About Gondi

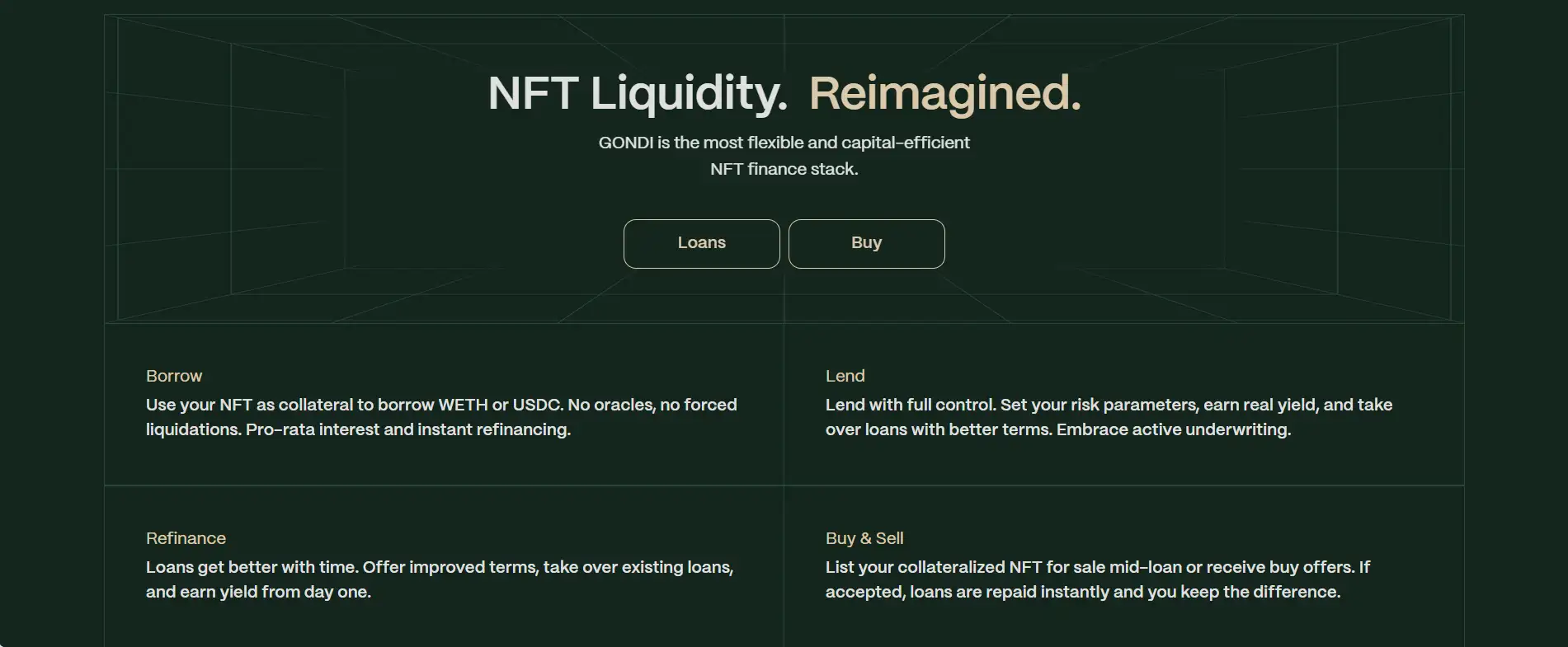

GONDI is a cutting-edge decentralized NFT lending protocol that redefines how digital assets are leveraged for liquidity. Focused on efficiency and flexibility, GONDI enables borrowers to use their NFTs as collateral to access WETH or USDC without relying on oracles or risking forced liquidations. With a refined structure and peer-to-peer model, GONDI opens the door to an entirely new layer of NFT-based finance that is permissionless, composable, and borrower-friendly.

At its core, GONDI provides a trustless financial stack designed around pro-rata interest accrual, instant refinancing, and dynamic borrower-lender negotiation. Now in its V3 iteration, it introduces key innovations like Tranche Seniority, which allows for more granular risk management. Whether you're a collector unlocking liquidity or a lender seeking yield from blue-chip assets, GONDI offers unmatched control and capital efficiency in NFT finance.

Launched to address inefficiencies in existing NFT lending markets, GONDI provides a completely reimagined finance protocol tailored specifically for non-fungible assets. Unlike traditional platforms, GONDI introduces a model that eliminates oracle dependencies, removes automated liquidations, and places negotiation power directly in the hands of users. The platform enables NFT holders to borrow stablecoins like WETH or USDC using their NFTs as collateral. Interest accrues only for the time borrowed, thanks to its innovative pro-rata interest model.

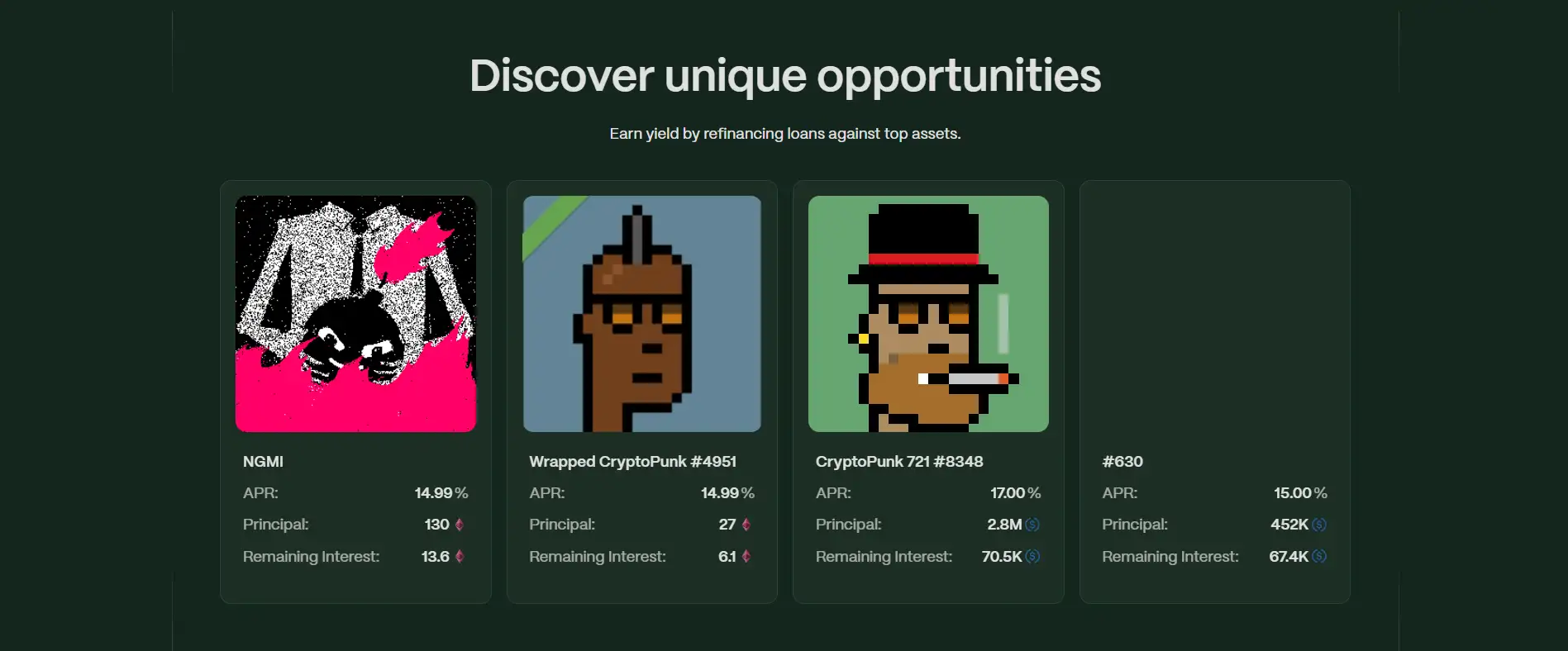

One of GONDI’s most powerful features is instant refinancing. Lenders can offer improved terms and take over existing loans in real time. Borrowers benefit without needing to monitor fluctuating floor prices or actively manage their positions. GONDI also allows users to list NFTs for sale during an active loan and receive immediate loan repayment if a sale goes through—giving asset holders a wide spectrum of exit options.

The protocol is designed with both borrowers and lenders in mind. Borrowers retain access to token-gated communities and airdrops using integrations like Delegate Cash and Tokenproof. On the lending side, GONDI empowers users to create tailored lending strategies by defining parameters such as duration, APR, and tranche seniority. Lenders can refinance loans, initiate renegotiations, or make custom offers across collections to optimize their returns.

In terms of growth, GONDI has already facilitated over $300M in loan volume with $100M in total value locked (TVL), and a refinancing rate of 30%, demonstrating strong market demand and real usage. It has been independently audited by trusted firms including Code4Arena, Halborn, Quantstamp, and CertiK, adding additional confidence in its security.

In the rapidly expanding NFTfi space, GONDI stands alongside other platforms like NFTfi, and BendDAO but differentiates itself with its refinancing mechanics, borrower protections, and unmatched flexibility for lenders.

GONDI provides numerous benefits and features that set it apart in the NFT lending ecosystem:

- Oracle-Free Borrowing: Borrowers are protected from sudden liquidations caused by unreliable price feeds, as GONDI does not use oracles.

- Pro-Rata Interest: Interest accrues only for the duration of the loan, enabling cost-efficient borrowing.

- Instant Refinancing: Lenders can take over loans with better terms, offering borrowers more competitive interest rates automatically.

- Token-Gated Utility Preserved: Borrowers maintain access to communities and airdrops using Delegate Cash and Tokenproof even while their NFT is collateralized.

- Custom Lending Strategies: Lenders can configure loan parameters like APR, principal, duration, and tranche seniority to match their risk profile.

- Buy & Sell Mid-Loan: NFTs used as collateral can still be sold on-market, automatically repaying the loan and unlocking value for the borrower.

- Security & Audits: GONDI is audited by top security firms such as Halborn, Code4Arena, and Quantstamp, ensuring the platform is robust and secure.

Getting started with GONDI is fast and straightforward for both borrowers and lenders:

- Visit the Platform: Head to the official GONDI website and click “Launch App” to begin.

- Connect Your Wallet: Use your preferred wallet (e.g., MetaMask, WalletConnect) to securely connect to the app.

- Borrow Against NFTs: Select a whitelisted NFT, choose from loan offers, and borrow WETH or USDC. No gas fees are required for listing.

- Lend and Refinance: Set your risk parameters, browse existing loans, and instantly refinance those with better terms for higher returns.

- Access Documentation: Review lending mechanics, refinancing rules, and supported collections in the official GONDI documents.

- Join the Community: Follow the project on Twitter or connect via Discord to stay updated and engage with users.

Gondi FAQ

GONDI enables instant refinancing by allowing any lender to take over an active loan by offering better terms, such as a lower APR. This mechanism is automatic and requires no action from the borrower. If a lender chooses to refinance a loan, they repay the original lender’s principal and accrued interest, and the new loan takes effect immediately. This allows borrowers to benefit from improved terms over time, without needing to monitor or intervene. Learn more at the GONDI website.

Yes, GONDI supports integrations like Delegate Cash and Tokenproof, which allow borrowers to maintain access to token-gated communities, claim airdrops, and participate in exclusive events—even if their NFT is currently being used as loan collateral. This ensures that utility and benefits tied to ownership are preserved throughout the duration of the loan. For more details, visit gondi.xyz.

GONDI is designed with a liquidation model that avoids oracles. Instead of relying on floor prices or external feeds, loans only default if borrowers do not repay by the agreed maturity. In case of default, single-lender loans allow the lender to claim the NFT. For multi-lender loans, a structured buyout window and auction process ensures fairness. Senior tranches are prioritized during distribution. This model prevents panic-based liquidations and ensures borrower safety. Visit GONDI to explore liquidation documentation.

GONDI offers full underwriting control for lenders. Users can define specific loan parameters including duration, APR, principal, and tranche seniority tolerance. This enables the creation of personalized lending strategies that align with individual risk appetite. Additionally, lenders can instantly refinance active loans or renegotiate terms to improve yield. Offers can be submitted with custom fees, empowering lenders to engage in active loan management across whitelisted NFT collections. More info available on gondi.xyz.

In case of a default, GONDI’s non-custodial system triggers a structured resolution process. For single-lender loans, the lender can directly claim the NFT. For loans with multiple lenders, the lender with the highest principal has a 48-hour buyout window to purchase other tranches. If no buyout occurs, the NFT is auctioned and proceeds are distributed pro-rata by seniority. This ensures fair asset recovery while maximizing value retention for all parties involved.

You Might Also Like