About Maple

Maple Finance is a leading digital asset lending platform built for institutional capital markets. Combining on-chain transparency with credit market infrastructure, Maple redefines secured lending by offering fully collateralized loans, real-time risk monitoring, and permissioned pool access for verified lenders.

Founded in 2019 by former bankers and credit investment professionals, Maple serves as the bridge between traditional finance and decentralized finance. It enables institutions to lend and borrow digital assets with fixed-rate terms and institution-grade risk assessment. Through its dual product lines — Maple Institutional and the DeFi-native Syrup.fi — the platform empowers users across the financial spectrum with secure, transparent, and high-yield lending solutions.

Maple is a secure, curated digital lending platform that connects institutional capital to overcollateralized borrowing opportunities in the crypto economy. Built on smart contracts and powered by blockchain technology, Maple provides verified lenders access to lending pools offering stable, fixed-yield returns. Since launch, the protocol has facilitated over $6.7 billion in loans and maintains a 165%+ collateral ratio, demonstrating the platform's commitment to safety and sustainability.

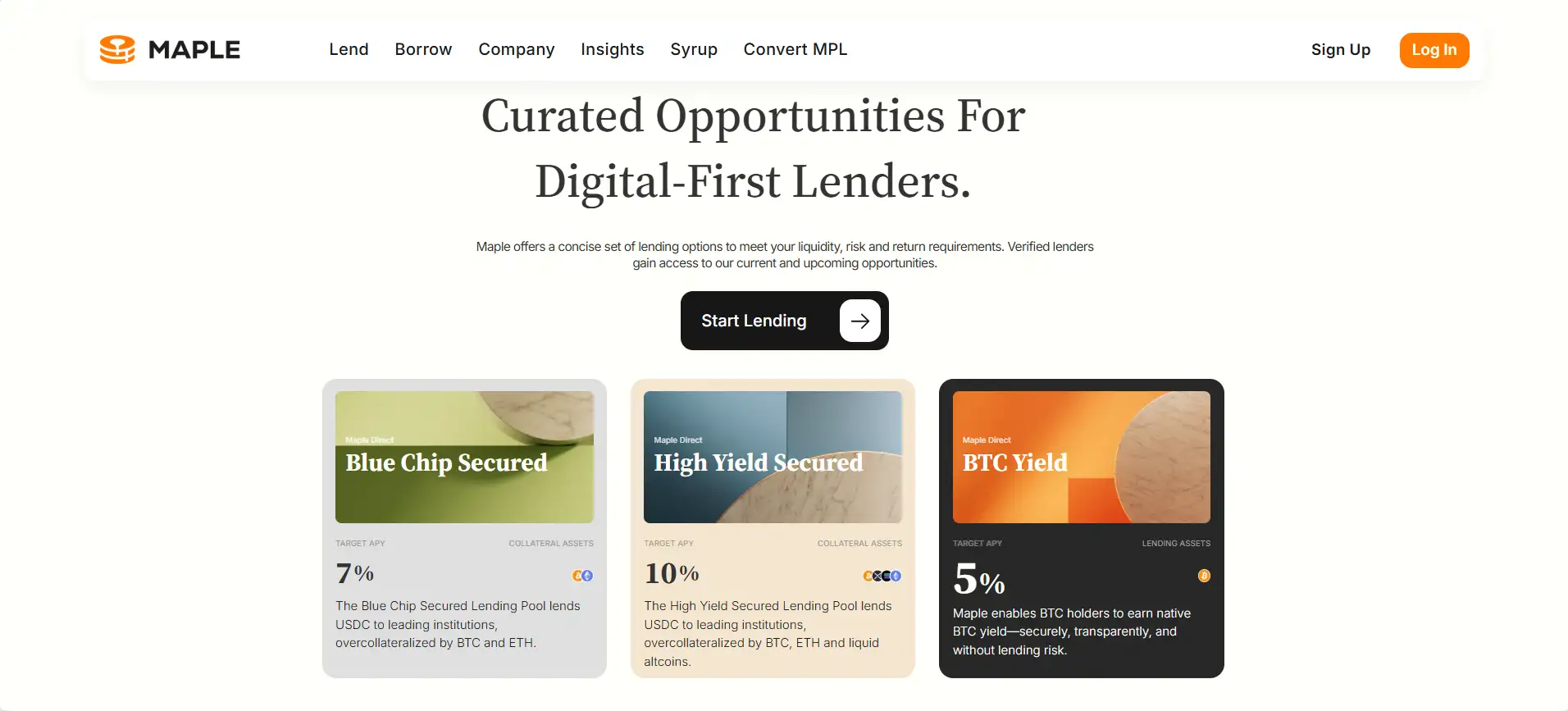

At the core of Maple’s infrastructure are its permissioned lending pools: Blue Chip Secured, High Yield Secured, and BTC Yield. These pools provide returns between 5% and 10% APY, backed by overcollateralized positions using ETH, BTC, and other liquid altcoins. By integrating KYC processes and smart contract security, Maple gives institutional and verified DeFi lenders total visibility and risk-adjusted returns. Meanwhile, borrowers benefit from access to capital with flexible terms and real-time loan management tools.

Maple is also deeply committed to decentralization and governance through the SYRUP token, which aligns participants, fuels ecosystem incentives, and governs both the institutional and permissionless DeFi offerings. This governance token can be staked to earn rewards while contributing to decision-making for protocol upgrades and economic incentives. Maple’s integration with major data platforms like Messari, and DeFi Llama further supports transparency and analysis.

Unlike competitors such as Aave, Compound, and TrueFi, Maple delivers a unique hybrid between institutional lending and decentralized infrastructure. It brings institutional-grade risk assessment, collateral management, and debt servicing into the on-chain world — transforming how crypto-native and traditional capital interact in the financial system.

Maple Finance offers a powerful range of benefits and features that make it an exceptional solution for digital asset lending:

- Permissioned Lending Pools: Access secure, compliant lending opportunities with curated institutional borrowers and transparent smart contracts.

- High-Yield Lending: Earn predictable fixed APYs between 5% and 10% by depositing into structured lending pools backed by overcollateralized loans.

- Institutional-Grade Risk Management: All loans are vetted through Maple's internal credit assessment and risk management frameworks.

- Fully Collateralized Loans: Every loan issued is backed by high-quality digital assets like ETH, BTC, and stablecoins to ensure repayment security.

- Transparent On-Chain Operations: Real-time data and auditability ensure lenders and borrowers have complete visibility into loan terms, collateral ratios, and performance.

- SYRUP Governance: Stake and participate in community-driven governance to shape protocol policies and earn incentives.

- Syrup.fi for DeFi Users: A permissionless access point to Maple’s infrastructure, democratizing institutional lending for retail DeFi participants.

Getting started with Maple Finance is straightforward for both lenders and borrowers:

- Sign Up: Visit the Maple Finance website and create an account. For lending access, complete the KYC process to join the Global Allowlist.

- Explore Pools: Navigate to the “Lend” section and browse opportunities such as Blue Chip Secured, High Yield Secured, or BTC Yield.

- Deposit Funds: Choose a pool and deposit assets like USDC or BTC. You'll receive LP tokens representing your stake and returns.

- Monitor Performance: Use Maple’s dashboard to track APY, collateral ratios, loan performance, and any default or impairment events.

- Borrow Capital: If you're a borrower, complete the application form and undergo due diligence. Once approved, submit loan requests and drawdown funds upon acceptance.

- Govern with SYRUP: Stake your SYRUP tokens to gain voting rights and earn ecosystem rewards through community governance.

- Join the Community: Engage on Telegram, follow on Twitter, or explore analytics on Dune.

Maple FAQ

Maple protects lenders through overcollateralized loans, rigorous credit assessments, and smart contract enforcement. All borrowers undergo institutional-grade due diligence and must post high-quality digital assets like ETH, BTC, or liquid altcoins as collateral. Real-time monitoring and risk transparency ensure that lender capital is always secured and that defaults are managed with collateral liquidation and recovery protocols.

The Global Allowlist is a core component of Maple’s security framework for permissioned lending pools. Once a lender completes KYC, their wallet is added to the Allowlist, granting access to all Maple pools. Only whitelisted addresses can deposit into these pools or receive LP tokens, which ensures regulatory compliance and prevents unauthorized transfers. This system safeguards institutional-grade lending integrity while maintaining user privacy and decentralization.

Yes, you can participate in Maple’s lending pools without holding SYRUP. Lenders are not required to stake or hold governance tokens to deposit into pools and earn yield. However, holding SYRUP allows users to engage in governance, propose upgrades, and earn rewards by staking. While optional, SYRUP is the gateway for those who want to influence the platform’s future and participate more deeply in the Maple ecosystem.

Impairments on Maple are proactive and transparent. Rather than waiting for a borrower to fully default, Maple can flag loans at risk of non-repayment before the grace period ends. This system distributes risk fairly across lenders and discourages last-minute capital withdrawals. If repayments are made, the impairment is lifted. If not, the loan transitions to default with collateral liquidated. This approach minimizes losses and improves capital efficiency for all pool participants.

The SYRUP token is central to Maple’s governance and incentive system. Token holders can stake SYRUP to gain voting rights, propose changes, and help steer the protocol’s future. Rewards from protocol activity are distributed to stakers, aligning long-term participation with tangible value. SYRUP unifies both the institutional and DeFi branches of Maple, powering decision-making across Maple Institutional and Syrup.fi, and strengthening alignment between users and platform growth.

You Might Also Like