About YieldFi

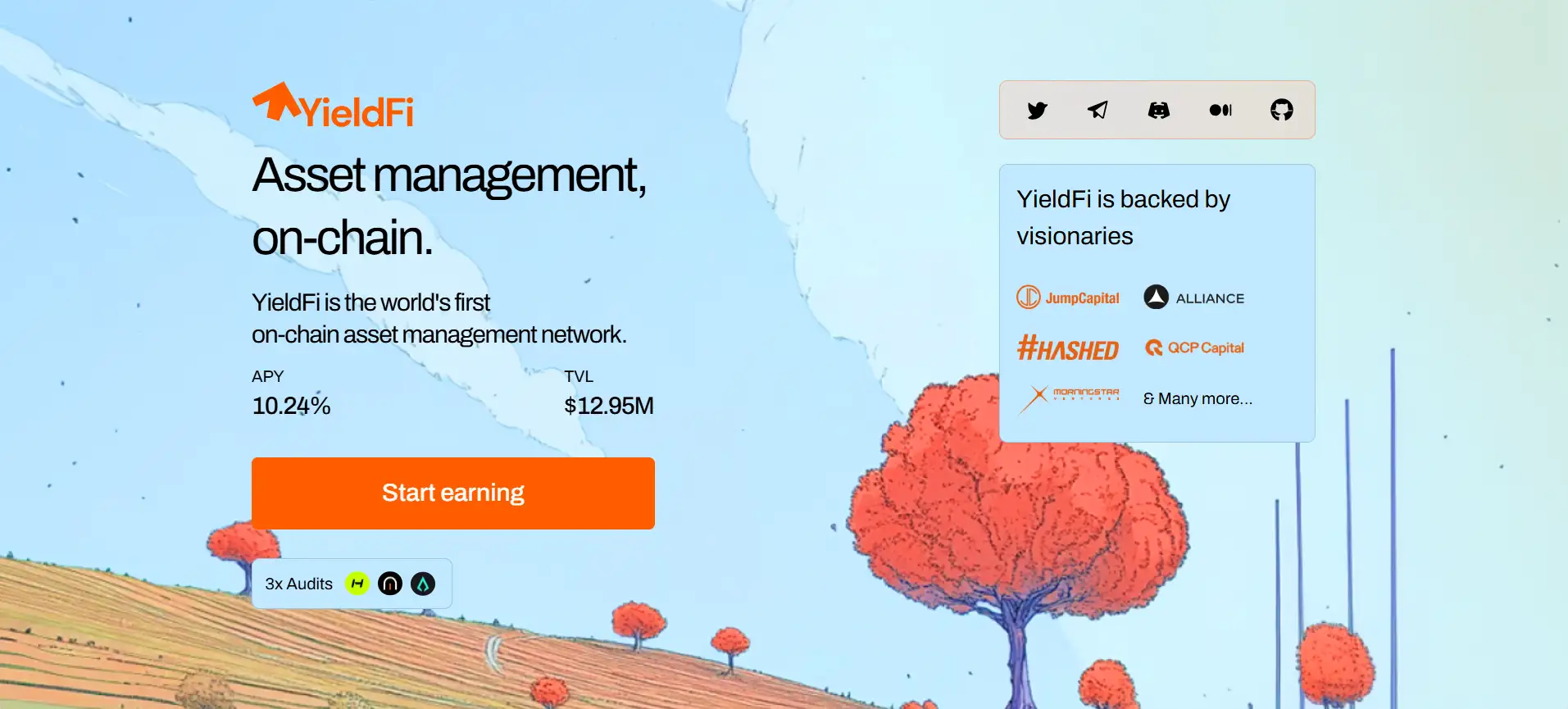

YieldFi is the world’s first fully on-chain asset management platform designed to simplify yield generation through a transparent, secure, and composable DeFi ecosystem. Built with institutional-grade security and real-time transparency, YieldFi offers users direct access to optimized, risk-adjusted returns without the need for manual strategy execution.

Powered by its proprietary yUSD stablecoin, YieldFi integrates a “fund-of-funds” approach, deploying user capital across a curated set of battle-tested DeFi protocols and strategies. Whether you're a DeFi novice or an experienced investor, YieldFi turns idle stablecoins into productive assets with a simple one-click staking interface and minimal drawdown risk.

YieldFi represents a new generation of DeFi protocols that bring traditional asset management practices fully on-chain. With a total value locked (TVL) surpassing $12.9 million and an average APY of 10.01%, the platform enables users to convert stablecoins like USDT or USDC into yUSD — a yield-bearing ERC-4626 token that appreciates as rewards accrue from diversified DeFi strategies.

What sets YieldFi apart is its V2 architecture, which introduces groundbreaking composability enhancements. Smart contracts and protocols can now interact directly with the YieldFi minting mechanism, opening doors to integrations with Pendle, Spectra, Napier, Contango, and Yearn Finance. This unlocks new utility for yUSD in PT/YT markets, looping strategies, and treasury optimization. On top of that, YieldFi is audited by multiple firms including Halborn, Cantina, and Cyfrin, reinforcing its security-first approach.

Unlike traditional DeFi protocols that carry smart contract custody risks, YieldFi keeps user assets in vaults with 100% on-chain transparency and zero contract exposure except during redemptions. Deposits are spread across proven platforms like Curve, Morpho, Ethena, and Pendle, and each strategy undergoes strict due diligence. This ensures less than 1% drawdown risk, making the platform ideal for conservative yield seekers.

The platform also includes the YieldFi Fusion Program, a roadmap-driven initiative to scale its multi-chain presence, launch new integrations, and reward its community. YieldFi is currently expanding across Ethereum, Base, Optimism, and Arbitrum while introducing new asset classes. With a strong backing from investors like Jump Capital, Alliance, and Hashed, and a roadmap focused on accessibility, transparency, and composability, YieldFi is shaping the future of decentralized asset management.

Competing platforms in the on-chain asset management and yield generation space include Yearn.fi, Morpho, Pendle, and Spectra. However, YieldFi’s full-stack transparency, direct contract composability, and institutional-grade security stack give it a uniquely robust position in the market.

YieldFi provides numerous benefits and features that make it a standout in the on-chain asset management space:

- yUSD Yield-Bearing Stablecoin: Fully backed by stablecoins, yUSD accrues yield automatically through diverse DeFi strategies.

- Fund of Funds Architecture: Deploys capital across multiple top DeFi platforms, reducing risk and maximizing yield.

- V2 Architecture Composability: Supports protocol-level integrations with PT/YT tokens, leverage strategies, and treasury tools.

- Low Drawdown Risk: Engineered for stability, with less than 1% drawdown across strategies, ideal for conservative investors.

- Non-Custodial Asset Management: Assets are never locked in exploitable smart contracts and remain viewable via on-chain transparency dashboards.

- Seamless Migration Tools: Intuitive 1-click migration from v1 to v2 vaults for existing users.

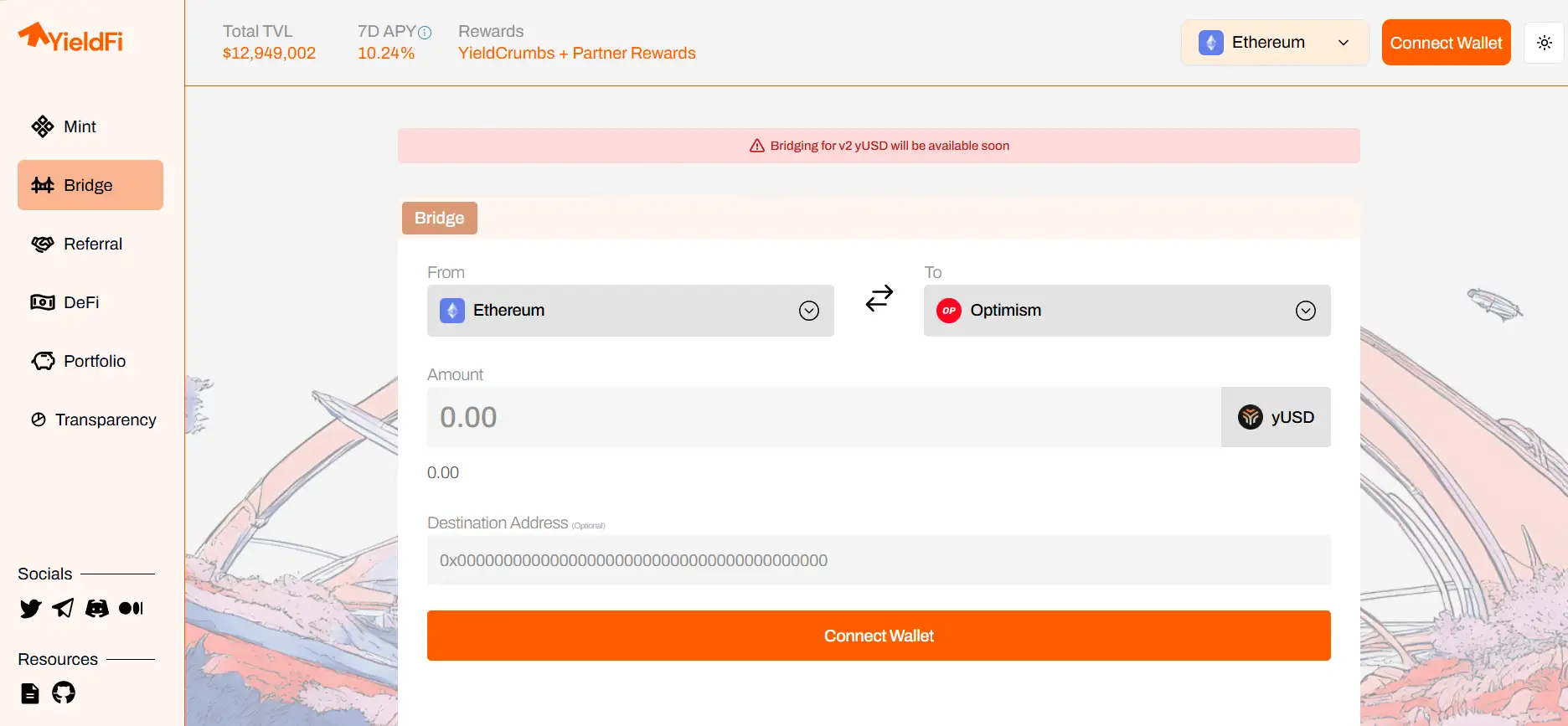

- Multi-Chain Ready: Currently active on Ethereum, Base, Arbitrum, and Optimism, with future expansions planned.

YieldFi makes it easy for anyone to begin earning with on-chain asset management:

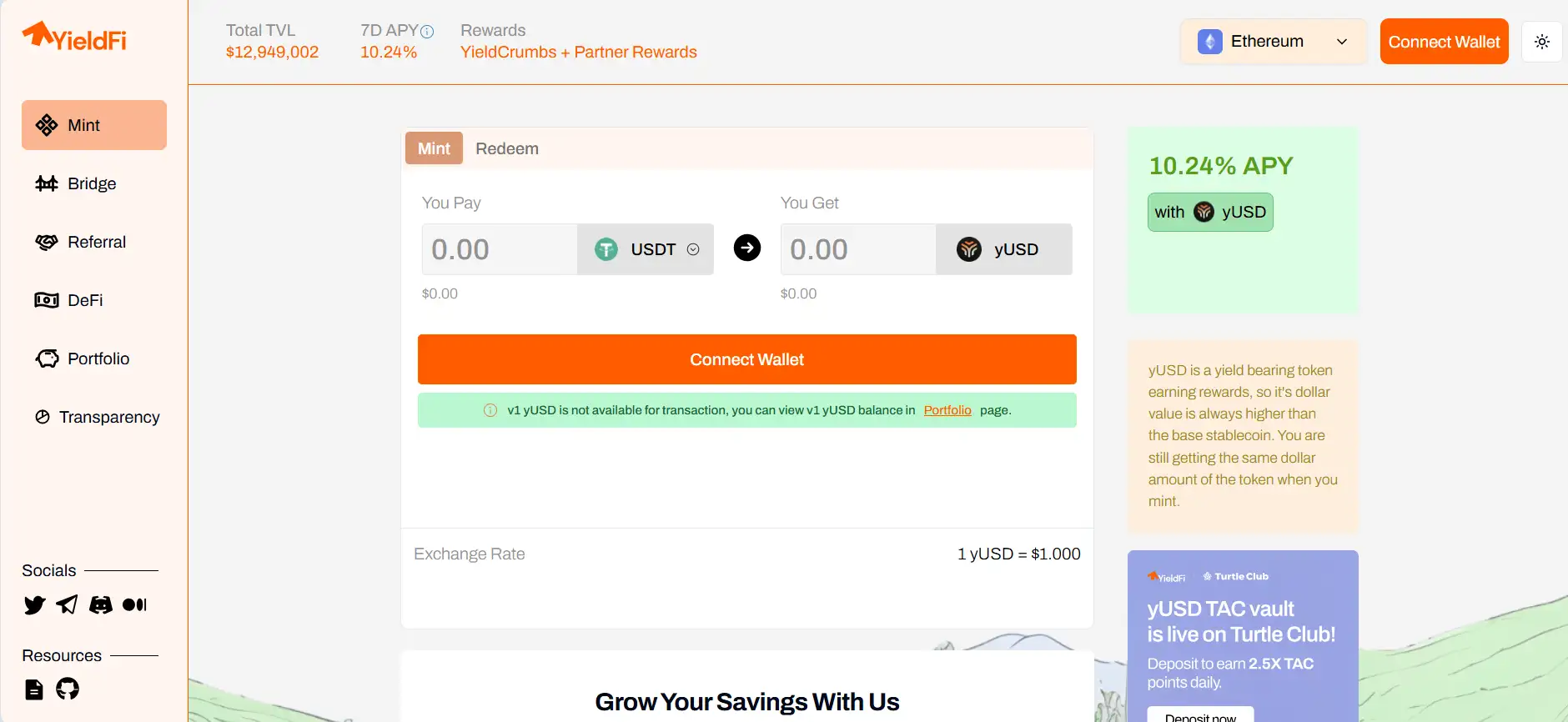

- Step 1: Connect Your Wallet: Head to YieldFi and connect your Web3 wallet (MetaMask, WalletConnect, etc.).

- Step 2: Choose an Asset: Use supported stablecoins like USDC or USDT to mint yUSD.

- Step 3: Stake yUSD: Once minted, yUSD automatically earns through integrated strategies. You can stake it for additional rewards via Curve or in-platform vaults.

- Step 4: Track Performance: Use the YieldFi dashboard to monitor your performance, APY, and strategy allocations in real time.

- Step 5: Withdraw or Redeem: Withdraw yUSD at any time. Your position will be redeemed proportionally from the underlying strategies.

YieldFi FAQ

YieldFi eliminates smart contract custody risks by ensuring user funds are not held in vulnerable contracts. Instead, assets are tokenized into yUSD and only interact with contracts during minting and redemption events. The rest of the time, funds are deployed directly to whitelisted DeFi strategies through secure, non-custodial vaults. There’s no hidden risk of contract exploits or overnight rug pulls — everything is fully transparent and on-chain. Explore this in more detail on the YieldFi website.

yUSD is more than just a stablecoin. It’s a yield-bearing ERC-4626 token backed 1:1 by stablecoins and deployed into a curated set of battle-tested DeFi strategies. What sets it apart is the way it seamlessly integrates into multiple protocols like Curve and Pendle, supports looping, and offers compound interest by design. Users holding yUSD earn automatically, without the need to manually stake or claim rewards. Learn more about yUSD’s advantages on YieldFi.

YieldFi V2 introduces full contract-to-contract composability, which means any on-chain protocol can interact directly with yUSD’s minting and strategy engine. This unlocks integrations with platforms like Pendle (PT/YT tokens), Yearn (automated yield strategies), and Contango (looping). Developers and protocols can now plug into YieldFi’s architecture without limitations, enabling complex, high-yield composable strategies never before possible in DeFi. See it in action at YieldFi.

YieldFi maintains a drawdown risk of less than 1% by employing diversified, delta-neutral strategies and rigorous risk management. Instead of chasing volatile APYs, assets are deployed across stable, audited protocols like Curve, Pendle, and Ethena. The system actively monitors positions and rebalances based on market shifts to preserve capital. This makes YieldFi ideal for users seeking yield with institutional-grade safety. Review their risk framework at YieldFi Docs.

Yes, YieldFi offers a 1-click migration tool for seamless movement from v1 to v2 vaults. Your assets, position, and any accrued rewards are preserved during the upgrade. The migration process is intuitive and guided directly within the YieldFi interface. Dedicated support is also available via Telegram and Discord to assist users during the transition. Learn how to migrate securely at YieldFi.

You Might Also Like