About youves

youves is a decentralized finance (DeFi) platform built on the Tezos blockchain, designed to enable users to create and manage synthetic assets. These synthetic assets, such as uUSD, uBTC, and uXTZ, are algorithmically stabilized and backed by collateral, allowing users to engage in DeFi activities without the need to hold the actual underlying assets. youves is committed to providing a non-custodial, transparent, and decentralized environment where users have full control over their assets and can participate in the governance of the platform through the YOU token.

The mission of youves is to democratize access to advanced financial tools that were traditionally available only to institutional investors. By leveraging the power of the Tezos blockchain, youves offers a platform that is secure, scalable, and cost-effective, making it accessible to a global audience. The platform’s focus on synthetic assets opens up new opportunities for users to hedge against volatility, diversify their portfolios, and generate passive income through staking and liquidity provision.

youves was launched as a pioneering DeFi platform on the Tezos blockchain, with a focus on synthetic asset creation and management. The project was developed in response to the growing demand for decentralized financial instruments that offer stability, transparency, and security. By leveraging Tezos’ strengths, including its on-chain governance, low transaction fees, and energy efficiency, youves provides a platform that is both robust and user-friendly.

The core of youves is its synthetic asset ecosystem, which currently includes uUSD, uBTC, and uXTZ. These synthetic assets are algorithmically pegged to the value of their respective real-world counterparts, providing users with a stable and reliable means of engaging in DeFi activities. The creation of these assets is made possible through a collateralized minting process, where users lock up assets such as XTZ to back the synthetic assets they create. This collateralization not only ensures the stability of the synthetic assets but also incentivizes users to participate actively in the platform.

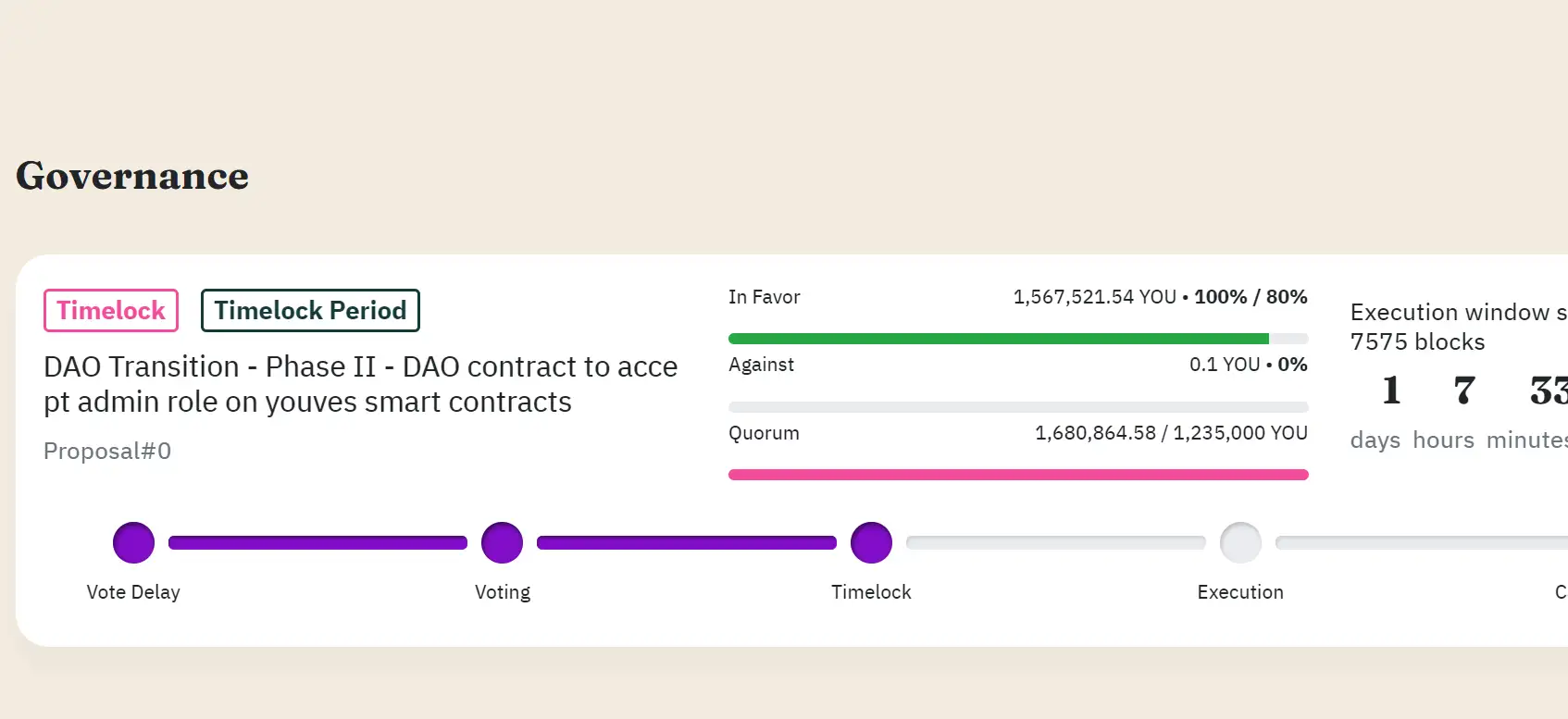

Governance on youves is conducted through a Decentralized Autonomous Organization (DAO), where decisions about the platform’s future are made by YOU token holders. This governance structure allows the platform to remain decentralized and community-driven, with users having a direct say in key aspects such as protocol upgrades, new asset listings, and changes to the platform’s parameters. The YOU token, therefore, plays a crucial role in aligning the interests of all participants within the youves ecosystem.

The platform has undergone significant development since its inception, with continuous improvements to its user interface, smart contracts, and overall functionality. These developments have been guided by community feedback and a commitment to innovation, ensuring that youves remains at the forefront of the DeFi space on Tezos. The project has also formed strategic partnerships within the Tezos ecosystem, collaborating with other projects to enhance liquidity, security, and user experience.

In terms of competition, youves operates in a landscape that includes other DeFi platforms offering synthetic assets and decentralized governance, such as MakerDAO on Ethereum. However, by building on Tezos, youves benefits from lower transaction costs, energy-efficient consensus mechanisms, and a growing community of developers and users. These advantages position youves as a unique and compelling alternative for users looking for a decentralized platform that is both secure and scalable.

Looking ahead, youves plans to expand its offerings by introducing new synthetic assets and enhancing its governance capabilities. The platform aims to become a comprehensive solution for decentralized asset management, providing users with a wide range of tools to create, trade, and manage assets in a decentralized manner. As the DeFi space continues to evolve, youves is well-positioned to adapt and grow, driven by its strong community and innovative approach.

- Decentralized Governance: The YOU token is central to the governance of youves, giving holders the ability to vote on important decisions, propose changes, and influence the platform's development. This decentralized governance model ensures that the platform remains community-driven and aligned with the interests of its users.

- Synthetic Assets: youves allows users to create and manage synthetic assets like uUSD, uBTC, and uXTZ. These assets provide exposure to real-world currencies and cryptocurrencies without needing to hold the actual underlying assets. This feature enables users to engage in a wide range of financial activities, from trading and investing to hedging and yield farming.

- Non-Custodial Platform: Operating on a non-custodial model, youves ensures that users maintain full control over their assets at all times. This enhances security and privacy, as users do not need to rely on a third party to manage their funds.

- Low Transaction Costs: Built on the Tezos blockchain, youves benefits from Tezos' low transaction fees, making it cost-effective for users to mint, trade, and manage synthetic assets. This is a significant advantage over platforms built on other blockchains with higher transaction costs.

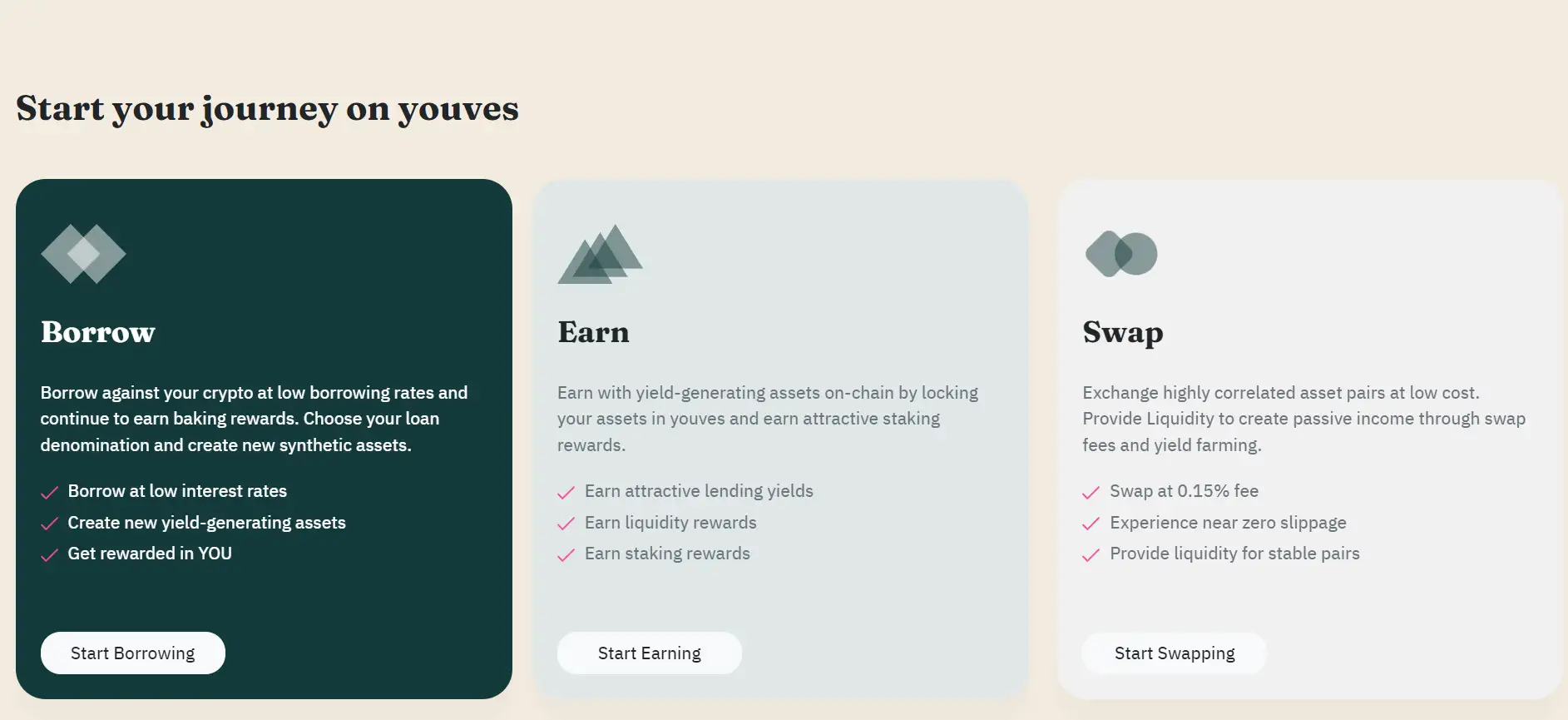

- Staking and Yield Generation: Users can stake their YOU tokens or provide liquidity to earn rewards. This staking mechanism not only provides a passive income stream but also supports the stability and security of the platform.

- Scalability and Security: Tezos is known for its scalability and security, and youves leverages these strengths to offer a platform that can handle a large number of transactions efficiently while ensuring that users' assets are safe.

- Community-Driven Development: The platform's roadmap is shaped by its community, with YOU token holders playing a key role in deciding future features and upgrades. This ensures that the platform evolves in a way that reflects the needs and preferences of its users.

- Create a Tezos Wallet: Before using youves, you need to create a Tezos wallet. Recommended wallets include Temple, and Kukai.

- Connect Wallet to youves: Visit the youves platform and connect your Tezos wallet. Ensure you have some Tezos (XTZ) tokens to cover transaction fees.

- Mint Synthetic Assets: Choose the asset you wish to mint (uUSD, uBTC, or uXTZ) and provide the required collateral. Follow the prompts to complete the minting process.

- Participate in Governance: If you hold YOU tokens, you can participate in the governance of the platform by voting on proposals and influencing the future direction of youves.

- Stake and Earn: Stake your YOU tokens or provide liquidity to earn rewards. Navigate to the staking section on the platform and follow the instructions to start earning.

- Explore More: Dive deeper into the platform’s features by exploring options like swapping assets, managing collateral, and utilizing the platform’s advanced financial tools. Detailed guides and tutorials are available in the official youves documentation.

youves Token

youves Reviews by Real Users

youves FAQ

Holding the YOU token allows you to participate in the decentralized governance of the youves platform. You can vote on proposals, influence platform developments, and stake tokens to earn passive income. Additionally, as the platform grows, the value of the YOU token may appreciate, offering potential long-term financial benefits.

Synthetic assets on youves are digital representations of real-world assets, such as uUSD (pegged to USD) and uBTC (pegged to Bitcoin). These assets are backed by collateral and maintained through algorithms that stabilize their value. Users can mint, trade, and use them in DeFi activities without holding the actual underlying assets.

youves maintains the stability of its synthetic assets through over-collateralization and automated market operations. This ensures that the value of assets like uUSD and uBTC remains pegged to their respective real-world counterparts, providing users with reliable financial instruments for various DeFi activities.

Yes, providing liquidity on youves allows you to earn rewards in the form of YOU tokens. By participating in liquidity pools, you contribute to the platform’s ecosystem and are compensated with additional tokens, which can be staked or traded for other assets.

Yes, synthetic assets minted on youves can be traded on other DeFi platforms that support assets on the Tezos blockchain. This interoperability allows users to access a wider range of DeFi opportunities, enhancing the liquidity and utility of these assets.

You Might Also Like