About Radiant Capital

Radiant Capital is a groundbreaking DeFi protocol that aims to solve one of the most persistent problems in decentralized finance—liquidity fragmentation. Built as an omnichain money market, the protocol enables users to seamlessly lend and borrow assets across major blockchain networks. Unlike traditional DeFi platforms that require users to stick to a single chain, Radiant Capital empowers users to deposit assets on one chain and borrow on another without needing complex bridging processes or multiple interfaces.

This innovative infrastructure is powered by the Radiant DAO, whose mission is to unify and simplify decentralized finance. Through cross-chain operability, community governance, and a clear focus on security and transparency, Radiant Capital is helping shape what many consider the next evolution of DeFi—also referred to as DeFi 3.0. The platform is audited by top firms like BlockSec, PeckShield, and OpenZeppelin and has over 155,000+ users contributing to its growing ecosystem.

Radiant Capital was launched with the vision to unify the scattered liquidity across different blockchain ecosystems and offer a seamless user experience in decentralized lending and borrowing. Historically, DeFi platforms have been siloed, requiring users to operate within the limitations of single-chain infrastructure. This siloed structure often led to inefficiencies, including high fees, fragmented markets, and poor user experience. Radiant Capital addresses these challenges by providing a single interface to access cross-chain lending and borrowing functions, making it one of the first true omnichain money markets.

The protocol uses LayerZero's interoperability solution and Stargate’s stable router interface to enable users to deposit any supported asset on one chain and withdraw from another. For example, users can deposit wBTC on Arbitrum and withdraw ETH on Ethereum Mainnet. This eliminates the need for multiple interactions across different DeFi apps and bridges. At its core, Radiant focuses on capital efficiency, offering users enhanced yields and loan accessibility while maintaining a high level of security.

The latest iteration, Radiant v2, brings significant improvements to the protocol. It migrates RDNT to an Omnichain Fungible Token (OFT) standard, making it easier for users to move assets across chains and for the protocol to integrate new networks in the future. Radiant V2 also includes a revamped emissions model, focused on long-term sustainability and reducing mercenary liquidity farming. Token emissions are tied to dynamic liquidity providers (dLP), who must lock liquidity to become eligible for RDNT rewards and fee sharing.

Radiant’s governance is fully decentralized, using Discourse for proposal discussions and Snapshot for voting. This empowers the community to guide the development and evolution of the protocol. Security is another key pillar of Radiant’s design, with ongoing bug bounty programs through Immunefi and audits by leading blockchain security firms.

In terms of competition, Radiant competes with platforms like Aave, Compound, and Venus. However, what sets Radiant apart is its focus on omnichain functionality, true decentralization, and forward-looking emission mechanics. As the DeFi landscape evolves, Radiant is positioning itself as a protocol not just for today, but for the future of cross-chain finance.

Radiant Capital offers numerous features and advantages that distinguish it in the evolving DeFi ecosystem:

- Omnichain Lending & Borrowing: Users can deposit and borrow across multiple chains without using bridges or multiple interfaces.

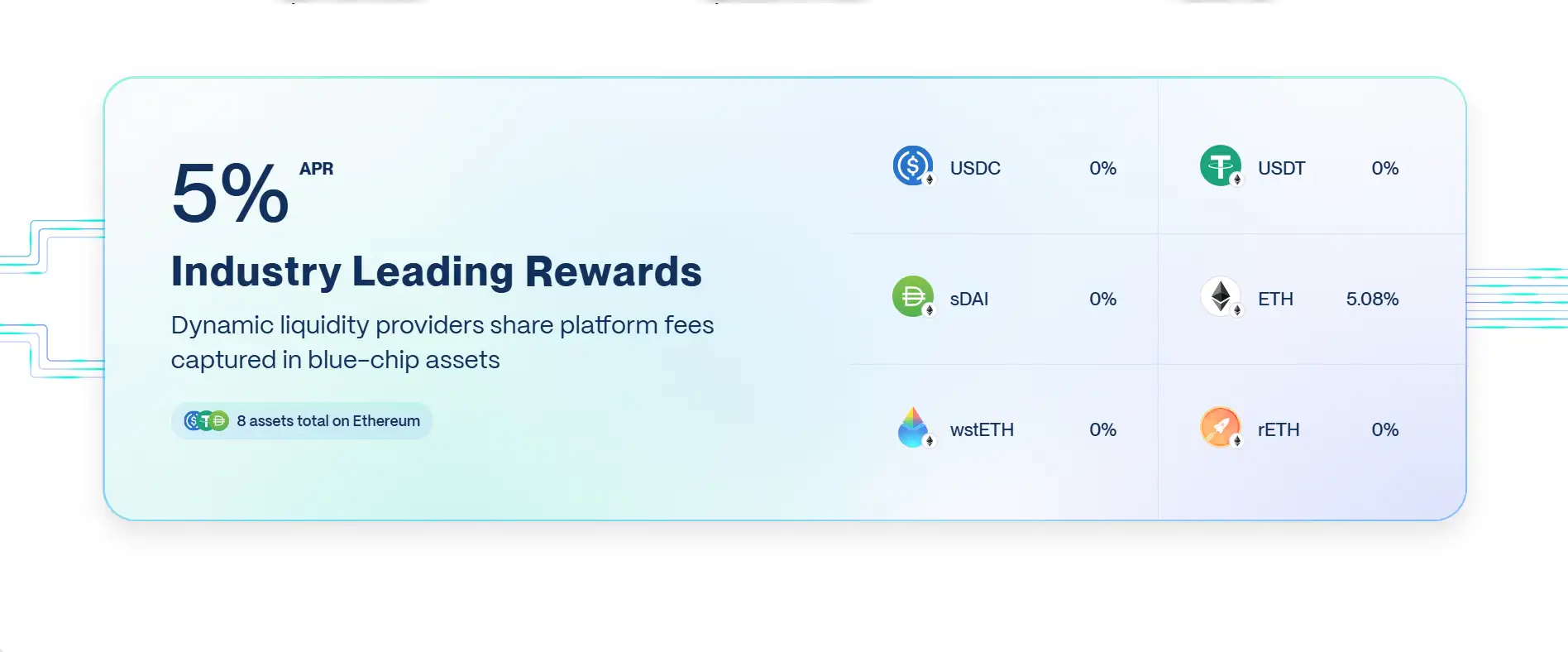

- Dynamic Liquidity Providers (dLP): Only users who lock liquidity tokens are eligible for RDNT emissions and platform fee sharing in blue-chip assets like BTC, ETH, and stablecoins.

- Decentralized Governance: Community-driven governance with proposals discussed on Discourse and voted on via Snapshot.

- Audited & Battle-Tested: Multiple security audits from top-tier firms including OpenZeppelin, BlockSec, and PeckShield, along with an active bug bounty program on Immunefi.

- Real Utility & Sustainable Tokenomics: A redesigned emissions model that prevents mercenary farming and ensures long-term sustainability.

- RDNT Token Integration: RDNT is now an OFT-20 token, allowing seamless cross-chain transfers and direct protocol ownership over bridging contracts.

- Platform Rewards: Users who lock dLP receive rewards in major crypto assets from interest, flash loans, and liquidation fees.

Getting started with Radiant Capital is simple for anyone familiar with DeFi applications and wallet integration:

- Set Up a Web3 Wallet: Download and install MetaMask or any wallet compatible with Arbitrum and Ethereum. Fund your wallet with ETH, wBTC, or stablecoins.

- Visit the App: Go to the Radiant Capital dApp to connect your wallet and view available lending and borrowing markets.

- Deposit Assets: Select your preferred chain and asset, then approve and deposit it into the protocol. Supported assets include ETH, USDC, USDT, wstETH, sDAI, and more.

- Borrow Across Chains: Once you’ve supplied collateral, borrow supported assets on different chains seamlessly using Radiant’s omnichain interface.

- Stake for RDNT Rewards: Lock your liquidity as dLP tokens to activate eligibility for RDNT emissions and revenue sharing from platform fees.

- Participate in Governance: Engage with proposals on Discourse and vote via Snapshot to help shape the future of the protocol.

- Explore Tutorials: Learn more through the official Radiant YouTube Channel for step-by-step guides.

Radiant Capital FAQ

Radiant Capital uses LayerZero’s interoperability solution combined with Stargate’s stable router interface to create a seamless omnichain lending and borrowing experience. This allows users to deposit assets like wBTC on one chain and borrow ETH on another without manually bridging funds. By removing traditional cross-chain bridges, Radiant Capital reduces complexity, costs, and security risks typically associated with moving assets between chains.

Dynamic Liquidity Providers (dLP) receive a range of exclusive benefits. By locking their liquidity, dLP users activate eligibility for RDNT emissions and share in platform fees paid by borrowers, flash loans, and liquidations. These fees are distributed in blue-chip assets such as BTC, ETH, and stablecoins. Regular depositors can lend and borrow but do not earn this premium revenue-sharing model. This encourages long-term participation and protocol stability on Radiant Capital.

Radiant Capital is a fully decentralized, community-governed protocol. Proposals are submitted and discussed openly on Discourse before moving to an official vote on Snapshot. Voting power is determined by locked $RDNT liquidity, ensuring that only active, vested participants shape the future of the protocol. Proposals reaching quorum and majority approval are automatically implemented, creating a transparent and fair decision-making process.

Security is at the core of Radiant Capital. The protocol has been audited by leading firms such as OpenZeppelin, BlockSec, PeckShield, and Zokyo, and it runs an ongoing bug bounty program through Immunefi. These measures protect user funds from potential exploits, mitigate risks of oracle manipulation, and build trust by demonstrating Radiant’s commitment to safety. Users benefit by participating in a protocol that has invested millions in security infrastructure.

The migration of $RDNT to an OFT (Omnichain Fungible Token) format fundamentally enhances its cross-chain capabilities. This change enables seamless fee sharing across multiple chains, quicker integrations with new networks, and native ownership of bridging contracts instead of relying on third parties. As a result, Radiant Capital can roll out updates and new chain deployments faster, while $RDNT holders enjoy increased flexibility and more secure cross-chain transfers.

You Might Also Like