About Angle

Angle is a decentralized, over-collateralized stablecoin protocol built to enable secure, transparent, and efficient access to Euro and Dollar-pegged digital currencies. Founded on the principles of transparency, solvency, and yield generation, Angle empowers users to hold and use stablecoins without sacrificing the benefits of decentralization. Through its open and robust infrastructure, the platform is creating a new financial foundation for digital economies.

The protocol operates through several smart contract modules, each optimized for different user needs, including borrowing, minting, yield generation, and forex trading. With stablecoins like EURA and USDA, users can engage in decentralized finance with assurance of asset backing and capital efficiency. The protocol’s integration with both DeFi and TradFi mechanisms positions Angle as a significant player in the evolution of programmable money and onchain financial services.

Angle Protocol is an open-source, decentralized infrastructure enabling the issuance of reliable, over-collateralized stablecoins. Its design architecture comprises independent modules, allowing stablecoin creation through different mechanisms—such as borrowing, minting via asset baskets (Transmuter), and yield generation via savings contracts. Launched with the aim to address weaknesses in traditional and decentralized stablecoins, Angle ensures high scalability, robust price stability, and full collateral transparency.

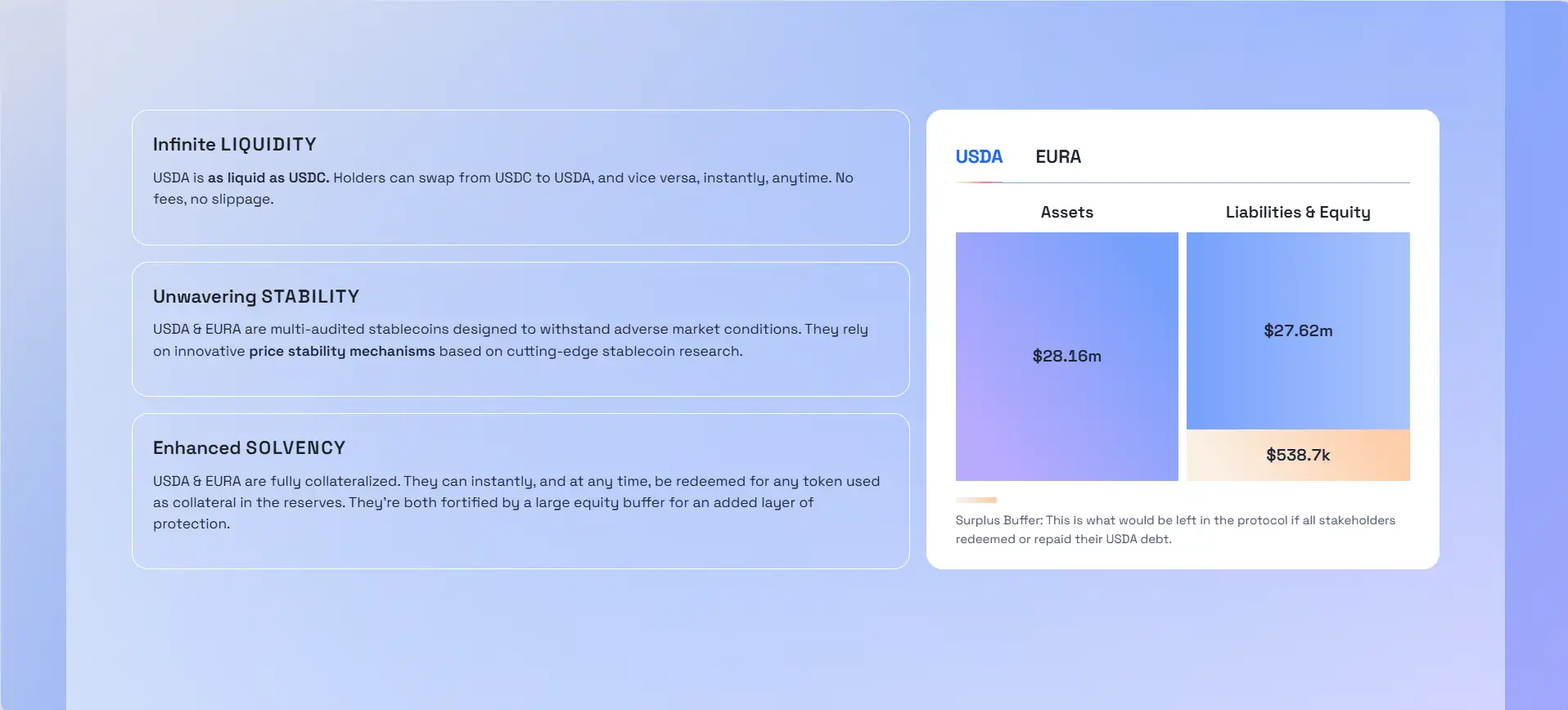

The two flagship stablecoins, USDA (USD-pegged) and EURA (Euro-pegged, formerly agEUR), each operate with segregated reserves. These reserves are public and audited, giving users complete visibility into backing assets. Angle’s Transmuter module is a core innovation—it enables stablecoin minting from a basket of assets with dynamic fee modeling and strong safeguards like circuit breakers to protect against black swan events and depegging. This makes Angle significantly more resilient than predecessors like MakerDAO.

Beyond minting and redemption, users can borrow Angle stablecoins against volatile or yield-bearing collateral through the Borrowing Module, mirroring systems like Aave or Compound, but with more flexibility and gas-efficient liquidations. The protocol offers composability and cross-chain operability via bridges like LayerZero, and implements strict limits to avoid overexposure from potential bridge exploits.

Other key features include algorithmic market operations, flash loans, and onchain forex services that enable users to swap EUR/USD stablecoins with minimal slippage. Angle has also developed a suite of public goods such as carbon calculators and impermanent loss simulators to serve the wider Web3 ecosystem.

With its robust and modular architecture, strong governance via the ANGLE token, and integrations across DeFi, Angle Protocol stands out among stablecoin ecosystems. Competitors include MakerDAO, Frax, and Liquity, although Angle’s modularity and Euro-focus offer unique advantages.

Angle Protocol offers numerous benefits and features that set it apart in the decentralized stablecoin ecosystem:

- Robust Price Stability Mechanisms: Both EURA and USDA are secured by innovative modules like Transmuter, which automatically balances reserve exposure and enforces redemptions during black swan events.

- High Liquidity & Zero Slippage: Angle stablecoins can be exchanged 1:1 with USDC and other assets with no slippage or fees, supported by deep integrations with DEXs like 1inch, Paraswap, and Odos.

- Native Yield Generation: Users earn passive income via stUSD and stEUR without taking extra composability risks—yields come directly from the protocol’s activity in DeFi and tokenized securities.

- Cross-Chain Compatibility: Angle operates across multiple chains with secure bridging infrastructure (e.g., LayerZero) and global/hourly caps to limit exploit exposure.

- Trustless Governance: The protocol is governed by holders of the ANGLE token who can vote on all key decisions, making Angle a fully decentralized ecosystem.

- Open & Audited Infrastructure: The smart contracts powering Angle Protocol have been audited by top security firms like ChainSecurity, Code4rena, and Sigma Prime.

- Onchain Forex Functionality: Angle enables seamless EUR/USD stablecoin swaps at competitive rates, rivaling traditional forex platforms.

Angle Protocol makes it easy to start using its stablecoin products and features with a user-friendly application and flexible options:

- Connect Your Wallet: Head to app.angle.money and connect a Web3 wallet like MetaMask, Coinbase Wallet, Rabby, or Trust Wallet.

- Acquire Stablecoins: Buy EURA and USDA directly through the app by swapping supported assets (e.g., USDC, ETH) or use decentralized exchanges like 1inch or Paraswap.

- Earn Yield: Stake your stablecoins to convert them into stEUR or stUSD and earn passive income. No additional setup or DeFi knowledge is needed.

- Borrow Angle Stablecoins: Deposit collateral such as wstETH or USDC and borrow EURA or USDA using the Borrowing Module. Enjoy capital efficiency and leverage features.

- Bridge Between Chains: Use the built-in bridge infrastructure to transfer ANGLE, EURA, or USDA between supported networks like Ethereum, Optimism, and Polygon with minimal fees.

- Participate in Governance: Hold ANGLE tokens and visit the governance dashboard to vote on proposals and influence protocol direction.

- Simulate Transactions: Use the Spy/Impersonation tool to test any wallet's experience without executing real transactions—ideal for exploration and safety checks.

Angle FAQ

Angle Protocol ensures full liquidity during market turbulence by designing its stablecoins—USDA and EURA—to be redeemable at all times using diversified baskets of reserve assets. This is achieved via the Transmuter module, which automatically balances exposure and avoids over-concentration in any single asset. Even in black swan events, users can exit the system through algorithmically fair redemptions, without waiting for governance action. The system's design removes any reliance on centralized entities and prioritizes onchain solvency and transparency. Full reserve audits and instant redemption functionality are accessible on the Angle official site.

The Transmuter system plays a critical role in ensuring stablecoin price stability by dynamically adjusting minting and redemption incentives based on asset deviations from their target price. When a reserve asset starts to depeg, the system applies higher fees for using that asset, discouraging reliance on unstable backing. Simultaneously, it ensures that redemptions are proportional and not based on a first-come, first-serve basis—eliminating the possibility of bank runs. With its autonomous and governance-independent design, the Transmuter gives Angle Protocol a unique edge in protecting user funds.

Angle Protocol uniquely bridges the gap between DeFi and TradFi by investing stablecoin collateral into both tokenized securities and DeFi lending markets. This allows users to benefit from real-world yields—like treasury rates—without converting to fiat. The result is a native yield on USDA and EURA, automatically distributed via stUSD and stEUR, with no additional action required. Users can hold their crypto, earn stable returns, and retain full onchain control. Learn more about this hybrid model on the Angle website.

stEUR and stUSD are yield-bearing versions of Angle's stablecoins that come without composability risks found in other protocols. Unlike protocols that layer risk through lending and staking integrations, Angle earns yield directly through its core operations. There's no dependency on third-party platforms for yield generation, and users don’t need to lock up funds or risk impermanent loss. These products are backed by fully-audited reserves and benefit from Angle’s strong risk management and fee-optimizing systems.

Yes, Angle Protocol supports real-time forex swaps between USDA and EURA with rates that rival or beat centralized platforms. Users can swap between the two stablecoins directly onchain through the Angle app, with minimal slippage and no hidden fees. Thanks to its deep liquidity and decentralized infrastructure, users experience transparent pricing, instant settlement, and full custody of their assets. Compared to banks and CEXs that charge high spreads and delay transfers, Angle delivers a much faster and more efficient experience.

You Might Also Like