About Lombard

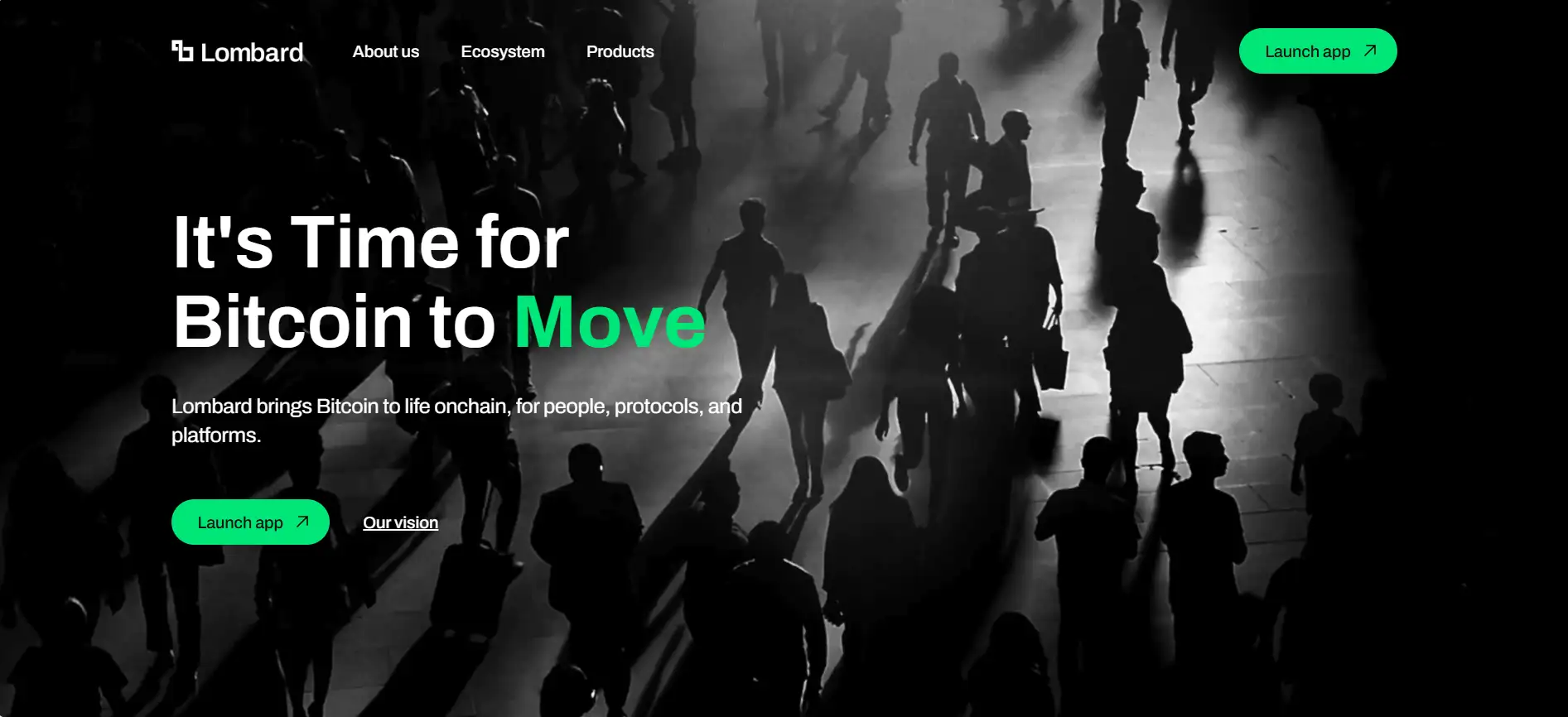

Lombard is a pioneering platform that unlocks the full potential of Bitcoin by bringing it onchain for use across DeFi, applications, and protocols. Positioned as the foundational infrastructure for Bitcoin’s onchain future, Lombard allows BTC holders to stake, trade, and earn with their Bitcoin while preserving its native security and simplicity.

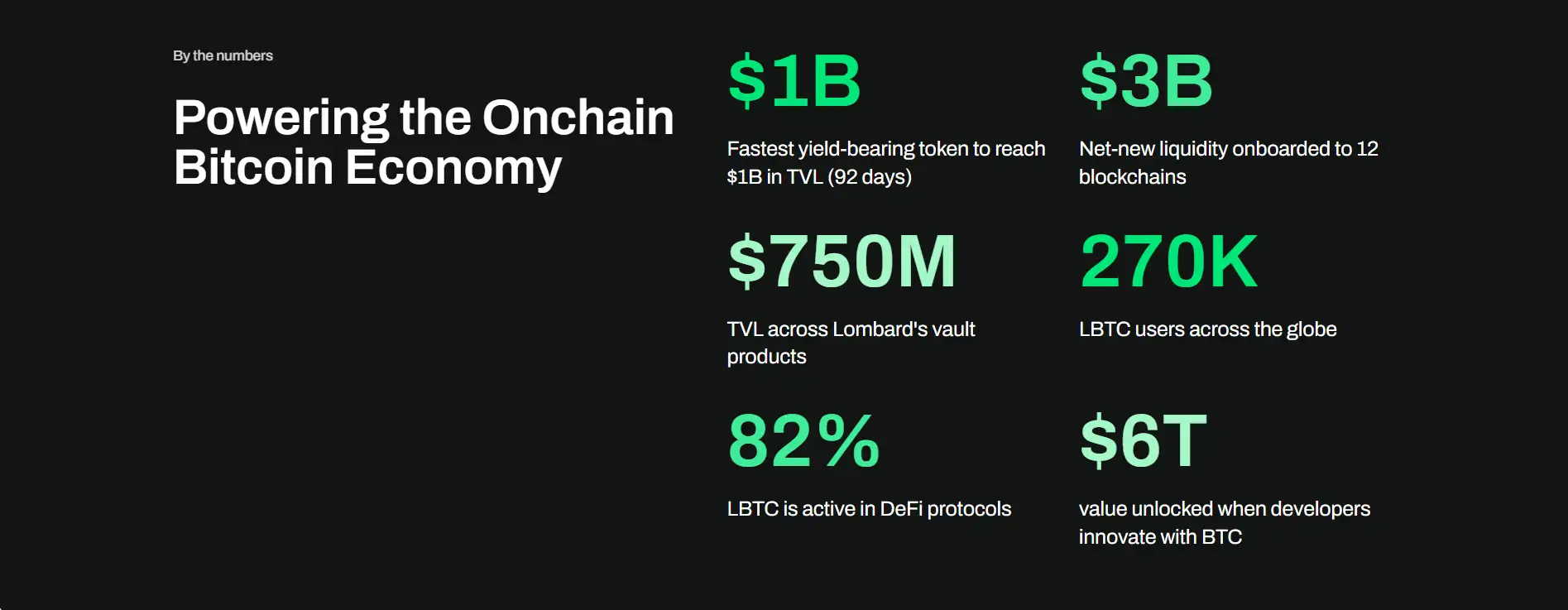

Backed by institutional-grade partners and adopted by leading developers and DeFi protocols, Lombard has rapidly established itself as a key layer in the emerging Bitcoin capital markets. Through innovations like LBTC—the leading liquid-staked Bitcoin token—and integrations with over 12 chains, Lombard provides a secure and scalable gateway to put Bitcoin to work across the Web3 ecosystem.

Lombard was founded in 2024 with a mission to enable permissionless innovation using Bitcoin. Despite being the most valuable digital asset, Bitcoin has historically remained idle in cold storage and largely disconnected from the innovation of DeFi. Lombard is changing this by delivering a full-stack product suite that activates, connects, and scales Bitcoin liquidity across protocols, chains, and user interfaces.

The cornerstone of Lombard’s architecture is LBTC, a liquid-staked token that allows Bitcoin holders to earn native yield without sacrificing liquidity. Since its launch, LBTC has reached $1B in TVL in just 92 days, with $3B in net-new liquidity deployed across 12 blockchains. Alongside LBTC, Lombard offers vault strategies managed by risk professionals, a DeFi Marketplace to borrow and lend BTC, the Lombard SDK for integrating staking into other apps, and the Lombard Ledger, a secure bridge operated by a consortium of top-tier digital asset institutions.

Lombard is executing its roadmap in three phases:

- Phase 1 – Activate Liquidity: Launching LBTC, DeFi Marketplace, and vaults to mobilize BTC across onchain ecosystems.

- Phase 2 – Capital Markets: Developing tools like Cross-Chain BTC, SDK integrations, and tokenized financial products.

- Phase 3 – Bitcoin Economy: Building the base layer for trustless Bitcoin innovation with developer platforms and full decentralization.

The platform is trusted by major players including Galaxy, Kiln, P2P, Figment, OKX, Wintermute, and more. Competitively, Lombard stands apart from wrapped BTC solutions like wBTC and cross-chain bridges such as THORChain by offering institutional-grade staking, audited infrastructure, and deep DeFi integration. As the gateway for BTC into onchain finance, Lombard is positioned to catalyze a new era of Bitcoin adoption.

Lombard provides several groundbreaking features and benefits for Bitcoin holders, institutions, and developers:

- LBTC – Liquid Staking for BTC: Stake your Bitcoin and mint LBTC to earn yield while keeping full liquidity to use in DeFi.

- Vault Strategies: Gain passive income through curated vaults managed by top-tier asset and risk managers.

- Lombard DeFi Marketplace: A unified platform to lend, borrow, and trade BTC across 12 leading blockchains.

- Bitcoin Staking Infrastructure: Stake BTC directly to Finality Providers on Babylon, operated by trusted partners like Galaxy, Kiln, and Figment.

- Lombard Ledger Bridge: A secure and audited bridge solution to bring Bitcoin onchain, backed by 14 digital asset institutions.

- Lombard SDK: Integrate Bitcoin staking and yield generation into your product with a single integration layer.

- Security Consortium: Lombard is protected by top audit firms including Cantina, OpenZeppelin, Veridise, and Halborn.

- Cross-Chain BTC (Coming Soon): A new Bitcoin primitive that will allow wrapped and staked BTC to move trustlessly across ecosystems.

Getting started with Lombard is straightforward for Bitcoin users, developers, and institutions:

- Visit the official website: Head to lombard.finance to explore all product offerings.

- Stake BTC to mint LBTC: Use the Lombard App to deposit Bitcoin and receive LBTC in return, earning native yield while staying liquid.

- Explore DeFi opportunities: Access vaults, lending markets, and liquidity pools on the Lombard DeFi Marketplace.

- Integrate Lombard SDK: Wallets, dApps, and exchanges can easily embed BTC staking and deposits using the Lombard SDK.

- Bridge BTC securely: Use Lombard Ledger to bring Bitcoin onchain via a secure, institutional-grade bridge.

- Read the docs: Technical and security documentation is available through the official Gitbook.

Lombard FAQ

LBTC is fundamentally different from wrapped BTC because it represents liquid-staked Bitcoin earning native yield while remaining usable in DeFi. Unlike wBTC, which is fully custodial and simply tokenizes BTC on Ethereum, Lombard enables BTC holders to stake directly with Finality Providers and mint LBTC, unlocking both yield and liquidity simultaneously.

Yes. The Lombard SDK is a production-ready toolkit that allows wallets, exchanges, and dApps to seamlessly integrate Bitcoin staking and yield generation into their products. This lets developers bring native BTC deposits and LBTC minting directly to users without building the infrastructure from scratch. Documentation is available via the official Gitbook.

Lombard Vaults provide curated, actively managed strategies run by leading risk managers and asset managers. Institutions can allocate BTC to these vaults to earn diversified onchain yields with institutional-grade risk controls. By offering one-click access to multiple protocols, Lombard reduces operational complexity while maximizing returns for institutional clients.

The Lombard Ledger is secured by a consortium of 14 leading digital asset institutions such as Galaxy, Kiln, P2P, and Wintermute. Each transaction undergoes multi-party verification to ensure robust protection against exploits. Combined with continuous auditing from firms like OpenZeppelin, Cantina, and Halborn, Lombard provides one of the most secure pathways to bring BTC onchain.

Yes. The upcoming Cross-Chain BTC primitive will let developers onboard wrapped and staked BTC seamlessly across ecosystems. This innovation means Lombard will support BTC liquidity for lending, trading, and staking on multiple blockchains without requiring separate infrastructure for each form of Bitcoin.

You Might Also Like