About CreditLink

Creditlink is redefining on-chain credit infrastructure by combining AI-powered identity verification with dynamic credit scoring. The protocol is designed to solve critical inefficiencies in DeFi by removing the need for over-collateralization and enabling trustless credit mechanisms. Creditlink empowers users and protocols with data-driven intelligence to participate in decentralized finance with higher capital efficiency and lower entry barriers.

By building a decentralized identity layer and scoring model, Creditlink aims to unlock new use cases in DeFi lending, DAO governance, credit asset issuance, and airdrop targeting. It positions itself as a foundational protocol for the emerging trust economy in Web3, offering smarter, real-time credit intelligence that goes beyond wallet balances and transaction history.

Creditlink is an AI-powered, cross-chain credit scoring and verification protocol that seeks to transform the landscape of Web3 financial infrastructure. As the Web3 ecosystem grows, the need for reliable, decentralized credit systems becomes increasingly urgent—especially in the context of DeFi, where over-collateralization and Sybil attacks present ongoing challenges.

Creditlink addresses these challenges through its AI-based credit scoring engine that evaluates users based on behavioral patterns, asset holdings, on-chain activity, and risk factors. This results in dynamic, verifiable credit scores that power a wide range of DeFi products. Whether for enabling collateral-free loans, building credit-weighted governance systems, or detecting airdrop farming, Creditlink creates a reliable foundation for trust and identity in a permissionless world.

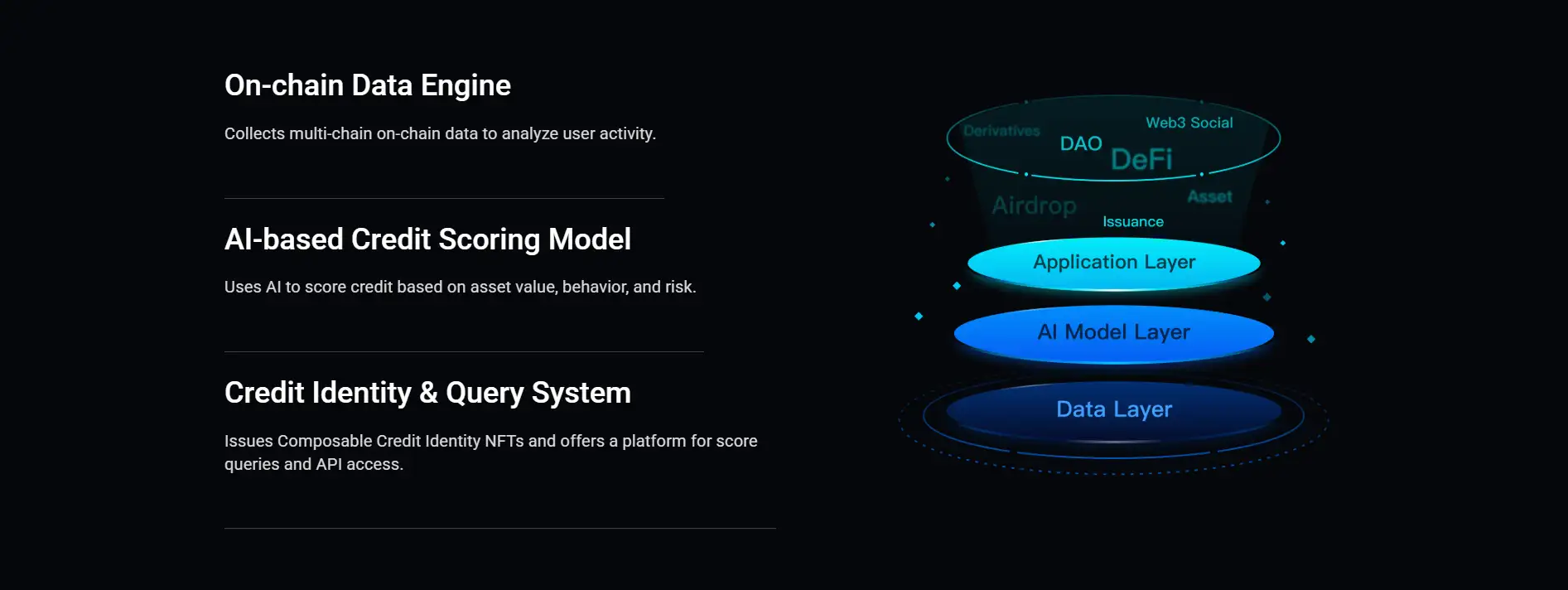

The platform is composed of several modular components:

- On-chain Data Engine: Gathers real-time, multi-chain user data for behavioral and transactional analysis.

- AI Credit Scoring Model: Uses over 200 metrics across 3 dimensions to evaluate user profiles.

- Credit Identity & Query System: Issues NFTs tied to users' scores and provides an API for developers.

With zero-latency retrieval and support for over six high-impact application scenarios, Creditlink delivers scalable performance across the DeFi and DAO ecosystem.

One of Creditlink’s strongest differentiators is its modular approach to real-world use cases:

- Token Airdrops: Filters Sybil addresses and inactive wallets to ensure high-value, targeted distribution.

- Project Investment: Offers token audit reports and whale detection for informed investment decisions.

- DAO Governance: Provides credit-weighted voting and profiling to prevent manipulation.

- DeFi Lending: Enables behavioral-based lending with credit-based risk models.

Compared to alternatives like ARCx, Masa Finance, and Spectral Finance, Creditlink takes a more comprehensive and modular approach by offering both infrastructure and application-specific solutions tailored for DAOs, investors, and dApps.

Creditlink offers an advanced suite of on-chain credit features designed to serve a wide range of Web3 applications:

- AI-Powered Credit Scoring: Scores users in real-time based on 200+ metrics covering asset value, activity, and behavioral history.

- Cross-Chain Compatibility: Integrates data from multiple chains, enabling a holistic view of a user’s creditworthiness.

- Decentralized Identity: Issues verifiable Credit Identity NFTs that serve as portable Web3 reputations.

- Collateral-Free DeFi Lending: Allows DeFi platforms to reduce over-collateralization and unlock capital efficiency.

- Smart Airdrops & Governance: Targets only high-quality addresses and protects voting processes from Sybil attacks.

- Credit Derivatives: Enables new DeFi products like credit-based insurance, bonds, and structured investments.

Getting started with Creditlink is simple and secure. Follow these steps to explore the platform and benefit from on-chain credit intelligence:

- Visit the Official Website: Head over to the Creditlink homepage and click “Launch App” to enter the platform.

- Connect Your Wallet: Use MetaMask or WalletConnect to access your Web3 wallet and interact with the dApp.

- Score Your Address: Click “Score Me” to instantly receive your on-chain credit rating powered by AI and behavior analytics.

- Explore Use Cases: Try out tools like Smart Analysis, Batch Wallet Evaluation, or Credit Identity NFT generation.

- Use or Stake $CDL: Unlock advanced features, stake to boost reputation, or vote in governance using your $CDL tokens.

- Join the Community: Stay engaged via Twitter, Telegram, or Discord.

- Join the Presale: Participate in the $CDL token presale directly via AsterDEX by connecting your wallet and placing an order.

CreditLink FAQ

Creditlink uses an AI-powered credit scoring model that evaluates users across 200+ metrics, including asset value, on-chain activity, and behavioral history. This allows DeFi protocols to assess risk in real-time and offer collateral-free lending with confidence. By integrating Creditlink, platforms can reduce over-collateralization and improve capital efficiency while protecting themselves from default risk.

Credit Identity NFTs issued by Creditlink are composable, verifiable, and portable across multiple chains. Unlike traditional scoring dashboards, these NFTs carry your on-chain reputation and credit score wherever you go, enabling you to unlock services, participate in governance, and access lending opportunities without re-verification each time.

Creditlink integrates credit-weighted voting and behavioral tagging to safeguard DAO governance. Instead of simply counting tokens, DAOs can weigh votes by credit score, reducing the influence of Sybil addresses and preventing whales from dominating decisions. This makes governance more fair, secure, and transparent for communities on Creditlink.

Creditlink helps projects execute targeted airdrops with its Batch Analysis tool. By detecting Sybil addresses, filtering inactive wallets, and profiling user value, Creditlink ensures that tokens go to genuine, engaged users. This reduces token waste, increases retention, and improves community quality after the airdrop.

By staking $CDL, the native token of Creditlink, users can enhance their on-chain reputation and increase their credit score weight. This unlocks premium platform features, improves visibility for airdrops or governance roles, and grants ecosystem privileges in partner dApps. Staking aligns users with the protocol’s growth and rewards them with additional benefits.

You Might Also Like