About Wise Lending

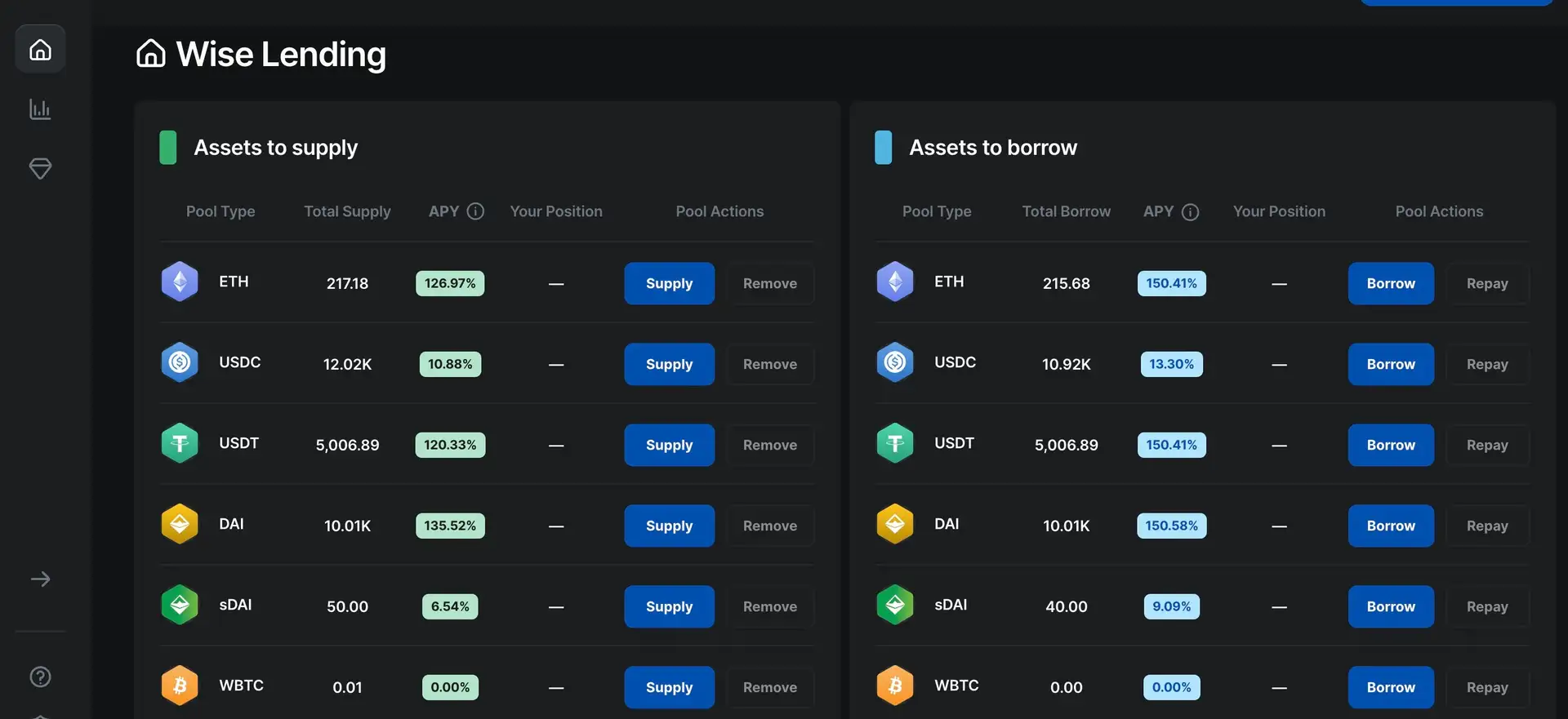

Wise Lending is a decentralized liquidity market tailored for lending and borrowing crypto assets. The platform integrates top DeFi yield sources, offering competitive annual percentage yields (APYs) for lenders while allowing borrowers to access the best yield opportunities seamlessly. Built on Chainlink Oracles and Aave Pools, Wise Lending ensures enhanced security and reliable pricing, making it a trusted platform for crypto asset management. The project's mission is to democratize access to high-yield opportunities in the DeFi space, providing users with a secure, efficient, and user-friendly platform to maximize their crypto investments.

Wise Lending distinguishes itself in the crowded DeFi space by combining high-yield farming options with a robust, secure, and user-centric platform. The project has undergone rigorous audits by leading security experts, ensuring the integrity and security of its smart contracts. This commitment to security is a cornerstone of Wise Lending, providing users with peace of mind as they engage in lending and borrowing activities.

One of the key features of Wise Lending is its integration with Chainlink Oracles and Aave Pools. This integration ensures that users receive accurate and timely pricing information, enhancing the platform's reliability and efficiency. By leveraging these industry-leading technologies, Wise Lending can offer competitive APYs and secure borrowing options.

The platform's primary competitors include Aave, Compound, and Yearn Finance. Each of these platforms offers decentralized lending and borrowing services, but Wise Lending sets itself apart through its unique combination of features and focus on user experience.

- Aave: Aave is a well-established DeFi protocol that allows users to lend and borrow a wide range of crypto assets. Known for its innovative features like flash loans and credit delegation, Aave provides a comprehensive lending and borrowing experience.

- Compound: Compound is another leading DeFi protocol that enables users to earn interest on their crypto holdings or borrow assets against them. The platform's focus on transparency and security has made it a popular choice among DeFi enthusiasts.

- Yearn Finance: Yearn Finance automates yield farming by finding the best interest rates across various DeFi protocols. This automation simplifies the process for users, making it easier to maximize returns on their investments.

Wise Lending’s innovative approach includes features like dynamic interest rates, which adjust based on market demand and supply, and an intuitive user interface that simplifies the lending and borrowing process. The platform also offers robust educational resources and community support, ensuring that users of all experience levels can navigate the DeFi landscape effectively.

In terms of future developments, Wise Lending aims to expand its ecosystem by adding support for more crypto assets and integrating additional DeFi protocols. This expansion will provide users with even more opportunities to maximize their returns and diversify their portfolios. The platform's roadmap includes plans for enhancing its governance model, further decentralizing decision-making, and improving user experience through continuous feedback and iteration.

- High APYs: Wise Lending offers competitive annual percentage yields for lenders by integrating with top DeFi yield sources. This ensures that users can maximize their returns on deposited assets.

- Security: The platform's integration with Chainlink Oracles and Aave Pools, coupled with thorough audits by leading security experts, ensures a secure environment for lending and borrowing.

- Decentralized Governance: WISE token holders can participate in the platform's governance, voting on key proposals and shaping the future of Wise Lending.

- User-Friendly Interface: The intuitive design of the Wise Lending platform makes it accessible for users of all experience levels, providing a seamless and efficient user experience.

- Comprehensive Support: With robust educational resources and active community support, users can easily navigate the platform and make informed decisions.

- Create an Account:

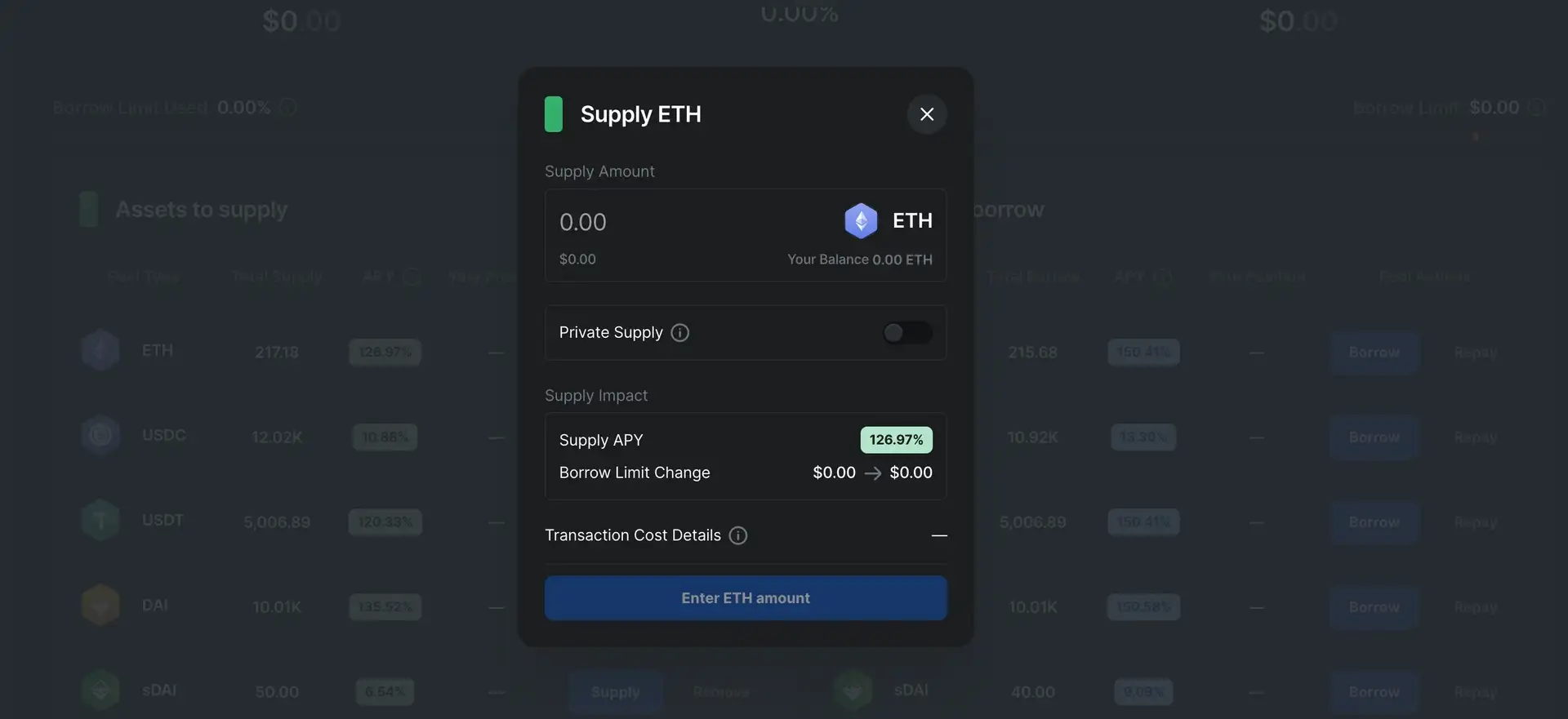

Visit the Wise Lending app and sign up using your email or preferred crypto wallet. - Deposit Assets:

Choose your preferred crypto assets from a wide selection and deposit them into the lending pools. The platform supports major cryptocurrencies like BTC, ETH, and various ERC-20 tokens.

Wise Lending Reviews by Real Users

Wise Lending FAQ

Wise Lending is a decentralized liquidity market that allows users to supply crypto assets and earn a variable APY from borrowers. It integrates top DeFi yield sources to provide competitive rates for lenders.

Wise Lending works by allowing users to lend their crypto assets into lending pools. Borrowers can then access these funds and lenders earn interest. The platform utilizes Chainlink Oracles and Aave Pools for enhanced security and performance.

Wise Lending is designed for cryptocurrency investors looking to earn passive income through lending and staking, as well as borrowers seeking liquidity for their crypto assets.

Wise Lending offers features such as decentralized lending and borrowing, high-yield farming, staking options, and the use of Chainlink Oracles for enhanced security. The platform is designed to provide competitive rates and secure transactions.

Power Farms are high-yield farming options offered by Wise Lending. They integrate top DeFi yield sources to provide competitive APYs for staked assets. Users can participate in these farms to maximize their earnings.

You Might Also Like