About MYSO

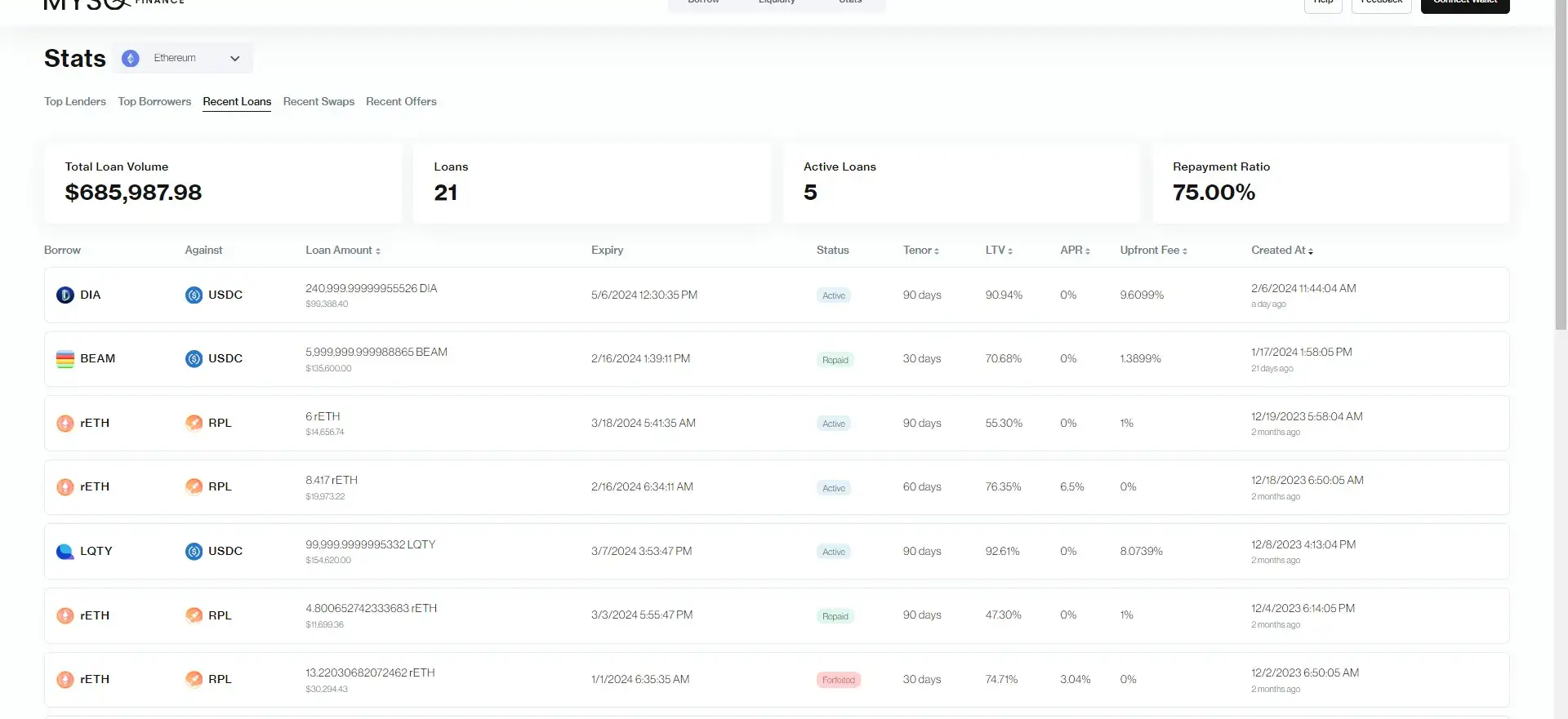

MYSO Finance is a decentralized finance (DeFi) platform that offers unique Zero-Liquidation Loans. The platform allows users to borrow funds without the risk of liquidation, which is a significant innovation in the DeFi space. MYSO Finance aims to provide a safer and more flexible lending experience by eliminating the common risk of liquidation that borrowers face in traditional DeFi protocols.

With a mission to revolutionize DeFi lending, MYSO Finance is positioned as a leading platform in the space, offering innovative financial products that cater to the needs of a growing DeFi community. The platform's unique approach to lending not only enhances user experience but also contributes to the overall growth and maturity of the decentralized financial market.

MYSO Finance was developed to address the challenges of traditional DeFi lending, specifically the risk of liquidation during periods of market volatility. The platform introduces Zero-Liquidation Loans, which allow borrowers to access funds without the fear of having their collateral liquidated if market conditions change unfavorably. This innovation provides a more stable and secure borrowing environment for users.

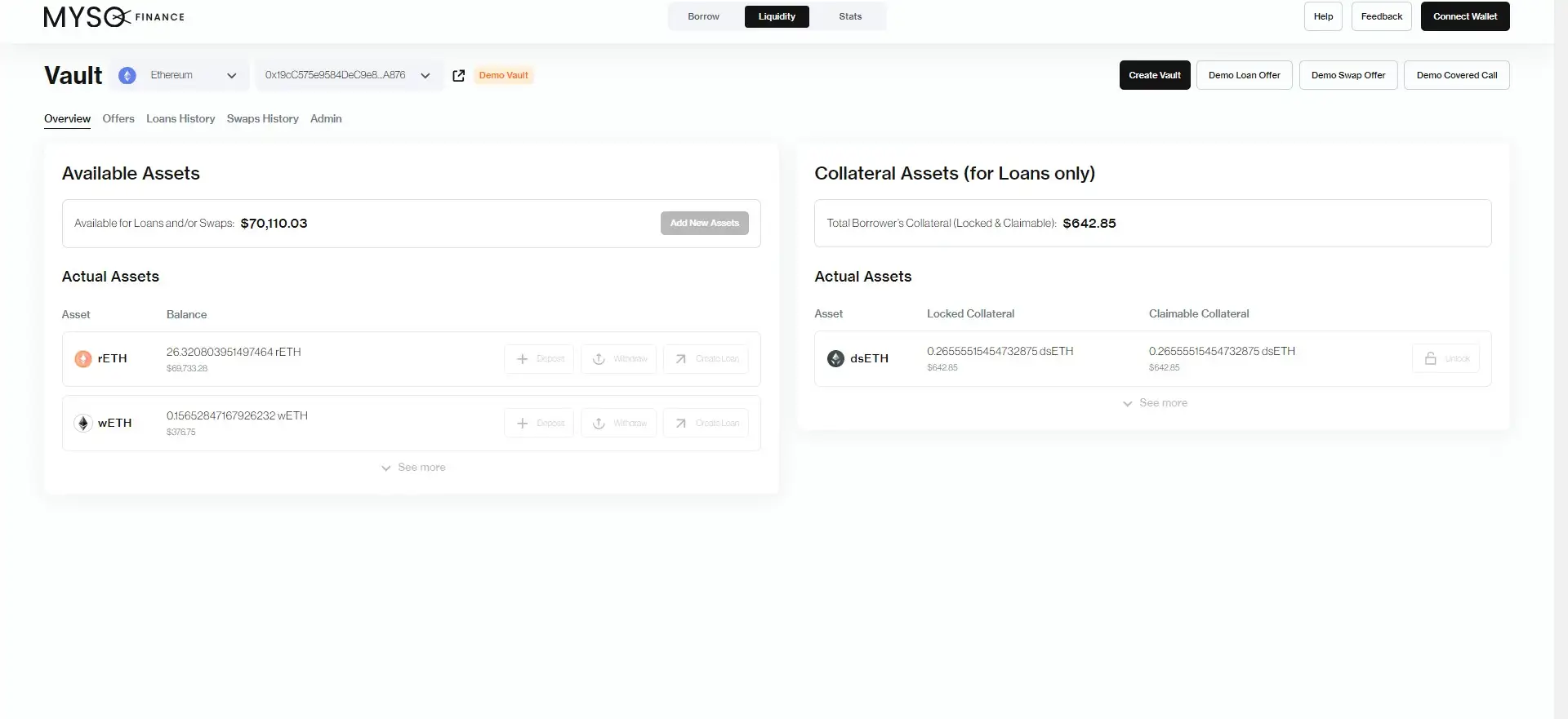

The platform operates on smart contracts, which automate the lending process and ensure that all transactions are secure and transparent. This automation not only reduces the risk of human error but also increases the efficiency of loan processing. Users can interact with the platform through a user-friendly interface that simplifies the process of obtaining and managing loans.

MYSO Finance also focuses on accessibility, allowing users to borrow against a variety of assets, including cryptocurrencies and NFTs. This flexibility makes the platform appealing to a wide range of DeFi participants, from individual investors to large institutions. By offering such a versatile lending product, MYSO Finance is poised to become a key player in the DeFi ecosystem.

In terms of competition, MYSO Finance faces rivals such as Aave and Compound, which also offer decentralized lending services. However, MYSO Finance differentiates itself with its Zero-Liquidation Loans, providing a unique value proposition in the competitive DeFi lending market.

MYSO Finance offers several benefits and features that make it stand out in the DeFi lending space:

- Zero-Liquidation Loans: The platform's most distinctive feature, allowing users to borrow without the risk of liquidation, even during volatile market conditions.

- Smart Contract Automation: All lending processes are handled by secure and transparent smart contracts, reducing the need for intermediaries and ensuring efficiency.

- Collateral Flexibility: Users can borrow against a wide range of assets, including cryptocurrencies and NFTs, providing more options and flexibility for borrowers.

- User-Friendly Interface: MYSO Finance offers a simple and intuitive interface, making it easy for users to access and manage their loans.

- Decentralized and Secure: Built on decentralized technology, the platform ensures that users maintain control over their assets throughout the lending process.

- Community-Focused Development: MYSO Finance is constantly evolving, with new features and improvements driven by community feedback and the needs of its users.

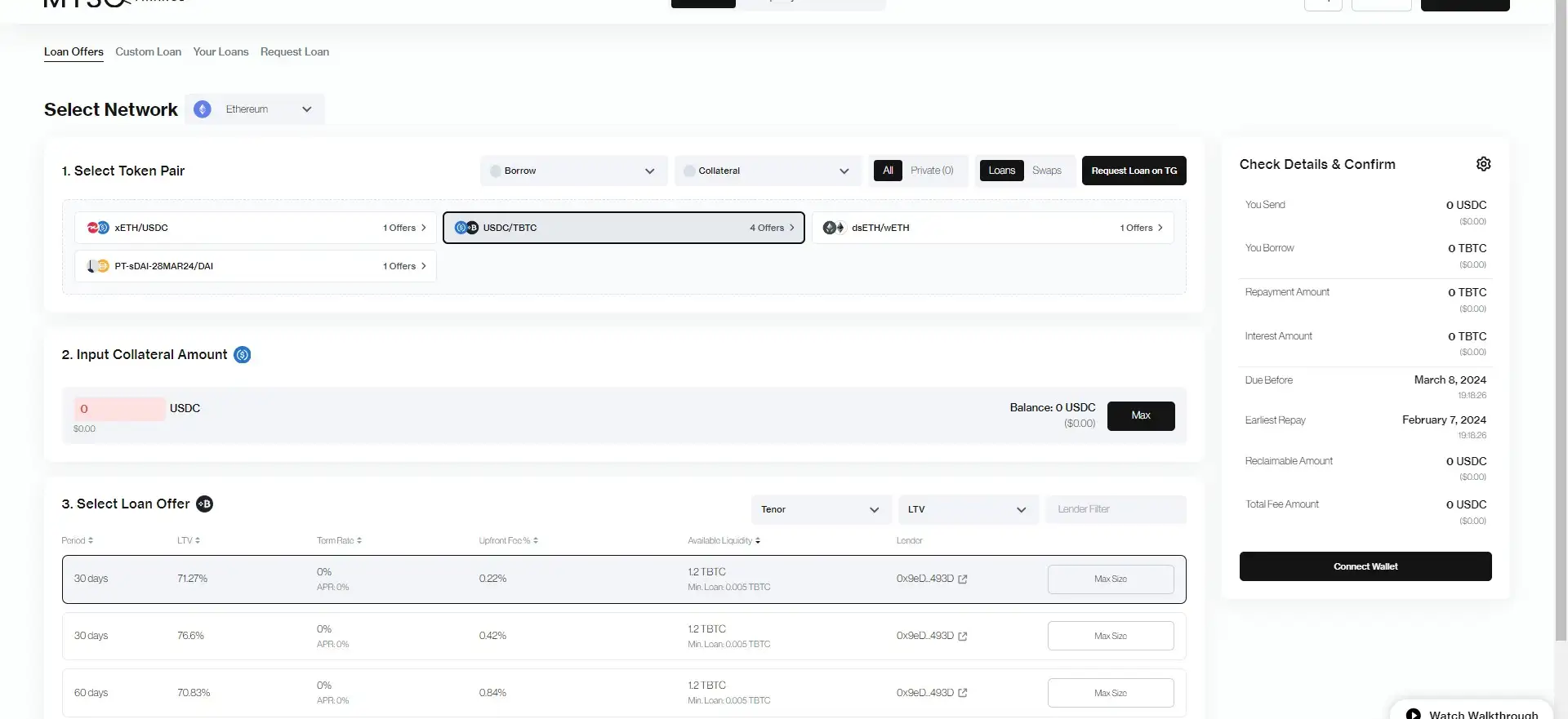

To get started with MYSO Finance, follow these steps:

- Visit the Website: Go to the MYSO Finance website and connect your wallet to access the platform. Supported wallets include MetaMask and WalletConnect.

- Explore Loan Options: Browse the available loan options and select the one that best suits your needs. The platform offers loans against various assets, including cryptocurrencies and NFTs.

- Set Up Your Loan: Choose the amount you wish to borrow and provide the necessary collateral. Review the loan terms and conditions before confirming the transaction.

- Manage Your Loan: Once your loan is active, you can manage it through the platform’s dashboard. This includes making repayments, adjusting collateral, or paying off the loan early if desired.

- Stay Informed: Keep up to date with the latest features and updates by visiting the MYSO Finance documentation and following the platform's community channels.

By following these steps, you can start using MYSO Finance to access zero-liquidation loans and other innovative DeFi lending solutions.

MYSO Reviews by Real Users

MYSO FAQ

MYSO Finance offers Zero-Liquidation Loans by utilizing advanced smart contracts that are designed to protect collateral from liquidation during market volatility. Instead of traditional liquidation, MYSO uses an innovative model that mitigates risks for borrowers, allowing them to maintain their assets even during adverse market conditions.

On MYSO Finance, you can use a variety of assets as collateral, including popular cryptocurrencies like Ethereum and stablecoins, as well as NFTs. This flexibility allows users to leverage different types of assets to secure loans that best suit their financial needs.

Staking MYSO tokens offers several benefits, including earning rewards, participating in governance decisions, and accessing premium features such as lower fees and enhanced borrowing terms. Staking helps users maximize their involvement and rewards within the MYSO Finance ecosystem.

Yes, MYSO Finance allows users to repay their loans early without incurring any penalties. This feature provides flexibility for borrowers to manage their finances effectively and avoid unnecessary interest costs.

Security is a top priority for MYSO Finance. The platform uses smart contracts that are rigorously tested and audited to secure all transactions. Additionally, users retain control over their assets throughout the lending process, reducing the risk of loss due to centralized failures.

You Might Also Like