About Ooki

Ooki is a fully decentralized, non-custodial protocol that empowers users to engage in margin trading, lending, borrowing, and staking across multiple blockchains. With no KYC, no central authority, and a strong DAO governance model, Ooki redefines financial services by offering a secure and transparent environment for users to gain financial independence in the DeFi space.

Designed to be open, permissionless, and community-governed, Ooki Protocol provides innovative trading mechanics like up to 15x leverage, perpetual positions, and minimal liquidation penalties. By supporting Ethereum, Polygon, Arbitrum, BSC, and Optimism, Ooki ensures users have access to the best rates, widest asset selection, and cross-chain trading capabilities—all from one unified interface.

Ooki Protocol is a decentralized financial primitive designed for margin trading, lending, borrowing, and decentralized governance. It allows users to open leveraged long or short positions with up to 15x leverage, lend crypto assets for passive income, and borrow funds against collateralized tokens. The protocol runs fully on-chain with no centralized intermediaries and ensures user custody of funds through smart contracts deployed on Ethereum, Arbitrum, BSC, Optimism, and Polygon.

The platform's core tokens include OOKI for governance and fee sharing, iTokens like iUSDC or iDAI that accrue interest over time, and vBZRX, a vesting token that gradually converts into OOKI while retaining voting rights. By staking OOKI, users not only earn platform-generated fees but also gain voting power to shape the future of the protocol through the three-tiered DAO governance process.

Ooki’s smart contracts have been audited by reputable firms, and the platform integrates Chainlink’s decentralized oracles for real-time, tamper-resistant pricing. In case of loan defaults, Ooki has implemented a 10% interest-funded insurance pool to protect lenders. The lending, borrowing, and trading mechanisms operate through a dynamic interest rate model that balances supply and demand in real time, maximizing protocol efficiency and risk management.

Competing with platforms like Aave and Compound, Ooki stands out for its focus on margin trading, staking, and multichain accessibility. The protocol's unique blend of DAO governance, trading tools, and decentralized infrastructure positions it as a powerful tool for both casual and professional DeFi users looking to maximize returns and control.

Ooki offers a powerful set of decentralized financial tools designed for traders, lenders, borrowers, and governance participants across multiple chains:

- Cross-Chain Support: Access margin trading, lending, and borrowing on Ethereum, BSC, Polygon, Arbitrum, and Optimism—all from a single interface at ooki.cc.

- Up to 15x Leverage: Users can take long or short positions with high leverage, using decentralized mechanics that preserve asset ownership.

- Staking Rewards: Stake OOKI tokens to earn a share of fees collected across all chains. Rewards include OOKI, SUSHI, and 3CRV, with customizable claim and restake options.

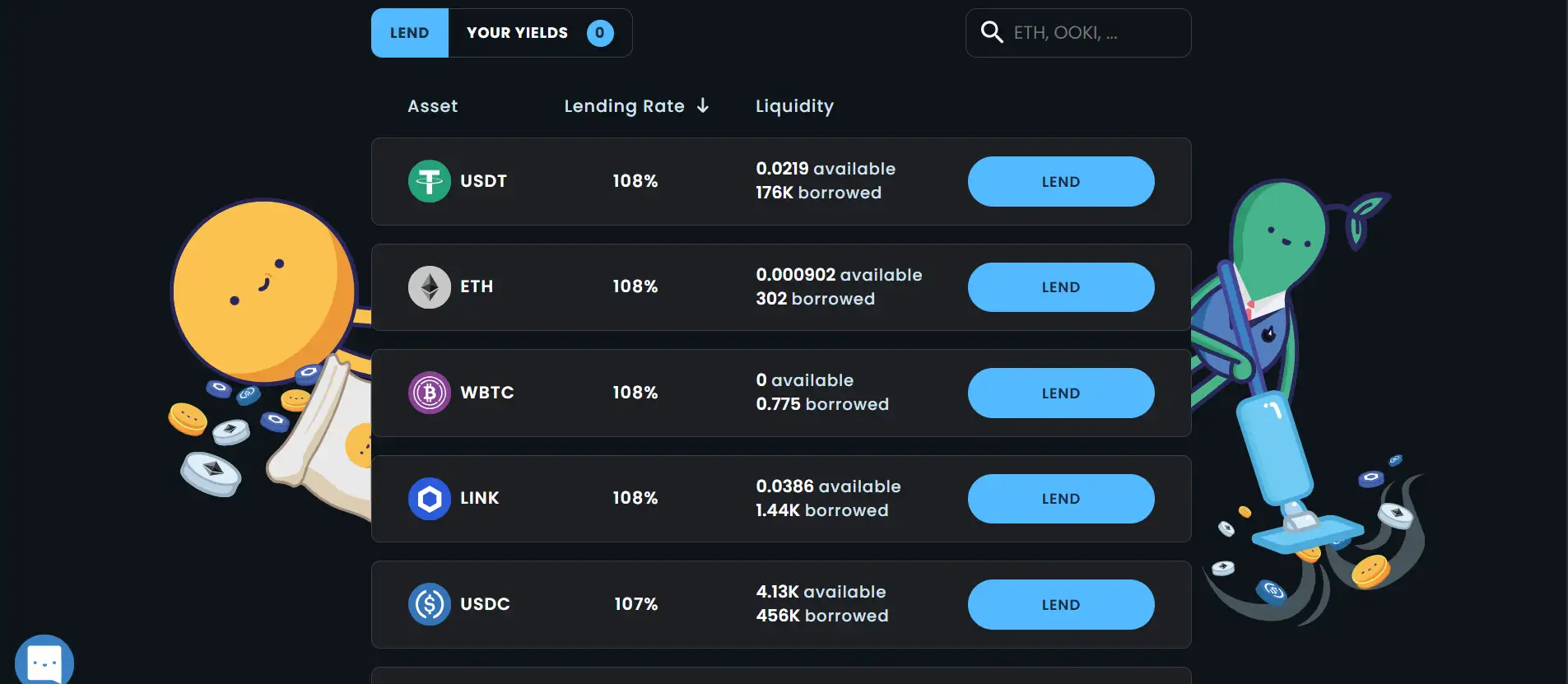

- iTokens with Auto-Yield: Interest-bearing tokens like iDAI and iUSDC constantly accrue value as borrowers pay interest into the lending pool.

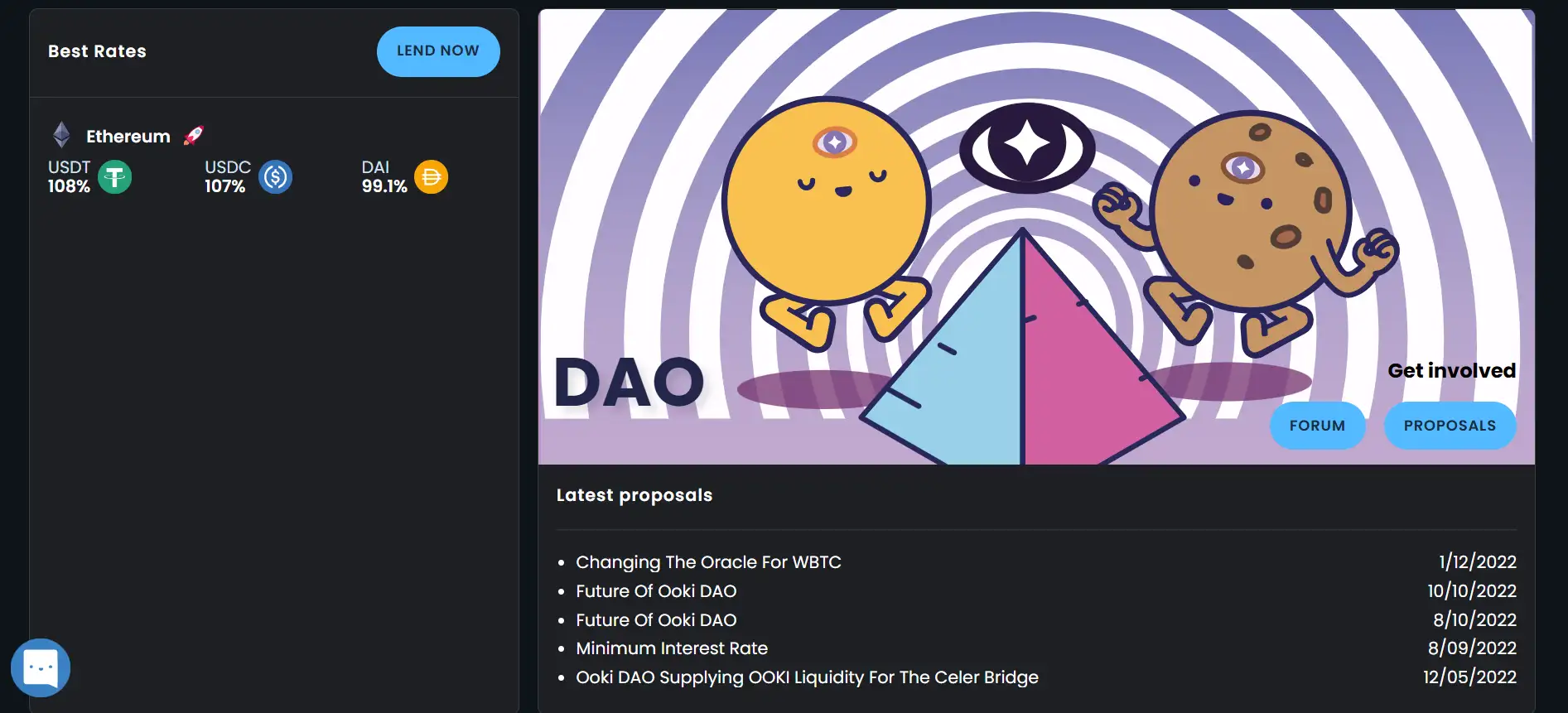

- DAO Governance: OOKI token holders govern the protocol through a three-phase voting process involving forum proposals, snapshot votes, and on-chain ratification.

- Minimal Liquidation Risk: Positions that fall under the margin requirement are only partially liquidated, reducing risk and cost for users.

- Insurance Fund Protection: 10% of borrower interest goes into a fund to protect lenders in case of undercollateralized loans.

- No KYC or Custody: Trade and lend with full control of your assets. No account, verification, or intermediary needed.

Getting started with Ooki Protocol is fast, decentralized, and fully under your control. Here’s how to start trading, lending, and earning with Ooki:

- Visit ooki.cc and click “Launch App” to access the decentralized interface.

- Connect your wallet using MetaMask or another WalletConnect-compatible wallet on your preferred chain (Ethereum, Arbitrum, Optimism, Polygon, or BSC).

- To lend, select a supported asset on the Lending page, approve token spending, and confirm the transaction. You’ll receive an iToken that auto-accrues interest.

- To borrow, choose the asset, deposit collateral, and initiate your loan. Your borrowing rate adjusts dynamically based on demand.

- To trade, head to the Trading interface, select your position (long/short), enter leverage and size, and execute the trade.

- Stake your OOKI tokens on the Ethereum chain to earn a share of protocol fees and influence the protocol through governance votes.

- For in-depth guidance and protocol updates, explore the Ooki Documentation and join the Ooki Discord community.

Ooki FAQ

Ooki provides fully decentralized margin trading with up to 15x leverage, all without custodial risks or user verification. Unlike centralized platforms, you maintain control of your assets via smart contracts. Positions on ooki.cc are perpetual and renew automatically, with minimal liquidation penalties designed to protect users from total position loss.

By staking OOKI tokens on Ethereum, users earn a portion of fees generated across all supported chains, including trading, lending, and borrowing activity. Stakers receive OOKI, SUSHI, and 3CRV rewards, and gain governance rights through voting. The more OOKI you stake, the larger your influence and earnings. Stake now via ooki.cc.

Yes, Ooki Protocol supports Ethereum, BSC, Arbitrum, Polygon, and Optimism, and lets users switch between networks using the same wallet. No new account is required. Simply connect your wallet (MetaMask, WalletConnect, etc.) and choose the chain you wish to use from the app interface. All actions remain non-custodial. Start at ooki.cc.

Ooki DAO governance is a structured 3-stage process: forum discussion, snapshot voting, and on-chain ratification. Token holders with staked OOKI or vBZRX can create, vote, and ratify proposals related to upgrades, fees, roadmap items, and more. Governance ensures the protocol is fully community-led and decentralized. Learn more at Ooki Docs.

iTokens like iDAI or iUSDC are interest-bearing assets received when you lend funds on Ooki. They increase in value as borrowers pay interest into the lending pool, giving holders a steady, auto-compounding yield. iTokens can be held, transferred, or used as collateral. View lending options at ooki.cc.

You Might Also Like