About PWNDAO

PWN is an innovative decentralized finance (DeFi) platform designed to revolutionize the lending and borrowing landscape by enabling users to leverage a wide array of digital assets as collateral. Traditional financial systems often impose rigid and exclusionary conditions, but PWN offers a more inclusive and flexible alternative that caters to the diverse needs of the digital economy. Users can secure loans using assets such as NFTs, ERC-20 tokens, and other digital assets, which are typically considered illiquid in conventional markets.

The mission of PWN is to democratize access to liquidity, enabling anyone with valuable digital assets to unlock their value without selling them. This feature is particularly significant in the rapidly growing world of digital assets, where individuals and organizations increasingly seek ways to leverage their holdings without having to part with them. The platform's peer-to-peer lending system allows borrowers and lenders to directly negotiate terms, ensuring fairer and more transparent financial interactions. Furthermore, PWN eliminates the risk of price-based liquidations, common in traditional lending platforms, by not relying on external oracles. This feature ensures borrowers do not lose their collateral due to market volatility, providing a more secure and predictable lending environment.

PWN is a pioneering platform in the DeFi ecosystem, created to provide a flexible, secure, and user-centric alternative to traditional lending systems. Developed to address the limitations of existing financial platforms, PWN allows users to use a wide variety of digital assets, including NFTs and ERC-20 tokens, as collateral for loans. This approach opens up new liquidity avenues for digital asset holders, enabling them to unlock value from their assets without needing to sell them.

The platform is built with a strong focus on decentralization and security, ensuring that all transactions are conducted on a peer-to-peer basis without intermediaries. One of PWN’s key innovations is its oracle-less design, which protects borrowers from the risk of price-based liquidations. This means that once a loan is agreed upon, the terms are fixed, and borrowers are not affected by sudden market fluctuations that could impact their collateral. This feature sets PWN apart from other DeFi lending platforms, where price volatility often leads to unexpected liquidations.

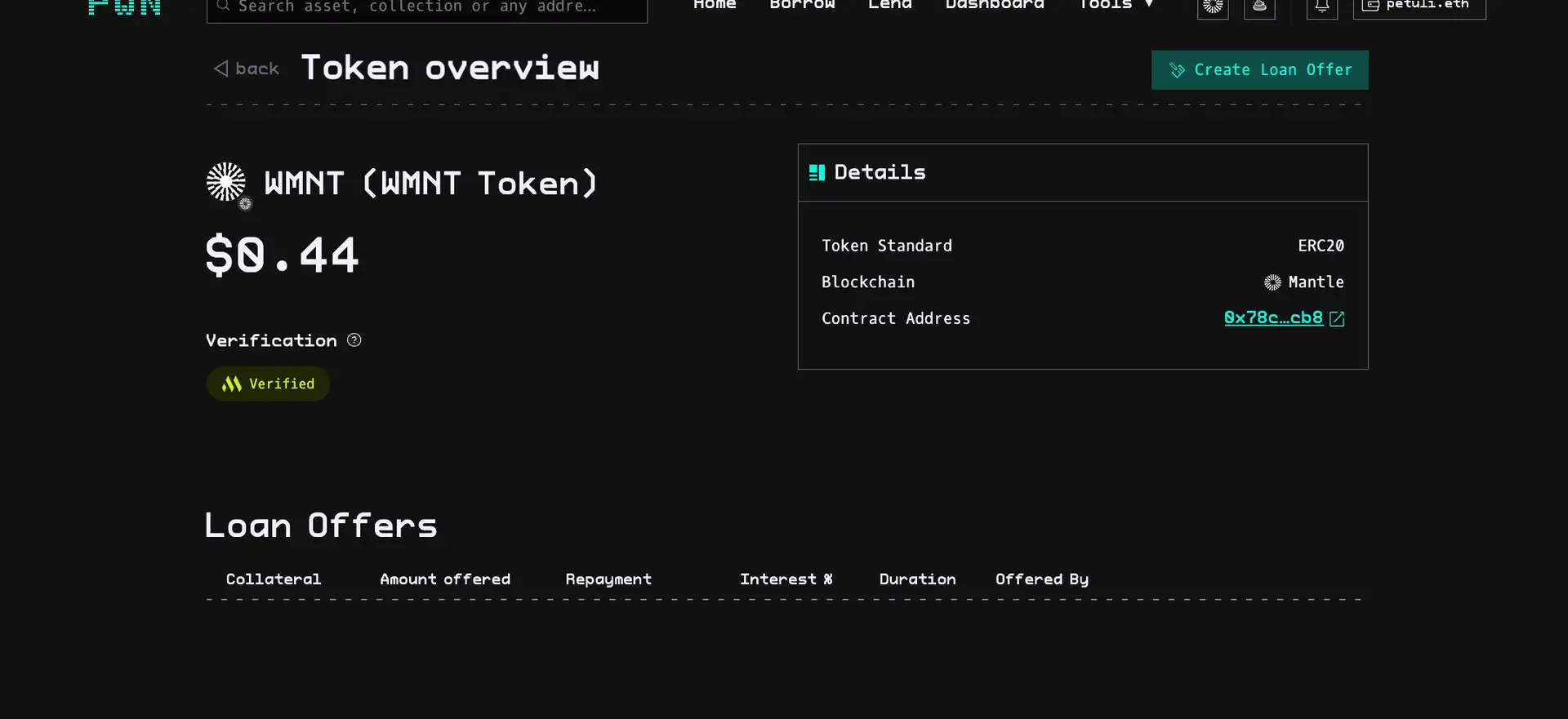

PWN operates across multiple blockchain networks, including Ethereum, Polygon, and Binance Smart Chain, enhancing its accessibility and utility. This multi-chain support allows users to choose the network that best meets their needs, whether they prioritize transaction speed, cost, or compatibility with other DeFi protocols. The platform also supports a broad range of collateral types, from high-value NFTs to bundles of ERC-20 tokens, giving users unprecedented flexibility in how they use their digital assets.

The development of PWN has been marked by several key milestones, including the expansion to multiple blockchain networks, the introduction of its oracle-less loan system, and the establishment of a governance model that allows token holders to participate in decision-making processes. The PWN governance model is designed to be inclusive, enabling users to propose and vote on changes to the platform, ensuring that it evolves in line with the community’s needs.

In the competitive landscape of DeFi lending, PWN stands out by offering collateral flexibility, the absence of price-based liquidations, and multi-chain support. While platforms like Aave and Compound are strong players in this space, they primarily focus on liquid ERC-20 tokens. In contrast, PWN’s inclusion of illiquid assets like NFTs gives it a unique edge, making it particularly appealing to users who wish to leverage valuable assets without selling them. For more detailed information, visit the official PWN website.

- Wide Range of Collateral: PWN allows users to leverage various types of digital assets as collateral, including NFTs, ERC-20 tokens, and asset bundles. This flexibility provides users with more options compared to traditional lending protocols.

- Oracle-less Liquidation: Unlike many DeFi platforms, PWN does not rely on external oracles to determine collateral value, eliminating the risk of price-based liquidations. This ensures borrowers are not forced to liquidate assets due to market volatility, offering a more stable and secure lending environment.

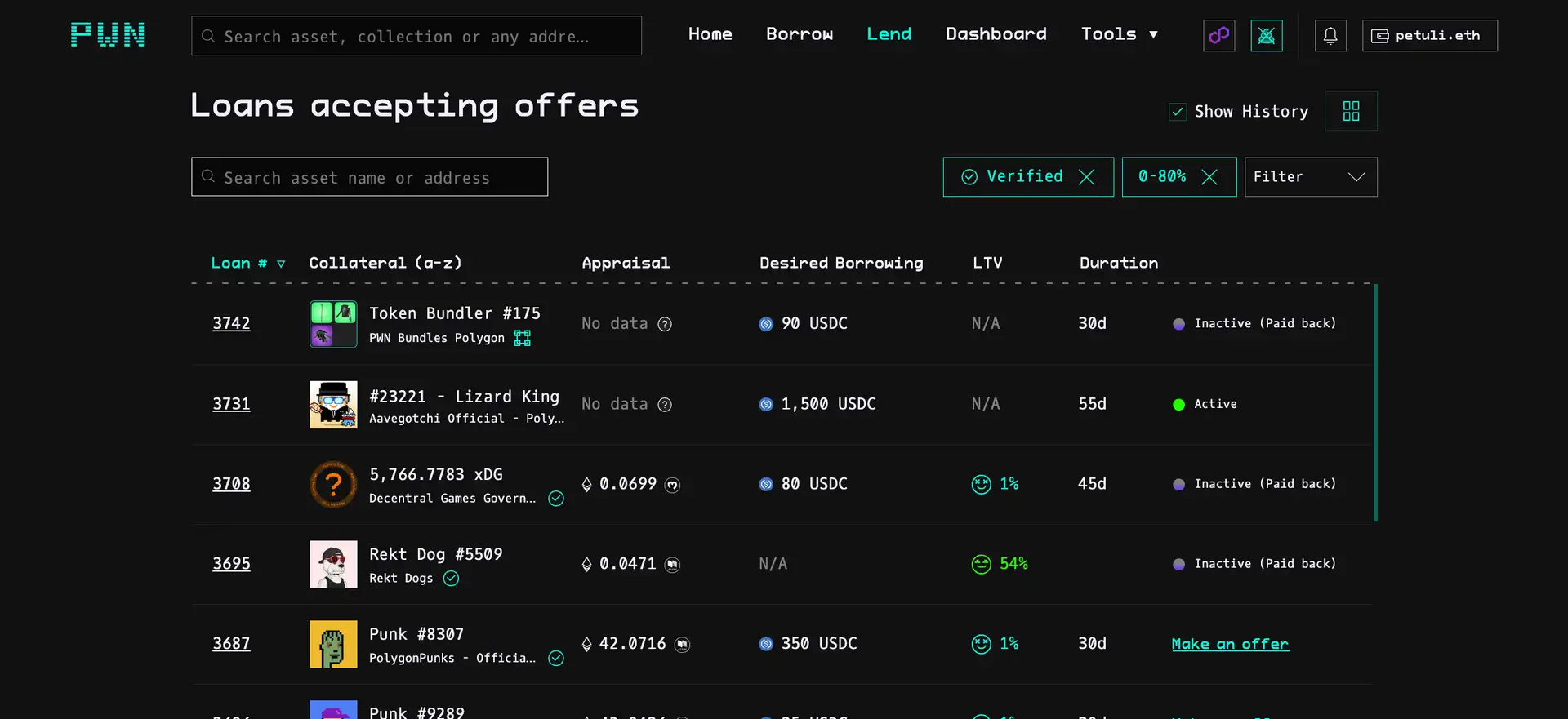

- Customizable Loan Terms: Borrowers and lenders on PWN can directly negotiate the terms of their loans, including the loan amount, interest rate, loan-to-value ratio (LTV), and duration. This peer-to-peer negotiation ensures tailored agreements that meet the specific needs of both parties.

- Multi-Chain Support: PWN operates on multiple blockchain networks, including Ethereum, Polygon, and Binance Smart Chain. This multi-chain approach provides users with more options in terms of transaction speed, cost, and network compatibility, enhancing the platform’s accessibility and user experience.

- Decentralized and Permissionless: The PWN platform is fully decentralized, meaning there are no intermediaries involved in the transaction process. This ensures a higher level of security and transparency, aligning with the broader principles of the DeFi ecosystem.

- User Governance: PWN features a governance model that allows token holders to participate in decision-making processes. Users can propose changes, vote on protocol updates, and help shape the future of the platform, ensuring it remains responsive to the community’s needs.

- No KYC Requirements: As a fully decentralized platform, PWN does not require users to undergo Know Your Customer (KYC) procedures. This feature enhances user privacy and accessibility, making the platform more inclusive for users around the world.

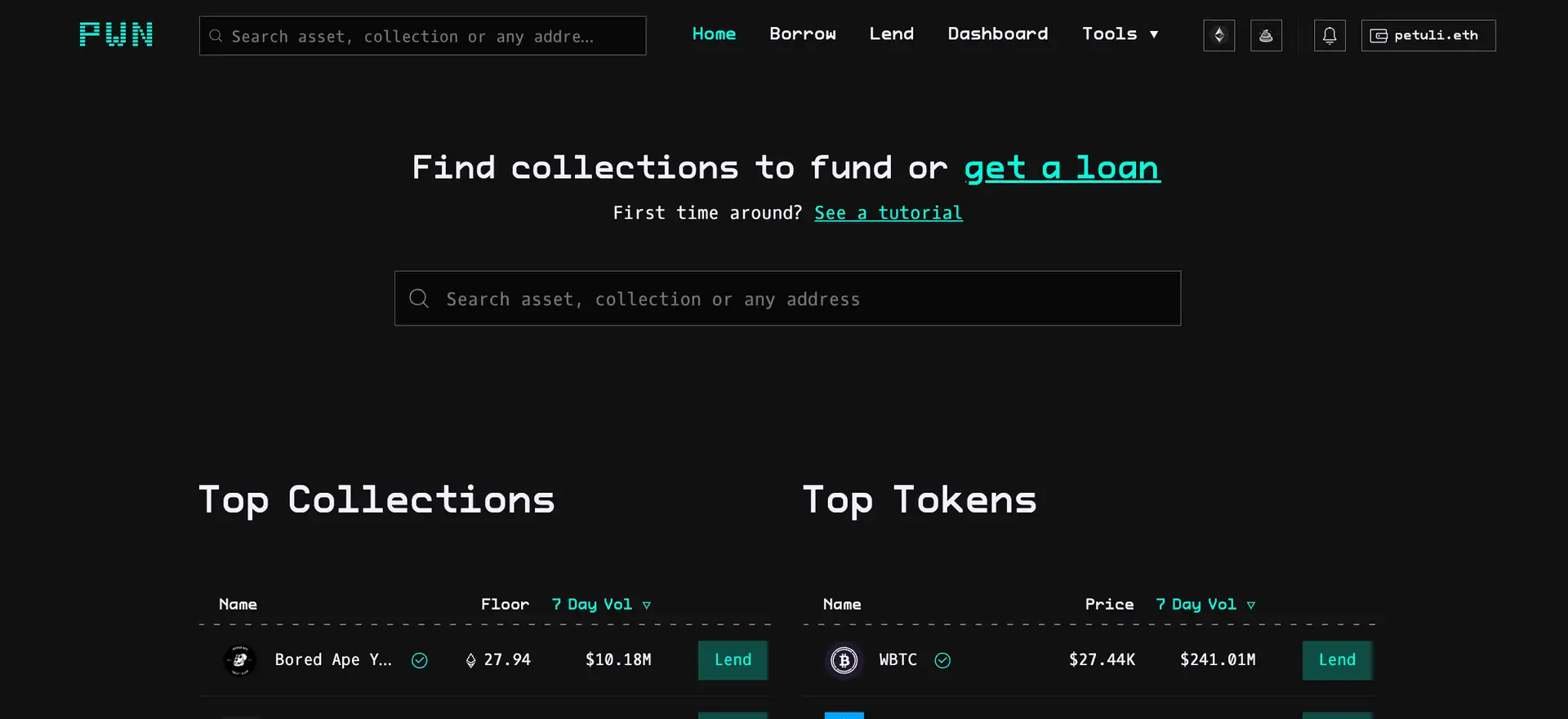

- Accessibility: PWN's interface is designed to be user-friendly, catering to both experienced DeFi users and newcomers. The platform provides clear instructions and guides to help users navigate the lending and borrowing process with ease.

- Security and Transparency: All transactions on PWN are executed through smart contracts, ensuring the process is transparent and tamper-proof. The platform’s code is open source, allowing for community audits and enhancing trust in the system.

- Comprehensive Documentation: PWN offers extensive documentation to help users understand the platform's features, lending mechanics, and governance structure. This makes it easier for new users to get started and for experienced users to explore advanced features.

- Connect Your Wallet: To begin using PWN, visit the platform at PWN App. You'll need to connect an Ethereum-compatible wallet such as MetaMask, which will act as your interface for interacting with the platform.

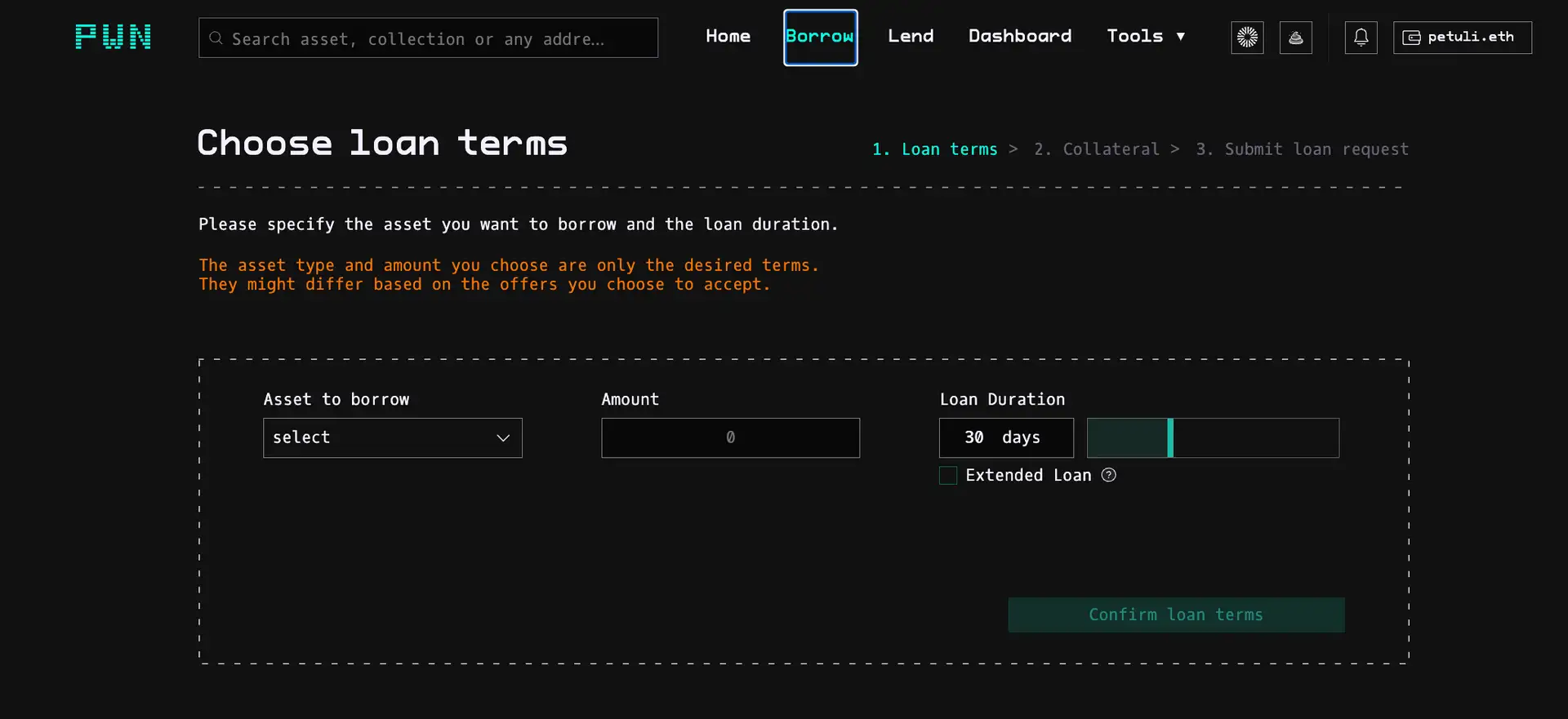

- Select Your Collateral: Once your wallet is connected, choose the digital assets you wish to use as collateral. This can include NFTs, ERC-20 tokens, or other supported assets. PWN supports a wide range of collateral types, giving you the flexibility to leverage the assets you already hold.

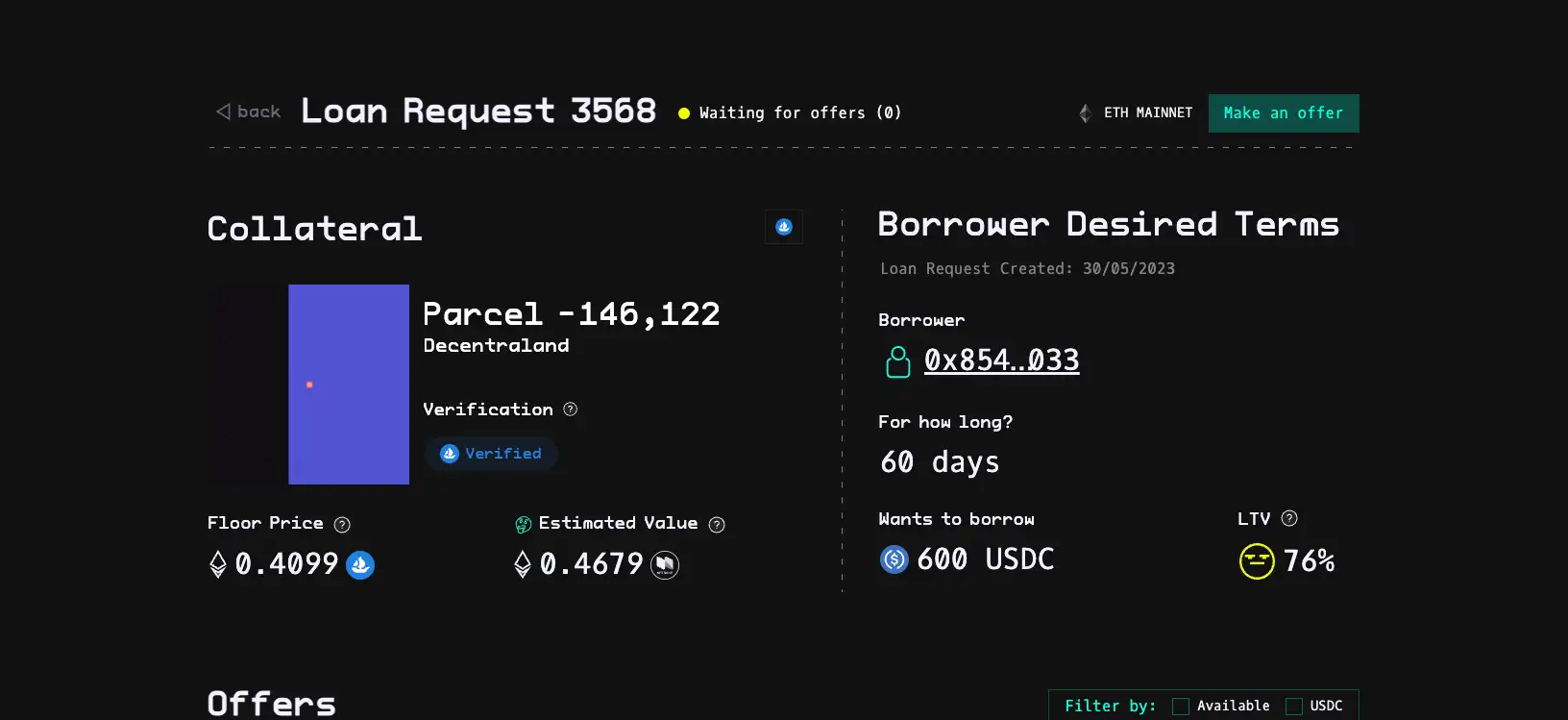

- Create a Loan Offer or Proposal: If you are a borrower, create a loan proposal by specifying the terms you want, such as the amount you wish to borrow, the interest rate, loan duration, and the type of collateral. Lenders can browse these proposals and choose the ones that match their lending criteria.

- Negotiate Terms: PWN’s platform allows borrowers and lenders to directly negotiate the terms of the loan. This peer-to-peer negotiation ensures that both parties reach an agreement that is mutually beneficial.

- Finalize and Execute the Loan: After agreeing on the terms, the loan is finalized and executed through a smart contract. The borrower’s collateral is locked in the smart contract, and the lender provides the loan amount to the borrower.

- Manage Your Loan: During the loan term, you can manage your loan through the PWN platform. You’ll be able to view the loan’s status, track repayment schedules, and make repayments directly through the interface.

- Repay and Retrieve Collateral: To retrieve your collateral, repay the loan amount plus any agreed-upon interest by the loan’s end date. Once repayment is completed, the smart contract will release your collateral back to your wallet.

- Dealing with Default: If a borrower fails to repay the loan on time, the collateral will automatically be transferred to the lender as per the terms agreed upon in the smart contract. This process is handled automatically and transparently by the platform’s code.

- Explore Advanced Features: For users interested in exploring more complex financial strategies, PWN offers additional features such as collateral bundling and multi-chain collateral management. Detailed guides and tutorials are available in the PWN Documentation to help users make the most of these options.

PWN’s platform is designed to be intuitive and straightforward, making it accessible for both new and experienced users. With comprehensive documentation and a supportive community, getting started with PWN is a seamless experience.

PWNDAO Reviews by Real Users

PWNDAO FAQ

On PWN, you can use a wide variety of digital assets as collateral, including NFTs, ERC-20 tokens, and bundled assets. This flexibility allows you to leverage assets that might otherwise be illiquid.

PWN uses an oracle-less design that eliminates the risk of price-based liquidations. This means your collateral is not affected by market volatility, providing a more secure lending experience.

Yes, PWN allows borrowers and lenders to directly negotiate terms such as loan amount, interest rate, and duration, ensuring that both parties can agree on mutually beneficial terms.

No, PWN is a fully decentralized and permissionless platform, meaning there are no KYC requirements. This ensures privacy and accessibility for all users.

Once you repay your loan, the smart contract will automatically release your collateral back to your wallet. This process is secure and fully automated.

You Might Also Like