About Voltage Finance

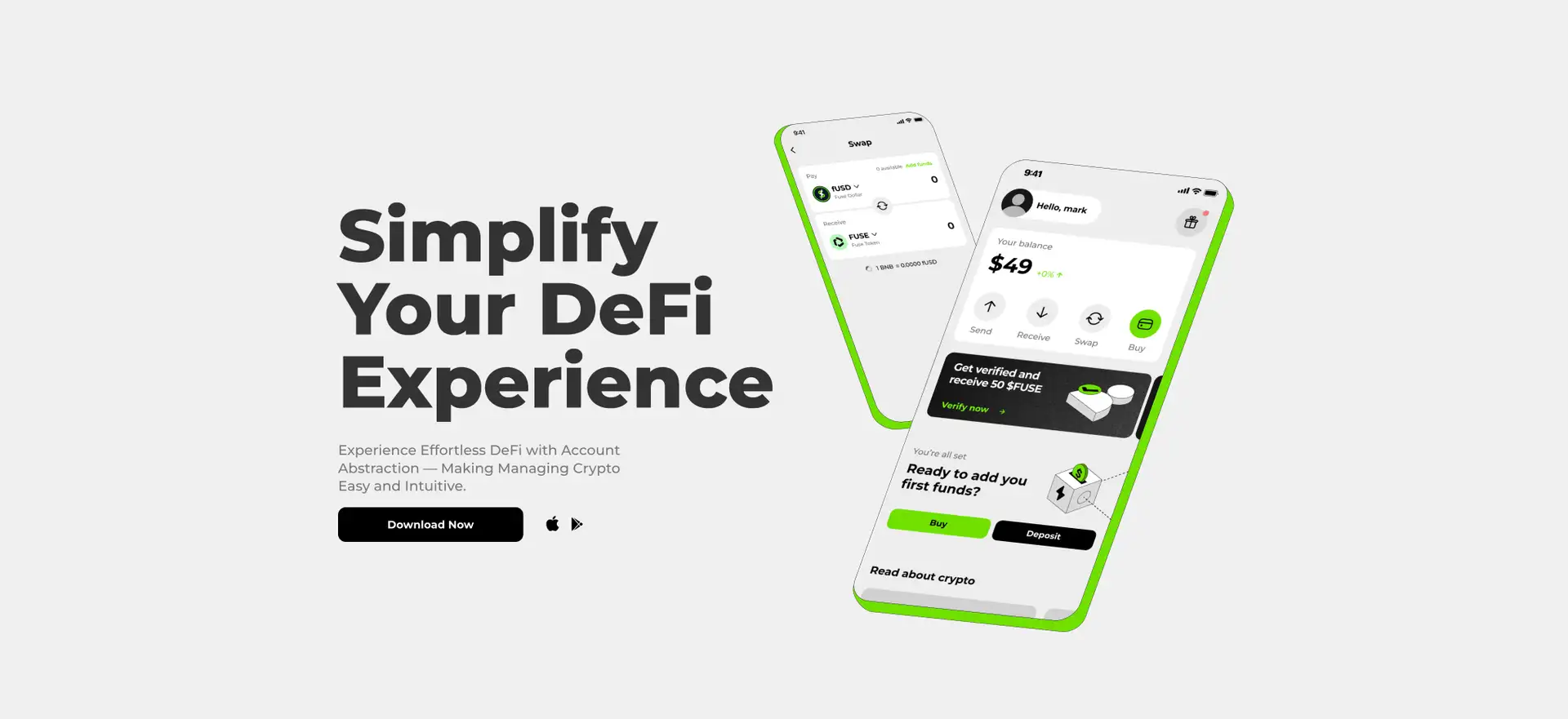

Voltage Finance is a decentralized exchange (DEX) and automated market maker (AMM) that operates on the Fuse Network. The project’s primary mission is to provide a seamless DeFi experience that is accessible to both seasoned users and newcomers. By leveraging the Fuse Network’s low fees and fast transaction times, Voltage Finance aims to remove barriers to entry for decentralized finance, offering tools that allow users to swap, stake, and farm tokens with minimal friction.

Voltage Finance stands out as a comprehensive DeFi platform that integrates a wide range of features under one roof. This includes token swaps, staking, yield farming, and community governance, all within a user-friendly interface. By focusing on decentralization and community-driven growth, Voltage Finance aspires to democratize financial access on a global scale. The platform's intuitive design ensures that even users new to the DeFi space can easily navigate and start benefiting from the ecosystem.

Voltage Finance is a next-generation decentralized exchange (DEX) and automated market maker (AMM) built on the Fuse Network, offering a robust suite of DeFi services. The platform launched with the goal of becoming a leading DeFi hub on the Fuse Network by providing low-cost, fast, and accessible financial services for users worldwide. The Fuse Network, known for its scalability and low fees, is an ideal environment for Voltage Finance, enabling seamless transactions and making DeFi more affordable and accessible.

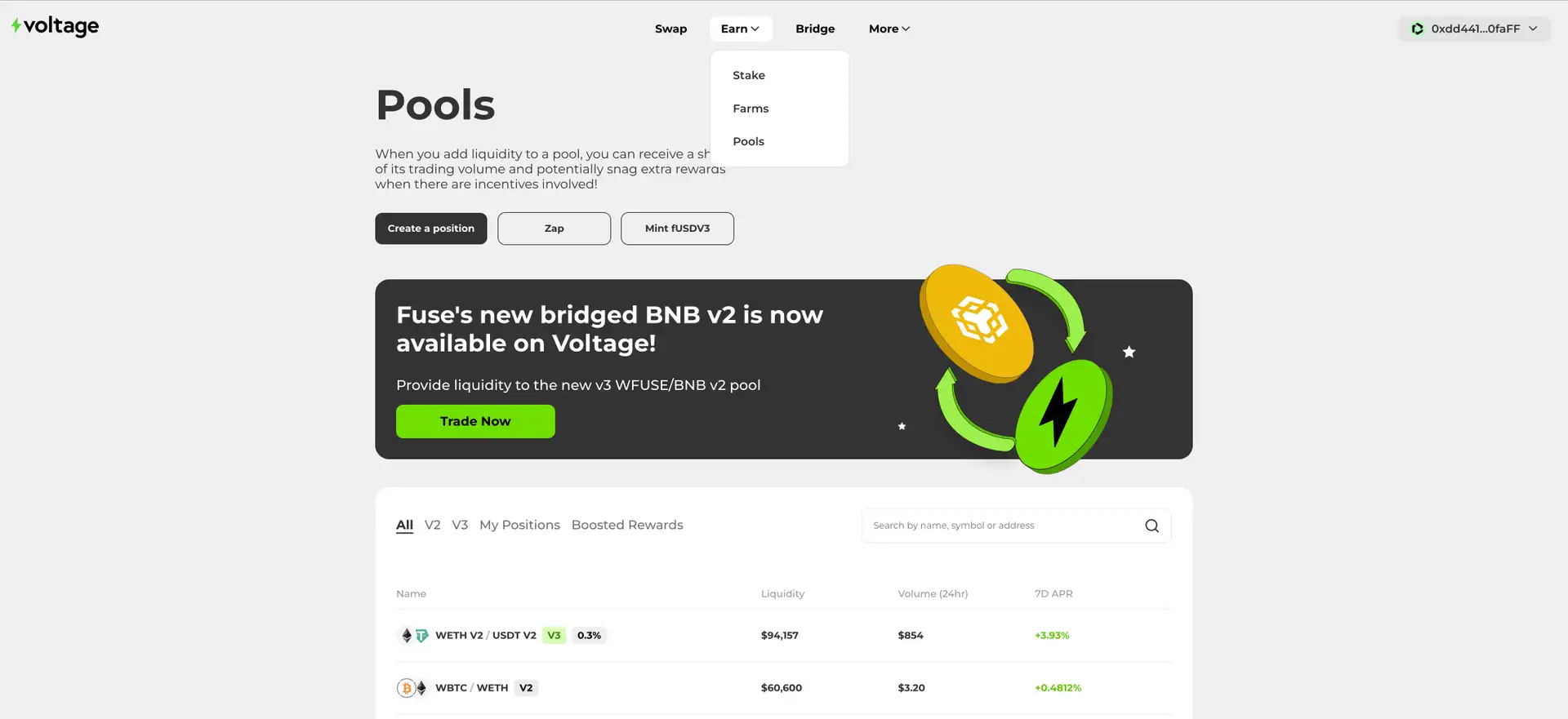

Voltage Finance’s history is marked by rapid development and community growth. Since its launch, the project has implemented multiple upgrades, introduced new liquidity pools, and rolled out community-driven governance. The platform has successfully integrated its native VOLT token into its operations, offering incentives for liquidity providers and stakers. The governance model ensures that users have a say in the platform’s direction, which has led to a vibrant, engaged community that actively participates in decision-making.

Voltage Finance competes not only with other DeFi platforms on the Fuse Network but also with major players like Uniswap, SushiSwap, and PancakeSwap. However, the platform differentiates itself by leveraging the unique advantages of the Fuse Network, such as reduced transaction costs and faster settlement times. The ability to offer lower fees and a more streamlined experience positions Voltage Finance as a strong competitor in the DeFi space.

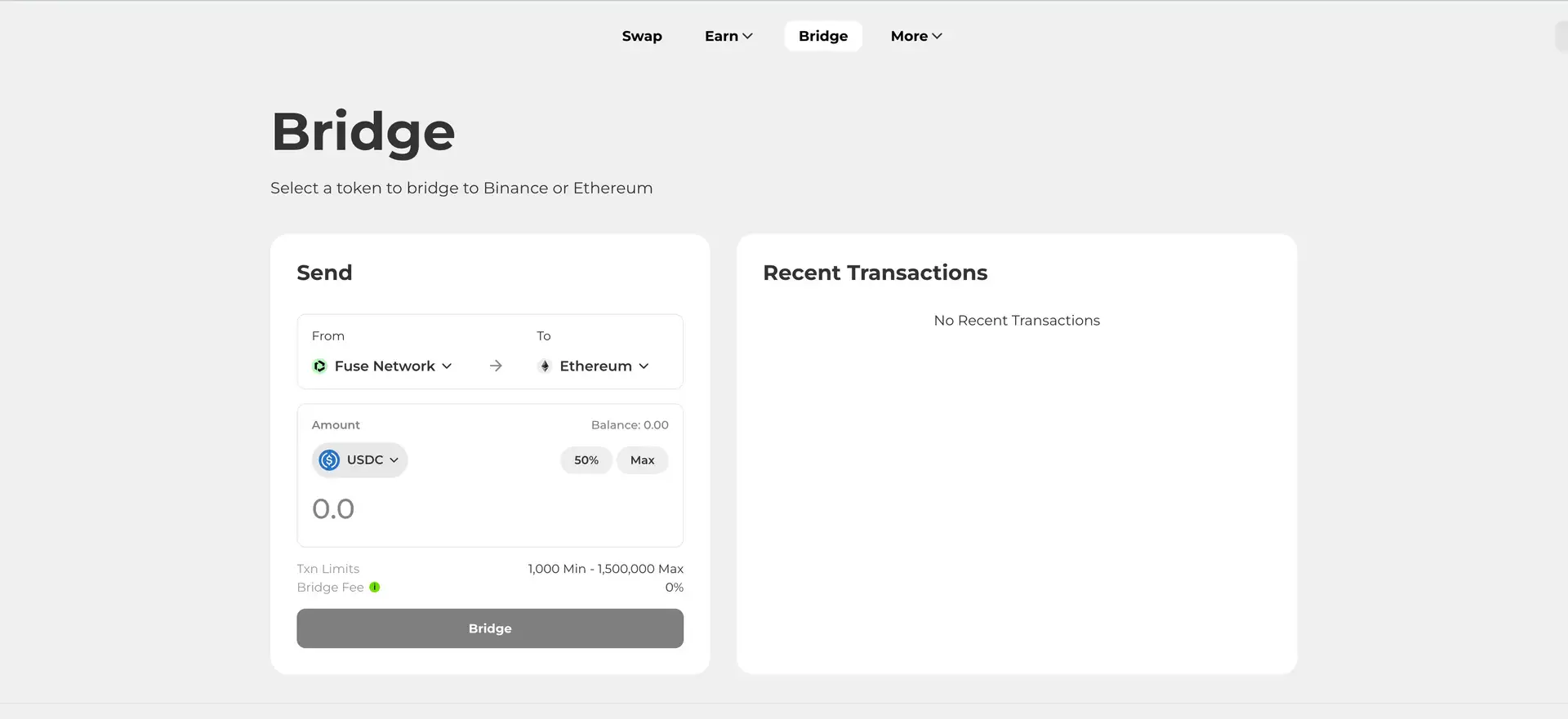

Key milestones include the successful launch of the VOLT token, the expansion of liquidity pools, and the introduction of community governance. As the platform continues to grow, it aims to integrate new features such as cross-chain compatibility and advanced trading tools. The development roadmap is ambitious, focusing on expanding the ecosystem while maintaining decentralization and community focus. Additionally, partnerships and strategic collaborations are in place to broaden the platform’s reach and utility.

Looking ahead, Voltage Finance plans to enhance user experience by introducing more intuitive interfaces, deeper integration with other Fuse Network projects, and educational resources aimed at onboarding new users into the DeFi world. By prioritizing user experience and fostering an inclusive community, Voltage Finance is well-positioned to become a dominant force in the decentralized finance landscape.

- Low Fees and High-Speed Transactions: The platform leverages the Fuse Network’s scalable infrastructure, offering users low gas fees and faster transaction times compared to other blockchains.

- Comprehensive DeFi Services: Voltage Finance provides a full range of decentralized finance tools, including token swaps, staking, yield farming, and community governance, all within one platform.

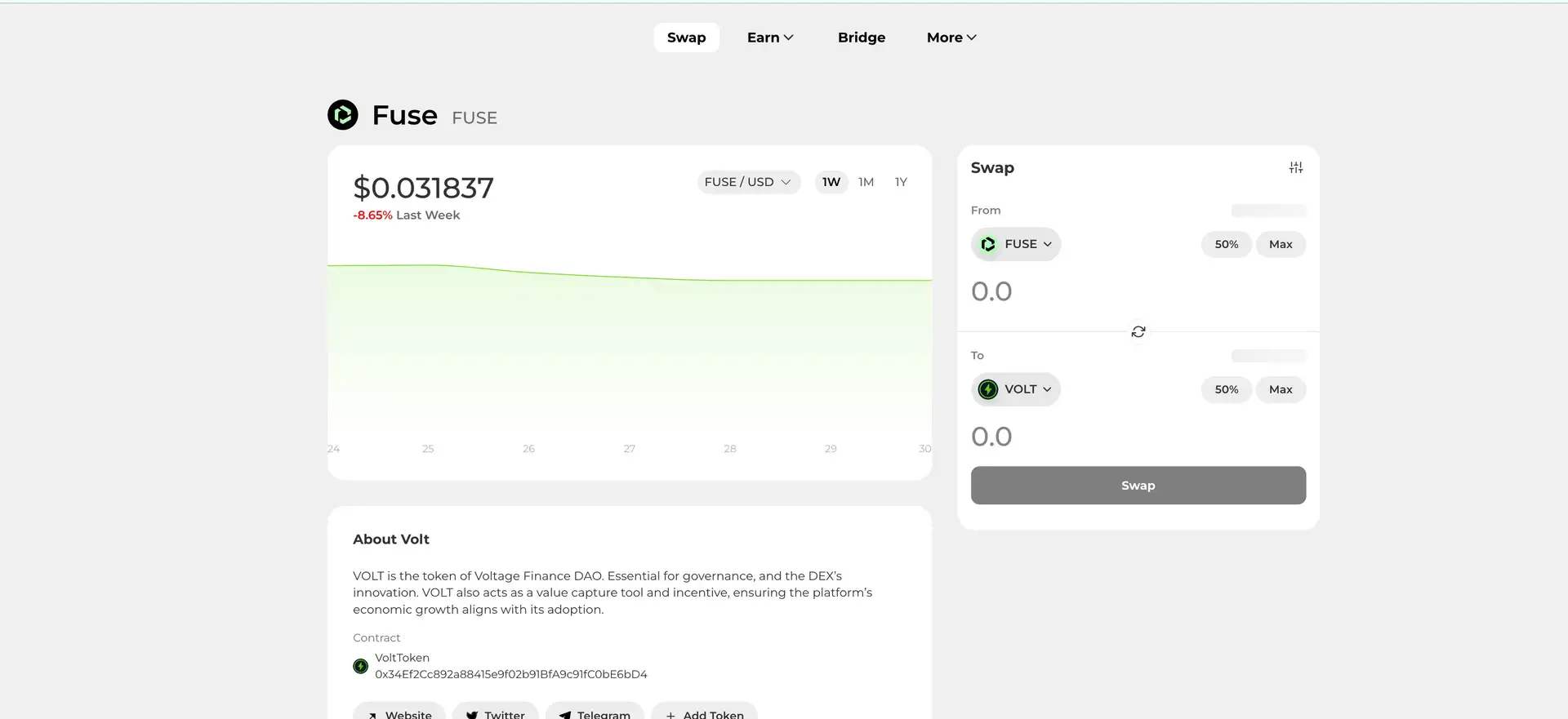

- Decentralized Governance: VOLT token holders have voting rights that allow them to influence key platform decisions, ensuring that Voltage Finance remains decentralized and community-focused.

- Incentives for Liquidity Providers and Stakers: The platform offers attractive rewards for those who contribute liquidity or stake VOLT tokens, making it a compelling choice for yield farming.

- User-Friendly Interface: Despite offering a broad array of features, Voltage Finance maintains an intuitive design that makes it easy for both new and experienced users to navigate the platform.

- Scalability and Future Growth: The platform’s roadmap includes expanding cross-chain compatibility, introducing new liquidity pools, and offering advanced trading features, ensuring long-term viability.

- Set Up a Wallet: To begin, users need to create a Fuse-compatible wallet like MetaMask or another supported wallet. MetaMask is popular because it can be easily configured to connect to the Fuse Network.

- Connect Your Wallet to Voltage Finance: Once your wallet is ready, visit the Voltage Finance website and connect your wallet. The platform’s interface will prompt you to connect automatically if not already done.

- Acquire Fuse and VOLT Tokens: You will need Fuse tokens to cover transaction fees and VOLT tokens to participate in staking and governance. These tokens can be obtained through Voltage Finance’s DEX or other compatible decentralized exchanges.

- Explore the Platform’s Features: After acquiring the necessary tokens, you can start swapping, staking, or providing liquidity directly on the platform. Voltage Finance offers detailed guides in its documentation to help users maximize their experience.

- Participate in Governance: By holding VOLT tokens, you can take part in decentralized governance by voting on platform proposals. Simply navigate to the governance section within the interface to view ongoing proposals and cast your vote.

- Leverage Yield Farming and Staking: Voltage Finance offers multiple pools where users can stake their tokens to earn rewards. Explore the available options and select a pool that aligns with your strategy.

- Stay Updated: To get the most out of Voltage Finance, regularly check for updates, new features, and community proposals through their documentation and official channels.

Voltage Finance Token

Voltage Finance Reviews by Real Users

Voltage Finance FAQ

The VOLT token is not just for governance; it’s a multipurpose asset within the Voltage Finance ecosystem. Users can stake VOLT to earn rewards, participate in liquidity mining, and unlock special features. By staking VOLT, users can gain access to exclusive opportunities, higher yields, and other incentives that go beyond voting rights.

Voltage Finance focuses on delivering a seamless user experience with low fees and high-speed transactions thanks to the Fuse Network. By offering an intuitive interface, simplified onboarding, and accessible educational resources, the platform is designed to be approachable even for those new to decentralized finance. Additionally, Voltage Finance prioritizes community-driven development, ensuring that users' needs are reflected in ongoing platform improvements.

Unlike many DEXs that suffer from high gas fees and slow transactions, Voltage Finance leverages the Fuse Network to provide a more efficient and cost-effective experience. The platform's focus on community governance, combined with its ability to offer scalable DeFi services, gives it a unique edge in the crowded market. Voltage Finance is also designed with user education in mind, offering resources that guide users through every aspect of the platform, making it more accessible.

Through the decentralized governance model powered by the VOLT token, every user has a say in the platform’s future. Unlike some governance models where only major stakeholders have influence, Voltage Finance offers a truly democratic voting system where even small token holders can propose and vote on changes. This approach fosters a more inclusive community and ensures that the platform evolves based on real user needs and ideas.

The long-term vision of Voltage Finance is to become a fully decentralized and self-sustaining DeFi ecosystem that scales with user adoption. As the platform grows, it plans to introduce cross-chain compatibility, new liquidity pools, and advanced trading tools while keeping transaction costs low. The goal is to continuously adapt and expand while remaining community-focused, ensuring Voltage Finance stays ahead in a rapidly evolving DeFi landscape.

You Might Also Like