staking solution.

Looking ahead, Veno Finance aims to continue its growth and expansion. The project plans to introduce new features and enhancements that will further improve the user experience and increase the platform’s utility. With a strong foundation and a clear vision for the future, Veno Finance is well-positioned to lead the liquid staking industry.

- Liquid Staking: Stake tokens and receive liquid tokens in return, allowing for flexible use across various protocols.

- Enhanced Rewards: Boost APY through integration with ecosystem partners, providing additional opportunities for earning rewards.

- Security: Enterprise-grade staking infrastructure ensures high performance and security, protecting users' assets.

- Utility Token: VNO provides additional rewards and liquidity incentives, enhancing the overall value of the platform.

- Multi-Network Support: Compatible with various blockchain networks, including Cronos, Cosmos, Ethereum, and Celestia, offering users diverse staking options.

- Community Governance: Holders of the VNO token can participate in governance, voting on key proposals and decisions affecting the platform.

- NFT Integration: Users receive NFTs during the unbonding period, which can be exchanged for their original tokens once the period ends, adding a unique and innovative feature to the staking process.

- Visit the Veno Finance website and familiarize yourself with the platform.

- Click on "Connect Wallet" at the top right corner of the page.

- Select your preferred wallet (e.g., Metamask, WalletConnect) and follow the prompts to connect it to the platform.

- Once your wallet is connected, navigate to the staking section of the platform.

- Choose the token you wish to stake from the available options (e.g., CRO, ATOM, ETH, TIA).

- Enter the amount you wish to stake and confirm the transaction through your wallet.

- After staking, you will receive liquid tokens (e.g., LCRO, LATOM, LETH, LTIA) in your wallet.

- You can use these liquid tokens across partner protocols to maximize your staking rewards.

- To unstake, go to the unstaking section and follow the prompts. You will receive an NFT representing your stake during the unbonding period, which can be exchanged for your original tokens once the period ends.

Veno Finance Token

Veno Finance Reviews by Real Users

Veno Finance FAQ

Veno Finance stands out in the liquid staking market due to its innovative integration of NFTs for unbonding periods. This unique feature allows users to receive NFTs representing their staked assets during the unbonding period, which can be traded or exchanged for the original tokens once the period ends. Additionally, Veno Finance offers enhanced rewards through strategic ecosystem partnerships and supports multiple blockchain networks, providing users with diverse staking options.

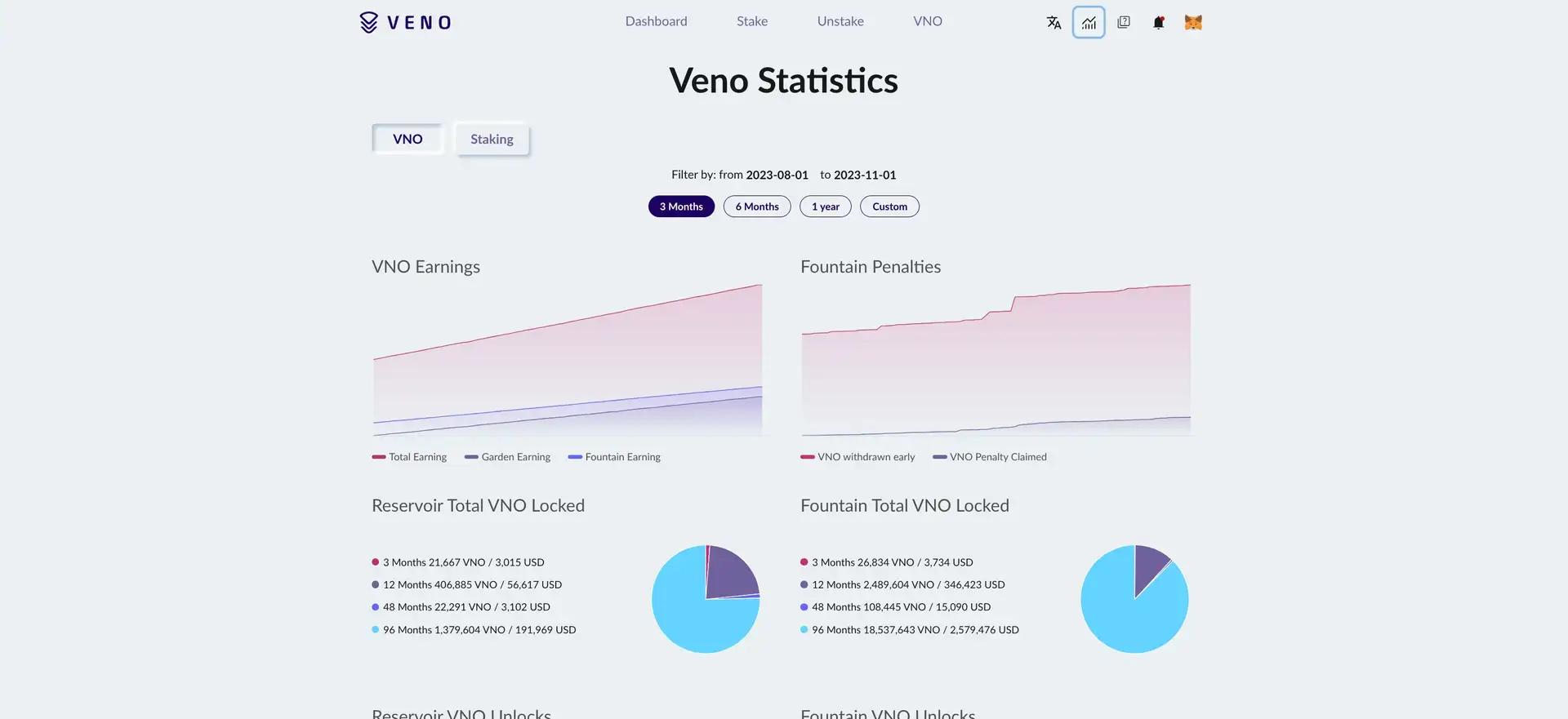

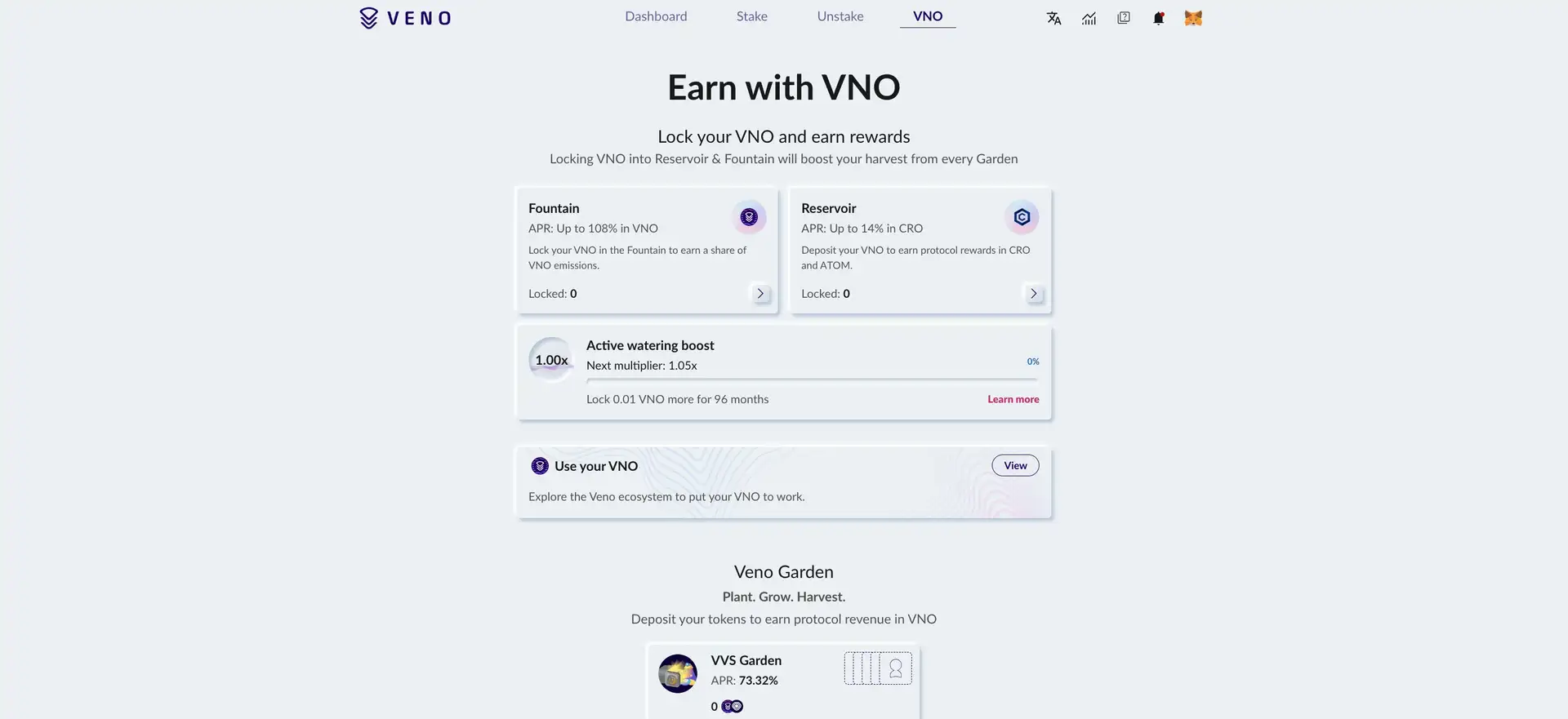

The Reservoir mechanism on Veno Finance allows users to lock their VNO tokens to earn real yield rewards in ATOM and WCRO. By participating in the Reservoir, users can benefit from the platform’s yield-generating strategies, which are designed to maximize returns. This mechanism incentivizes long-term holding of VNO tokens and provides an additional layer of earning potential for participants.

Yes, liquid tokens received from staking on Veno Finance can be used across various decentralized applications (dApps) within the partner ecosystem. These liquid tokens, such as LCRO, LATOM, LETH, and LTIA, offer flexibility and enable users to participate in yield farming, liquidity provision, and other activities on partner protocols, thereby enhancing their overall staking rewards.

During the unbonding period on Veno Finance, users receive an NFT that represents their staked assets. This NFT can be held, traded, or exchanged for the original tokens once the unbonding period ends. This innovative approach provides users with a unique and tradable asset during the typically inactive unbonding period, adding an extra layer of utility and potential liquidity.

The VNO token offers multiple benefits within the Veno Finance ecosystem. It serves as a utility token, providing additional staking rewards, liquidity incentives, and governance rights. VNO holders can participate in platform governance, voting on key proposals and decisions. Additionally, VNO can be used in various yield-generating strategies, further enhancing its value and utility for users.

You Might Also Like