About WBTC

Wrapped Bitcoin (WBTC) is a blockchain-based asset that bridges Bitcoin and Ethereum, allowing Bitcoin holders to interact with the Ethereum ecosystem through a tokenized representation of BTC. By converting BTC to an ERC-20 compatible token, WBTC enables users to leverage the liquidity and value of Bitcoin across DeFi platforms, lending protocols, DEXs, and smart contracts on Ethereum and other chains.

Each WBTC token is backed 1:1 with actual Bitcoin and can be redeemed at any time, providing full transparency through on-chain proof of reserves. Jointly initiated by BitGo, Kyber Network, and Ren, and governed by the WBTC DAO, this protocol-driven project has become a crucial liquidity bridge between Bitcoin and decentralized finance.

Wrapped Bitcoin (WBTC) was launched in 2019 as the first tokenized version of Bitcoin on the Ethereum blockchain. The goal was to solve a key limitation of Bitcoin—its lack of programmability—by wrapping it into an ERC-20 token, allowing seamless integration with Ethereum-based applications. As the popularity of decentralized finance (DeFi) surged, the importance of a Bitcoin equivalent within the Ethereum ecosystem became more evident, and WBTC quickly became the most widely adopted solution.

The project is supported by an alliance of partners including BitGo (custody provider), Kyber Network (liquidity provider), and Ren (interoperability protocol). These entities form part of the Wrapped Tokens DAO, a decentralized governance structure that manages the addition and removal of custodians and merchants via a multi-signature contract. This transparent and decentralized approach ensures that the WBTC system remains secure, scalable, and community-driven.

A standout feature of WBTC is its complete on-chain transparency. Every action—minting, burning, and transfer—is recorded and verifiable through the WBTC dashboard. All WBTC tokens in circulation are 100% backed by Bitcoin held in custody, and users can verify this at any time through publicly available records. This high level of transparency builds trust among users, institutions, and developers alike.

Over time, WBTC has expanded to support multiple chains beyond Ethereum, including Solana, Base, Kava, and Osmosis, boosting its cross-chain utility and interoperability. By doing so, WBTC continues to fulfill its mission to make Bitcoin more accessible and useful in modern blockchain ecosystems.

In the broader ecosystem, WBTC can be compared to other tokenized Bitcoin protocols such as RenBTC, BTCB (by Binance), and tBTC (by Threshold Network). However, WBTC stands out due to its maturity, transparency, DAO governance, and wide adoption across DeFi protocols including Uniswap, Compound, MakerDAO, and Curve.

Wrapped Bitcoin (WBTC) provides numerous benefits and features that make it a cornerstone of the DeFi space:

- 100% Bitcoin-Backed: Every WBTC token is backed 1:1 with Bitcoin, held in custody by trusted entities such as BitGo. This ensures security, trust, and full redemption capability.

- On-Chain Transparency: All minting and burning events are publicly verifiable via the WBTC Dashboard, giving users confidence in the system’s legitimacy.

- DeFi Compatibility: WBTC is compatible with Ethereum-based dApps including Uniswap, Aave, Compound, and MakerDAO, opening up a wide array of use cases like lending, borrowing, and trading.

- Cross-Chain Expansion: WBTC is now available on Solana, Base, Kava, and Osmosis, enhancing its utility across ecosystems.

- Community-Driven Governance: Governed by the Wrapped Tokens DAO, decisions around custodians, merchants, and protocol changes are handled via a decentralized, multi-signature governance process.

- Institutional Support: Backed and utilized by reputable entities like FalconX, Wintermute, CoinList, and Galaxy, WBTC is trusted by large financial players.

Getting started with Wrapped Bitcoin (WBTC) is straightforward for both retail users and institutions looking to interact with Bitcoin in the DeFi ecosystem:

- Get a Wallet: Use an Ethereum-compatible wallet like MetaMask, Coinbase Wallet, or Trust Wallet to store and interact with WBTC.

- Acquire WBTC: You can buy WBTC on major exchanges such as Binance, Coinbase, or via decentralized platforms like Uniswap.

- Use WBTC in DeFi: Once acquired, you can use WBTC in DeFi protocols like Aave, Compound, Sky.Money, or Curve to earn yield, take out loans, or provide liquidity.

- Check WBTC Reserves: For added trust, users can always visit the WBTC Dashboard to verify that every token in circulation is fully backed by Bitcoin held by custodians.

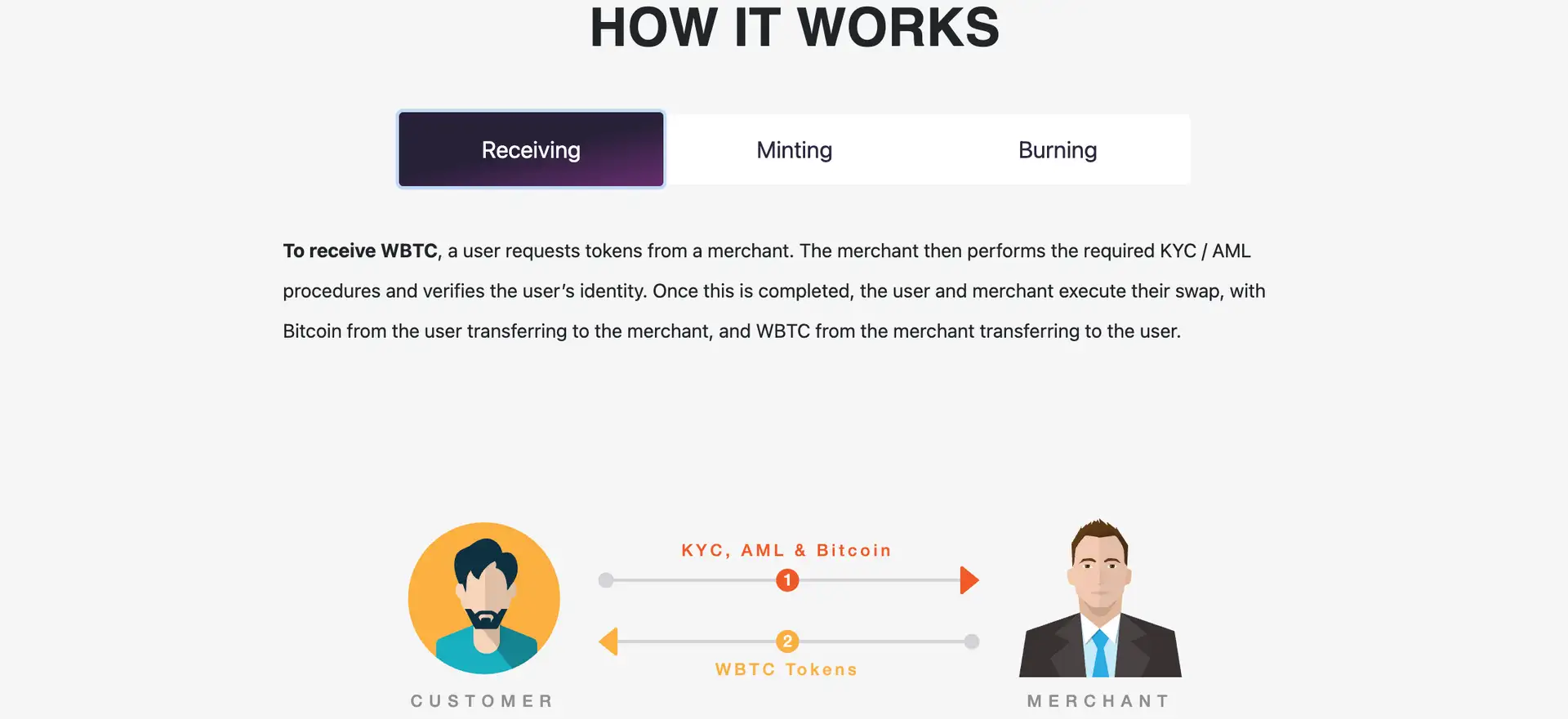

- Advanced Use: Institutions and traders can also interact with WBTC through merchant services after completing KYC/AML, allowing them to mint or redeem WBTC directly.

WBTC Reviews by Real Users

WBTC FAQ

Wrapped Bitcoin (WBTC) transforms Bitcoin into an ERC-20 token, allowing it to be used in Ethereum smart contracts. By wrapping BTC into a tokenized format, developers can integrate Bitcoin liquidity into dApps, DeFi protocols, and automated on-chain processes without modifying the original Bitcoin blockchain.

Merchants are authorized entities in the WBTC network responsible for handling user requests for minting or redeeming tokens. They manage the KYC/AML process, initiate swaps, and interact with custodians to facilitate secure 1:1 conversions between Bitcoin and WBTC. Without merchants, the user access layer of WBTC wouldn’t function.

The WBTC DAO operates through a decentralized, multi-signature governance system where no single party controls the protocol. Key decisions like adding/removing merchants or custodians are made by a group of institutional members holding keys to a smart contract. This distributes control and enhances transparency and security without relying on a central authority.

Minting and burning events are recorded on-chain and viewable in real time on the WBTC Dashboard. This public ledger ensures that the total amount of WBTC in circulation exactly matches the Bitcoin reserves held by custodians. Users can verify the backing independently using blockchain explorers and the official dashboard.

Institutional traders use WBTC to bypass Bitcoin’s slow transaction speeds when moving assets between exchanges. Since WBTC lives on the faster Ethereum blockchain, BTC liquidity can be transferred in minutes instead of hours. This is especially useful for high-frequency trading and arbitrage strategies across DeFi and centralized platforms.

You Might Also Like