About Zerolend

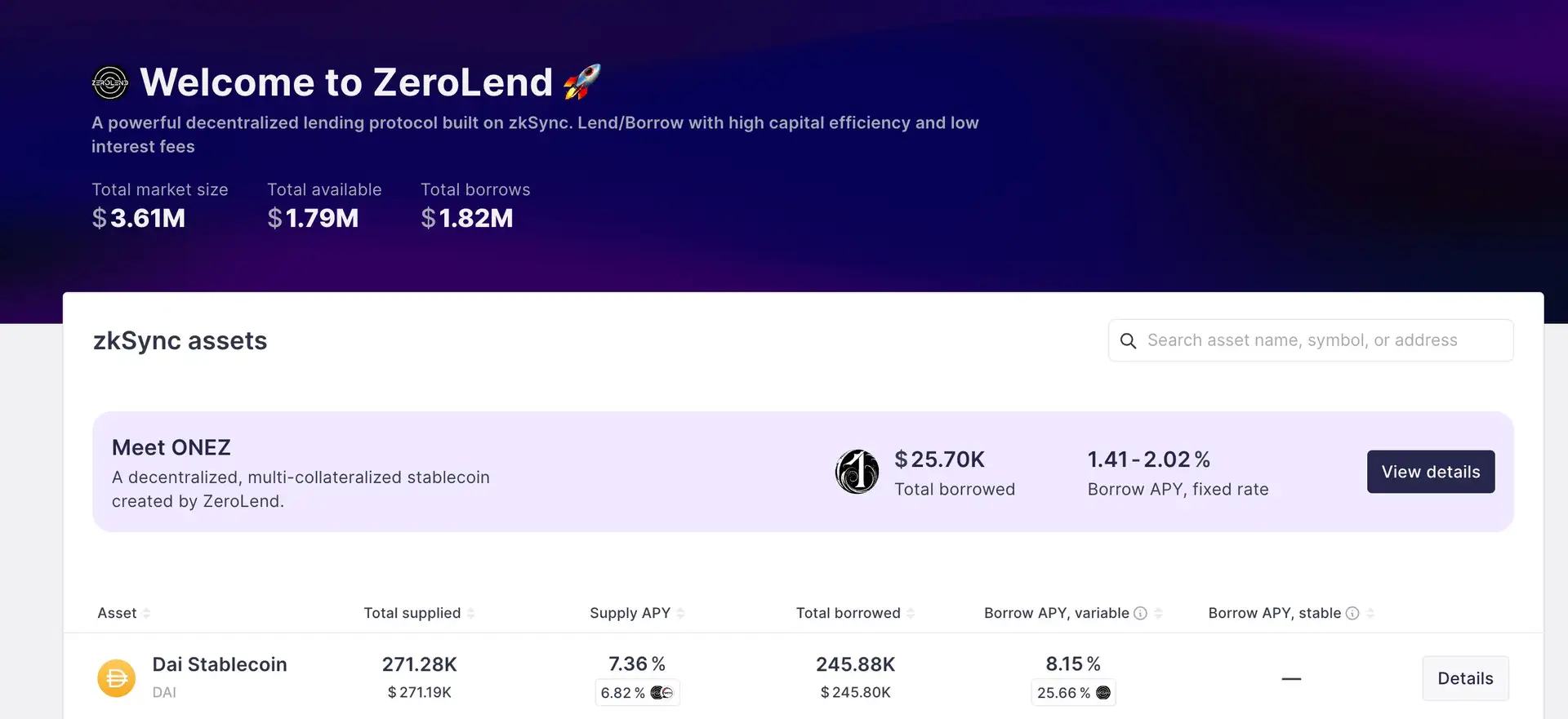

ZeroLend is a cutting-edge decentralized, non-custodial lending protocol that focuses on providing scalable and efficient lending solutions across multiple Layer 2 networks. The project’s mission is to create a seamless and user-friendly decentralized finance (DeFi) platform that enhances capital efficiency and accessibility. ZeroLend is dedicated to offering innovative financial solutions, including Liquid Restaking Tokens (LRTs) lending and Real World Assets (RWAs) lending, along with account abstraction features that simplify user interactions with the protocol.

The core aim of ZeroLend is to address the limitations of traditional DeFi lending platforms by leveraging the capabilities of Layer 2 technologies. These technologies enable faster and cheaper transactions, making DeFi more accessible to users across the globe. By focusing on multi-chain integration, ZeroLend aims to provide a robust and versatile platform that caters to a wide range of user needs and preferences.

In summary, ZeroLend is poised to revolutionize the DeFi lending landscape by offering innovative and scalable solutions that enhance user experience and broaden the scope of decentralized financial applications.

ZeroLend was established with the vision of creating a decentralized, non-custodial lending protocol that leverages the advantages of Layer 2 solutions to offer scalable and efficient financial services. The protocol aims to bridge the gap between traditional financial systems and decentralized finance (DeFi) by providing innovative solutions that cater to a diverse range of users.

History and Development

ZeroLend was founded by a team of experienced blockchain developers and financial experts who recognized the need for more scalable and efficient DeFi lending solutions. The project has undergone significant development since its inception, with a focus on building a robust and versatile platform that can operate seamlessly across multiple Layer 2 networks.

Key Milestones:

- Multi-Chain Launch: ZeroLend has successfully launched on several Layer 2 networks, including Linea, zkSync, Manta, Blast, and X Layer. This multi-chain approach enhances the protocol’s scalability and reduces transaction costs, making it more accessible to users.

- Introduction of LRT and RWA Lending: The protocol has introduced innovative lending solutions, such as Liquid Restaking Tokens (LRTs) lending and Real World Assets (RWAs) lending. These solutions enable users to leverage a wider range of assets for borrowing and lending, expanding the scope of DeFi applications.

- Deployment of $ZERO Token: The launch of the $ZERO governance token has empowered the community to participate in the protocol’s governance, ensuring that decisions are made in a decentralized and democratic manner.

Innovative Features

- Liquid Restaking Tokens (LRTs): ZeroLend supports the lending and borrowing of LRTs, such as EtherFi and Puffer. This feature allows users to utilize their staked assets for loans in stablecoins or ETH, providing additional liquidity and flexibility.

- Real World Assets (RWAs): The protocol facilitates the use of tangible assets, such as real estate or commodities, as collateral for loans. This expands the range of assets that can be utilized in DeFi, bridging the gap between traditional finance and decentralized finance.

- Account Abstraction: ZeroLend offers account abstraction features that simplify user interactions with the protocol. This includes streamlined processes for lending, borrowing, and staking, making the platform more user-friendly.

Similar Projects

- Aave: A decentralized lending protocol that allows users to lend and borrow a variety of cryptocurrencies.

- Compound: A DeFi lending platform that enables users to earn interest on their crypto assets and borrow against them.

- MakerDAO: A decentralized credit platform that supports the creation of DAI, a stablecoin backed by collateral.

Competitors

While ZeroLend shares similarities with these projects, it differentiates itself through its multi-chain approach, support for LRTs and RWAs, and focus on scalability and user experience.

Future Prospects

ZeroLend is committed to continuous innovation and improvement, with plans to introduce new features and expand its ecosystem. The protocol aims to become a leading player in the DeFi lending space by offering unparalleled scalability, efficiency, and user experience.

Multi-Chain Support

ZeroLend operates on various Layer 2 solutions, including Linea, zkSync, Manta, Blast, and X Layer. This multi-chain approach enhances scalability and reduces transaction costs, making the protocol more accessible to a broader audience.

LRT Lending

The protocol supports the lending and borrowing of Liquid Restaking Tokens (LRTs), such as EtherFi and Puffer. This feature provides users with additional liquidity options, allowing them to leverage their staked assets for loans in stablecoins or ETH.

RWA Lending

ZeroLend facilitates the use of Real World Assets (RWAs) as collateral for loans. This expands the range of assets that can be utilized in DeFi, bridging the gap between traditional finance and decentralized finance.

Governance

The $ZERO token enables holders to participate in the protocol's governance. This decentralized voting system ensures that the protocol evolves in a manner aligned with the community’s interests.

Staking Rewards

Users can stake $ZERO tokens to earn rewards, incentivizing long-term participation and enhancing protocol security. Staking helps maintain the protocol's stability and provides users with passive income opportunities.

Community Incentives

ZeroLend offers various incentives to encourage user participation, including airdrops and liquidity mining programs. These initiatives are designed to attract new users and foster active engagement within the ecosystem.

Create an Account:

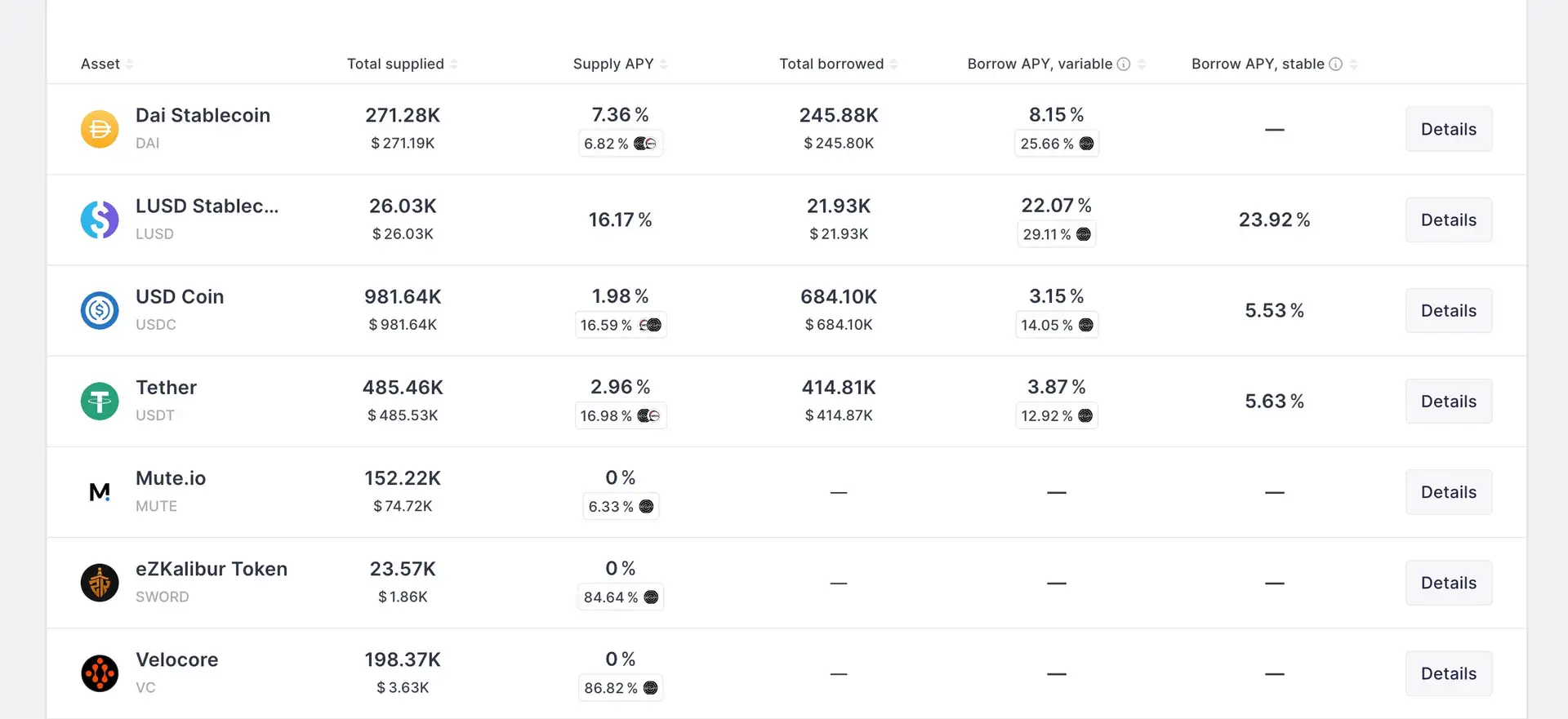

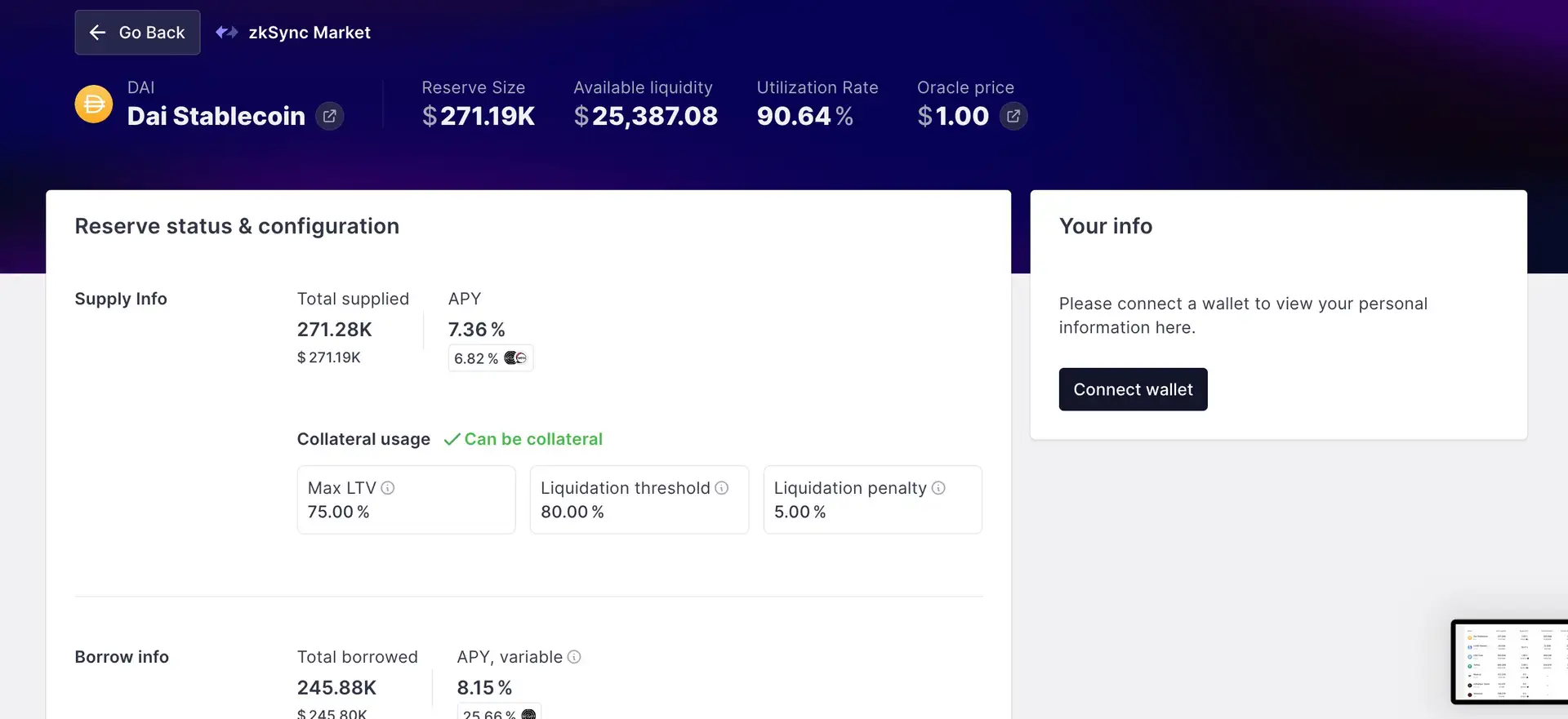

Deposit Assets:

- Go to the "Lending" section.

- Select the asset you wish to deposit.

- Confirm the transaction in your wallet.

Borrow Against Collateral:

- Navigate to the "Borrow" section.

- Choose the asset and amount you wish to borrow.

- Confirm the terms and complete the transaction.

Stake $ZERO:

- Visit the "Staking" page.

- Select the amount of $ZERO to stake.

- Confirm the staking transaction.

Governance Participation:

- Go to the "Governance" section.

- Review and vote on active proposals using your staked $ZERO.

For detailed tutorials and guides, visit the ZeroLend Docs.

Zerolend Token

Zerolend Reviews by Real Users

Zerolend FAQ

Yes, ZeroLend supports the use of Real World Assets (RWAs) as collateral for loans, bridging traditional finance and decentralized finance.

The $ZERO token enables holders to participate in protocol governance, voting on important decisions such as protocol upgrades and new feature integrations.

ZeroLend offers various incentives, including airdrops and liquidity mining programs, designed to attract and engage new users.

ZeroLend offers account abstraction features, streamlining processes for lending, borrowing, and staking, making the platform more user-friendly.

You Might Also Like