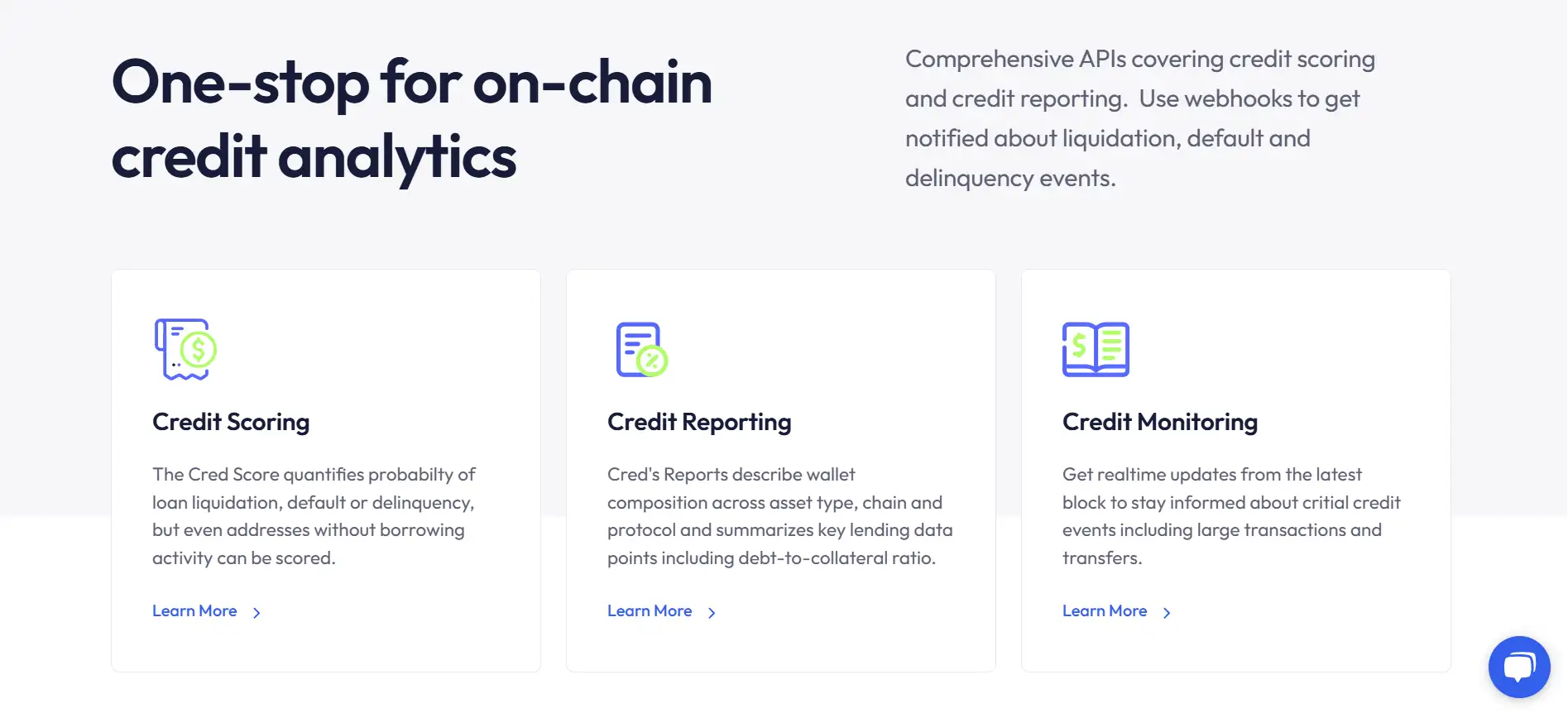

About Cred Protocol

Cred Protocol is redefining credit risk assessment in Web3 by offering a transparent, data-driven approach to scoring and monitoring digital asset behavior. Designed for lenders, wallets, underwriters, and identity protocols, Cred Protocol delivers real-time credit data infrastructure that enhances trust and decision-making across decentralized finance ecosystems.

Through its comprehensive services—including Credit Scoring, Credit Reporting, Monitoring, and Private Credit analytics—Cred Protocol enables stakeholders to evaluate the risk profile of any wallet address across eight supported blockchains. With over 200 million scorable EVM addresses and integration across 30+ lending protocols, it’s a foundational tool for risk-aware innovation in DeFi.

Cred Protocol delivers the first fully-fledged on-chain credit infrastructure designed to quantify lending risk at scale. Leveraging both on-chain and off-chain data, Cred Protocol offers a suite of products that measure an account's ability and intent to repay loans. This includes real-time credit scoring, blockchain-based credit reports, and event-triggered monitoring systems that capture critical wallet behaviors.

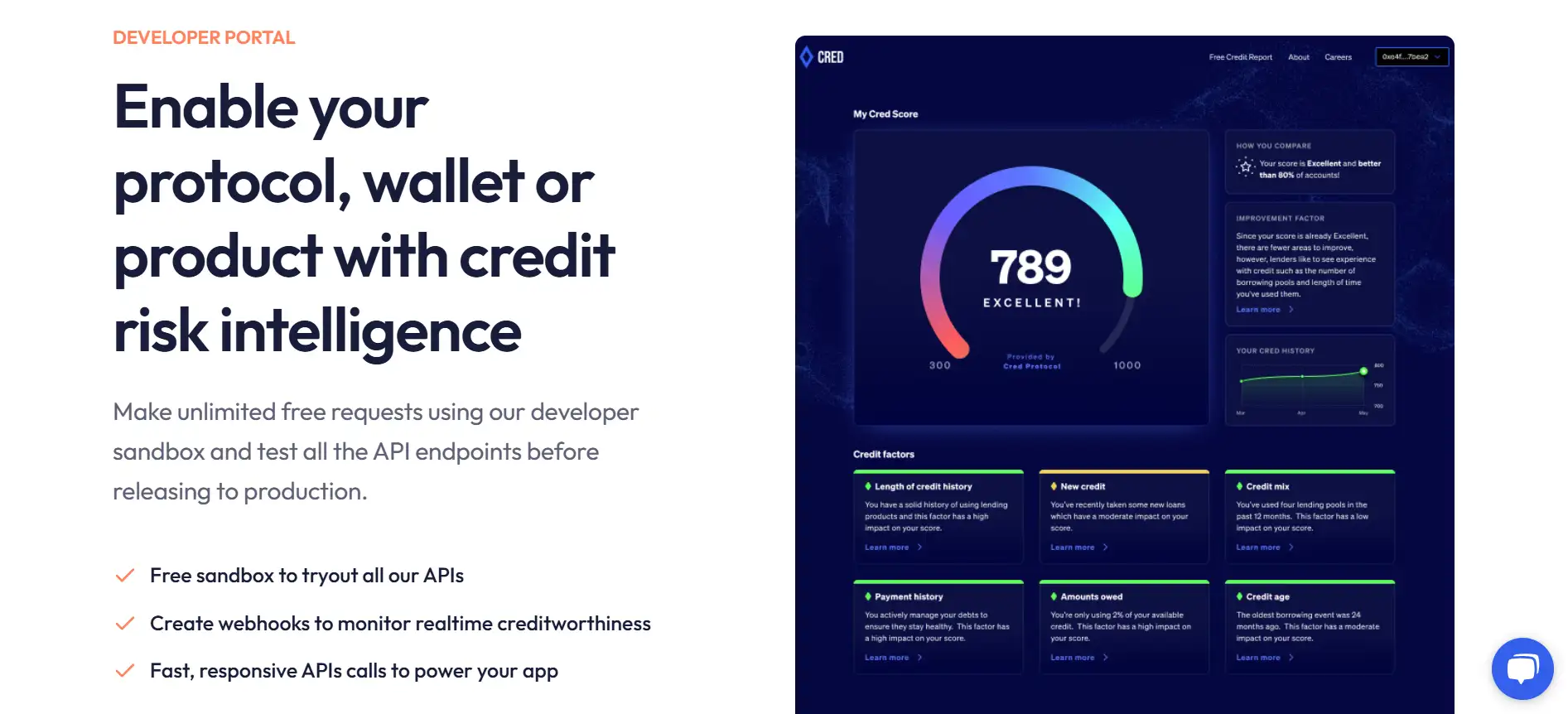

The heart of Cred’s ecosystem lies in the Cred Score—a machine learning model that evaluates a wallet’s risk by analyzing multiple categories of behavior. Factors include borrowing history, account composition, transaction activity, and protocol interactions. Even wallets with no direct loan history can be scored based on ecosystem participation and reputation signals, helping to improve DeFi inclusion.

With support for 8 major blockchains and integrations with key lending protocols like Aave, Compound, and Morpho, Cred Protocol acts as a one-stop gateway for accurate, cross-chain credit assessment. APIs are available to developers through a free sandbox, making it easy to build, test, and launch DeFi tools enhanced by credit intelligence. The platform supports event-driven webhooks for real-time monitoring of delinquencies, defaults, and liquidations.

Key collaborators and integrators include Quadrata, Krebit, and Orange Protocol, reflecting Cred’s growing footprint in identity and trust infrastructure. The protocol is designed for scale, serving both institutional credit evaluators and consumer-facing dApps with equal flexibility.

Beyond core scoring, Cred Protocol is actively developing private credit analytics for mid-market businesses, combining privacy-preserving methods with verifiable identity structures. The team is also researching integrations with on-chain identity verifiers to enhance fraud mitigation and accountability. As Web3 matures, Cred aims to become the de facto standard for measuring and managing creditworthiness in decentralized systems.

Cred Protocol provides a rich array of benefits and features that establish it as a leader in on-chain credit infrastructure:

- Real-Time Credit Scoring: Generate a score based on predictive analysis of loan default, liquidation, or delinquency across major blockchains.

- Comprehensive Credit Reports: Evaluate wallet composition, debt-to-collateral ratios, protocol exposure, and asset distribution.

- Monitoring & Webhooks: Stay informed with event-based updates tied to key credit behaviors like large transfers or risk-triggering activity.

- Multi-Chain Support: Access credit insights across 8 blockchains and over 30 lending protocols including Aave, Compound, and Morpho.

- Machine Learning-Powered: Cred Score uses a weighted model of Credit Factors—like Borrowing History, Account Composition, and Trust.

- Fraud Protection: Prevent manipulation through accountability APIs, fraud flags, and reputation evaluation.

- Developer Sandbox: Test the full API suite for free before moving into production environments.

- Privacy-Conscious Identity: Combine credit with attestation and KYC protocols for secure, reputation-based lending.

Cred Protocol makes it easy for developers and institutions to integrate credit scoring intelligence into any DeFi product or protocol:

- Sign Up: Create a free account at Cred Protocol to access the developer portal and sandbox.

- Review Documentation: Explore the full API suite, including endpoints for credit scoring, reporting, and event monitoring.

- Start Testing: Use the free sandbox to make unlimited API calls and create webhooks for live wallet events.

- Score Wallets: Request scores on EVM-compatible addresses and gain insights on borrowing risk, composition, and more.

- Monitor Risk: Set up automated notifications for key risk signals such as default, liquidation, or credit downgrades.

- Deploy in Production: Migrate from sandbox to live environments and integrate scoring into dApps, wallets, lending dashboards, or identity solutions.

- Join the Community: For support and collaboration, connect with the Cred team on their Discord Server.

Cred Protocol FAQ

The Cred Score is based entirely on on-chain activity, not off-chain financial history or identity. Unlike traditional scores, it analyzes wallet behavior across lending protocols, asset composition, and ecosystem interactions to predict loan default risk. It uses a machine learning model built for Web3, offering a transparent and privacy-conscious alternative to legacy credit systems. Learn more at Cred Protocol.

Yes. Cred Protocol provides a lightweight integration process with fast, responsive APIs and a developer sandbox to test endpoints before going live. You can use webhooks for live monitoring or pull real-time scores with simple API calls. Everything is documented in their developer portal at Cred Protocol.

Cred Protocol can still score wallets without any direct loans using factors like account health, asset composition, and ecosystem interactions. These dimensions help provide a baseline assessment of creditworthiness, allowing more users to participate in DeFi even if they haven’t yet taken out a loan. This inclusiveness helps drive adoption of credit-based Web3 systems.

The scoring model is protected by anti-manipulation mechanisms, such as fraud detection layers and Accountability APIs. Users cannot improve their score simply by transacting with themselves. Cred also groups features into high-level credit factors to preserve transparency without exposing score mechanics. Learn more at Cred Protocol.

Yes. Through Credit Monitoring and webhooks, you can receive real-time notifications on events like liquidations, defaults, or credit downgrades. These alerts help lenders and platforms take timely actions to manage risk. Setup takes minutes using the developer tools at Cred Protocol.

You Might Also Like