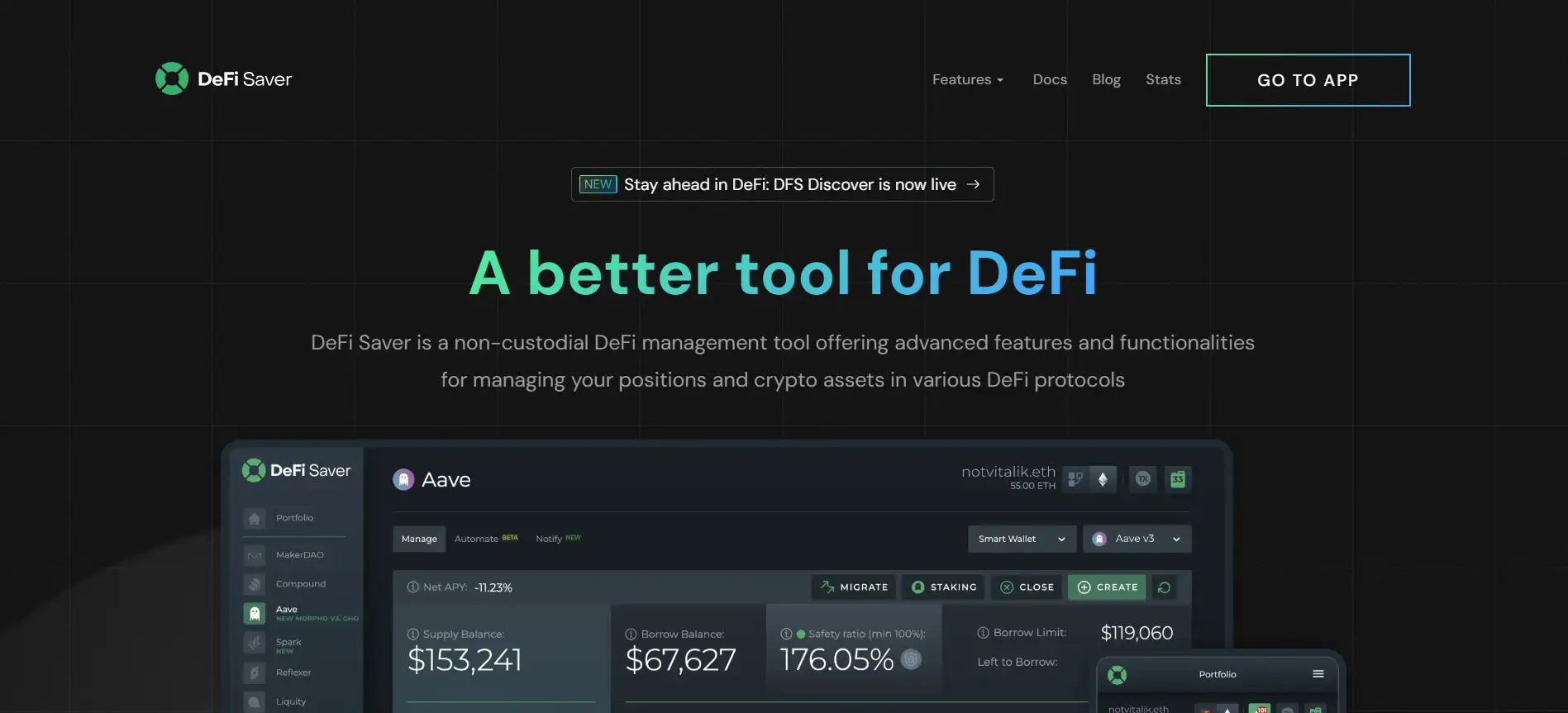

About DeFi Saver

DeFi Saver is a comprehensive non-custodial DeFi management platform that empowers users with a wide range of advanced features to manage their DeFi positions securely and efficiently. Built with a user-centric and security-first design, DeFi Saver enables seamless access to top DeFi protocols including Aave, Compound, MakerDAO, Morpho, and Spark, while supporting key networks such as Ethereum, Optimism, Arbitrum, and Base.

Its modular architecture combines lending, borrowing, leverage management, and portfolio automation into one robust ecosystem. With features like stop-loss, take profit, boost, repay, and recipe-based transactions, users retain full custody and control over their assets while executing complex strategies with ease. DeFi Saver has become a cornerstone for DeFi power users looking for reliability, transparency, and automation.

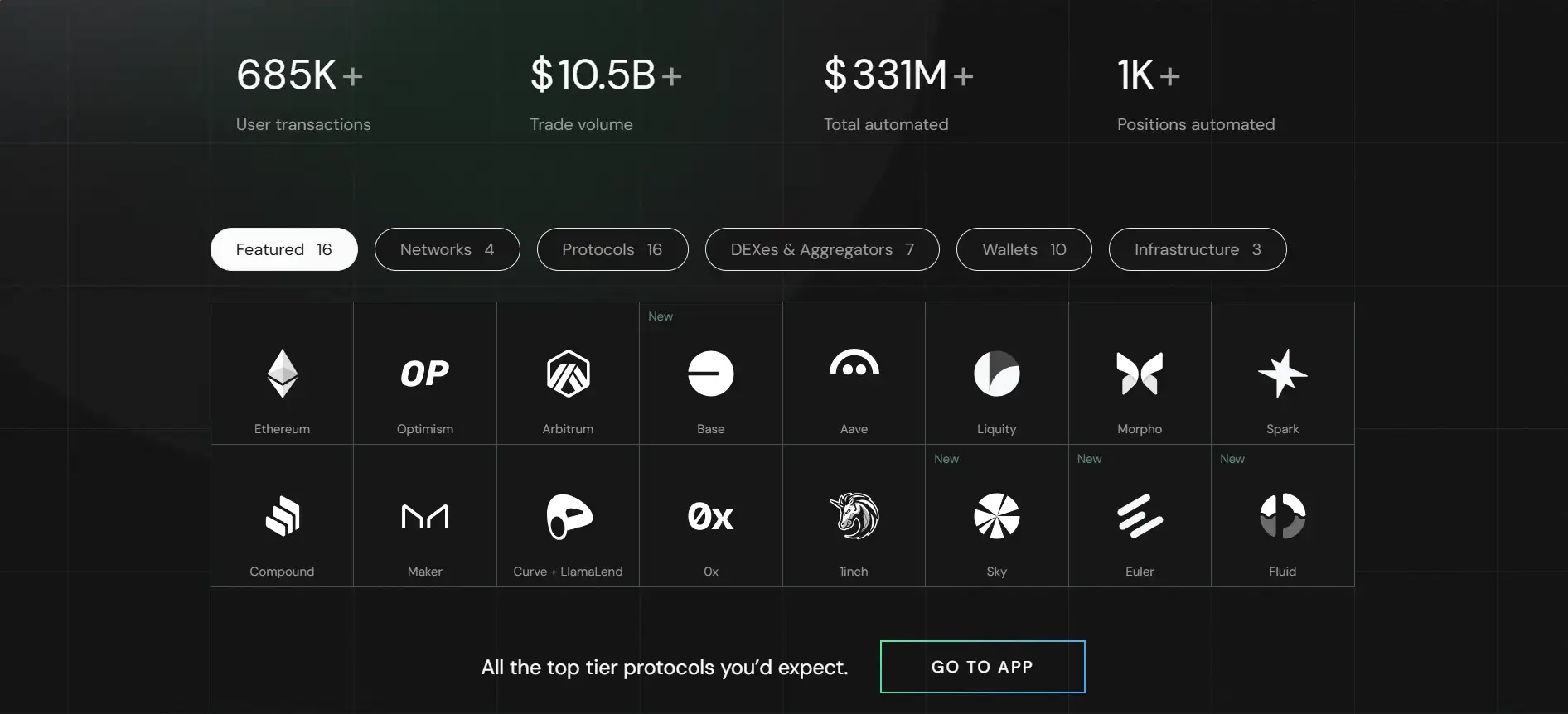

DeFi Saver was launched with the vision of simplifying access to decentralized finance while maintaining high standards of flexibility and transparency. Developed by the Decenter team, the platform has grown to support over $10.5B in trade volume and more than 685,000 transactions. With over $331M worth of positions automated, the application is used by DeFi traders, institutions, and yield strategists to maintain optimal positions and avoid liquidation events.

Over time, DeFi Saver has introduced a suite of unique features including the Loan Shifter (which allows switching debt and collateral positions across protocols), Recipe Creator (to build multi-step custom transactions), and DFS Automation (for hands-off strategy execution). In addition, it supports dynamic market discovery tools under DFS Discover, enabling users to analyze and filter lending/borrowing opportunities across protocols like Aave, Spark, Compound, and Morpho.

Competitors in this space include platforms such as InstaDapp, 1inch, and Zerion, though DeFi Saver distinguishes itself with highly customizable automations and true non-custodial functionality, all backed by audited smart contracts.

DeFi Saver provides numerous benefits and features that make it a top-tier choice for DeFi management:

- Multi-Protocol Integration: Manage positions across Aave, Compound, MakerDAO, Spark, and Morpho in one place.

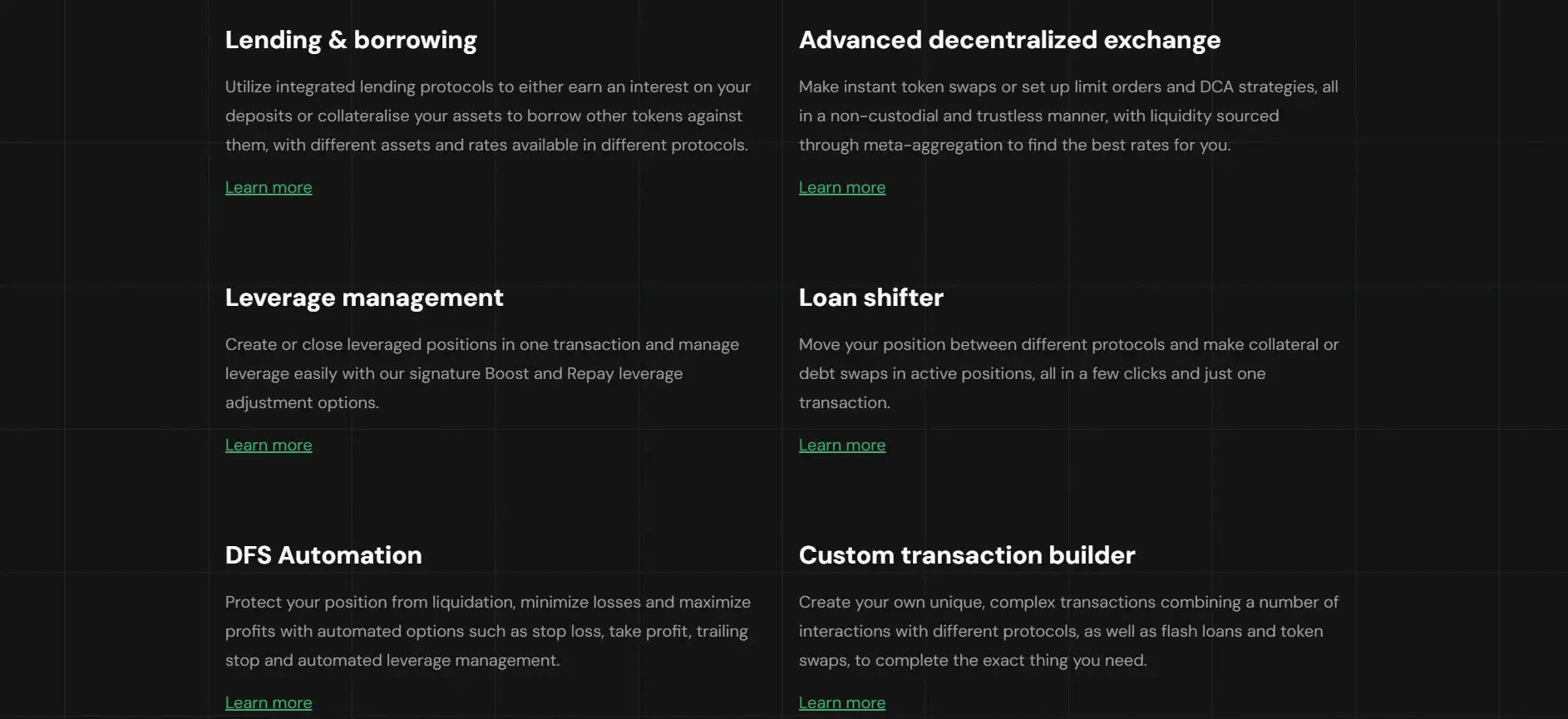

- DFS Automation: Set Stop Loss, Take Profit, Boost, Repay, and Trailing Stop for risk-free hands-off strategy execution.

- Loan Shifter: Seamlessly move collateral or debt across protocols in a single transaction to optimize rates and reduce risk.

- Recipe Creator: Build complex flash-loan-based strategies using a visual interface with over 100 supported actions.

- Meta Aggregated DEX: Swap tokens using best pricing sourced from 1inch, 0x, Paraswap, and others.

- Simulation Mode: Test all features and supported protocols risk-free before deploying with real funds.

DeFi Saver makes getting started with DeFi automation and management straightforward:

- Step 1 – Visit the App: Head to the DeFi Saver App and click “Connect Wallet.”

- Step 2 – Select a Wallet: Compatible wallets include MetaMask, Ledger, Trezor, WalletConnect, Coinbase Wallet, Rabby, and more.

- Step 3 – Choose a Protocol: Pick from Aave, Maker, Spark, Compound, or Morpho and decide your strategy—lend, borrow, or leverage.

- Step 4 – Enable Automation (Optional): Configure automation parameters such as target collateral ratios, stop-loss prices, or take-profit levels.

- Step 5 – Confirm & Monitor: Execute your transaction and track it via the real-time dashboard. Use DFS Stats to monitor platform-wide analytics.

DeFi Saver FAQ

DeFi Saver offers non-custodial liquidation protection through smart contract automation that users control. With automation strategies like Boost, Repay, and Stop Loss, users can set their own thresholds and conditions, and all actions are executed directly through their smart wallets. Funds remain fully under user control at all times, ensuring both safety and transparency. You can explore this at DeFi Saver.

Yes, with Loan Shifter by DeFi Saver, users can move lending and borrowing positions across protocols like Aave, Spark, or Compound without manual closing. Using atomic execution and flash loans, it performs collateral and debt swaps in one secure transaction. This enables real-time strategy adjustments while avoiding gas inefficiencies.

The Recipe Creator is a tool for designing custom DeFi strategies that execute in a single transaction. Users can combine lending, borrowing, swaps, flash loans, and automation into one efficient flow. It supports precise rule-setting and safety parameters, making it ideal for advanced DeFi use cases.

Absolutely. Simulation Mode is a risk-free testing environment that replicates real DeFi conditions without using your actual wallet or assets. You can simulate automated strategies, leverage adjustments, and custom recipes before deploying them live. It’s perfect for experimenting safely.

DeFi Saver protects against MEV attacks using its TxSaver feature, which handles transactions off-chain before submission. This approach hides your transaction details from public mempools and prevents front-running, sandwich attacks, or failed trades. It also requires no ETH for gas and incurs no extra service fees. Learn more at DeFi Saver.

You Might Also Like