About Zeroloss

ZeroLoss is an innovative decentralized finance (DeFi) platform designed to revolutionize trading and liquidity provision within the blockchain ecosystem. Its core mission is to protect users from trading losses, a common issue in traditional Automated Market Makers (AMMs) due to price volatility and impermanent loss. The platform achieves this through its proprietary Proactive Market Maker (PMM) algorithm, which minimizes risks and losses during trades.

Built on the Binance Smart Chain (BSC), ZeroLoss offers low transaction fees and high-speed execution, making it a preferred choice for traders and liquidity providers. As a part of the DeFi 2.0 movement, the project focuses on increasing user participation by offering staking opportunities, liquidity pools, and governance features. Through its native token, ZLT, the platform fosters user engagement in decentralized governance, allowing them to vote on key decisions and contribute to platform development.

ZeroLoss is a forward-thinking DeFi platform addressing fundamental issues with decentralized trading, particularly the risk of losses caused by market volatility and impermanent loss. In traditional Automated Market Makers (AMMs) like Uniswap and PancakeSwap, liquidity providers often experience losses due to price movements between the time they enter and exit a liquidity pool. ZeroLoss mitigates this problem through its Proactive Market Maker (PMM) algorithm, which is designed to optimize trades and limit exposure to losses. This sets it apart from other platforms that rely on traditional AMM models.

Since its inception, ZeroLoss has continually evolved to include advanced DeFi functionalities. Initially launched on the Binance Smart Chain, it takes advantage of the BSC's low fees and fast transaction speeds, offering a cost-effective solution for users. In addition to this, the platform is working towards integrating other blockchains like Polygon and Solana to ensure users can access a wider range of liquidity sources and conduct cross-chain operations without friction.

Another key aspect of ZeroLoss is its staking and liquidity provision mechanisms. Users can stake their ZLT tokens or provide liquidity to earn rewards, which adds value to their holdings while supporting the platform's liquidity pools. This incentive system not only helps boost platform participation but also encourages more decentralized activity, further stabilizing the ecosystem.

ZeroLoss also places significant emphasis on community governance. Token holders of ZLT can participate in the decision-making process, shaping the future direction of the platform. This level of community involvement ensures that the platform remains flexible and responsive to user needs, making it a dynamic project within the DeFi space.

By solving issues related to impermanent loss and introducing new technologies like PMM, ZeroLoss is positioned as a significant player in the DeFi 2.0 movement. Its key competitors include decentralized exchanges like Uniswap, PancakeSwap, and SushiSwap, which also offer liquidity pools and staking but lack the advanced loss protection mechanisms that ZeroLoss provides. This unique focus on loss prevention gives it a competitive edge in the market, attracting both new users and experienced traders who seek more secure trading environments.

- Proactive Market Maker (PMM) Algorithm: The PMM algorithm prevents impermanent losses, a major issue with traditional AMMs. This system ensures users can engage in trading and liquidity provision with significantly lower risk, making ZeroLoss a safer platform for DeFi participants.

- Cross-Chain Operability: ZeroLoss is actively working on integrating other blockchain networks, including Polygon and Solana. This will allow users to trade and move assets seamlessly across multiple blockchains, increasing liquidity and reducing fees.

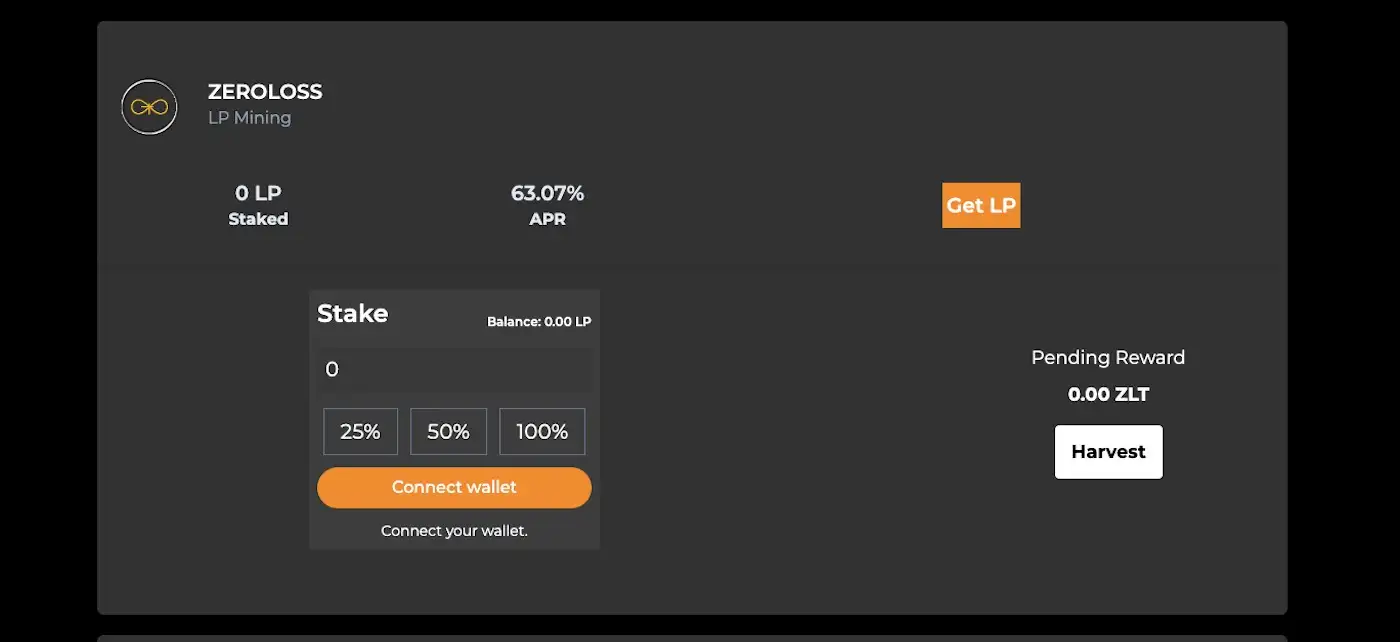

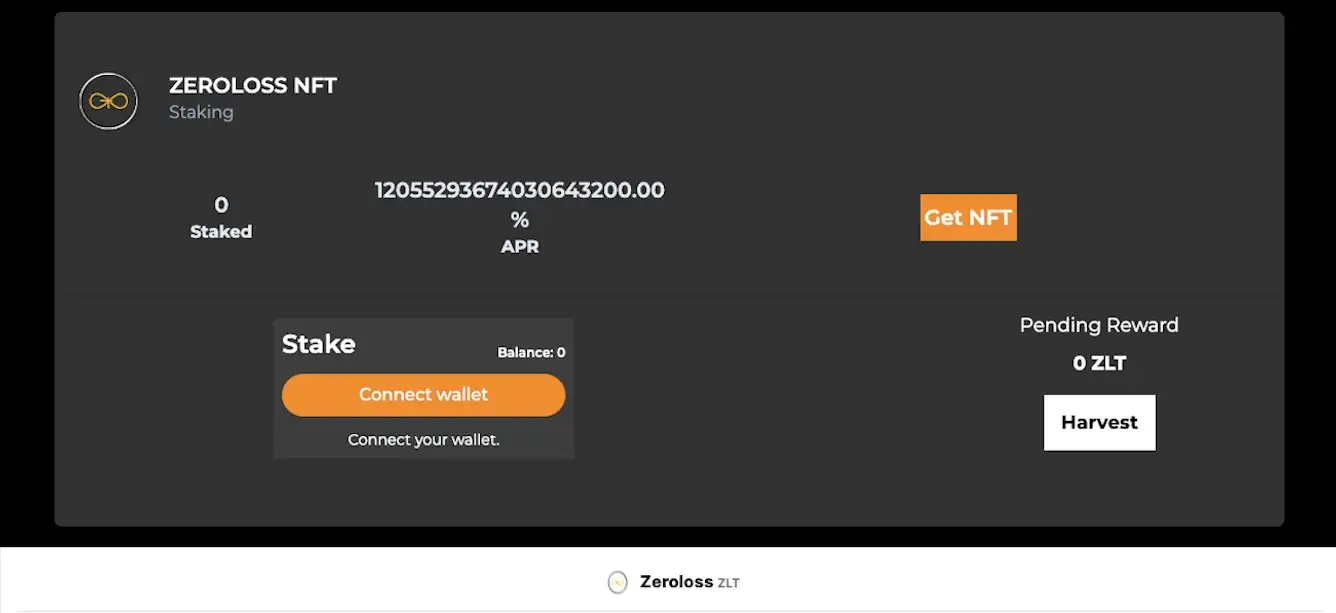

- Staking and Liquidity Pools: Users can stake ZLT tokens to earn rewards or participate in liquidity pools, where they receive fees from trades that occur within the pools. This provides opportunities for users to grow their holdings while helping the platform maintain deep liquidity.

- Governance Features: ZLT token holders have the power to vote on governance proposals, allowing the community to shape the future of the platform. This decentralized governance model ensures the project remains flexible and user-centric.

- Binance Smart Chain (BSC) Integration: Operating on BSC, ZeroLoss benefits from low transaction fees and fast transaction times, making it a cost-effective and scalable platform. Future expansions to other blockchains will enhance these advantages.

- Secure and Transparent: Built on a decentralized and transparent architecture, ZeroLoss ensures that users have full control of their assets. It employs industry-standard security measures to protect against hacks and breaches, further ensuring a safe DeFi experience.

- Set Up a Crypto Wallet: Download and install a compatible wallet, such as MetaMask or Trust Wallet. These wallets support the Binance Smart Chain (BSC) network, which ZeroLoss operates on. After installation, create a new wallet and securely store your backup phrase to ensure access to your funds.

- Connect to Binance Smart Chain: In your wallet, you must manually configure it to connect to the Binance Smart Chain. For MetaMask, open settings, navigate to the "Networks" tab, and input the details for BSC. Make sure your wallet is connected to BSC before trading or staking.

- Purchase BNB and ZLT: Buy BNB from a centralized exchange such as Binance and transfer it to your wallet. Then, head to PancakeSwap, where you can swap your BNB for ZLT. Be sure to adjust slippage tolerance to ensure your swap is successful.

- Start Trading, Staking, or Liquidity Provision: With ZLT tokens in your wallet, you can explore the features of ZeroLoss. You can trade, stake your ZLT to earn rewards, or participate in liquidity pools to earn trading fees.

- Explore Governance Features: Once you're set up, participate in the decentralized governance of ZeroLoss by voting on key platform decisions using your ZLT tokens. Engage with the community and stay up to date with the latest developments.

Zeroloss Reviews by Real Users

Zeroloss FAQ

ZeroLoss utilizes a proprietary Proactive Market Maker (PMM) algorithm designed to limit losses during market fluctuations. Unlike traditional AMMs, the PMM optimizes trade execution by proactively adjusting liquidity curves to avoid impermanent loss. This feature makes ZeroLoss more secure for traders and liquidity providers in volatile markets.

Staking on the ZeroLoss platform allows users to earn passive rewards by locking up their ZLT tokens. These rewards come from transaction fees and the liquidity pool, and staking helps maintain platform liquidity. The more tokens you stake, the higher the rewards, creating an incentive to hold and participate in the ecosystem.

ZeroLoss stands out due to its Proactive Market Maker (PMM) algorithm and focus on loss prevention. Traditional AMMs like Uniswap or PancakeSwap often suffer from impermanent loss, which ZeroLoss mitigates. Additionally, ZLT token holders can participate in governance, staking, and cross-chain operations, positioning the platform at the forefront of DeFi 2.0.

Cross-chain operability allows ZeroLoss users to move assets across different blockchains, such as Polygon and Solana. This feature increases liquidity, lowers transaction costs, and offers broader market access. By supporting multiple chains, ZeroLoss offers greater flexibility and security for its users in the ever-expanding DeFi ecosystem.

As a ZLT token holder, you can participate in the ZeroLoss governance model by voting on key platform proposals. Your voting power is proportional to the number of tokens you hold, giving you a direct role in shaping the platform's future, from upgrades to governance decisions.

You Might Also Like