About WELF

WELF is a forward-thinking wealth management platform that bridges the gap between traditional finance (TradFi) and digital investment ecosystems. Designed with a client-first philosophy, WELF offers personalized solutions that span advisory, management, and investment—making the platform a one-stop hub for holistic asset growth, preservation, and planning.

By integrating traditional financial instruments like bonds and private debt with innovative DeFi products such as flexible staking and tokenized wealth flows, WELF redefines wealth management. The platform empowers users with tools like WELF Tailor, WELF Solutions, WELF Yield, and WELF Flow, each targeting a specific aspect of personalized wealth optimization. The core mission is to build a system where innovation and trust coexist to create enduring prosperity.

WELF represents a new paradigm in digital and traditional wealth fusion, combining the legacy discipline of finance with the agility of blockchain. The project’s suite of offerings covers both ends of the spectrum. On the traditional side, WELF emphasizes trust, guided expertise, and tailored strategies—tools clients have historically relied upon to build secure wealth. Meanwhile, on the digital front, the platform introduces asset-backed solutions built on a blockchain infrastructure that is designed to be user-friendly, secure, and future-proof.

The platform’s digital product stack includes:

- WELF Tailor™: A forthcoming customizable portfolio builder

- WELF Solutions™: Bespoke advisory and business support services

- WELF Yield™: A fixed-income solution offering exposure to bonds, private debt, and risk-managed strategies

- WELF Flow™: An adaptive investment engine focused on balancing long-term positions with short-term tactical plays

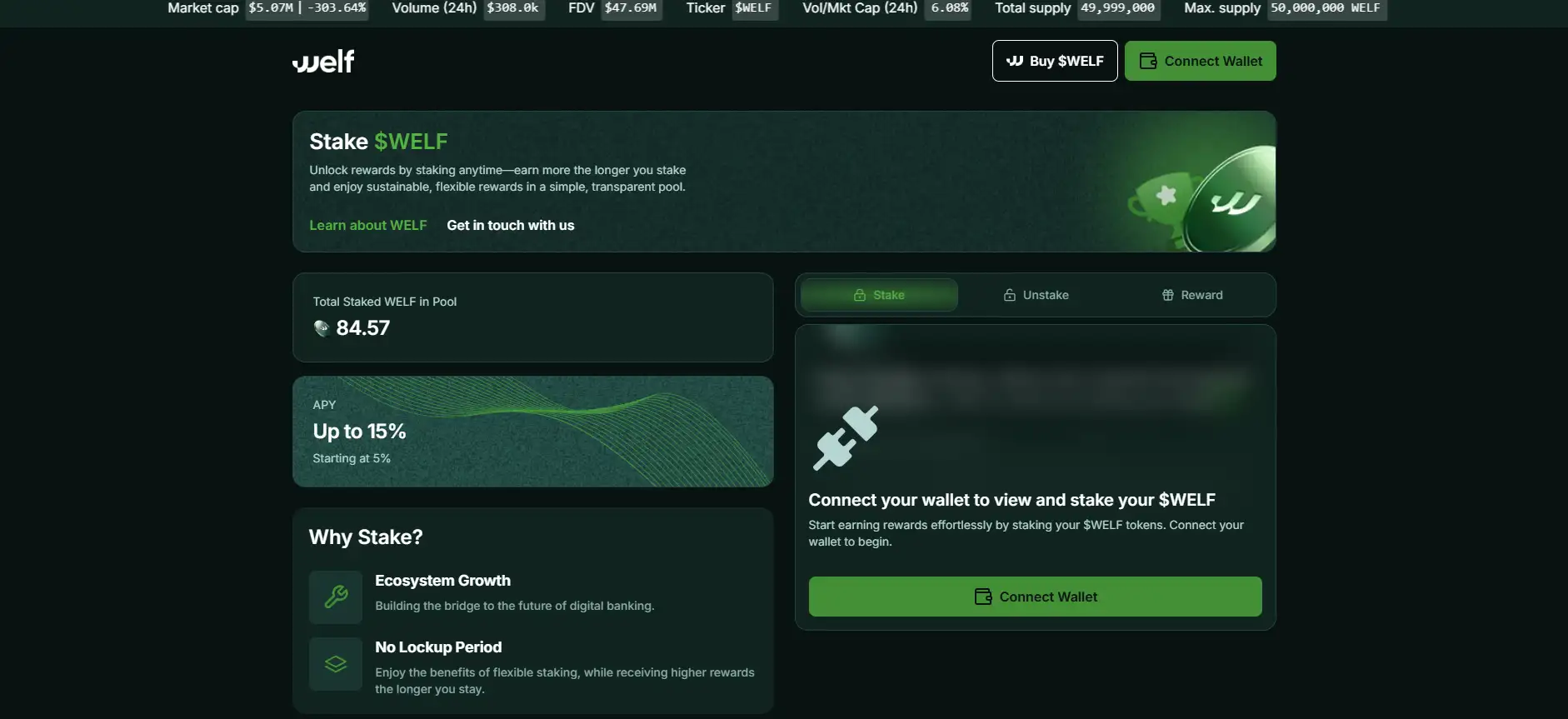

For users in both TradFi and DeFi, WELF builds a secure pathway through market uncertainty. The addition of a native utility token, $WELF, supports the ecosystem’s internal economy. Users can stake $WELF with no lock-up period, gaining up to 15% APY. This tokenized infrastructure underlines the project’s ambition to scale digitally without abandoning traditional values.

In a space increasingly dominated by either rigid legacy systems or overly speculative DeFi tools, WELF occupies a vital middle ground. It competes indirectly with platforms like SwissBorg, which also integrates crypto with wealth management strategies, and Nexo, known for its token utility and high-yield savings. What sets WELF apart is its strong focus on bespoke advisory, hybrid investment design, and long-term wealth preservation strategies tailored for sophisticated clients.

WELF offers a dynamic suite of features that distinguish it in the evolving wealth management ecosystem:

- Integrated TradFi-DeFi Strategy: Combines traditional investments like bonds and advisory with digital staking, savings, and smart portfolios.

- Tokenized Ecosystem: Users can purchase and stake $WELF tokens with no lock-up and up to 15% APY, building passive income in a secure environment.

- Bespoke Advisory with WELF Solutions™: High-net-worth and business clients can access tailored services for lifestyle, planning, and compliance.

- Market-Responsive Investing: WELF Flow™ adapts portfolios in real-time based on market signals, while WELF Yield™ offers safer fixed-income growth.

- Coming Soon Innovation Stack: Future-ready tools like WELF Tailor™, WELF Wallet™, Exchange, and Credit Products are already in development.

- Full Transparency & No Entry Barriers: Open architecture and a clear fee structure let anyone explore WELF with confidence.

WELF makes it simple for users from all backgrounds to begin their wealth management journey in a digitally-enhanced yet human-centric ecosystem:

- Step 1 – Visit the Platform: Head over to the official WELF DApp to explore the current offerings and stay updated on the latest tools launching soon.

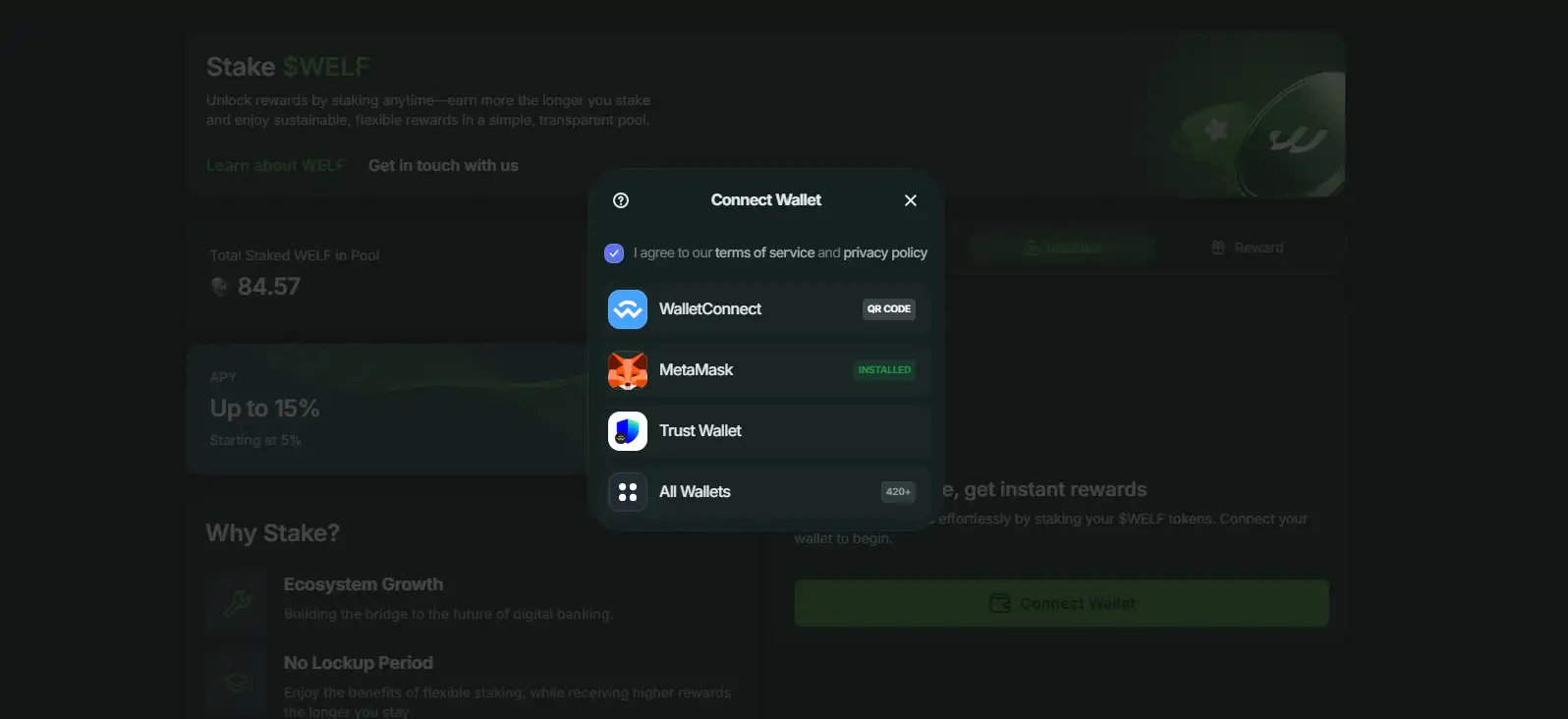

- Step 2 – Connect or Create an Account: Traditional and crypto users alike can connect their wallet or register an account (coming soon).

- Step 3 – Stake $WELF: Purchase and stake $WELF tokens to begin earning flexible rewards up to 15% APY, starting at 5%.

- Step 4 – Contact Advisory: Email [email protected] to get in touch with wealth managers for personalized strategy building.

- Step 5 – Explore Upcoming Tools: Keep track of upcoming product launches like WELF Wallet™, Exchange, Tailor™, and Flow™ to broaden your investment options.

WELF Token

WELF Reviews by Real Users

WELF FAQ

WELF offers a flexible staking system that contrasts sharply with traditional DeFi models that require rigid lock-ups. Users can stake and unstake at any time, and the platform incentivizes longer-term commitment by gradually increasing APY over time—starting from 5% and going up to 15%. This makes staking accessible to users who need liquidity but still want to earn high yields. Stake anytime through the WELF platform.

Through modules like WELF Tailor™ and WELF Solutions™, WELF takes a bespoke approach to portfolio creation. Rather than offering pre-set products, the platform uses an advisory-led model that starts with a personal or business profile review. From there, a team curates goal-based strategies that can include fixed income, adaptive trading, or hybrid investments—all delivered via secure digital rails. Learn more at WELF.

Each module within the WELF ecosystem addresses a unique facet of wealth building. WELF Yield™ provides stability via bonds and private debt, WELF Flow™ focuses on tactical market strategies, and WELF Tailor™ enables personalized planning. These branded layers reflect WELF’s vision to offer modular, plug-and-play financial services—where users can pick and build based on evolving needs. Discover them at WELF.

WELF takes a hybrid onboarding approach that speaks the language of traditional finance. It avoids complex DeFi terminology and allows users to interact with modules through familiar UI elements, like dashboards and account-based flows. With traditional advisory channels, email-based support, and simple yield calculators, WELF is a DeFi-powered platform built for non-crypto natives. See how at WELF.

Unlike platforms with rigid schedules, WELF staking offers progressive APY tiers. Rewards are time-sensitive, meaning the longer you stake, the better the return—without needing to commit funds to a locked contract. This flexible staking mechanism rewards consistency over time rather than immobility, and you can track your performance via the live dashboard on WELF.

You Might Also Like